Difference between revisions of "ANLY482 AY2016-17 T2 Group 2 Findings"

| Line 35: | Line 35: | ||

<!--Content--> | <!--Content--> | ||

| + | <!--Main Findings--> | ||

| + | ==<div style="background: #6A8D9D; line-height: 0.3em; font-family:helvetica; border-left: #466675 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#F2F1EF"><strong>Main Findings</strong></font></div></div>== | ||

| + | |||

| + | <div style="margin:20px; padding: 10px; background: #ffffff; text-align:left; font-size: 95%;-webkit-border-radius: 15px;-webkit-box-shadow: 7px 4px 14px rgba(176, 155, 121, 0.96); -moz-box-shadow: 7px 4px 14px rgba(176, 155, 121, 0.96);box-shadow: 7px 4px 14px rgba(176, 155, 121, 0.96);"> | ||

| + | <b><u>Cross-Sectional Analysis</u></b><br> | ||

| + | <b>General Sales</b><br> | ||

| + | *Total sales have increased 60% after the launch of the online betting site | ||

| + | *Old customers of the remote services went into other bet types | ||

| + | <b>Customer Behavioural Patterns</b> | ||

| + | *Composition of younger age customers (21-30, 31-40) increased | ||

| + | *These new younger customers and the old younger customers have shifted mostly to the internet site | ||

| + | *Betting hours are more spread out now | ||

| + | *Bets are more frequent but lower bet amount | ||

| + | *A higher percentage increase for other nationalities (Malaysians, Indians, Chinese, Burmese) | ||

| + | <b><u>Longitudinal Analysis</u></b><br> | ||

| + | *Main difference, drop in sales for TOTO | ||

| + | *Otherwise, similar observations as Cross-Sectional Analysis | ||

| + | </div> | ||

| + | |||

<!--Cross-sectional analysis--> | <!--Cross-sectional analysis--> | ||

==<div style="background: #6A8D9D; line-height: 0.3em; font-family:helvetica; border-left: #466675 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#F2F1EF"><strong>Cross-sectional analysis</strong></font></div></div>== | ==<div style="background: #6A8D9D; line-height: 0.3em; font-family:helvetica; border-left: #466675 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#F2F1EF"><strong>Cross-sectional analysis</strong></font></div></div>== | ||

Revision as of 14:47, 21 February 2017

Main Findings

Cross-Sectional Analysis

General Sales

- Total sales have increased 60% after the launch of the online betting site

- Old customers of the remote services went into other bet types

Customer Behavioural Patterns

- Composition of younger age customers (21-30, 31-40) increased

- These new younger customers and the old younger customers have shifted mostly to the internet site

- Betting hours are more spread out now

- Bets are more frequent but lower bet amount

- A higher percentage increase for other nationalities (Malaysians, Indians, Chinese, Burmese)

Longitudinal Analysis

- Main difference, drop in sales for TOTO

- Otherwise, similar observations as Cross-Sectional Analysis

Cross-sectional analysis

| General Sales |

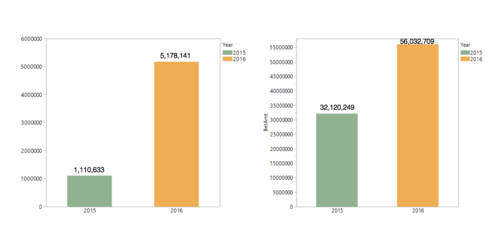

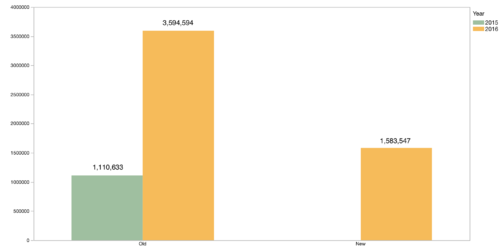

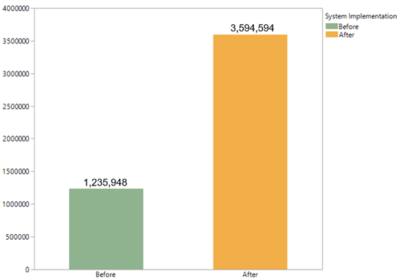

Total purchase frequency and sales

We observed that the purchase frequency has increased from 1,110,633 in 2015 to 5,178,141 in 2016. This amounts to a staggering 366% increase in total purchasing frequency upon the launch of the online ticketing site.

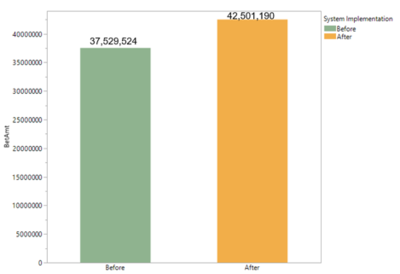

Total ticketing sales on the other hand has increased from 32,120,249 to 56,032,709, which amounts to only an 75% increase. Comparing to the proportion increase in purchasing frequency, we identify that although customers are seen to be purchasing more frequently, it appears they are purchasing in smaller amounts instead.

