ANLY482 AY2016-17 T1 Group6/Final Progress

| Home | Team | Project Overview | Midterm Progress | Final Progress | Project Management | Documentation |

Communications data, such as the emails exchanged by employees, can be of rich insight when analyzing and predicting business performance.

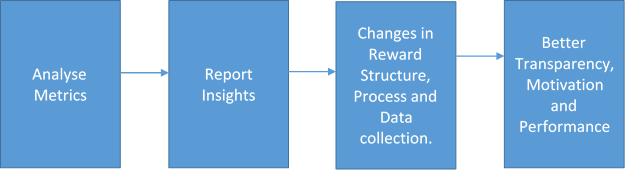

For a B2B company such as Trustphere, communicational efficiency from their sales team is essential for increase in revenue and growth. Acknowledging that sales numbers in dollars are not adequate by themselves to gauge the potential and performance of the sales team, our team has analyzed emails exchanged by salespeople, to report specific insights that enable the senior management to monitor individual salesperson’s progress in the sales cycle and identify bottlenecks in the sales process.

These insights include, but are not limited to, the salesperson’s internal and external network, response time and communications promptness when communicating with a client, progress in current sales accounts and a postmortem of failed accounts. Our attempt is to make sales performance based on communications efficiency as visible and measurable as possible, hoping that it will not only reform the commission structure to motivate employees to hone their communication skills but also give the management a bird’s eye view of the real time sales progress, instead of knowledge of just the successful accounts.

TrustSphere, a software-as-a-service company, delivers Relationship Analytics solutions to organizations enabling them to unlock the value of their networks. This set of analytics surfaces insights that help clients across the globe improve key business issues including sales force effectiveness, enterprise-wide collaboration and corporate governance. Solutions are delivered through leading technology and business partners such as IBM, Salesforce.com and SugarCRM.

Being a B2B company, TrustSphere has a dedicated Sales team of 19 people (as of 31st August 2016) around the world. The team’s responsibility is to approach prospective clients with TrustSphere’s product, persuade them to agree to a meeting and to commission a proof of concept (POC). Once a salesperson gets a client to agree to a meeting or a POC, he/she qualifies for a sales commission. The team is also tasked with seeking out partners and maintaining partnerships for the company.

Apart from sales and commission dollars, the company has little information about the sales process, how efficiently salespeople communicate with clients and the extent of internal collaboration with other TrustSphere departments. Our team was therefore engaged to use their existing email communications data to evaluate communicational efficiency of each individual salesperson and develop a reporting model (dashboard) for the Sales Director to have a bird’s eye view of real-time sales progress.

While much has been explored in the field of Sales Analytics, a recent study reveals that few companies have delved into the area of Sales People Analytics. Deloitte found that almost 70% of companies felt they were weak in using HR data to predict workforce performance and improvement.

Conventional wisdom tells us there are several ways to evaluate a salesperson’s performance, such as the size of his external network and his sales figures. New research says this is an oversimplification of sales practices . Steward et al. (2010) found that higher-performing salespeople regularly activated their internal company networks to coordinate a team of experts tailored to serve a particular customer. Purely focusing on sales figures as an indicator of performance also neglects the time aspect. Sometimes long-term projects take months to realize revenues. Harvard Business Review also found that spending time with both internal and external connections contributed to success in selling.

Overwhelming research evidence pointing at the inadequacy of looking purely at sales figures. Further, the importance of ‘People Data’ re-emphasizes the criticality of communicational efficiency. Currently TrustSphere’s approach to assessing performance in this regard is self-reporting and review meetings with the Sales team. The team functions largely independently and management has little understanding of communicational effort and hardly any insight into opportunities for improvement in the sales process other than feedback from salespeople.

We intend to use TrustSphere’s data of their salespeople’s email communications to measure outreach, relationships, clients, responsiveness, collaboration and sales progress of the Sales team by adding a layer of mathematical and data-supported insights. Furthermore, we intend to provide actionable recommendations on better data collection so that future analysis becomes easier for TrustSphere. Lastly, we aim to develop a reporting model (dashboard) prototype that TrustSphere can adopt and develop for tracking performance in future. We foresee that with continuous and real time insight into salespeople communications, senior management will be able to employ better decision making capabilities with regards to the sales process and overhaul training and commission structures for the Sales team.

Our project began with the primary objective of making the sales process and communicational efficiency as visible and measurable as possible. Thus, our team interviewed sales associates and discussed the possibilities with our point-of-contact at the company to gain insight into what information would be useful and most critical to them when it came to evaluating sales performance. With that, we explored the range of possible questions and areas of analysis we could delve into. After repeated meetings with the client and consultations with our advisor, we narrowed our scope down to:

1. Relationship Report

- Analyse the volume and strength of Internal and External Relationships salespeople have developed over the analysis period

- Consider the frequency and recency of emails exchanged by and with the salesperson to highlight their communication and collaboration efforts

2. Clients and Sales Stages

- Report the sales progress for each account up-till 31st August i.e. how many accounts are active and what stage of the sales cycle they are in

- Evaluate the performance of each salesperson depending on how many accounts they have in each stage, their response trends in each stage, progress from historical communication indications etc.

- Provide a post-mortem on inactive accounts, reporting on how long communications with a client lasted, in what stage communications ended and which salespeople were responsible

3. Social Network Analysis

- Analyse collaboration trends e.g. which departments salespeople interact with more, whether there lies a communication gap between teams

- Examine overlap trends, to see if multiple salespeople interact with the same client, and whether abnormalities exist within the overlap

Data was provided to us by the client in Week 3. They provided us with 1 main dataset of email communications of sales employees and a supplementary staff list to aid our analysis with details of departments and hierarchy in the organization.

