ANLY482 AY2017-18T2 Group01: Project Findings

On running our clusters through the process detailed in our Project Management section, we developed 7 clusters with 3 tiers (High Value, Moderate Value and Low Value). The cluster and their key characteristics are as follows:

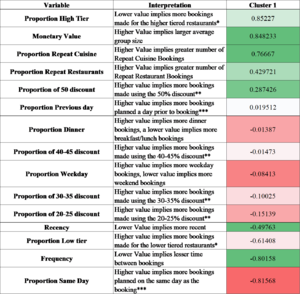

Cluster 1: The Know-it-All Social Planners

This cluster is probably one of our highest valued clusters with high Recency and Frequency scores. They prefer using the 50% Discount, booking higher tiered restaurants, planning their bookings in advance and booking for larger group sizes. There also seems to be a preference for booking over the weekend and visiting similar restaurants within the same cuisine. With this information, we infer that this group really understands and maximises the value that eatigo provides by booking expensive restaurants at discount, while planning their bookings for larger groups. With this, we refer to this group as the 'The Know-it-All Social Planners'.

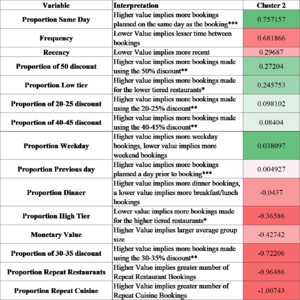

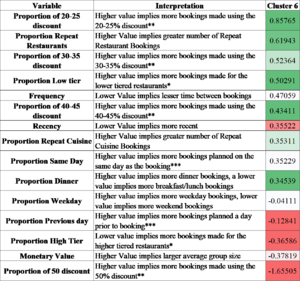

Cluster 2: The Discount Seeking Occasional Bookers

This cluster is probably one of our lowest valued segments with low Recency and Frequency scores. They tend to have the maximum preference for 50% discount range, book in small groups, book lower tiered restaurants with little planning (bookings made on the same day), with low restaurant repition and bookings mostly made for weekdays. With this kind of observation, we refer to this group as the ‘Discount Seeking Occasional Bookers’.

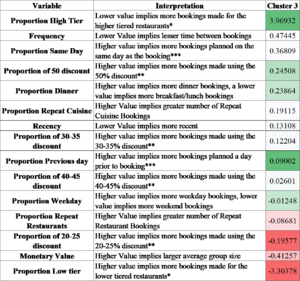

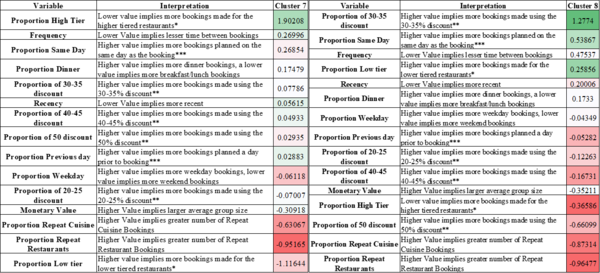

Cluster 3: The Yet-to-be-realized Premium Planners

This cluster seems to be a potentially high valued cluster. Currently, the recency and frequency scores are average. They seem to have similar traits as Cluster 1, in that they also tend to use 50% discount the most, prefer higher tiered restaurants, and pre-plan their booking. They differ in that they tend to book in smaller groups, their repetition of restaurants seems low and they seem to prefer weekday bookings. Therefore, we infer that this segment seems to understand how to use the eatigo platform, and book higher tiered restaurants, however, would need more attention to increase their bookings. So, we refer to this segment as the 'The Yet-to-be-realized Premium Planners'.

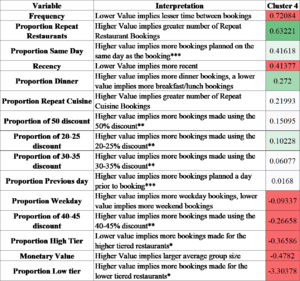

Cluster 4: The Discount Neutral Restaurant Seekers

This cluster seems to be a low valued cluster with the lowest frequency and lowest recency scores. They do not seem to have a very clear preference for a certain discount type, book mostly in small groups at mid-tiered restaurants, do not plan their bookings (high preference for booking on the same day), tend to repeat restaurants and prefer booking on the weekend. Therefore, we inferred that this cluster seems to comprise of users that probably have restaurant preferences and use the eatigo platform if they find a discount for their restaurant. So, we refer to this segment as the 'The Discount Neutral Restaurant Seekers'.

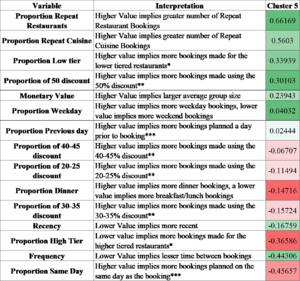

Cluster 5: The Informed Routine Planners

This cluster seems to be another high valued cluster, with high recency and frequency scores. This segment tends to use the 50% discount tier the most, book in relatively larger group sizes, often book lower tiered restaurants and generally pre-plan their bookings. They tend to re-visit the same restaurants and have a preference towards weekday bookings. This segment seems to comprise most of eatigo’s customers (40%) and we interpret that they really understand the eatigo platform and use it for their everyday dining needs. So, we refer this segment as 'The Informed Routine Planners'.

Cluster 6: The As-Per Convenience Repeaters

This cluster seems to be a relatively low valued cluster, with low recency scores and moderate frequency scores. They don’t seem to be using 50% discounts very much, generally book in small group sizes, at lower tiered restaurants and sometimes plan in advance with a preference to repeat restaurants with no clear preference for weekdays or weekends. From this, since we know that the 50% discount tier is generally off-peak times, we infer that the customers within this segment must be booking during the peak time. Therefore, we feel that this segment sometimes check-into the eatigo platform, at the time that suits them for the restaurants that they prefer. So, we refer to this segment as 'The As-Per Convenience Repeaters'.

Cluster 7 (Cluster 7 & Cluster 8): The Whatever Is Available Bookers

On profiling, as can be observed by the Z-Score Table above, we found cluster 7 and cluster 8 very similar. Therefore, we combined them. Together, this segment represents a moderately valued cluster with average frequency and low recency scores. The cluster does not seem to use the 50% discount very much, prefers to book in small groups, generally books lower tiered restaurants and make bookings on the same day. They don’t seem to repeat restaurants and have no clear weekday or weekend preference. Therefore, we feel like this segment occasionally checks into the eatigo platform during their preferred dining time and makes a booking at whichever restaurant they find a good discount at. Therefore, we call this Cluster, 'The Whatever Is Available Bookers'.