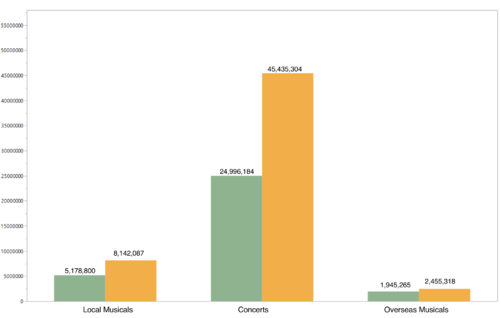

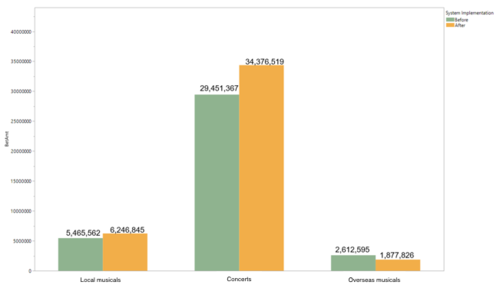

Total sales by product

Looking at the total sales of each product, we observed that sales have increased the most for concert tickets by $20,439,120. On the other hand, overseas musical sales have seen the least increase by only $510,053.

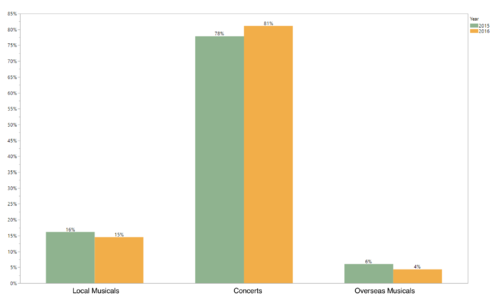

Percentage sales by product

We then decide to take a closer look at the changes in the sales composition in each year. We notice that concert sales remains the highest composition and have increased by 3% from 78% in the previous year to 81% in the current year. Local musicals and overseas musicals on the other hand have decreased by 1% from 16% to 15% and 2% from 6% to 4% respectively.

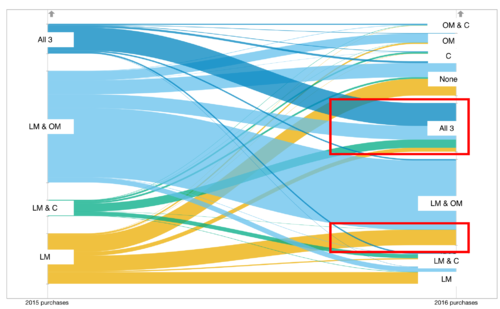

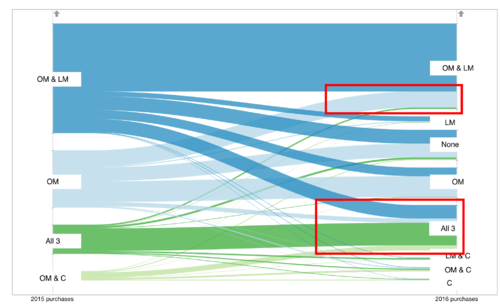

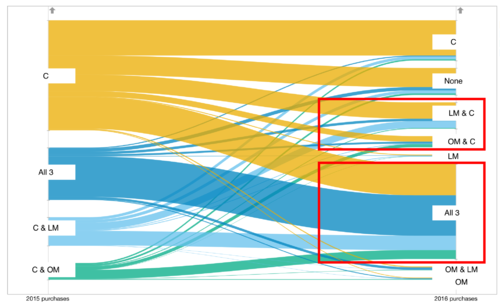

Product shift for local musicals

As we are interested to find out if there are changes in the ticketing behavior of customers between the three products, we decided to look into the product shift. As observed from the figure above, we have identified that an increase in local musical customers who are seen to be purchasing on all of the three products. In addition, we also observe a noticeable amount of customers who used to only purchase local musicals, purchasing on overseas musicals after the launch of the online ticketing site as well.

Product shift for overseas musicals

Looking at the product shift for overseas musicals customers, we observe that there a significant proportion of customers who used to only purchase on overseas musicals, purchasing local musicals as well. In addition, it can be seen that there is an increase in overseas musicals customers who are purchasing on all the three products.

Product shift for concerts

From the figure above, we detected that many of the customers who used to purchase on concerts only, have seen to be purchasing musical tickets as well. Moreover, we also find that many concert customers now are also customers for both local and overseas musicals.

| Transaction Variables |

Having looked at the general sales pattern, the next part of the exploratory data analysis delves into a number of key transaction variables which illustrates the differences in the purchasing behavior before and after the launch of the online ticketing site. These transaction variables include hour of day, day of week, ticket amount, channel (internet or phone) and ticket types.