1. Daily Email Communication Dataset

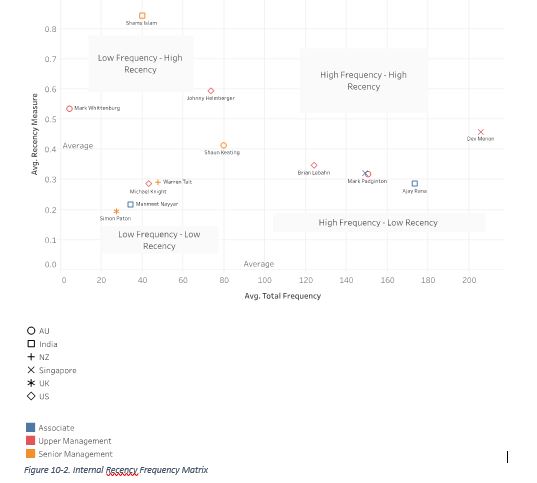

This dataset contained year-to-date (up till 31 August 2016) records of daily email communication data of all 19 TrustSphere sales people across the globe. This data includes the following 6 variables. (109,771 Records)

- Date: Includes the date and time of a particular email being sent

- Originator address: Sender email address

- Recipient address: Receiver email address

- Direction: Nature of communication (internal, inbound or outbound)

- MsgID: Unique message ID of emails sent

- Email Subject: Email subject header

2. Staff List

The dataset lists all of TrustSphere staff (57) with the following 5 variables.

- Name

- Hierarchy

- Department

- Position

- Location

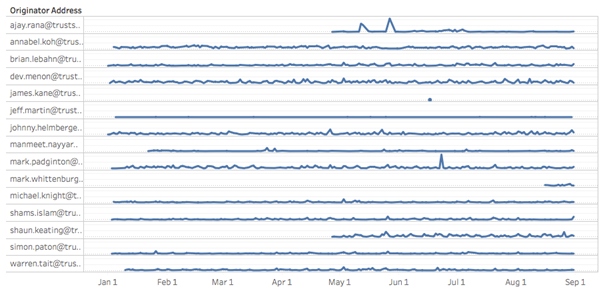

Our first step was to check confirm that salespeople have been actively communicating through email, as appointment and exit dates were not made available to us, we had to confirm that all sales employees were in fact active and employed with TrustSphere during our Analysis period.

1. Summary of Findings

- No records were found for 3 Salespeople

- 1 Salesperson had only sent one email over the course of 7 months

- 1 Salesperson sent an abnormally low number of emails, leading to an assumption that he has a secondary work email

- 3 were new hires made in the analysis period of 1st January to 31st August 2016

2. Implication

After deliberation of the results with TrustSphere, the 3 salespeople with no records and the 1 with a single record were to be removed from our analysis under the assumption that they were no longer employed by TrustSphere. The salesperson with a low number of emails and the 3 new hires were to be included in the report but filtered out as and when they were likely to skew results. Therefore analysis was carried out with 14 active salespeople.

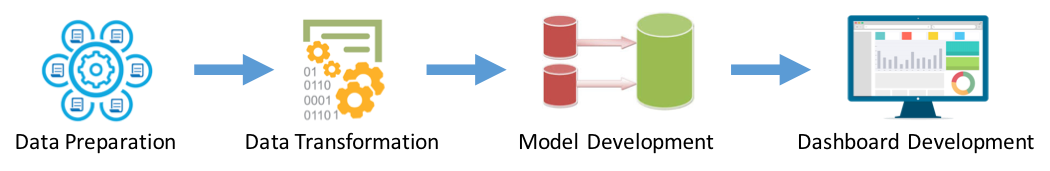

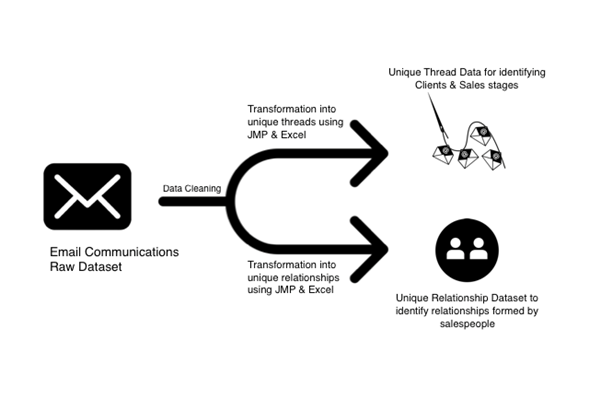

The data had to be cleaned and transformed in order for us to compute and visualize our desired metrics and attributes. Email communications contain a lot of junk and irrelevant emails that need to be cleared out as well. We cleaned and transformed the Initial dataset into two separate datasets to better address the needs of our scope.

Details of the Data cleaning and transformation process can be found in our Mid-Term Proposal. The variables for the datasets are as follows:

1. Classification of Metrics

Following our exploratory analysis and during the transformation process of the data and repeated meetings with the client, we established certain classifications and metrics that ease reporting of sales performance.

