ANLY482 AY2017-18T2 Group06 Project Overview

|

|

|

|

|

|

|

|

The ability to understand and visualize price movements of foreign exchange rates plays an important role in discovering insights for trading companies. Price movements based on market fundamentals are not sufficient to understand the irrational market behaviors in short time frames such as seconds or minutes movements. To address this problem, better models are required to give more insights to learn about the price patterns. This allows us to better understand the currency pair, US Dollar to Japanese Yen movement and to discover actionable insights based on the two techniques used in our paper: Technical Analysis and Time Series Forecasting.

Using the existing market data that pH7 has collected, this research study aims to share with you our journey through this research process to understand the currency price movements. The research study starts with an overview of the business and research motivations to understand the trends within the dollar yen in different time frames and time periods. Through our consolidated findings and the ARIMA model to forecast price movements for the USD/JPY, we hope to be able to find actionable insights to advise our client on a better approach to tackle this currency pair.

MOTIVATION &OBJECTIVES

The price movements of foreign exchange rate currency pairs have always been an instrument of focus by financial institutions and investors.

Currently, pH7 views technical analysis models through their brokerage provided dashboards which do not deliver any combined analysis across more than one technical analysis model or provide any form of suggested trading action they should take. They expressed an interest in using Bollinger Bands together with Relative Strength Index (RSI) to better understand the price movement patterns.

Therefore, we intend to use technical analysis-Bollinger Bands, RSI and Time Series Forecasting- ARIMA method to analyze price movements and provide a form of trading action which they could adopt. Our objective is to develop a simple and yet useful R-Markdown file that our sponsor would be able to edit and deploy to generate insights for his future trade executions.

With our methodologies used to deduce these insights, this would allow them to forecast future trends and behaviors in the financial markets.

METHODOLOGY

Our methodology will be a 5-step approach for the analysis on the time series data for foreign exchange currency pairs.

Exploratory Segment

1. Data Collection

At the initial phases of data collection, we must ensure that we have the sufficient fields that are needed for modelling in the later stage.

2. Data Cleaning + Transformation

In the data cleaning and transformation phase, the data would be tweaked into necessary statistical and analytics parameters necessary for running analysis models later.

3. Initial Data Exploration

In this area, the data would be initially explored, and we would determine the approach of analysis model based on the nature of the dataset. The nature of our dataset focuses on time series and price related movements, careful data exploration must be done to understand the best tools to use.

Iterative Segment

4. Selecting and Deploying the Analysis Model

In this area, we would be experimenting with multiple different analysis approaches based on our initial understanding of the dataset after the exploration. It could range from forecasting to technical analysis, discovering seasonal trends and visualizations to uncover time series patterns to achieve the objectives of our client.

5. Model Validation

We would be proposing a multi-variate methodology of sampling data to validate our analysis model. In this aspect, we would be using the 2-way of approach of model validation called “train and test”.

We would also be using benchmark metrics to test our analysis models to ensure that it is satisfactory. Should it not be satisfactory, we would go back to phase 4 of model building or phase 2 to rebuild the model till the results is satisfactory.

DATA

Data Source

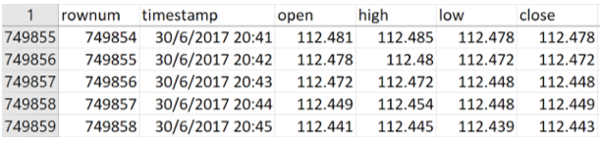

The dataset given to us includes multiple timeframes of the same period of time series data for a 2 years’ time period; 1st July 2015 to 30th June 2017.

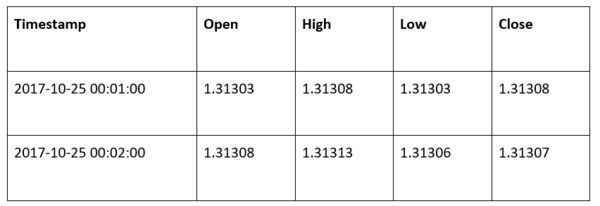

The data fields include:

- Timestamp (timestamp of the data)

- High (High point of the currency pair for the minute)

- Low (Low point of the currency pair for the minute)

- Open (open price of the currency pair for the minute)

- Close (closing price of the currency pair for the minute)

To access our client’s database, we used Rstudio codes to directly access the AWS servers and retrieve the data as needed for our analysis. This gave us the flexibility of choosing time periods we want to work with for our analysis.

The resulting data retrieval for 2 years worth of minute tick data for 1 currency pairs comes close to 750,000 rows.

SCOPE OF WORK

We intend to adopt the following steps in our analysis:

• Discover insights within the provided data

• To collect and ensure the data of currency pair is relevant in modelling

• Ensure accuracy of data by checking for multicollinearity during data exploration stage

• Identification of approaches that range from visualization to machine learning algorithms to determine predictor and target variables

• Validate model through “train, test and validate”

• Use a large sample data to prevent overfitting and bias in our model

• Design a unique predictive model

• Utilisation of benchmark metrics to test the success rate of the predictive model

• It is important to note that the scope of the project is versatile and can be furthered to address additional questions pH7 might have on the dataset

REFERENCES

B. (n.d.). Dynamic Bayesian Networks. Retrieved November 3, 2010. Retrieved from https://bi.snu.ac.kr/Courses/g-ai10f/Ch9_DBN.pdf.

Gray, A. (2017, March 9). The world’s 10 biggest economies in 2017. Retrieved from https://www.weforum.org/agenda/2017/03/worlds-biggest-economies-in-2017/

PETRICĂ, A., STANCU, S., & TINDECHE, A. (2016). Limitation of ARIMA models in financial and monetary economics. Retrieved from http://store.ectap.ro/articole/1222.pdf

Rise of the billionaire robots: how algorithms have redefined hedge funds. (2016, May 15). Retrieved from https://www.theguardian.com/business/us-money-blog/2016/may/15/hedge-fund-managers-algorithms-robots-investment-tips

Satariano, A., & Kumar, N. (2017, September 27). The Massive Hedge Fund Betting on AI. Retrieved from https://www.bloomberg.com/news/features/2017-09-27/the-massive-hedge-fund-betting-on-ai

US, I. F. (2011). U.S. Dollar Index. Retrieved from https://www.theice.com/publicdocs/ICE_USDX_Brochure.pdf.