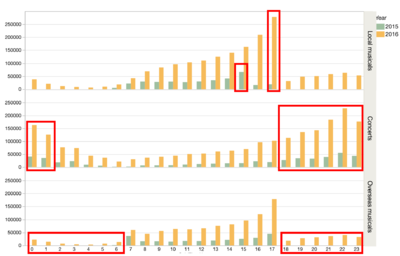

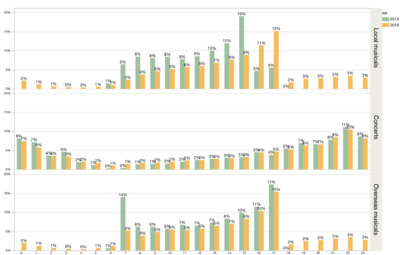

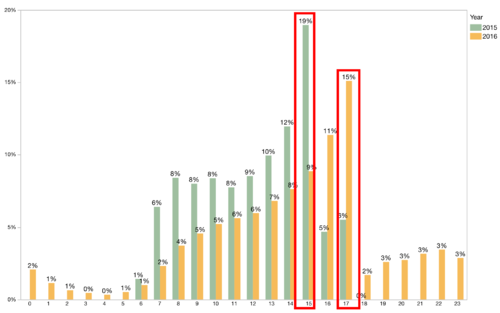

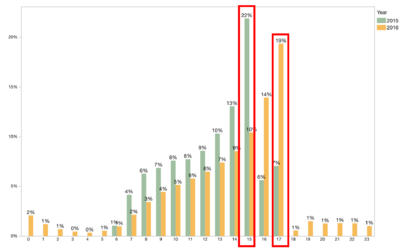

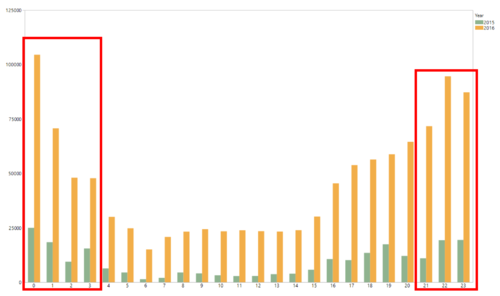

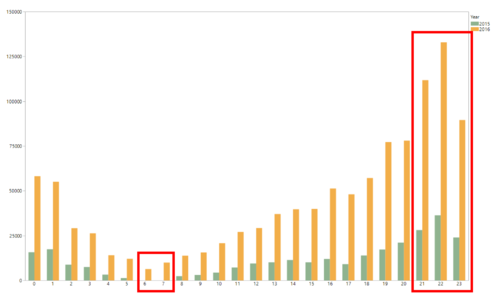

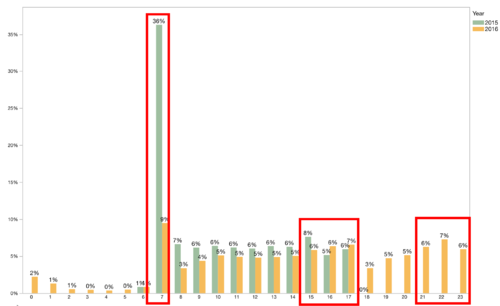

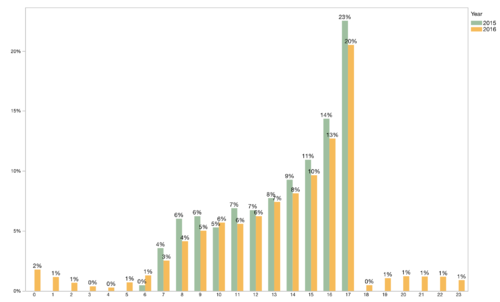

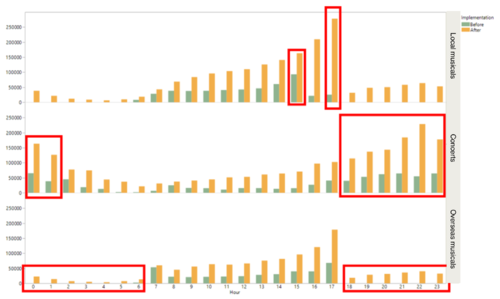

Total purchase frequency and percentage frequency by hour of day

First, we observe the differences in purchasing behavior for the three products through the hour of the day sold. We noticed that there is shift in the peak of the hour sold from the 15th hour (3PM) to the 17 hour (5PM) for local musicals.

For concerts, we observed that there is significant increase in purchasing in the late night, especially from 18 (6PM) to the 1 (1AM) wee hour.

Overseas musical sees a shift in the peak hours from the 7 (7AM) and 17 hour (5PM) previously which is typically the time before customers starts and after they end work, to mainly the 17 hour (5pm). In addition, the purchasing behavior are more evenly spread out now given the availability of 24 hours purchasing on the internet as opposed to purchasing within the restricted phone working hours previously. This is true for local musicals as well.