1.1 Clients & Stages

- Sales Stages

- Prospecting Stage: When a prospecting email is sent out to a prospective client, they may or may not respond

- Meeting Stage: When the client has responded favourably to the prospecting stage and TrustSphere has a scheduled pitch meeting with the client

- POC Stage: When the client has agreed to commission a product trial

- After POC Stage: Follow ups, quotations, contracts etc

- Active and Inactive Clients

- Active Client: Contact has taken place within the past 30 days

- Inactive Client: No contact has taken place in the past 30 days

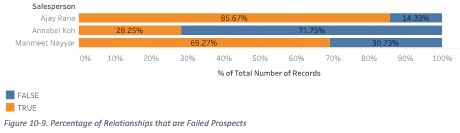

- Failed Prospects

- “Failed Prospect” is a classification that indicates what percentage of prospecting emails sent out failed to progress onto the meeting stage

1.2 Hot & Cold Relationships

- Hot Relationship: Last contact was made less than 3 days ago

- Cold Relationship: Last Contact was made more than 3 days ago

1.3 Strong & Weak Relationships

- Strong Relationship: Above average number of emails exchanged AND is a hot relationship

- Weak Relationship: Below average number of emails exchanged AND/OR is a Cold Relationship

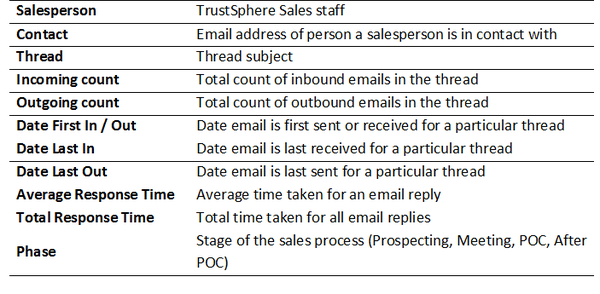

2. Data Dictionary

2.1 Unique Thread Dataset (For Clients and Stages)

Two things to note:

- Each Record is a unique thread of emails exchanged between a salesperson and an external contact.

- This data focuses solely on client relationships therefore internal and partner communications were filtered out.

2.2 Unique Relationship Dataset

- Each record is unique relationship between the Salesperson and a Contact.

- The relationship may be Internal or External.

1. Motivation & Purpose

The success of B2B sales is relationship building. It is necessary for any Sales team to sustain positive, consistent, and frequent communications with the customer to secure a sale . Similarly, or even more so in the B2B sphere, it is necessary for a salesperson to have frequent and active communications with a client (although this does not warrant spamming clients with unwanted emails). This builds rapport, propelling a salesperson to the client’s top of mind recall for a product and increases the likelihood of securing a deal.

As we do not have access to email content data, we are not able to assess how well salespeople communicate with the client in terms of communication, research and writing skills. However, we do have information regarding the timeline of communications through which we can determine whether salespeople communications are active/dormant or frequent/infrequent. Therefore, we use the frequency and activeness of a communication as a proxy for a strong relationship both in external and internal networks of a salesperson.

2. Specifying the Factors of Analysis

- Hot & Cold Relationships

The recency factor defines whether a relationship is hot or cold, i.e. whether the communication between two people is active or inactive. This was fuelled by the rationale that most business people are prompt in replying to emails relating to a service they are interested in, or a person they hold a strong rapport with. In other words a person is less likely to reply promptly to a chain they deem irrelevant.

We recommended Hot and Cold to be a binary variable. Internal communications responded to within 3 days are considered “Hot” and older than 3 days old classified as “Cold”, this figure was recommended to us by TrustSphere. For external relationships, we kept the benchmark at 10 days.

- Strong & Weak Relationships

Strong and weak relationships are a binary classification as well. The motivation for this factor comes from the requirement for constant and frequent communication to build a strong relationship.

A Strong External relationship is defined by:

- Greater than 3 Outbound Emails (3 is the rounded average of External Outbound Emails)

- Greater than 2 Inbound Emails (2 is the rounded average of External Inbound Emails)

- Hot External Relationship (Last Communication within 10 days from 31st August)

A Strong Internal relationship is defined by:

- Greater than 22 Outbound Emails (22 is the rounded average of Internal Outbound Emails)

- Greater than 12 Inbound Emails (12 is the rounded average of Internal Inbound Emails)

- Hot Internal Relationship (Last Communication within 3 days from 31st August)

3.Internal Network

- Visualization

The data was visualized and analysed using Tableau, although we are using d3.js for our dashboard where we will report external relationships. For insights and recommendations regarding internal relationships, we utilized Tableau to be more time and resource efficient.

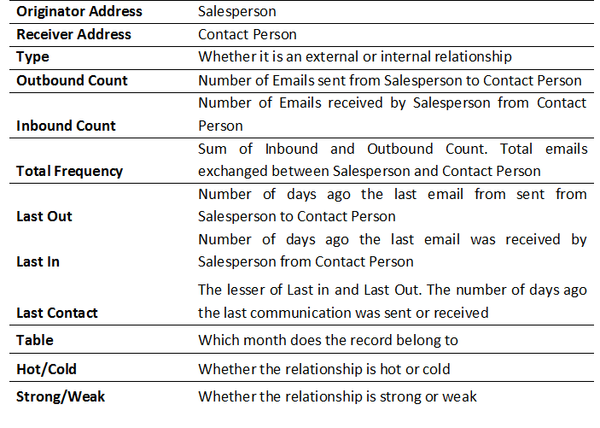

- Number of Internal Relationships

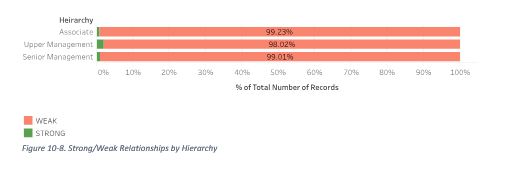

Salespeople have an average of 44 Internal Relationships over the analysis period. We observe that people of higher hierarchy have larger number of internal relationships as they manage teams and communicate more with internal parties. Associates have the lowest number of internal relationships as their main task is to seek out external prospective clients.

Salespeople have an average of 44 Internal Relationships over the analysis period. We observe that people of higher hierarchy have larger number of internal relationships as they manage teams and communicate more with internal parties. Associates have the lowest number of internal relationships as their main task is to seek out external prospective clients.

