Difference between revisions of "ANLY482 AY2016-17 T2 Group13 - Data Exploration"

| Line 67: | Line 67: | ||

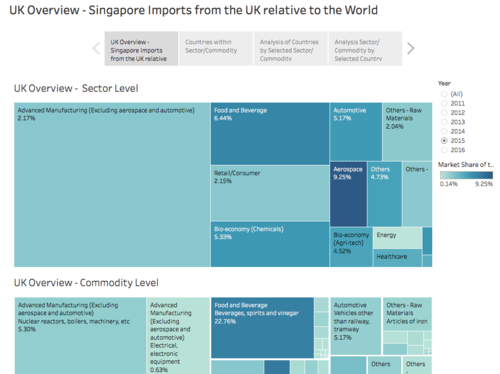

<b>1. Interpreting at a Glance</b><br> | <b>1. Interpreting at a Glance</b><br> | ||

| − | [[File:.png | + | [[File:4a._UK_Overview_-_Treemap.png|500px]] |

*Filtered Year = 2015 | *Filtered Year = 2015 | ||

In terms of trade value, Singapore imports “advance manufacturing” commodities from the UK the most. This accounts for 47% of UK’s total exports into Singapore amounting to US$2.6bn. | In terms of trade value, Singapore imports “advance manufacturing” commodities from the UK the most. This accounts for 47% of UK’s total exports into Singapore amounting to US$2.6bn. | ||

| Line 81: | Line 81: | ||

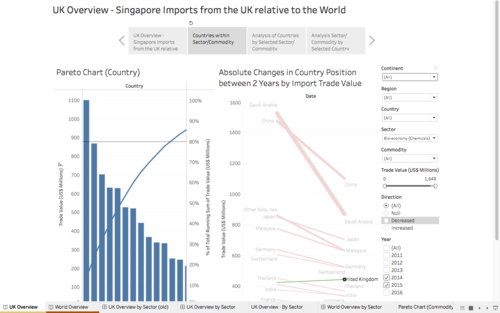

<b>2. Year on Year (YoY) Analysis of Bio-Economy (Chemicals) sector</b><br> | <b>2. Year on Year (YoY) Analysis of Bio-Economy (Chemicals) sector</b><br> | ||

| − | [[File:.png | + | [[File:4b._UK_Overview_-_Sector_Level.png|500px]] |

*For a YoY analysis using the Treemap, select (1) a sector of interest and (2) click through the years to see how market share has changed over the years. | *For a YoY analysis using the Treemap, select (1) a sector of interest and (2) click through the years to see how market share has changed over the years. | ||

| Line 89: | Line 89: | ||

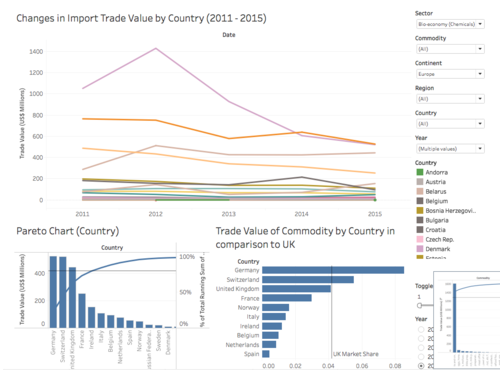

<div style="background: #dce6f9; line-height: 0.3em; font-family:Century Gothic; border-left: #003464 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#000000"><strong>Surface analysis of a selected sector/commodity</strong></font></div></div> | <div style="background: #dce6f9; line-height: 0.3em; font-family:Century Gothic; border-left: #003464 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#000000"><strong>Surface analysis of a selected sector/commodity</strong></font></div></div> | ||

| − | [[File:.png | + | [[File:4c._Pareto_Chart_&_Slope_Graph.png|500px]] |

*Filter Sector = "bio-economy" ; set slope graph year 2014 to 2015 | *Filter Sector = "bio-economy" ; set slope graph year 2014 to 2015 | ||

| Line 104: | Line 104: | ||

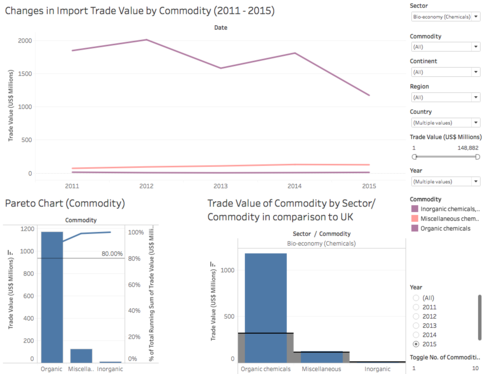

<div style="background: #dce6f9; line-height: 0.3em; font-family:Century Gothic; border-left: #003464 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#000000"><strong>Further analysis of a selected sector/commodity </strong></font></div></div> | <div style="background: #dce6f9; line-height: 0.3em; font-family:Century Gothic; border-left: #003464 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#000000"><strong>Further analysis of a selected sector/commodity </strong></font></div></div> | ||

| − | [[File:.png | + | [[File:4d._UK_Time_Series_(Countries).png|500px]] |

*Filter Sector = "Bio-economy (Chemicals)" ; Filter Continent = “Europe” | *Filter Sector = "Bio-economy (Chemicals)" ; Filter Continent = “Europe” | ||

| Line 114: | Line 114: | ||

| − | [[File:.png | + | [[File:4e._UK_Time_Series_(Commodity).png|500px]] |

*Filter Sector = "Bio-economy (Chemicals)" ; Filter Country = “Saudi Arabia”, “United Kingdom” | *Filter Sector = "Bio-economy (Chemicals)" ; Filter Country = “Saudi Arabia”, “United Kingdom” | ||

