Difference between revisions of "Group10 proposal"

| Line 23: | Line 23: | ||

= Background = | = Background = | ||

| − | + | Having an accurate housing price model is important for the government or policymakers as properties plays a significant role in household wealth and national economy. To date, the hedonic pricing model is still the commonly used method by researchers to study housing prices. Hedonic pricing models are often computed using an ordinary least squares (OLS) estimator, with the assumption that the observations are independent and identically distributed. This indicates that there is no spatial auto-correlation among the observations but in reality, that might not be true and thus, a hedonic pricing model could lead to biased, inconsistent and inefficient results. Our team attempts to explore the use of geographically-weighted regression (GWR) as a property pricing model and thereafter compare to see which is better. The research findings can help us understand the roles of various structural attributes and locational amenities in estimating property prices. | |

= Motivation = | = Motivation = | ||

Revision as of 11:55, 18 March 2020

Contents

Background

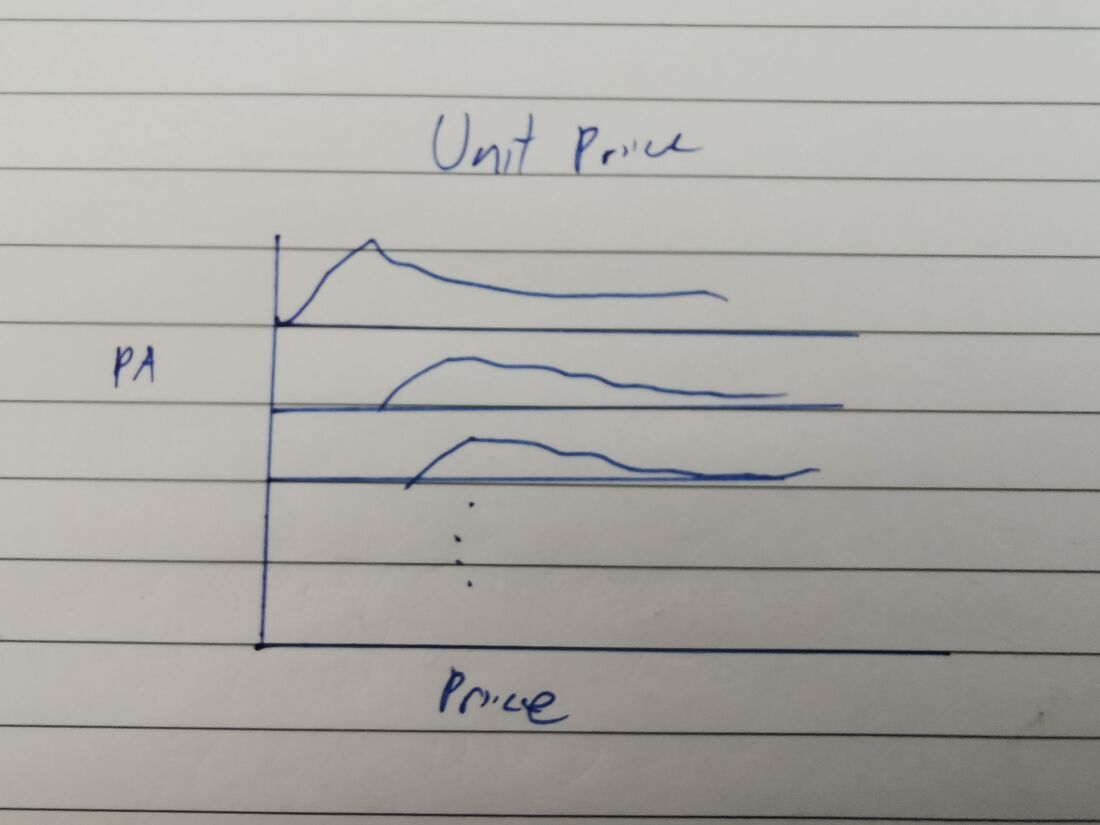

Having an accurate housing price model is important for the government or policymakers as properties plays a significant role in household wealth and national economy. To date, the hedonic pricing model is still the commonly used method by researchers to study housing prices. Hedonic pricing models are often computed using an ordinary least squares (OLS) estimator, with the assumption that the observations are independent and identically distributed. This indicates that there is no spatial auto-correlation among the observations but in reality, that might not be true and thus, a hedonic pricing model could lead to biased, inconsistent and inefficient results. Our team attempts to explore the use of geographically-weighted regression (GWR) as a property pricing model and thereafter compare to see which is better. The research findings can help us understand the roles of various structural attributes and locational amenities in estimating property prices.

Motivation

Project Objectives

Perform Geographically Weighted Regression to estimate/verify the listed price of a property by considering amenities like school and transport node

Proposed Scope and Methodology

Project Timeline

Features

Data Source & Preparation

| Data Source | Documentation |

|---|---|

| Realis | Transaction Data of Private Property in Singapore |

| School | Address of Schools |

Software

Packages

| Package Name | Description |

|---|---|

| shiny | Building of interactive web applications |

| shinydashboard | Dashboard Creation |

| ShinyThemes | Themes for Shiny |

| ShinyWidgets | Themes for Widgets |

| Tidyverse | Collection of R packages for data analysis, packages includes ggplot2, dplyr, tidyr, readr, purrr, tibble, stringr, forcats |