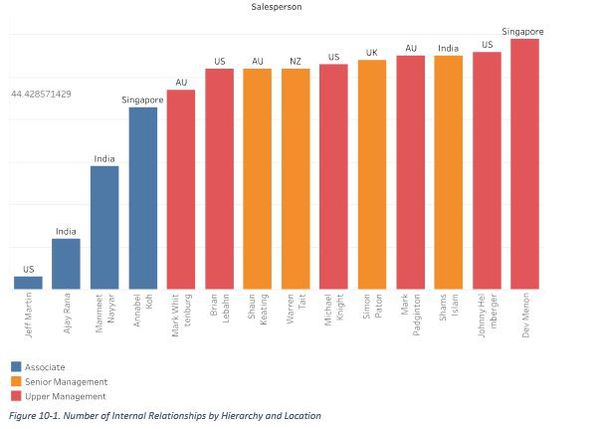

- Recency-Frequency Matrix

Salespeople are put on a Recency-Frequency Matrix. The matrix has Average Recency on the X axis and Average Frequency of a Salespersons relationships on the Y axis.

Average Frequency of a Salesperson = Σ(Total Frequency)/Number of Relationships

Total Frequency – The Total Number of Emails Exchanged by the Salesperson and the Internal Contact Person in the Relationship

Average Recency of a Salesperson = 1 / Σ (Last Contact)/Number of Relationships

Total Recency – The Total Number of Days since 31st August since the last contact was made between the Salesperson and Internal Contact Person in the Relationship

Point to note – Average recency plotted is divided by 1, as the higher the number of days since last contact the lower the average recency will be, i.e the average days since last contact and recency have an inverse relationship therefore the figure needs to be inversed.

As people move left to right on the plot, it signifies that they have more email exchanges per Internal relationship (High Average Email Exchange Frequency). As they move up on the plot, it signifies they have more active Internal relationships (The Average Number of Days since the last communication in a relationship are low).

For example, Dev holds the strongest position in Internal relationships by having frequent and ongoing interactions with internal parties.

What’s interesting to note is that although Senior Management has a higher number of Internal relationships, their average communications within each relationship is generally low, i.e. they do not interact much with their internal contacts.

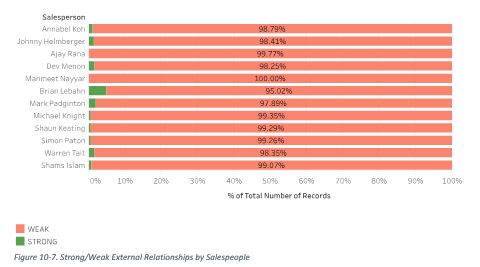

- Strengths of Relationships

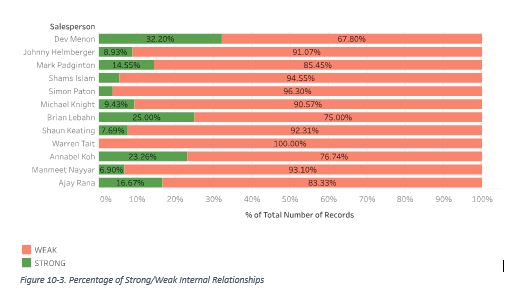

The above graph highlights the percentage of Strong and Weak Internal Relationships each Salesperson has. The bar chart validates the results of the Matrix showing that Senior Management Simon, Warren, Shaun and Shams (Senior Management) have a very low percentage of Strong Internal Relationships due to below average interaction with their internal parties.

We noticed that Warren has 100% weak relationships. We considered the possibility of him being on leave from 28th to 31st August 2016 – however his email activity reflected that he did send out and receive emails on said dates, just not to or from any internal parties.

Associates have less number of Internal Relationships however on an average these relationships are stronger than those of the Senior or Upper Management due to high and frequent interactivity, furthermore apart from Shams all other Senior Management sales employees fall under in the low frequency – low recency quadrant implying that many internal relationships have stagnated over the past 7 months.

Point to Note – Mark Whittenburg was removed from this analysis as he only joined a month before the end of our analysis period and therefore would not have many high frequency relationships that could qualify as “Strong”.

4.External Network

(a)Visualizations

(a.i) Number of External Relationships

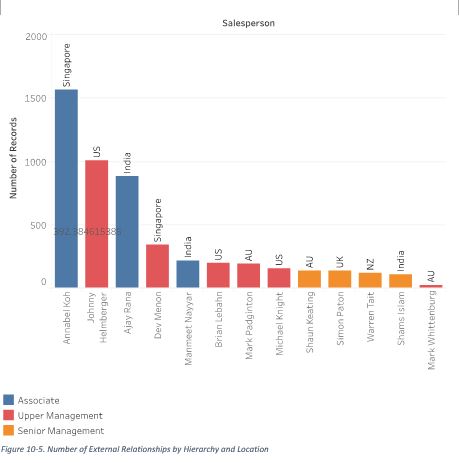

Salespeople have an average of 392 External Relationships over the analysis period. As expected a stark difference from Internal Relationships, people higher up in the hierarchy have lower number of external relationships than associates, as the latter are tasked with constantly reaching out to prospective clients. A lower number of External relationships for any associate could mean that they are not reaching out to enough prospective clients.

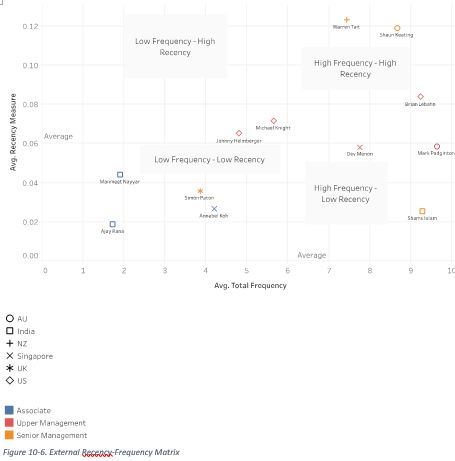

(a.ii) Recency-Frequency Matrix

The External Recency–Frequency Matrix is computed and plotted using the same calculations as the Internal Matrix.

