AY1516 T2 Team Hew - Overview

| Proposal | Interim Review | Final |

Contents

- 1 Background

- 2 Objectives

- 3 Research & Methodology

- 3.1 Review of Similar Work

- 3.2 Methodology

- 3.2.1 Objective 1 (Develop a database analysis to formulate a demographic and psychographic profile of customers):

- 3.2.2 Objective 2 (Analyse average product holdings per customer): Default rate

- 3.2.3 Objective 3 (Determine which customer segments and products are more profitable): Profitability

- 3.2.4 Objective 4 (Which channels are more profitable, direct online or through agents): Channels and profitability

- 3.2.5 Objective 5 (Propensity to buy or assess next best offer for customers to enhance effectiveness of marketing campaigns):

- 4 References

Background

Tokio Marine Insurance Group was established in 1879 as the first insurance company in Japan. Growing over the years through a mix of acquisitions, joint ventures and organic growth, the company’s network now spans 486 cities in 37 countries[1]. The company started with a single sales channel which is a traditional agency force but has now diversified distribution by establishing a broad distribution network to include:

- Independent Financial Advisors (IFA)

- Bancassurance

- Brokers (Local and International) Group business

- Agency

Some of the company’s sought-after insurance product highlights include[1]:

- Marine Cargo Insurance

- Engineering

- Personal Lines

- Life Insurance

In 1945, Tokio Marine re-entered the Asian market, providing a comprehensive range of Life and General Insurance solutions in multiple Asian countries. Tokio Marine Asia was set up in Singapore as the regional headquarters to manage the Group Companies (GCs) in Hong Kong, Singapore, Indonesia, India, Australia, Philippines, Malaysia, Thailand, Taiwan, China and Vietnam.[1]

Motivation

Tokio Marine’s Group Companies (GCs) collect a lot of data required for underwriting products only at the time of sale. Over time, many data points have been captured with little insights derived other than for underwriting purposes. This data is stored on multiple platforms. While some customers have multiple products, it currently is limited in the utilization of data captured to really understand the profile of the customers, what they bought, channel preference, etc

Data

The dataset will be provided by one of the Asian GCs - Tokio Marine Life Insurance Singapore (TMLIS). It contains about 100,000 transaction records gathered over several years from TMLIS’s customer policy purchases.

Sample Dataset headers:

- Customer NRIC

- Customer Name

- Customer Age upon purchase

- Customer Age now

- Policy plan type purchased

- Channel (purchased from)

- Adviser name

- Adviser firm

- Premium size

- Any subsequent policy purchases made

- HP no

- PDPA consent (Y/N)

- DNC consent (Y/N)

Objectives

There are a few objectives which were formulated together with Tokio Marine at the initial meeting. Only some of the objectives listed down will be chosen as the focus as final paper as it is dependent on the availability and feasibility of data.

- Develop a database analysis to formulate a demographic and psychographic profile of customers

- Analyse average product holdings per customer

- Determine which customer segments and products are more profitable

- Which channels are more profitable (i.e. direct, online or through agents)

- Propensity to buy or assess next best offer for customers to enhance effectiveness of marketing campaigns.

The first objective is to demographically segment customers for more targeted marketing efforts. A psychographic profile here refers to the tendencies/behaviours of certain demographic groups. Tokio Marine will provide external datasets and research to supplement our findings. The second objective would be to investigate when and how often a certain demographic terminates/renews their policies. The third objective, linked to the first, is to determine which customer segments are more profitable. The fourth objective is to determine which sales channels are more profitable and thus where efforts should be concentrated on. The last objective is to determine the customer’s propensity to buy and also the next best offer.

Scope of Work

While Tokio Marine has several objectives, we will be directing our efforts towards Objective 1 due to time constraints. This is also the main objective which Tokio Marine hopes to achieve.

Research & Methodology

Review of Similar Work

Typically, Affinity Analysis has been applied to consumer products like groceries and thus there exists little literature on this. However recently, Affinity Analysis has been used to analyze different customer segments and this has helped in supporting their decisions to target certain demographic groups[2].