Revision as of 00:35, 21 February 2017

In this section, we first will be going through a case study to demonstrate how to use the dashboard to obtain relevant findings.

A set of additional relevant findings for our sponsor organisation is appended below the case study.

The UK overview page aims to answer two basic questions at a glance:

For a particular sector/commodity:

- What is UK doing now? i.e. size of quadrilateral

- How is UK doing relative to the world? i.e. colour intensity

There are 2 ways of using Overview dashboard:

- Filtered Year = 2015

In terms of trade value, Singapore imports “advance manufacturing” commodities from the UK the most. This accounts for 47% of UK’s total exports into Singapore amounting to US$2.6bn. I.e. (Total Advance Manufacturing imported into SG from UK)/(Total Commodities imported into SG from UK)

However, relative to all “advance manufacturing” commodities in the world, it accounts for approximately 2.2% of them.

I.e. (Total Advance Manufacturing imported into SG from UK)/(Total Advance Manufacturing imported into SG from the World)

This means that Singapore imports “advance manufacturing” commodities from a lot of other countries apart from the UK. This could signify a saturated and competitive market or a more unlikely scenario, a major player in this market with an extraordinarily high market share.

2. Year on Year (YoY) Analysis of Bio-Economy (Chemicals) sector

- For a YoY analysis using the Treemap, select (1) a sector of interest and (2) click through the years to see how market share has changed over the years.

For the Bio-economy (Chemicals) sector, there has been an increasing market share from 2011 to 2015. This could be due to increasing imports from the UK in bio-economy commodities or that Singapore has decreased imports from this sector. i.e. increase in numerator or decrease in denominator. To check for this, proceed to the next dashboard, “Countries within Sector/Commodity”.

- Filter Sector = "bio-economy" ; set slope graph year 2014 to 2015

To determine which countries Singapore is importing bio-chemicals from, we analyse the dashboard reflecting “Countries within Sector/Commodity” - in this case, the Bio-economy (Chemicals) sector. We can also determine the changes in relative position of countries over a 2 year period through the slope graph.

From the tree map, China and Saudi Arabia are the main contributors to the imports in the Bio-economy (Chemicals) sector in 2015.

The slope graph shows that, from 2014 to 2015, Singapore seems to have imported a smaller trade value amount of bio-chemicals in general. This is seen through the general decrease in imports from most of the countries.

However, Singapore still seems to be importing from the UK, with an increase in import value of the UK (as well as Ireland). This could be due to a better quality of products from the UK and Ireland, which withstood the general decrease in imports from this sector and could lead to a potential market for the UK in this sector. It could also signify other countries withdrawing from this sector, allowing both UK and Ireland to be able to increase its imports in this sector into Singapore.

At this decision point, users can dive deeper into this particular sector, or can choose to select a single country to analyse. For the former, users can proceed to “Analysis of Countries by Selected Sector/Commodity”. For the latter, users can proceed to “Analysis of Sectors by Selected Country”.

- Filter Sector = "Bio-economy (Chemicals)" ; Filter Continent = “Europe”

This dashboard view for the Bio-economy (Chemicals) sector shows how the UK and other countries are doing over time, according to its import trade values.

If users filter by continent "Europe", only the countries in Europe will be shown on the time series. Switzerland, Germany and the UK are the top 3 importers within the Bio-economy (Chemicals) sector, with only UK increasing in its imports across the years. This supports the current proposition that UK could focus on building up its import capacity into Singapore in this sector.

To provide a more insightful comparison across the years, we drill down further into Saudi Arabia - the top importer within this sector - as well as UK.

- Filter Sector = "Bio-economy (Chemicals)" ; Filter Country = “Saudi Arabia”, “United Kingdom”

From the time series, even though Saudi Arabia has a significantly higher import trade value, its imports within this sector are drastically dropping through the years. While this may be good for the UK, it may also indicate that the general demand for commodities within this sector could also just be falling.

The bar charts along the bottom give a view on the top 10 countries importing commodities within this sector, based on import trade value. Here we can clearly see that UK still ranks as one of the top 10 countries SG imports from.

- Filter Country = “United Kingdom”; Filter Sector = "Bio-economy (Chemicals)"

This dashboard view for UK shows how its imports are doing over time, according to the import trade values.