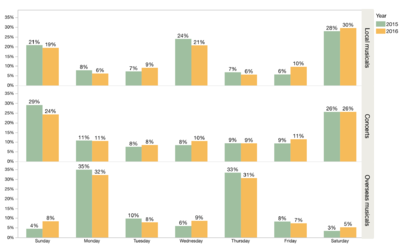

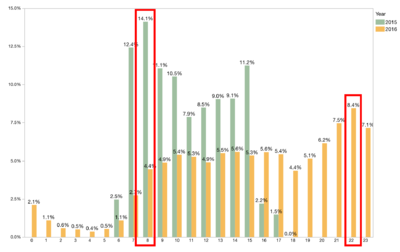

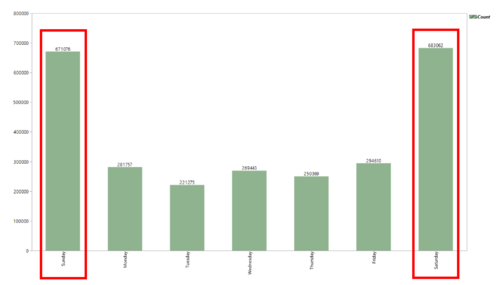

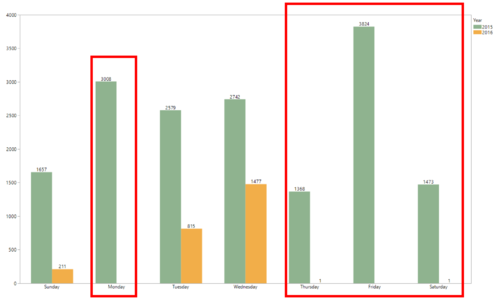

Total purchase frequency and percentage frequency by day of week

We can see that most purchases occurs on Monday, Wednesday, Friday for local musicals and Monday, Thursday for overseas musicals which are the common performance dates. This trend is similar across both years, with purchases increasing more significantly on these days as well.

For concerts, most purchases occurs on the weekends.

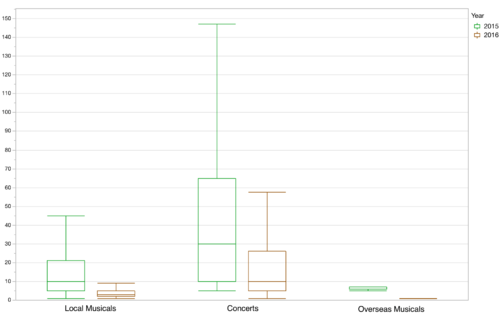

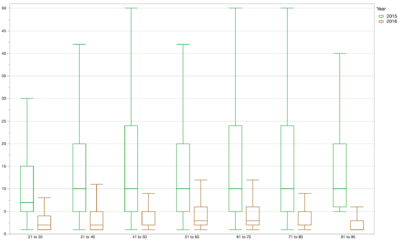

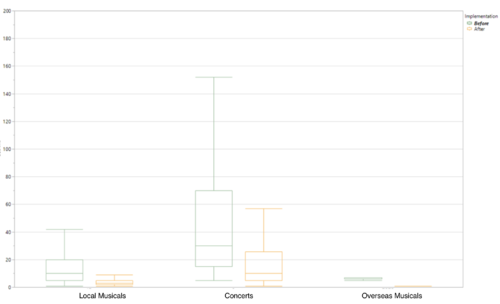

Ticket amount by product

We observe the median and the interquartile ranges for the ticket amounts have decreased in general. For local musicals, the median has decreased from $10 to $3, $30 to $10 for concerts and $7 to $1 for overseas musicals. This concludes that customers are generally purchasing lower amount tickets after the launch of the online site.