Kamakura’s[3] work on Market Basket Analysis and Path Analysis is valuable. He demonstrates that Path Analysis can be more useful than Market Basket Analysis in some cases as the sequence of purchase of products is more insightful than the static final basket of goods. Path Analysis can clearly illuminate whether goods are substitutes of each other or complements which provided decision support for cross-selling and bundling of grocery products.

Survival Analysis[4] models factors or variables that affects the time to an event. Two common methods are used to investigate the survival analysis of a model. First, Nonparametric methods provide simple and quick looks at the survival experience. Second, the Cox Proportional Hazards Regression Model relate the time that passes before some event occurs to one or more covariates that may be associated with that quantity of time. It remains the dominant analysis method for Survival Analysis.

Methodology

Many methodologies are discussed as this group is still in the initial stage of scoping the project. It is estimated that only 1 or 2 objectives will be taken for the project eventually.

Objective 1 (Develop a database analysis to formulate a demographic and psychographic profile of customers):

For this objective, we will investigate how the demographics of the customers impact the psychographic/behavioral profile of the customers and investigate the correlation using explorative data analysis and clustering techniques.

| Some of the demographics we will investigate are: | Some of the psychographic/behavioral profile we will investigate are: |

|---|---|

|

|

We can explore demographic segmentation of different nationalities to see if it plays an important role in the customer behaviour. An example is to investigate if Japanese customers are more likely to make subsequent purchase of policies in Tokio Marine than local customers.

The investigation of demographic and psychographic profile of the customers will translate into more effective marketing strategies. The company can concentrate its efforts of marketing on demographics of customers that are more profitable and give greater incentive to loyal customers to stay with the firm. Alternatively, the company can also incorporate upselling strategies for customers that are demographically more likely to purchase more expensive policies.

We will also conduct a time series analysis to examine how demographic/psychographic profiles change with time.

Objective 2 (Analyse average product holdings per customer): Default rate

This objective investigates the length of time a customer continues to hold a product. This investigates the likelihood and the rate at which customers default of periodic policy payments and the rate at which they cancel policies. A high rate of policy cancellation might indicate a flaw with the product that the product management team might need to investigate. The primary techniques to be used for this is Survival Analysis, where Nonparametric methods and Cox Proportional Hazards Regression Model will be used, using the SAS software.

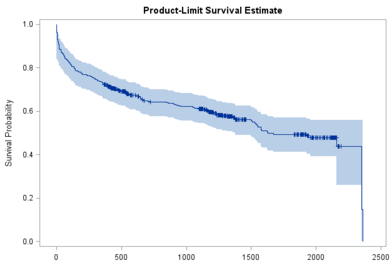

The Nonparametric method used will be a descriptive technique used to provide the rate at which the consumer drops a product. In SAS, a graph of the Kaplan Meier estimate can be used to allows users to see the survival function of the policy changes over time:

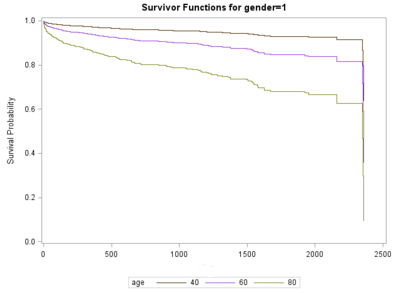

The Cox Proportional Hazards Regression Model investigates how different variables affect the policy cancellation rate (survival rate) of the policyholders using SAS. The graph below shows the survival function segmented to different age groups:

Some potential problems we might face is that most customers hold the policies until maturity. This means that there will be little variance among different groups. We might need to transform the data in order to obtain a more meaningful analysis.

Objective 3 (Determine which customer segments and products are more profitable): Profitability

In this objective, we will first have to estimate the customer lifetime value of each customer. The customer lifetime value is estimated using some of these variables:

- Premium paid

- Administration cost

- Claim rate

- Customer acquisition cost

- Retention rate

- Policy length

- Type of insurance (Whole, Universal, Variable, Term)

Using these variables, we will be able to calculate the margins for each customer. We will then segment the customers to its appropriate segment using clustering techniques. From these segments, we will be able to see the segments that are the most profitable and utilise the appropriate marketing policy.

Tokio Marine should strategically target campaign, provide cheaper deals and provide incentive for renewal to customers that are the most profitable. The company should also try to avoid having policies with customers that eat into margins or charge a higher premium from these customers.

