Difference between revisions of "ANLY482 AY2016-17 T2 Group 2 Findings"

| Line 45: | Line 45: | ||

<!--/Sub Header--> | <!--/Sub Header--> | ||

| + | <!--Content--> | ||

| + | ==<div style="background: #6A8D9D; line-height: 0.3em; font-family:helvetica; border-left: #466675 solid 15px;"><div style="border-left: #FFFFFF solid 5px; padding:15px;font-size:15px;"><font color= "#F2F1EF"><strong>Cross-sectional analysis</strong></font></div></div>== | ||

<!--General Sales Content--> | <!--General Sales Content--> | ||

<div style="margin:20px; padding: 10px; background: #ffffff; text-align:left; font-size: 95%;-webkit-border-radius: 15px;-webkit-box-shadow: 7px 4px 14px rgba(176, 155, 121, 0.96); -moz-box-shadow: 7px 4px 14px rgba(176, 155, 121, 0.96);box-shadow: 7px 4px 14px rgba(176, 155, 121, 0.96);"> | <div style="margin:20px; padding: 10px; background: #ffffff; text-align:left; font-size: 95%;-webkit-border-radius: 15px;-webkit-box-shadow: 7px 4px 14px rgba(176, 155, 121, 0.96); -moz-box-shadow: 7px 4px 14px rgba(176, 155, 121, 0.96);box-shadow: 7px 4px 14px rgba(176, 155, 121, 0.96);"> | ||

Revision as of 15:35, 20 February 2017

| Findings | Literature Review |

|---|

Cross-sectional analysis

| General Sales |

Total purchase frequency and sales

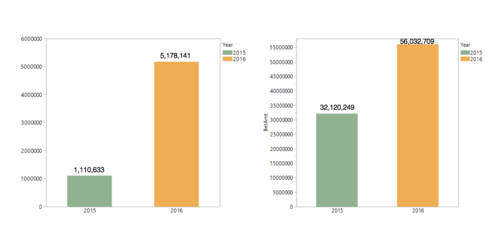

We observed that the purchase frequency has increased from 1,110,633 in 2015 to 5,178,141 in 2016. This amounts to a staggering 366% increase in total bet frequency upon the launch of the online ticketing site.

Total ticketing sales on the other hand has increased from 32,120,249 to 56,032,709, which amounts to only an 75% increase. Comparing to the proportion increase in bet frequency, we identify that although customers are seen to be betting more frequently, it appears they are betting in smaller amounts instead.

Total sales by product

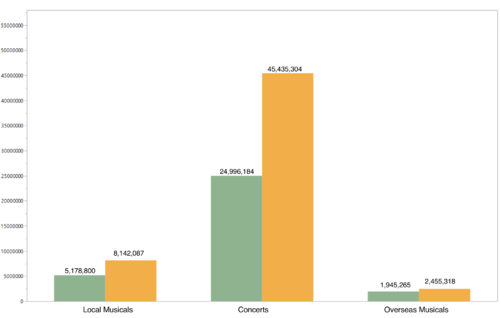

Looking at the total sales of each product, we observed that sales have increased the most for concert tickets by $20,439,120. On the other hand, overseas musical sales have seen the least increase by only $510,053.

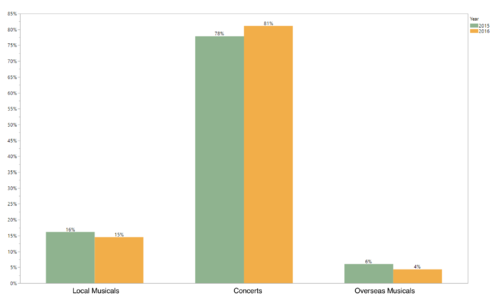

Percentage sales by product

We then decide to take a closer look at the changes in the sales composition in each year. We notice that concert sales remains the highest composition and have increased by 3% from 78% in the previous year to 81% in the current year. Local musicals and overseas musicals on the other hand have decreased by 1% from 16% to 15% and 2% from 6% to 4% respectively.

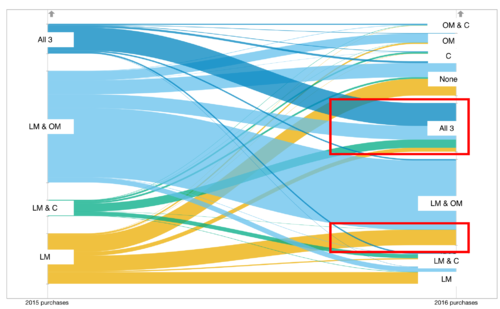

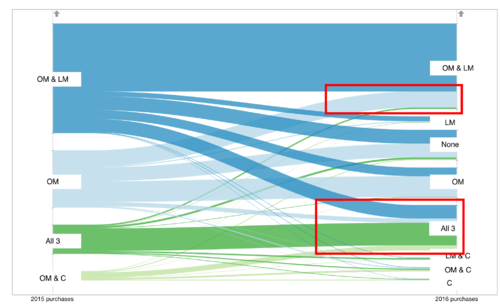

Product shift for local musicals

As we are interested to find out if there are changes in the ticketing behavior of customers between the three products, we decided to look into the product shift. As observed from the figure above, we have identified that an increase in local musical customers who are seen to be purchasing on all of the three products. In addition, we also observe a noticeable amount of customers who used to only purchase local musicals, purchasing on overseas musicals after the launch of the online ticketing site as well.

