IS484 AY2020/21 Term 1: AltitudePlus

Customer Mailing Address Analysis

Altitude+ Team Members

| Name | Primary Role | Secondary Role | |

|---|---|---|---|

| Soh Ern Zher Timothy | timothy.soh.2017@sis.smu.edu.sg | Project Manager | Business Analyst |

| Tan Hui Rong | huirong.tan.2017@sis.smu.edu.sg | Front-End Developer | UI / UX Designer |

| Xavier Lur Zher Bang | xavier.lur.2017@sis.smu.edu.sg | UI / UX Designer | Front-End Developer |

| Liu Zuo Lin | zuolin.liu.2017@sis.smu.edu.sg | Back-End Developer | Data Analyst |

| Truong Hai Bang | hbtruong.2017@sis.smu.edu.sg | Back-End Developer | Quality Assurance Analyst |

| Wan Ding Yang | dingyang.wan.2018@sis.smu.edu.sg | Data Analyst | Quality Assurance Analyst |

Faculty Supervisor

| Name | |

|---|---|

| Professor Alan Megarel | alanmegargel@smu.edu.sg |

| Professor Dennis Ng | dennisng@smu.edu.sg |

Sponsor

Citibank (Citi Ventures)

| Name | Role | |

|---|---|---|

| Yuqian Song | yuqian.song@citi.com | Head of APAC / EMEA Data Services and Head of Global Advanced Analytics Technology Solutions |

| Ashish Awasthi | ashish.awasthi@citi.com | Citibank Project Lead |

Project Overview

Project Description and Motivation

Addresses of people and businesses contain important information about them and Citibank is currently exploring the space of address analytics to gather address data usable in models and analytics.

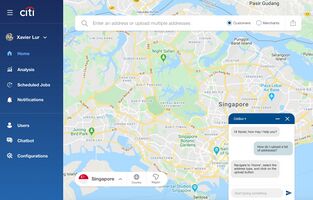

We will be developing an internal application for Citibank to periodically collect address-related data from multiple public data sources, pre-process and analyse the data. We aim to generate insights that supplements Citibank's existing models and use cases, such as targeted financial offering recommendations to enhance the experience for both customers and businesses.

Stakeholders

| Stakeholder Type | Description |

|---|---|

| Sponsor | Yuqian Song, Head of APAC / EMEA Data Services and Head of Global Advanced Analytics Technology Solutions |

| User |

Data analysts and architects at Citibank’s Global Consumer Technology (GCT) The GCT team is seeking an application that would

|

| Advisors / Practitioners / Mentors |

Alan Megargel - Contact point from SMU Dennis Ng - Contact point from SMU |

Deliverables

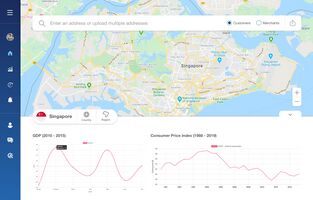

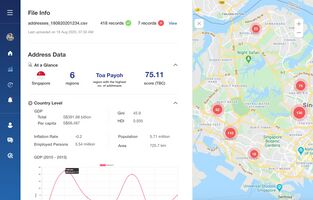

A proof of concept representing an internal application to be integrated with Citibank’s existing backend - an analytics tool that derives and generates actionable insights based on user-input addresses as well as open source data e.g. IMF, DBpedia, OneMap API etc.

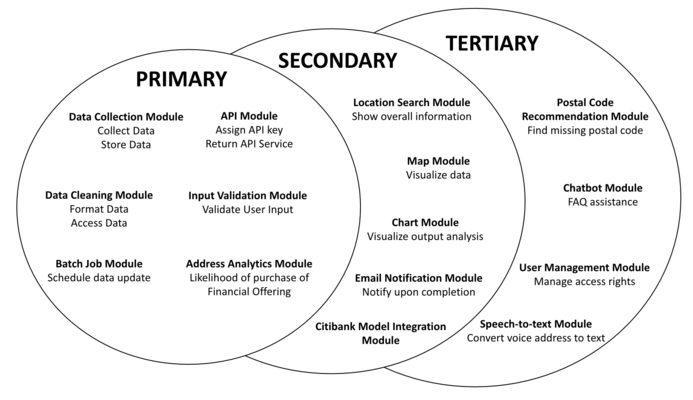

Our application will be segregated into 2 sections - the frontend and backend application. We will also include comprehensive documentation detailing the functionalities and implementation of our applications.