As people move left to right on the plot it signifies that they have more email exchanges per External relationship (High Average Email Exchange Frequency). As they move up on the plot, it signifies they have more active External relationships (the Average Number of Days since the last communication in a relationship are low)

Senior Management shows evidence of stronger, more established external relationships, this is because senior personnel do not send out prospecting emails and maintain contact with mostly existing and high profile clients and partners. A senior management employee in the Low Frequency – Low Recency quadrant could indicate inadequate effort in maintaining and establishing important external relationships.

Associates show below average interaction and stagnant relationships. Primarily because they are in-charge of reaching out to prospective clients, in many cases those clients may not respond to them or their communications may not pass initial stages. Therefore, although they have a high number of external relationships, these relationships are mostly weak.

(a.iii) Strength of Relationships

Many external relationships remain weak, this is presumably due to a lot of irrelevant/short term external communications that exist in an individual’s mailbox (apart from spam, advertisements, and newsletters that we have removed from the dataset). However, if we observe trends in comparison, we see that associates have little or no strong external relationships where as Senior and Upper Management have quite a few.

A considerable amount of external relationships of associates are failed prospects (refer to Section 9.1.1) i.e. pitch emails sent out to a prospective client that were either not responded to or were responded to in the negative. Failed prospects are drastically more for associates in the India team.

5.Discussions of Insights

Relationship analysis plays an important role is observing hierarchical trends in internal and external relationships, and it acts as a useful monitoring device to assess if salespeople display poor or unusual communication and interactivity.

The Internal Relationships of the Sales team do not represent an ideal dynamic. However the insights into hierarchical differences in Internal Relationships are reflective of common business practices and assumptions, i.e. it is common for senior management to have stronger external than internal relationships, as they are in-charge of business development for the company and therefore are likely to spend more time communicating with external parties. In further sections of the report, through SNA, we aim to delve deeper into the internal network of the Sales team to provide more actionable recommendations with respect to collaboration and inter-department communication.

In External relationships however, we observed a large scope for improvement in TrustSphere’s Sales team. External relationships are critical to acquire and maintain a sizeable pool of clients and partners. Our analysis shows that most salespeople have weak external relationships, especially the prospecting ones. To tackle this problem, we recommend that TrustSphere employ the following strategies to increase visibility and gain more mindshare of prospective and current clients.

(a) Recommendations for Improvements

- Personalize Prospecting Emails – Currently TrustSphere sends out industry specific emails to its prospective clients, for example a hospital may receive a prospecting email titled “How Relationship Analytics can increase productivity in healthcare”. But in today’s competitive business landscape, it isn’t enough to make industry-specific pitches. According to an Aberdeen report in 2015, personalized email messages improve click-through rates by an average of 14% and conversions by 10%. Majority of marketers across the globe attest to the fact that personalization plays a huge role in increasing recall and engagement . TrustSphere, using their analytical capabilities, should set up an automated process wherein a company name could be inserted into the subject header and email content by a salesperson. Personalization will improve the chance of an email being viewed or responded to. For instance, a prospecting email subject header sent to SMU could be “How Relationship Analytics can help SMU better monitor its educators”.

- Proactively Engage Clients – A recent Gallup report found that inaction on the part of B2B Sales teams in engaging a client has deteriorating effects on the client’s willingness to purchase. In fact, in many B2B industries, much of the share of business belongs to actively engaged customers . TrustSphere should produce content such as blog articles, infographics, commentary videos of industry specific relationship analytics trends that could be sent to prospective and existing clients to engage and re-engage them, making them interested in the product and respond positively to a sales pitch.

SNA helps visualize complex networks and identify gaps in communication and highlight redundancies. In organizations, SNA can help diagnose collaboration lapses (Novak, Rennaker and Turner, 2011). It reveals the true underlying networks in which colleagues collaborate and highlight interdependencies and redundancies across departments and hierarchies.

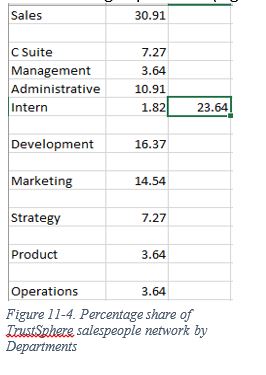

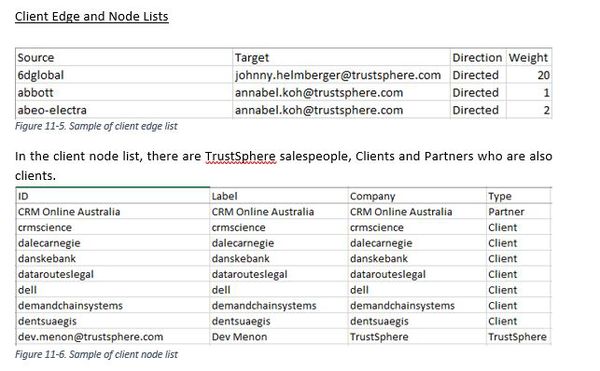

We will be exploring the social networks of TrustSphere’s salespeople in two parts: their internal network and their external network.

Salespeople's Internal Network

Contrary to popular belief, customer-directed behaviour only explains 10-20% of a salesperson’s performance (Ryals & Humphries, 2007). In fact, Bolander, Satornino, Hughes and Ferris (2015) found that 26.6% of the variance in salespeople performance can be explained by relationships within the company. Upon deeper thought, this should come as no surprise.