Objective 4 (Which channels are more profitable, direct online or through agents): Channels and profitability

This objective investigates the profitability of products sold by different channels of sales like direct, online or agent. The techniques used will be based on exploratory data analysis and clustering. We will be able to investigate the products each channel typically sells. On a whole, the profitability can be investigated by segmenting the data from different channels and looking at the profitability as a segment.

In order to have an in-depth look on the profitability. we could break down the profitability of different policies sold by each channel. The difference in profitability might lie in policy cancellation or the different cost of different channels. From these insight, Tokio Marine can order each channels to have a different specialisation of products based on profitability. For example, the online channel can specialise in travel insurance if it is found to be the most profitable channel.

Objective 5 (Propensity to buy or assess next best offer for customers to enhance effectiveness of marketing campaigns):

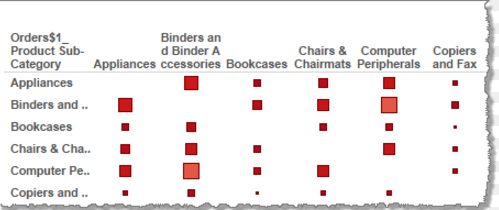

Our group will use Affinity Analysis to analyse the customer’s propensity to buy a certain basket of products. After segmenting customers according to demographics, we will conduct an Affinity Analysis to determine which basket of products these segments of customers usually buy. This will then provide guidance to Tokio Marine on marketing a specific group of products more aggressively to a segment of customers or which products to bundle together.

This can be visualized using a heatmap of co-occurrence as seen in the picture shown below, generated by Tableau:

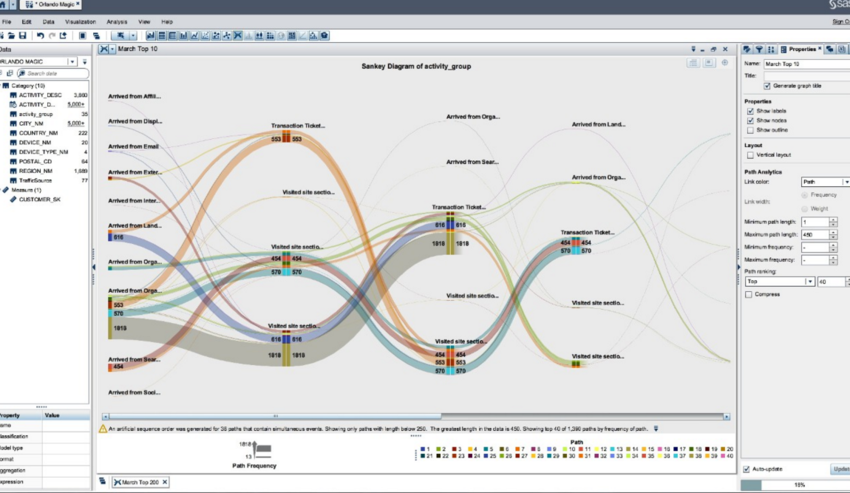

To suggest the next best offer for customers, an Event Sequence Analysis can be used (SAS Enterprise Miner terms it as Path Analysis). This will determine what products customers usually buy given that he has purchased a specific product. This will provide guidance to Tokio Marine on which products to cross-sell and how to more effectively price the products to maximize revenue.

This can be visualized using a Sankey Diagram as shown below.

Both these analytical methods can be done using SAS Enterprise Miner with several defined macros from the community. For further visualization and presentation, the results can be ported over to JMP for its interactivity and range of visualization options.

References

- ↑ 1.0 1.1 1.2 Our Story - Tokio Marine, Our Story - Tokio Marine.

- ↑ Roodpishi, M & Nashtaei, R. (2015). Market basket analysis in insurance industry. Management Science Letters , 5(4), 393-400.

- ↑ Kamakura, W. (2012). Sequential Market Based Analysis. Springer Science, Business Media, 23, 15-15. doi:DOI 10.1007/s11002-012-9181-6

- ↑ Introduction to SAS. UCLA: Statistical Consulting Group. from http://www.ats.ucla.edu/stat/sas/notes2/ (accessed November 24, 2007)