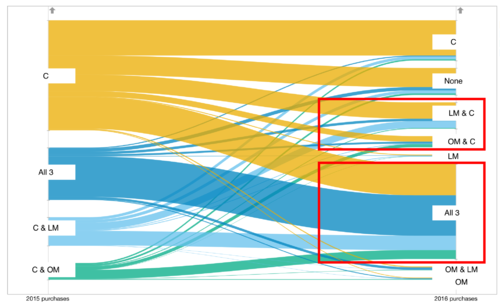

Product shift for overseas musicals

Looking at the product shift for overseas musicals customers, we observe that there a significant proportion of customers who used to only purchase on overseas musicals, purchasing local musicals as well. In addition, it can be seen that there is an increase in overseas musicals customers who are betting on all the three products.

Product shift for concerts

From the figure above, we detected that many of the customers who used to purchase on concerts only, have seen to be purchasing musical tickets as well. Moreover, we also find that many concert customers now are also customers for both local and overseas musicals.

| Transaction Variables |

Having looked at the general sales pattern, the next part of the exploratory data analysis delves into a number of key transaction variables which illustrates the differences in the purchasing behavior before and after the launch of the online ticketing site. These transaction variables include hour of day, day of week, ticket amount, channel (internet or phone) and ticket types.

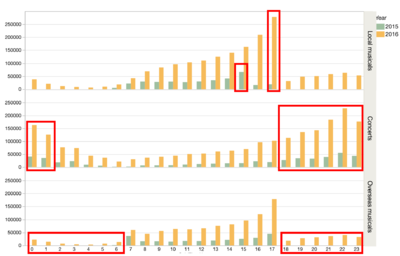

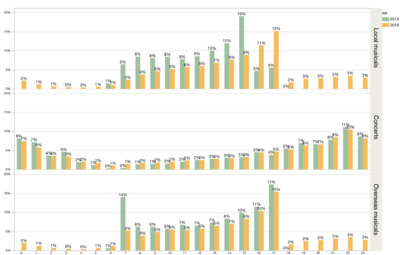

Total purchase frequency and percentage frequency by hour of day

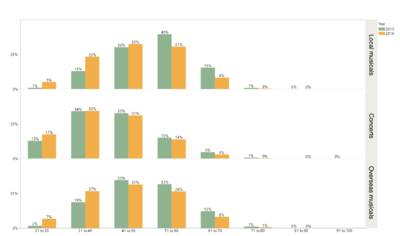

First, we observe the differences in purchasing behavior for the three products through the hour of the day sold. We noticed that there is shift in the peak of the hour sold from the 15th hour (3PM) to the 17 hour (5PM) for local musicals.

For concerts, we observed that there is significant increase in purchasing in the late night, especially from 18 (6PM) to the 1 (1AM) wee hour.

Overseas musical sees a shift in the peak hours from the 7 (7AM) and 17 hour (5PM) previously which is typically the time before customers starts and after they end work, to mainly the 17 hour (5pm). In addition, the purchasing behavior are more evenly spread out now given the availability of 24 hours purchasing on the internet as opposed to purchasing within the restricted phone working hours previously. This is true for local musicals as well.

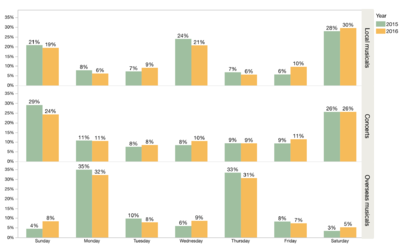

Total purchase frequency and percentage frequency by day of week

We can see that most purchases occurs on Monday, Wednesday, Friday for local musicals and Monday, Thursday for overseas musicals which are the common performance dates. This trend is similar across both years, with purchases increasing more significantly on these days as well.

For concerts, most purchases occurs on the weekends.