Well-connected individuals in an organization have access to more resources and expertise, improving the likelihood of their success. The leverage afforded by being connected to the right people directly affects a salesperson’s performance. Hence, by using established methods of internal social network analysis, we want to uncover the story behind TrustSphere’s salespeople performance.

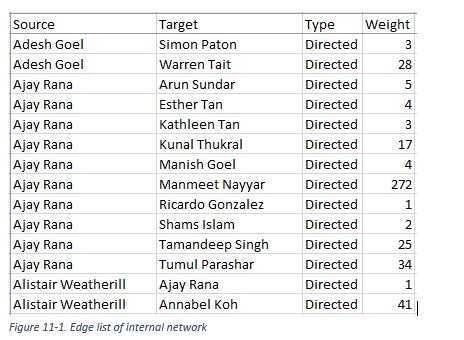

(a)Methodology

We extracted only emails exchanged between TrustSphere salespeople and other TrustSphere staff. It is important to note that the master dataset we have drawn from only includes emails from salespeople. Hence, this internal network data consists only of connections involving salespeople and does not cover the entire organization’s network.

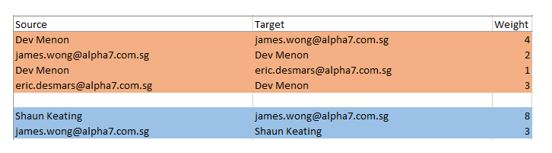

Email outbound count was assigned as Weight.

Each node was match to its department, hierarchy, and location. The general hierarchy, from highest to lowest, is:

- 1.C Suite

- 2.Upper Management

- 3.Senior Management

- 4.Manager

- 5.Associate

- 6.Operational

- 7.Intern

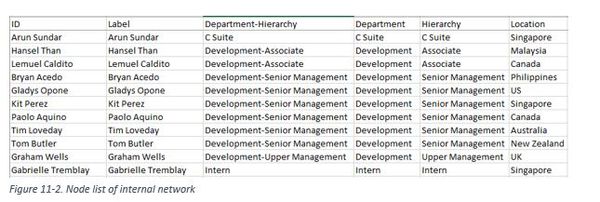

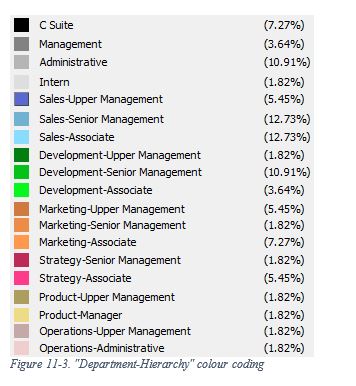

As Gephi cannot visualize more than 2 categorical characteristics, we created a new column “Department-Hierarchy”.

In analyses where we examined the “Department-Hierarchy”, nodes of the same department (e.g. Sales) were coded with the same parent colour (e.g. blue). Within department, nodes were coded from a darker to lighter colour (e.g. dark blue to light blue), from the highest hierarchy to the lowest.

The data was visualized Gephi to obtain the following graphs.

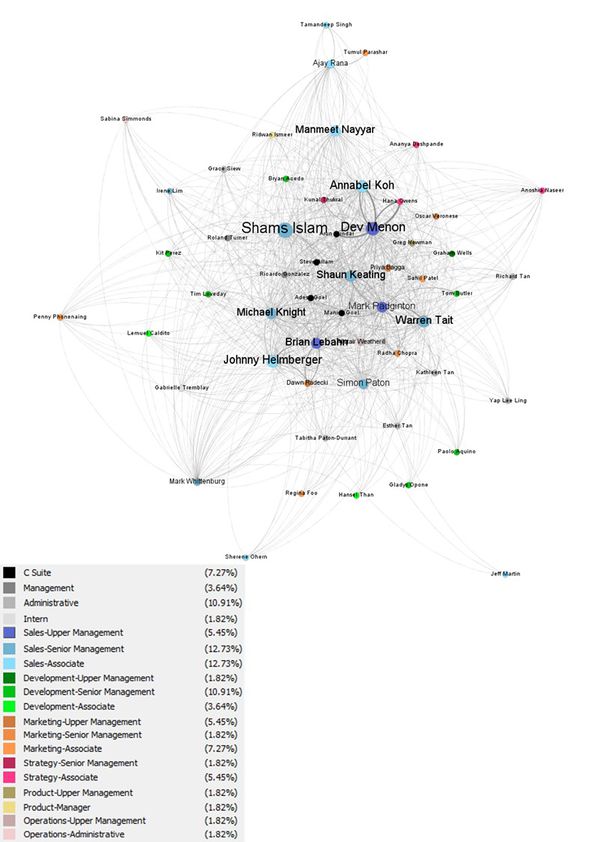

(b)Internal Network Graphs

Internal Network by Department-Hierarchy & Eigenvector Centrality

In this graph, the colours of the nodes represent their “Department-Hierarchy” and the size of the nodes correspond to their eigenvector centrality.

Eigenvector centrality is a good measure of influence because it scores a node in a network based on the number of ties to other high-scoring nodes (Prell, 2012). An actor connected to many nodes, i.e. having high degree centrality, might still have a high eigenvector centrality score. However, it might be outperformed by a node which has lesser connections but are connected to other nodes with high degree centralities. It is important to consider both direct and indirect ties because they “provide access both to people who can themselves provide support and to the resources those people can mobilize through their own network ties” (Adler & Kwon, 2002). Thus, Mehra, Dixon, Brass and Robertson (2006) argue that eigenvector centrality are a useful measure of the “availability of information and potential for influence”.

