Difference between revisions of "Analysis of User and Merchant Dropoff for Sugar App - Findings"

| Line 38: | Line 38: | ||

|} | |} | ||

| − | '''Merchant Growth | + | '''Merchant Growth''' |

| − | ''' | + | |

[[File:SugarM1.png|300px]] | [[File:SugarM1.png|300px]] | ||

| Line 47: | Line 47: | ||

Looking at the CDF plot, we can see that the cumulative growth in number of merchants have slowly been tapering off. Currently, Sugar has 835 merchants compared to a total of 6,860 establishments in the food & beverage (F&B) services industry (Singstat, 2016). Sugar’s merchant pool only constitutes only 12.2% of the industry and this means great room for potential in acquiring more merchants. | Looking at the CDF plot, we can see that the cumulative growth in number of merchants have slowly been tapering off. Currently, Sugar has 835 merchants compared to a total of 6,860 establishments in the food & beverage (F&B) services industry (Singstat, 2016). Sugar’s merchant pool only constitutes only 12.2% of the industry and this means great room for potential in acquiring more merchants. | ||

| + | |||

| + | '''Number of Orders per Merchant''' | ||

[[File:SugarM2.png|300px]] | [[File:SugarM2.png|300px]] | ||

| Line 55: | Line 57: | ||

| style="padding:0.3em; font-family:Georgia; font-size:100%; border-bottom:2px solid #626262; border-left:2px #66FF99; background: #18e2a1; text-align:left;" width="20%" | <font color="#000000" size="3em">User Growth<br></font> | | style="padding:0.3em; font-family:Georgia; font-size:100%; border-bottom:2px solid #626262; border-left:2px #66FF99; background: #18e2a1; text-align:left;" width="20%" | <font color="#000000" size="3em">User Growth<br></font> | ||

|} | |} | ||

| + | |||

| + | '''Number of User Sign ups per Month''' | ||

| + | |||

| + | [[File:SugarU2.png|300px]] | ||

| + | |||

| + | As shown by the graph, Sugar experienced its highest user growth in Apr 2015. It has not been consistent. Number of new users per month has been decreasing. | ||

| + | |||

| + | '''User sign-ups grouped by Day of Month''' | ||

| + | |||

| + | [[File:SugarU1.png|300px]] | ||

| + | |||

| + | Interestingly, the 5th and 6th day of each month has more orders than the rest of the month. | ||

{| style="background-color:#E6CCFF; color:#E6CCFF padding: 1px 0 0 0;" width="100%" cellspacing="0" cellpadding="0" valign="top" border="0" | | {| style="background-color:#E6CCFF; color:#E6CCFF padding: 1px 0 0 0;" width="100%" cellspacing="0" cellpadding="0" valign="top" border="0" | | ||

Revision as of 18:09, 28 February 2016

| Mid-Term | Finals |

|---|

Exploratory Analysis

| Merchants |

Merchant Growth

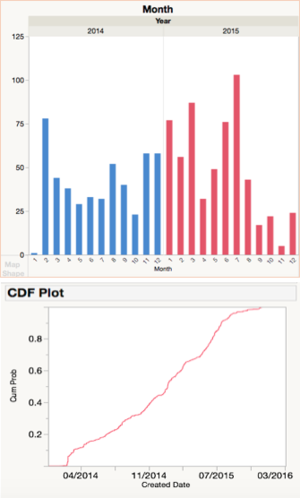

As we look towards Sugar’s merchant acquisition process over the past 2 years, there are several notable spikes.

For example, during the beta phase in February 2014, Sugar is trying to bring merchants on board before its official launch in July. There is also a noticeable spike in July 2015 which is probably due to Sugar’s campaign.

Looking at the CDF plot, we can see that the cumulative growth in number of merchants have slowly been tapering off. Currently, Sugar has 835 merchants compared to a total of 6,860 establishments in the food & beverage (F&B) services industry (Singstat, 2016). Sugar’s merchant pool only constitutes only 12.2% of the industry and this means great room for potential in acquiring more merchants.

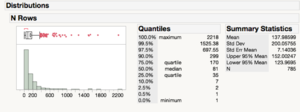

Number of Orders per Merchant

Looking at the number of orders, the distribution is mainly right-skewed. Around 80% of merchants generate only 200 or less orders over the course of 2 years whereas the top 20% are able to generate up to 2,200 orders in total. However, we should take into account how many total revenue is also generated by these top 20% merchants. Thus, we will be looking more into the funnel plot analysis to identify these star merchants.

| User Growth |

Number of User Sign ups per Month

As shown by the graph, Sugar experienced its highest user growth in Apr 2015. It has not been consistent. Number of new users per month has been decreasing.

User sign-ups grouped by Day of Month

Interestingly, the 5th and 6th day of each month has more orders than the rest of the month.

| Orders |