Difference between revisions of "AY1516 T2 Team Hew - Prediction"

| Line 44: | Line 44: | ||

| 49,066 || 2,570 || 3,295,056,701 || 4,297,418 || 21,090,896 || 90,927,485 | | 49,066 || 2,570 || 3,295,056,701 || 4,297,418 || 21,090,896 || 90,927,485 | ||

|} | |} | ||

| − | + | ||

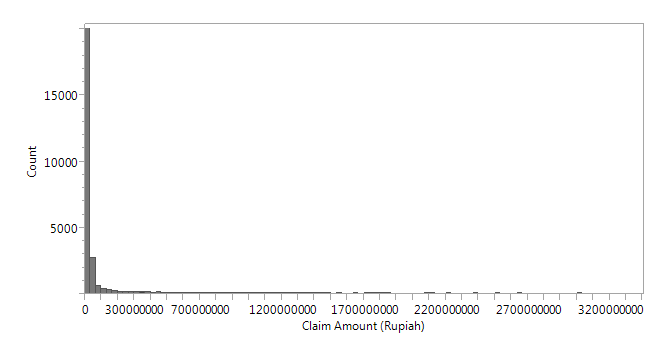

[[File:ClaimPaidOverall.png|center|Overall Claim amount distribution]] | [[File:ClaimPaidOverall.png|center|Overall Claim amount distribution]] | ||

<br /> | <br /> | ||

| Line 51: | Line 51: | ||

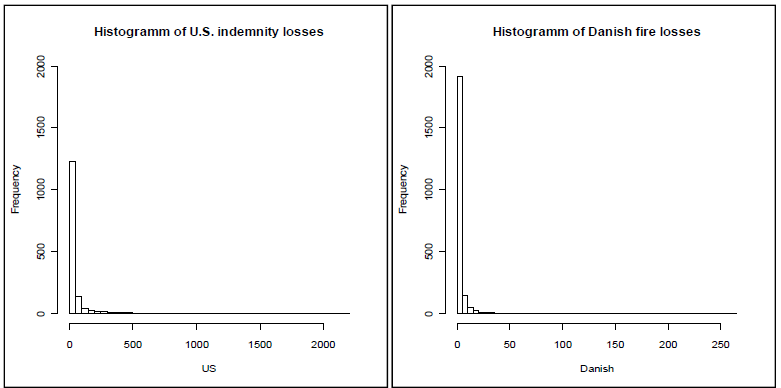

[[File:Eling's_Research.png|center|Eling's Research]] | [[File:Eling's_Research.png|center|Eling's Research]] | ||

<br /><br /> | <br /><br /> | ||

| + | |||

===Fit Distribution=== | ===Fit Distribution=== | ||

Revision as of 10:46, 17 April 2016

| Exploratory Analysis | Prediction |

Contents

Claim Amount Distribution Fitting

Analyze Distribution

Vaughn (1996) and a number of actuaries have mentioned that ClaimPaid amounts have to factor in inflation for greater accuracy. However, as the highest inflation rate attained by Indonesia for the time period of study is about 7%, this is rather negligible. Using JMP Pro 12, we first excluded rows where ClaimPaid = 0 and derived the distribution statistics of:

| N | Min | Max | Median | Mean | Standard Deviation |

|---|---|---|---|---|---|

| 49,066 | 2,570 | 3,295,056,701 | 4,297,418 | 21,090,896 | 90,927,485 |

From figure above, we can see that there are many instances of small claim amounts, with few instances of extreme values, and the distribution shape is right skewed. Similar distribution shapes for Claim amounts have also been derived from insurance companies based in other regions, as seen in figure below taken from Eling’s research (2011).

Fit Distribution

Linear Regression

Coming Soon

Research & Methodology

Coming Soon

References