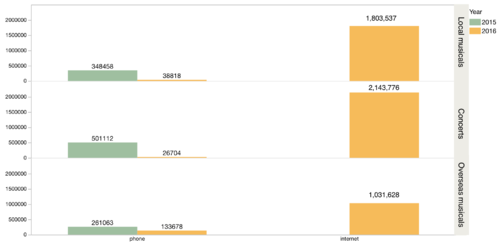

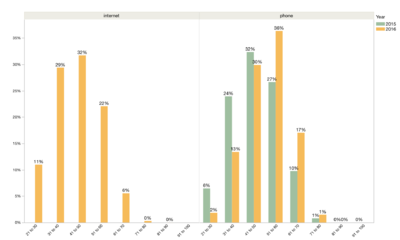

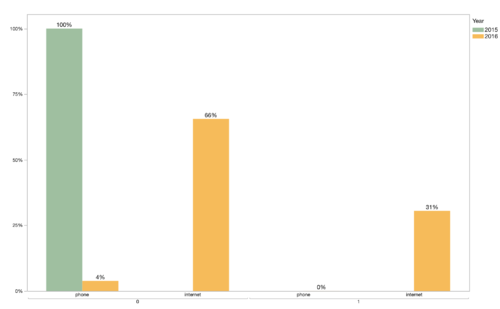

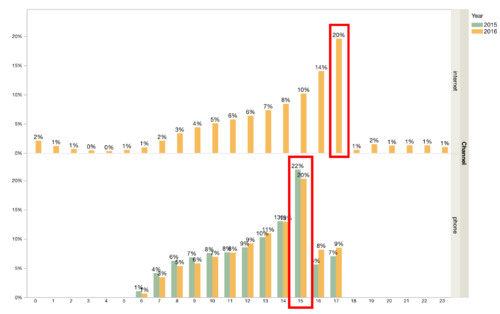

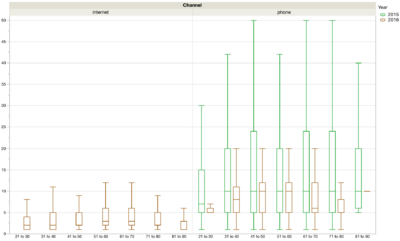

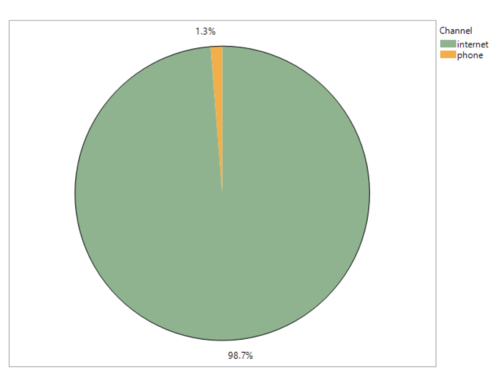

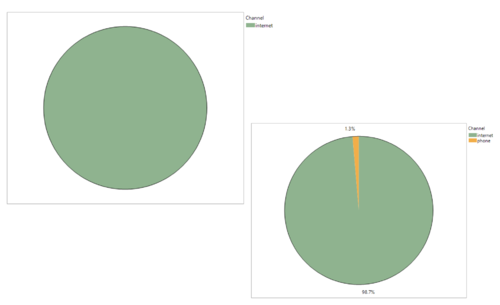

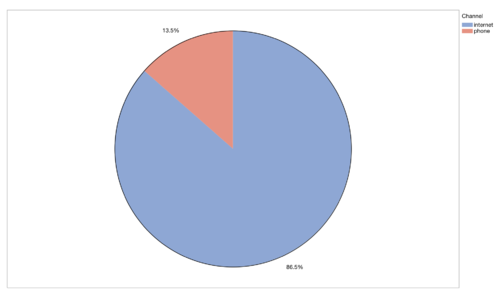

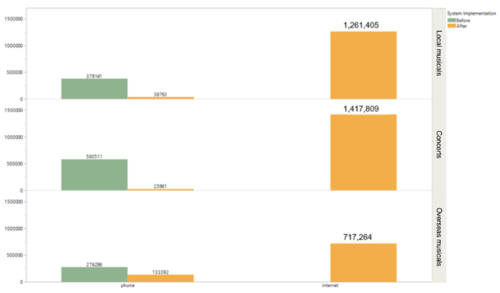

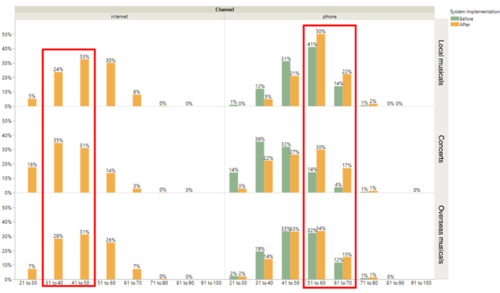

Total purchase frequency by channel

Looking at the total purchases by channel, it is apparent that the internet platform also sees a significant increase in new customers. In addition, majority of the customers have also moved from phone to the internet platform. Phone customers sees a 88% decrease for local musicals, 95% decrease for concerts and a 49% decrease for overseas musicals. It appears that overseas musicals have retained more phone sales compared to the other two products.

| Customer Variables |

Moving on, we will now explore how customer variables affects the purchasing behavior in our exploratory data analysis. Customer variables include demographics as such gender, age, nationality and the customer type whereby customers are classified as either old or new customers.

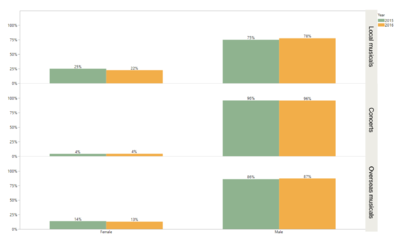

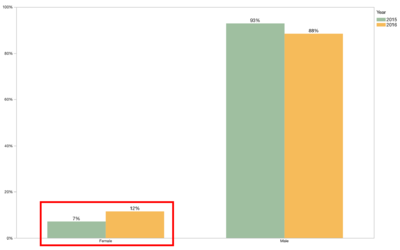

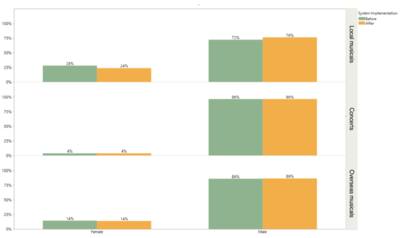

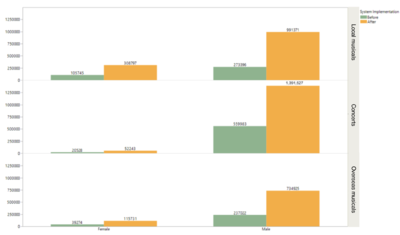

Total purchase frequency by gender

The first customer variable we will looking into is gender. We find that there are no significant change in the gender composition for each of the product as most of the customers are males. However, in absolute terms, we see that the total purchases for both females and males actually increased significantly. The total purchase increased by a whooping 354% for females, which is comparable to the increase in total purchase for males by 368%.

