IS484 AY2020/21 Term 1: ZeroBugs

The focus of this project is on Predictive Analysis of Risk Utilization.

ZeroBugs

Contents

About the Team

Team Members

- Akshat Goel (akshat.goel.2017@sis.smu.edu.sg) – Backend Developer

- Gracia Yuwono Kwantalalu (graciay.2017@sis.smu.edu.sg) – Database Administrator and Testing

- R Jeyavani (rjeyavani.2017@sis.smu.edu.sg) – Frontend Developer

- Rohan Mehta (rohan.mehta.2017@sis.smu.edu.sg) – Project Manager

- Wei Jiaqi (jiaqi.wei.2017@sis.smu.edu.sg) – Backend Developer

- Yang Fan (fan.yang.2017@sis.smu.edu.sg) – Frontend Developer

Faculty Supervisor

- Dr Dennis Ng

- Mr Alan Megargel

Sponsor

Organization: Citibank Department: Global Exchange Connectivity & Asia Cash Equities Technology

- Sudeep Kumar (sudeep1.kumar@citi.com)

- Vikas Chandrasekaran (vikas.chandrasekaran@citi.com)

Project Overview

Project Description

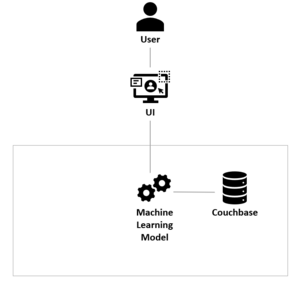

The aim of this project is to improve Citibank’s risk management system using predictive analytics. We are building a machine learning solution for the bank to predict imminent movement of the risk parameters based on historical trading patterns of their clients. This will enable Citi's clients and client facing officials to prevent regulatory violations.

Stakeholders

| Sponsor | This project is a collaboration between SMU and CitiVentures Innovation Lab. Citibank provides the project scope and management for the team. Mr Sudeep Kumar and Mr Vikas Chandrasekaran from the Global Exchange Connectivity & Asia Cash Equities Technology Lead at Citibank are the project sponsors and our contact persons. |

| User | Citibank will be using the outputs provided by this platform to check trading orders against risk parameters before sending the order to the market. Clients will place orders through Citibank’s systems which will then be checked in the backend with our system. |

| Supervisors | Mr Alan Megargel and Mr Dennis Ng from SMU are our supervisors who help us liaise with Citibank. |

Deliverables

This project is a proof of concept for a real-life business problem. It may be used for live usage after some modification by Citibank.

Scope

Project Plan

Risks

| Risks | Mitigation |

|---|---|

| Resource risk: As the project requires the application of a wide range of new technology, there is a risk that we might not be able to learn and apply them effectively in a short timeframe. | Assign each member to learn the different technology and collaborate. |

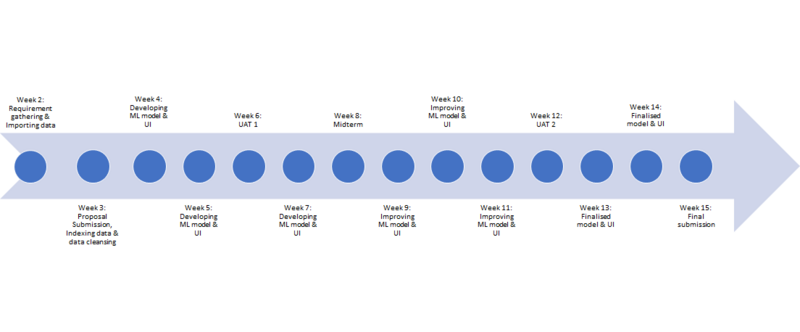

| Scope/timeline risk: As the project consists of many tasks which need to be done in a short period of time, there is a risk of not delivering the requirement on time. | Allocate clearly defined tasks to each member and allocate extra time in the schedule for delays. |

| Communication risk: There is a risk of sponsors misinterpreting our progress on the project if the updates are not accurately communicated. | Frequently discuss project updates with sponsors to ensure that the project is progressing in the direction they expect. |

| Legal risk: As we are dealing with confidential bank data, we are exposed to legal risks | Sign an NDA form and check with sponsors when uncertain about how to handle the data. |

Resource & Reference

1. Project Management:

- Asana - a tool to organize tasks and track team progress

- GitHub - a collaboration tool

2. Database:

- Couchbase - a NoSQL document-oriented database (required by the sponsor)

3. Machine Learning:

- TensorFlow - fast, flexible, and scalable open-source machine learning library for research and production

- Keras - one of the most popular and open-source neural network libraries for Python

4. User Interface:

- React - a JavaScript library for building user interfaces or UI components