Difference between revisions of "Analysis of User and Merchant Dropoff for Sugar App - Findings"

Jump to navigation

Jump to search

| Line 33: | Line 33: | ||

<!------- Details ----> | <!------- Details ----> | ||

==<div style="background: #95A5A6; line-height: 0.3em; font-family:helvetica; border-left: #6C7A89 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#F2F1EF"><strong>Exploratory Analysis</strong></font></div></div>== | ==<div style="background: #95A5A6; line-height: 0.3em; font-family:helvetica; border-left: #6C7A89 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#F2F1EF"><strong>Exploratory Analysis</strong></font></div></div>== | ||

| + | |||

| + | {| style="background-color:#E6CCFF; color:#E6CCFF padding: 1px 0 0 0;" width="100%" cellspacing="0" cellpadding="0" valign="top" border="0" | | ||

| + | | style="padding:0.3em; font-family:Georgia; font-size:100%; border-bottom:2px solid #626262; border-left:2px #66FF99; background: #18e2a1; text-align:left;" width="20%" | <font color="#000000" size="3em">Merchants<br></font> | ||

| + | |} | ||

| + | |||

| + | [[File:SugarM1.png|400px]] | ||

| + | |||

| + | As we look towards Sugar’s merchant acquisition process over the past 2 years, there are several notable spikes. | ||

| + | |||

| + | For example, during the beta phase in February 2014, Sugar is trying to bring merchants on board before its official launch in July. There is also a noticeable spike in July 2015 which is probably due to Sugar’s campaign. | ||

| + | |||

| + | Looking at the CDF plot, we can see that the cumulative growth in number of merchants have slowly been tapering off. Currently, Sugar has 835 merchants compared to a total of 6,860 establishments in the food & beverage (F&B) services industry (Singstat, 2016). Sugar’s merchant pool only constitutes only 12.2% of the industry and this means great room for potential in acquiring more merchants. | ||

==<div style="background: #95A5A6; line-height: 0.3em; font-family:helvetica; border-left: #6C7A89 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#F2F1EF"><strong>Funnel Plot Analysis</strong></font></div></div>== | ==<div style="background: #95A5A6; line-height: 0.3em; font-family:helvetica; border-left: #6C7A89 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#F2F1EF"><strong>Funnel Plot Analysis</strong></font></div></div>== | ||

Revision as of 18:04, 28 February 2016

| Mid-Term | Finals |

|---|

Exploratory Analysis

Exploratory Analysis

| Merchants |

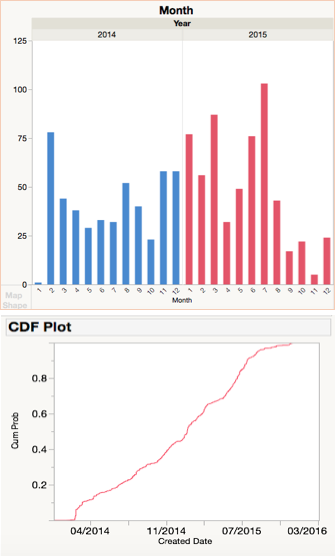

As we look towards Sugar’s merchant acquisition process over the past 2 years, there are several notable spikes.

For example, during the beta phase in February 2014, Sugar is trying to bring merchants on board before its official launch in July. There is also a noticeable spike in July 2015 which is probably due to Sugar’s campaign.

Looking at the CDF plot, we can see that the cumulative growth in number of merchants have slowly been tapering off. Currently, Sugar has 835 merchants compared to a total of 6,860 establishments in the food & beverage (F&B) services industry (Singstat, 2016). Sugar’s merchant pool only constitutes only 12.2% of the industry and this means great room for potential in acquiring more merchants.

Funnel Plot Analysis

Funnel Plot Analysis

Time-Series Analysis

Time-Series Analysis

Geospatial Analysis

Geospatial Analysis