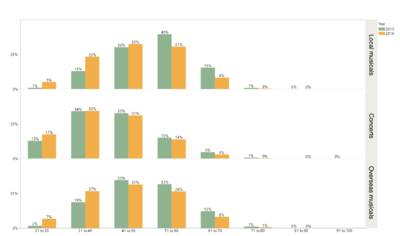

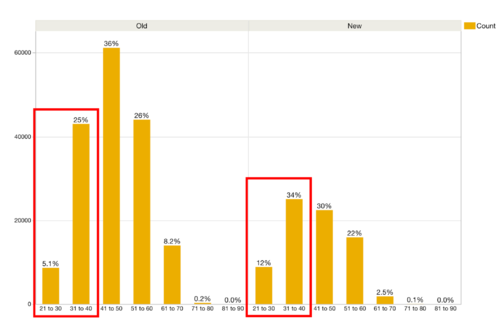

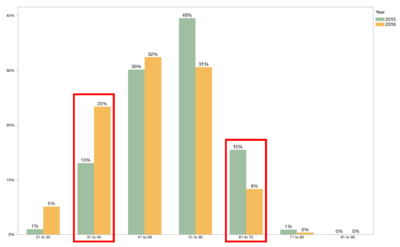

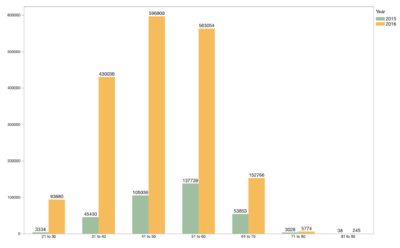

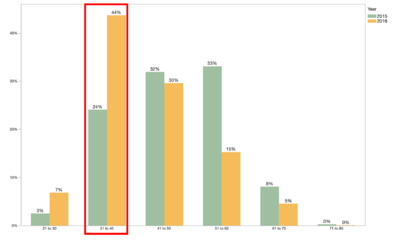

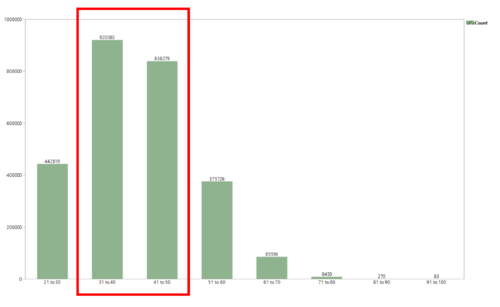

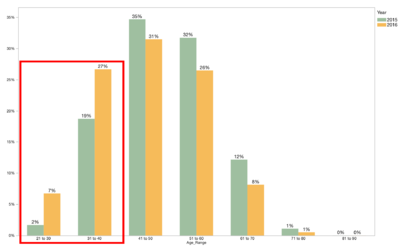

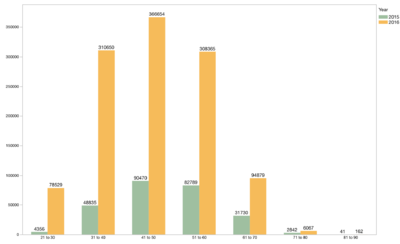

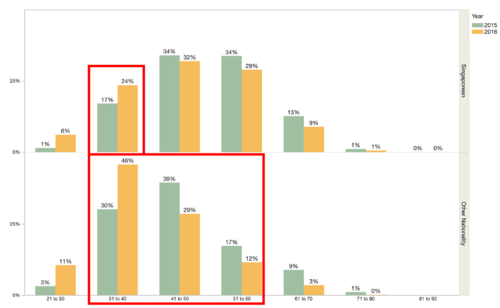

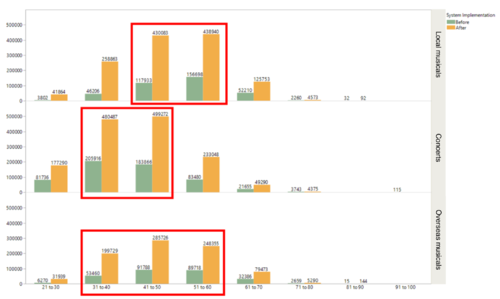

Total purchase frequency by age range

We identify a general increase in customers across all age groups. In particularly, local musicals sees a significant increase in customers from 41 to 60, concerts from 31 to 50 and overseas musicals from 31 to 60. We also notice a general increase in the composition of customers in the younger age group from 21 to 40 and vice versa.

We observe that a majority of the younger customers uses the internet as their main platform for purchasing. This strikes a contrast to the phone customers, which composes of a higher percentage of customers in the older age group.

We also noticed that the new customers generally belongs to the younger age group, with a large proportion of them in the age range of 21 to 40. This shows that the online ticketing site has indeed attracted customers of the younger generation.

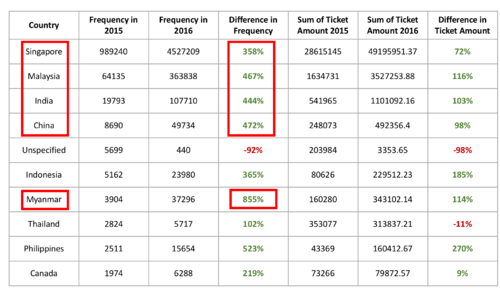

Total purchase frequency by nationality

We see that majority of customers are Singaporeans, followed by Malaysians, Indians and the Chinese. There appears to be a significant increase in customers of these nationalities with over 300% increase for Singaporeans and over 400% increase for customers from Malaysia, India and China. We would also like to highlight a substantial 855% increase in customers from Myanmar, although the total in absolute numbers is considered small compared to that of the Singaporeans.