Users can observe that most UK commodities have been decreasing in import value through the time series. Users can also observe that commodities that form Nuclear reactors, boilers, machinery, etc form the highest proportion of UK imports. Furthermore, users can drill upwards to view the trends among sectors.

Once again, the bar charts along the bottom give a view on the top 10 commodities that the UK is importing into Singapore, based on import trade value. Commodities from the Advanced manufacturing (excluding aerospace and automotive) sector form the highest value commodities from the UK in 2015.

Further questions that could be asked include:

- How is the UK doing YoY?

- Who are the current major competitors?

- Who might be a major competitor?

87% of UK's F&B exports to SG comes from beverage, spirits and vinegar. This make sense as whiskey is one of their top sellers in SG. From the tree map overview, a YoY analysis revealed that there has been a drop in trade value for SG imports of "beverages, spirits and vinegar" from the UK from 2013 ($746.7mil) to 2014 ($570mil) to 2015 ($526mil). As such the market share of this particular good relative to the world fell from 26.78% in 2013 to 21.60% in 2014 and rose slightly to 22.76% in 2015.

So how does one reconcile the rise in market share? We know that SG has been decreasing imports from UK these past few years. i.e. numerator decreasing. But is SG importing less overall as well?

Looking into SG imports of "beverages, spirits and vinegar" from the World, it appears that SG is importing lesser "beverages, spirits and vinegar" from 2013 to 2015 ($2.79bn -> $2.64bn -> $2.31bn). Taken together, table 1a and 1b shows how these numbers relate to each other.

Statistics of "beverages, spirits and vinegar" from 2013 to 2015

| Table 1a | |||

|---|---|---|---|

| Year | SG imports from UK (US Million) | SG imports from World (US Million) | Market Share |

| 2013 | 746.7 | 2790 | 26.78% |

| 2014 | 570 | 2640 | 21.60% |

| 2015 | 526 | 2310 | 22.76% |

- Note: Market Share = (Total beverage,spirits and vinegar imported into SG from UK)/(Total beverage,spirits and vinegar imported into SG from the World)

| Table 1b | |||

|---|---|---|---|

| Year | % rise/fall of SG imports from UK | % rise/fall of SG imports from World | % rise/fall Market Share |

| 2013-2014 | -23.7% | -5.4% | -5.2% |

| 2014-2015 | -7.7% | -12.5% | +1.2% |

From table 1b, it is evident that the slight increase in UK's market share is mainly due to the overall fall in SG imports of "Beverage, Spirits and Vinegars" being larger than the fall in SG imports from UK. Meaning to say, as long as total SG imports from UK does not exceed total SG imports from the World, UK will be in relatively good standing in terms of market share. As such, an analysis on the trends of SG imports from UK and imports from the World is sufficient to determine if UK's market share will remain in good standing or fall. This can also be said for analysis on any other commodities or sectors.

Looking at the top 10 countries by import trade value, we can see that France is a major competitor in the "Beverage, Spirits and Vinegar" market; coming in as the top country SG chooses to import this commodity from. Following behind UK is Malaysia in third place.

Looking into France, we can tell from the slope graph that the market share from France has dipped way more than the UK from 2014 to 2015. Here we are able to tell that even though France in absolute value still holds the highest share, they are not doing well in terms of imports of "beverage, spirits and vinegar" into SG.

Who then are the competitors that are increasing their market share in this area?

Looking into countries that show an increasing trend in their market share in "beverage, spirits and vinegar" imported into SG, two countries stand out the most - China and Vietnam. From 2011 to 2015, these two countries, though low on absolute trade value as compared to UK or France, has increased their market share by +45.7% and +88.1% respectively. From 2014 to 2015, +15.5% and +14.1% respectively.

What does this mean for the UK?

Taken together, there seems to be a trend of decreasing market share in the UK and increasing market share in other countries (i.e. China and Vietnam). Perhaps, there is a preference shift in the taste of Singaporeans in terms of the beverage, spirits and vinegar. More in-depth research needs to be done to ascertain if the aforementioned hypothesis is true. For now, we are unable to drill down into the specific commodity (i.e. 4d & 6d) to analyze further. Further analysis will be done after the interim presentation.

Analysing the Retail/Consumer sector, it was discovered that "Works of art, collector pieces and antiques" were the cause of the sector's UK market share increasing through the years.

From 2011 to 2015, market share for SG "Works of art, collector pieces and antiques" imports from UK increased 284.2%. From $17.4mil to $66.97mil respectively. The largest spike in market share occurred from 2014 to 2015 at 143.7% followed by 2012 to 2013 at 110.7%. Further analysis revealed that these spikes were not caused by a fall in overall imports of "Works of art, collector pieces and antiques" from the World. Instead, SG seems to be increasing its imports for this particular commodity throughout the years.

This indicates a growth in demand for arts in Singapore. Given that, Singapore has been heading towards growing the arts scene here, this actually comes to no surprise. For the UK however, it could be wise for them to continue tapping into this niche market before other countries start tapping into it. From an analysis of countries importing this commodity into SG, there has not been a significant increase in the number of countries in this industry.