From this graph, we see that salespeople possess relatively high eigenvector centralities. Many Sales Associates have higher eigenvector centrality scores than even C Suite or Management level employees, implying that salespeople in TrustSphere are likely to enjoy an availability of resources and have significant influence in the company.

Salespeople are in closest contact with higher Management and Administrative staff, further enforcing the idea that they hold influential network positions in the company. TrustSphere’s salespeople also collaborate almost equally as much with the Development department as the Marketing department (Figure below).

Ideally, we would not want to see salespeople on the periphery of the network. However, we realized that some of these salespeople are new to the company (Ajay Rana, joined March 2016; Mark Whittenburg, joined August 2016; Sherene Ohern, joined 2016). Others, such as Jeff Martin, lie on the periphery because they has left TrustSphere.

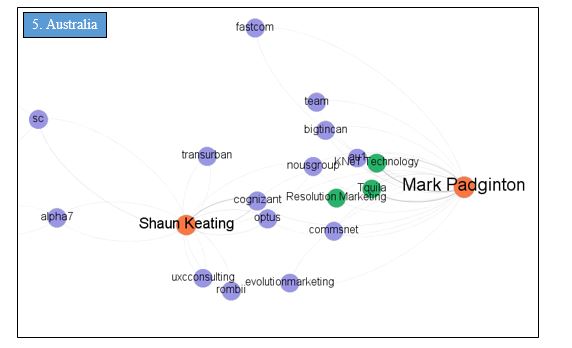

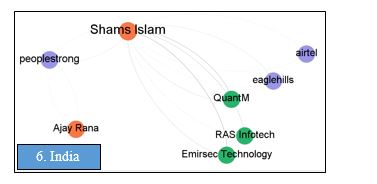

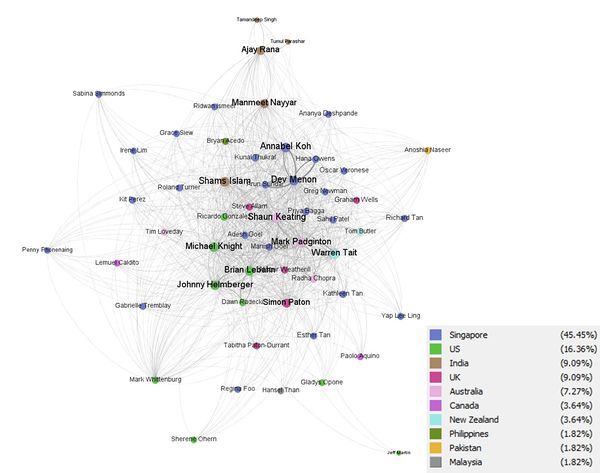

Internal Network by Location & Eigenvector Centrality

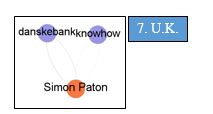

In this case, the colours represent geographical location, while the sizes still represent eigenvector centrality. It is important to note that there are only salespeople in the Australia, India, New Zealand, Singapore, U.S. and U.K. offices.

We notice that salespeople from Australia, New Zealand, Singapore, U.S. and U.K. tend to work together, forming a large cluster in the middle of the graph.

The India office is clearly removed from TrustSphere’s internal network, except for Shams Islam (Sales, Senior Management). Shams Islam also possesses relatively high eigenvector centrality. There is a possibility he is in a unique position to control the flow of resources to his colleagues in India, making him a gatekeeper of information and a powerful actor with high influence.