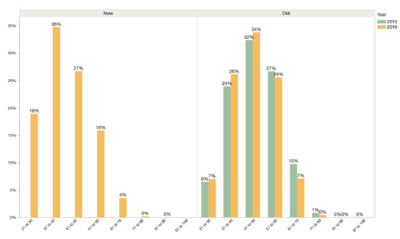

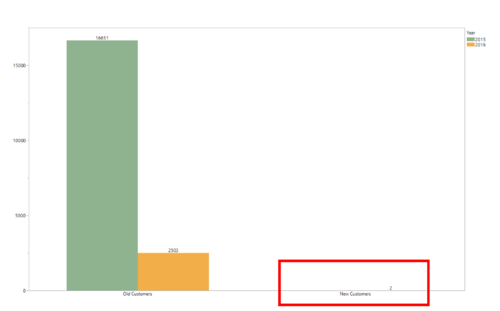

Total purchase frequency by customer type

Majority of the customers are old customers, compromising 69% of the sales. However, we see that new customers form a large portion, amounting to 31% of the total sales. This is a noteworthy result, indicating the success of the online ticketing site in attracting a large number of new customers.

Having seen the composition of old and new customers previously, we delved deeper into looking at the composition of internet and phone users for each customer type. We can tell that majority of the old customers have shifted to using the internet platform, with the proportion of phone users decreasing significantly to only 4%. Similar, the new customers primarily uses the internet platform as well.

| Product Content |

Having explored the general sales, the transaction variables and the customer variables, the following part of the exploratory data analysis will examine each of the product individually and identify key differences affecting the customer purchasing behavior.

LOCAL MUSICALS

Total purchase frequency by hour of day

We have observed a change in peak hour for local musicals. Now, let's take a look at the differences in peak hour during performance and non-performance dates.

Interestingly, from the figure on the left, we can see that non-performance dates have a different peak hour compared to performance dates. We can see many customers purchasing tickets at 10PM on the internet site (as the phone site closes at 6PM) instead of the early purchase time of 8AM previously.

We can also observe that performance dates have the same peak hour as the general analysis. Now, let us look at who are these last minute customers who purchase on performance dates.

Customers who purchase on phone are still observed to mostly purchase at 3PM whereas customers who purchase on internet mostly purchase at 5PM. The convenience of internet ticketing allowed customers to purchase at the last minute.

These internet last minute customers are mostly younger customers and more often than not, these customers are new young customers.

Total purchase frequency by age range

We have observed previously that there is an increase in young customers and decrease in old customers.

One observation that can be drawn is that younger customers purchase cheaper tickets than their older counterparts. Also, online customers purchase tickets substantially cheaper than the phone customers. However, even in the phone ticketing scene, the ticket amounts have decreased after the launch of online ticketing.

Total purchase frequency for other nationalities

A note worthy aspect that is not observed in other product types is the difference in customer demographics for customers from other nationalities.

We can see an interesting proportionate increase in female customers from other nationalities. This could mean that the online ticketing site drew the attention and purchasing behaviour of female non-Singaporean customers.

Also, there is a substantial increase that is even higher than the general increase in young customers who are not from Singapore.

CONCERTS

Total purchase frequency by day of week

We observed that the peak for concert is during the weekends. Therefore, we will drill in by weekdays and weekends to find out any behavioral change by customers.

Total purchase frequency by hour for weekday purchases

Looking at weekday by hour, we observe that customers mostly purchase during the night (9pm - 11pm) and early morning (12am - 3am). This pattern is similar to that before the launch. However, after the launch of the online ticketing channel, the spike in frequency is much higher. We decided to continue to drill in by the hour to find any differences in purchasing behaviour.

After drilling down by channel, we can see that most of the customers purchase via the internet channel. With only a small percentage, 1.3% of customers using phone channel to purchase.

Our team wanted to continue to explore further by looking at the purchase behavior between customers that use internet and phone channel.

Next, let us observe the frequency for purchases by hour for weekend. From the figure above, it can be seen that the spike in frequency is during the night and new purchases are made at 6am and 7am. Previously, when only phone channel were available, there were no purchases made during that time period. We continue to drill down by channel and other variables to find out more.

After drilling down by channel, we can see that most of the customers purchase via the internet channel. For the night, only a small percentage of customers purchase via phone channel.

Total purchase frequency by age range

From the figure above, it can be seen that there are more purchases by younger customers between the age of 31 to 50. Our team drill down more to find out the differences.

We can observe that purchases over the weekday has dropped significantly for the two top ticket types. Our team drill down and seek to find out the customers that made these purchases.

From the figure, we can tell that the two ticket types attracts more old customers as compared to new customers. With only 2 new customers purchasing for these two ticket types.