| S.N. | Deliverable | Component Description |

|---|---|---|

| 1 | Frontend Application Source Code | User interface for more intuitive user input and easier visualization of generated insights |

| 2 | Backend Application Source Code | Handles data collection, data cleaning, data pre-processing, data analysis, model building, batch job, REST API endpoints |

| 3 | Documentation | Describes use cases, functionalities and detailed implementation for both frontend and backend applications |

Assumptions

1. Project Assumptions

a. Data quality has been accessed and accepted by client.

b. Advanced Analytics and X Factor are to be further discussed and finalised by the mid-term presentations.

c. Public data sources are available, and the structure of the format does not change.

2. Client Assumptions

a. Citibank will carry out the necessary internal processes and checks to allow us to perform analysis using Citibank’s data.

b. Citibank will handle the administrative matters pertaining to various access rights in order to conduct our model integration with their existing model.

c. There is an alignment of requirements and deliverables between Citibank and our team.

3. Project Management Assumptions

a. Team members will be present for all planned meetings.

b. Team members have the necessary knowledge and expertise to carry out their assigned tasks.

4. Technology Assumptions

a. Technology requirements have been discussed and approved by Citibank

Scope

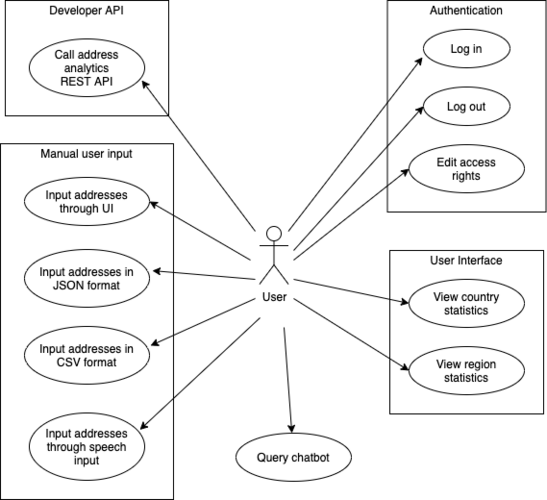

Use Case Diagram

User Interface

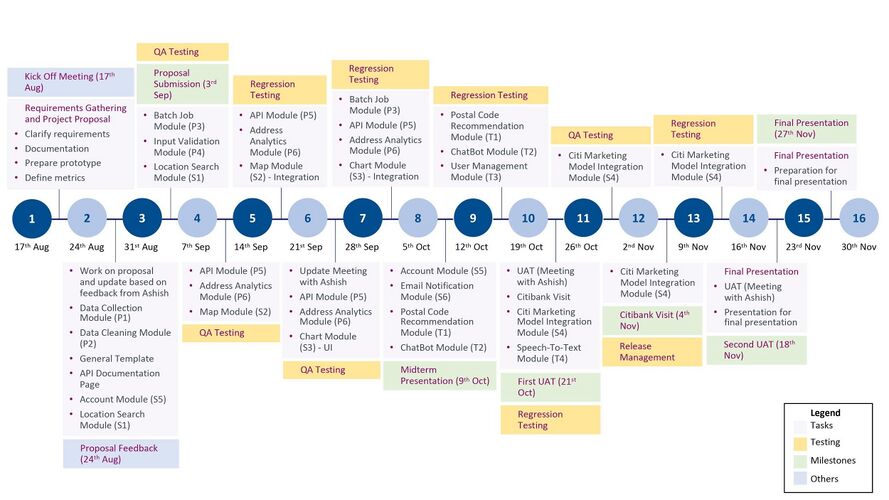

Project Plan

Project Milestone

Risks

Project Risks: Risks related to the project

- Scope Creep Risk

- Analytics Limitation Risk

- Project Assumption Risk

- Sustainability Risk

Client Risks: Risk related to client being unable to fulfil their commitments to the project

- Data Access Risk

- Client Expectation Risk

Project Management Risks: Risk of failing to meet schedule plans and the effects of that failure

- Dispute Risk

- Health and Safety Risk

Technology Risks: Risks related to technology

- Information Security Risk

Resource and Reference

- Analytics

- Banking Architecture

- Database Management

- Excel

- Financial Modelling

- Frontend / Backend Development

External Sources

- IMF

- DBpedia

- OneMap