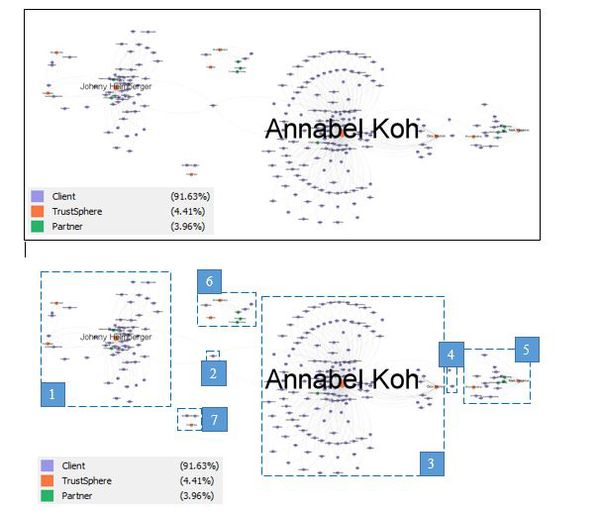

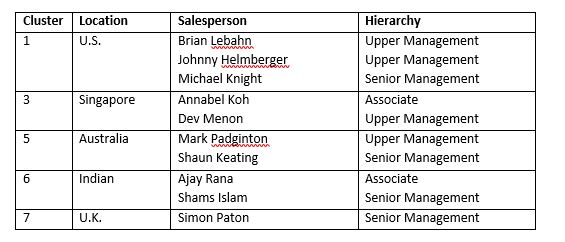

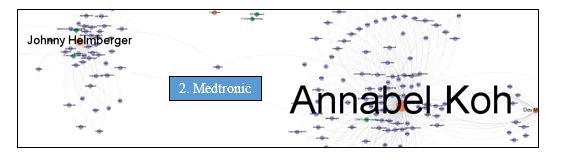

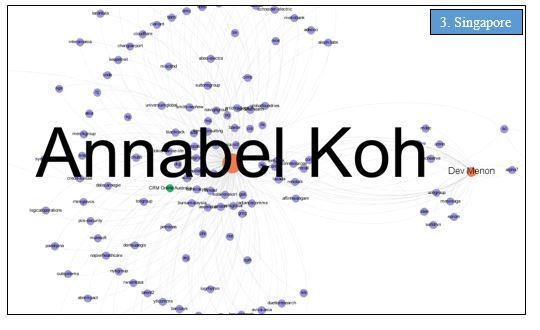

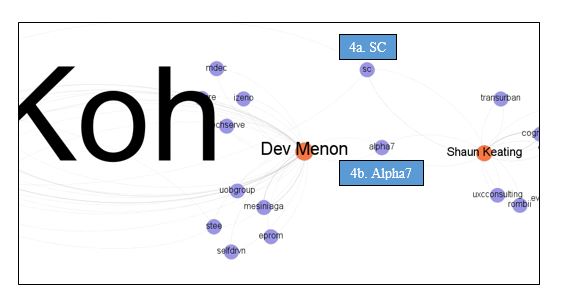

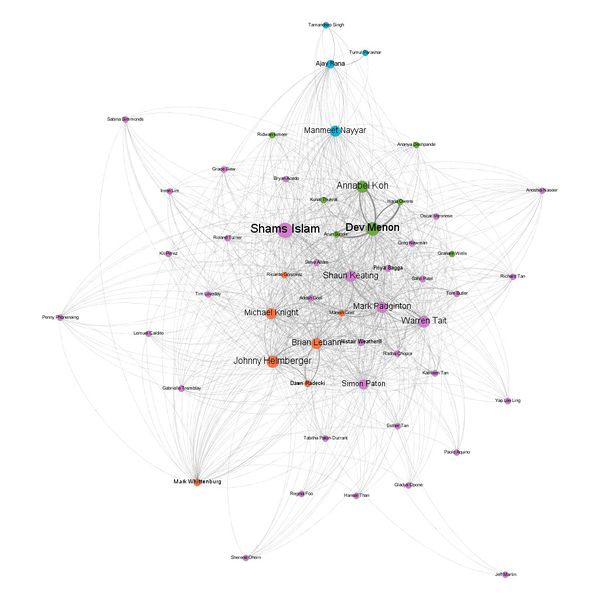

Internal Network by Modularity & Betweenness

In this graph, the colours represents the different informal communities TrustSphere employees are engaged in. Many employees can be expected to form their own informal relationships outside of formal corporate structure, much as people do in real life. These informal ties are much more informative of the way work is done in an organization (Cross, Borgatti & Parker, 2002) and could offer insights into improving organizational design (Novak, Rennaker and Turner, 2011). Communities were identified using Gephi’s “Modularity” function , which helps detect groups in networks and assigns them a “modularity class”, or group, which is represented by the different colours.

The community in orange corresponds to the US office and the blue corresponds to the India office. In this respect, we see that these offices are distinctly separate from the rest of the company. This might hinder knowledge-sharing and collaboration between offices. The most notable community highlighted in green consists mostly of a subset of employees from the Singapore office and one employee from the UK. Their functions span across departments such as Sales, Management, Strategy, and Development. Interestingly, their hierarchies range from Associate up to C Suite. The rest of the network belongs in the largest community in purple. It is likely they are not a part of any significant cluster that communicates particularly frequently.

The size of the nodes corresponds to betweenness centrality. Betweenness centrality considers how often an actor sits on the shortest path between two other nodes (Prell, 2012). Nodes with high betweenness centralities act like brokers or gatekeepers positioned between disconnected actors. These actors are powerful because without them, the two nodes they connect might never be able to pass information along to each other. Thus, even without being connected to many other nodes, a broker holds great influence over the flow of information and resources in the network.

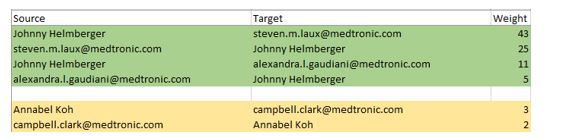

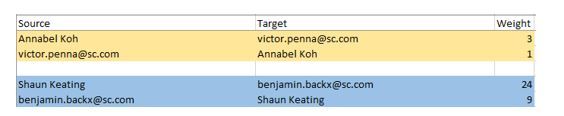

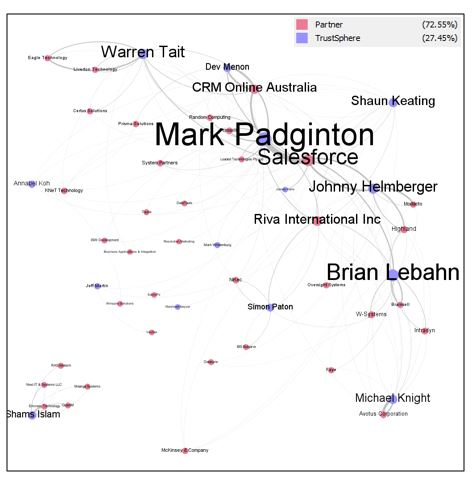

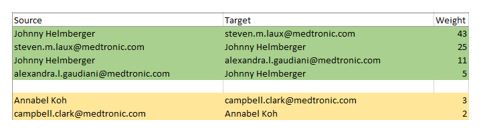

In this network, we see that employees with high betweenness centrality are Annabel Koh & Dev Menon (Singapore), Shams Islam (India), Shaun Keating (Australia), Warren Tait (NZ), Michael Knight, Brian Lebahn & Johnny Helmberger (US). These employees possess powerful positions as brokers in TrustSphere’s internal network. They are the gatekeepers of information and resources for their respective home offices. Interestingly, we see that Annabel Koh also possesses high betweenness despite being an Associate. We also notice that smaller offices such as those in Malaysia, Pakistan, Canada and Philippines do not have any gatekeepers, but it is also possible their brokers are not captured in this network since we have only focused on salespeople ties (emails).