OVERSEAS MUSICAL

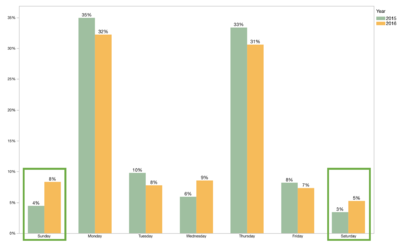

Total purchase frequency by day of week

We can that there is a general increase in purchases on all days, especially on Mondays and Thursdays. Most overseas musicals are performed on Mondays and Thursdays. This trend is identified in both years.

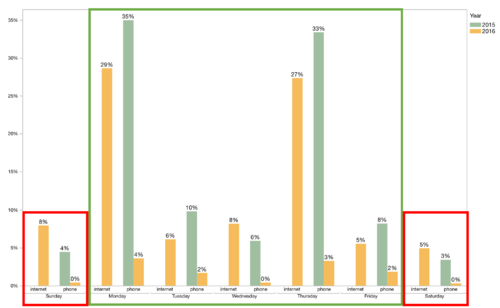

Looking at the percentage of total purchases by day of week, it is more obvious that the proportion of purchases have increased over the weekends. The possibility of such a behavior may be due to the convenience of online ticketing and hence we delve into looking at the sales by channel for each day of the week.

We can see that almost all of the weekend customers have switched to online ticketing. The convenience of such a switch may be the main reason in driving the proportion of customers who purchased over the weekends. In addition, we also notice that majority of the weekday customers have switched to the online ticketing platform, and higher occurrences of phone purchases only occurs on the performance dates.

As we would like to identify the difference in purchasing behavior between the performance and non-performance dates, we analysed the data based on these two categories. For the non-performance dates, we observe that most purchases occur on the 7 hour previously and is distributed relatively proportionately between the 8 and 17 hours. However after the launch of the online ticketing site, proportion of purchases in the 7 hour decreased significantly and purchase now are distributed between the 15 and 17 hours and between the 21 to 23 hours in the night. This behavior is mostly likely due to the convenience of online ticketing which allows customers to purchase at night.

Looking at the sales by hour for performance dates, on the other hand, we observe that the proportion of purchases actually increased as it nears the performance time at the 18 hour. This behavior is similar across both years. In addition, we also observe that there no significant purchasing activity in the night right after the performance dates, unlike sales from the non-performance dates.

Last minute customers who purchase just before the performance time at the 17 hour, mainly place their last minute purchases on the internet platform.

Total purchase frequency by age

We see that the number of customers increases in all age groups, especially so for those in the younger age range. Looking at the percentage composition, it is obvious that the proportion of young customers have increased significantly. This demonstrates that the online ticketing site has attracted a younger group of overseas musicals customers.

Total purchase frequency by nationality

Looking at the nationality of customers in each age group, we can see that the bulk of Singapore customers lies between the age range of 31 to 60, while customers of other nationality mainly come from the age range of 31 to 40.

Longitudinal analysis

| General Sales |

Total purchase frequency and sales

Similar to the cross sectional analysis which we have done above, we observe that there is a huge spike in purchase frequency. The figures amount to an increase of 190% in total purchases upon the launch of the online ticketing site.

Total sales increased only a mere 13%. This follow the same observation where we identify customers purchasing more often but in smaller amounts.

Total sales by product

Looking at the above figure, we observed that sales have increased the most for concerts by 4,925,152. An interesting observation we note here, as compared to cross-sectional analysis, is that there has been a drop in total sales amount for overseas musicals. We notice in earlier observation that overseas musicals has the least increase in sales. Our team will seek to find out more for the cause of decrease in sales amount for overseas musicals.

| Transaction Variables |

Total purchase frequency by hour of day

Looking at the total purchase per hour by product, we observe a similar trend for longitudinal study as compared with our cross-sectional study.

Total purchase frequency by day of week

Observation for day of the week by product also followed a similar trend. Frequency are higher for musicals during the draw dates.For concerts, frequency is higher during the weekend where performance are usually held.

Total purchase frequency by ticket amount

The above graph show the ticket amount for the different products. This concludes the same observation mentioned above that customers are generally purchasing in lower amounts after the launch of the online ticketing site.

Total purchase frequency by channel

From the graph by channel and product, we also notice that there is a huge shift of customers from phone ticketing to online ticketing. Furthermore, it can also be observed that overseas sales have retained more phone sales compared to the other two products which was similar to the cross-sectional analysis.

| Customer Variables |

Total purchase frequency by gender

Looking at the gender of the customers for both absolute and percentage amounts. We see that there is not much difference in percentage composition. However, in terms of absolute value, we notice that there is a significant increase in customers for both gender.

Total purchase frequency by age

The graph above show the total purchase made by customers by age group for each product. From the graph, we observe a similar trend with the cross-sectional studies. Local musicals attract customers that are older (41 to 60) while concerts attract a younger group of customers (31 to 50).

The analysis is similar with our cross-sectional study where we observe that majority of the younger customers use the internet as their main platform to purchase. While more older customers uses phone to purchase.

Except for some difference in purchasing frequency, especially in overseas musicals, longitudinal and cross-sectional analysis seemingly showed similar outcomes.