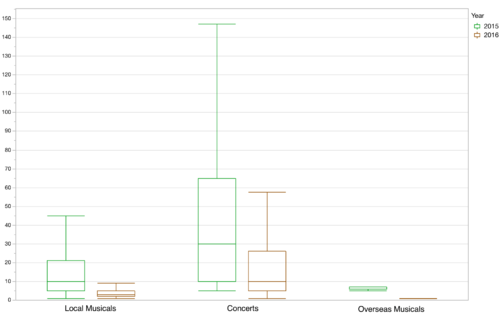

Ticket amount by product

We observe the median and the interquartile ranges for the ticket amounts have decreased in general. For local musicals, the median has decreased from $10 to $3, $30 to $10 for concerts and $7 to $1 for overseas musicals. This concludes that customers are generally purchasing lower amount tickets after the launch of the online site.

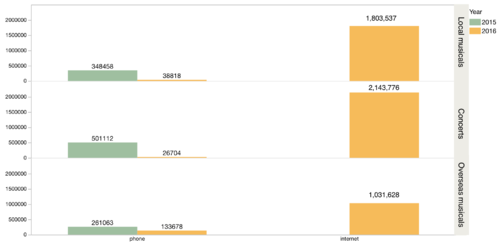

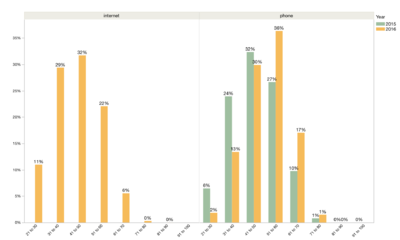

Total purchase frequency by channel

Looking at the total purchases by channel, it is apparent that the internet platform also sees a significant increase in new customers. In addition, majority of the customers have also moved from phone to the internet platform. Phone customers sees a 88% decrease for local musicals, 95% decrease for concerts and a 49% decrease for overseas musicals. It appears that overseas musicals have retained more phone sales compared to the other two products.

| Customer Variables |

Moving on, we will now explore how customer variables affects the purchasing behavior in our exploratory data analysis. Customer variables include demographics as such gender, age, nationality and the customer type whereby customers are classified as either old or new customers.

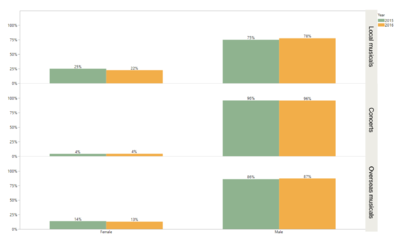

Total purchase frequency by gender

The first customer variable we will looking into is gender. We find that there are no significant change in the gender composition for each of the product as most of the customers are males. However, in absolute terms, we see that the total purchases for both females and males actually increased significantly. The total purchase increased by a whooping 354% for females, which is comparable to the increase in total purchase for males by 368%.

Total purchase frequency by age range

We identify a general increase in customers across all age groups. In particularly, local musicals sees a significant increase in customers from 41 to 60, concerts from 31 to 50 and overseas musicals from 31 to 60. We also notice a general increase in the composition of customers in the younger age group from 21 to 40 and vice versa.

We observe that a majority of the younger customers uses the internet as their main platform for purchasing. This strikes a contrast to the phone customers, which composes of a higher percentage of customers in the older age group.

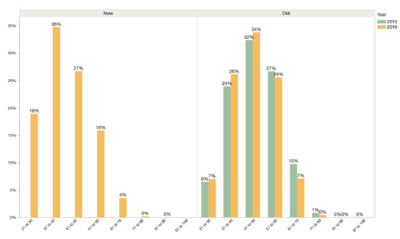

We also noticed that the new customers generally belongs to the younger age group, with a large proportion of them in the age range of 21 to 40. This shows that the online ticketing site has indeed attracted customers of the younger generation.

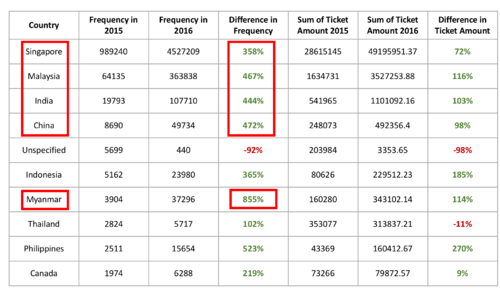

Total purchase frequency by nationality

We see that majority of customers are Singaporeans, followed by Malaysians, Indians and the Chinese. There appears to be a significant increase in customers of these nationalities with over 300% increase for Singaporeans and over 400% increase for customers from Malaysia, India and China. We would also like to highlight a substantial 855% increase in customers from Myanmar, although the total in absolute numbers is considered small compared to that of the Singaporeans.

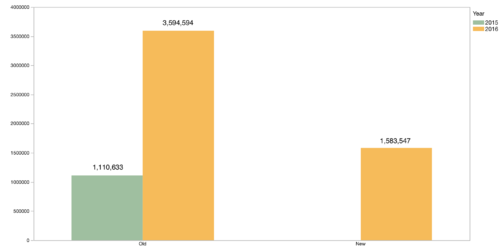

Total purchase frequency by customer type

Majority of the customers are old customers, compromising 69% of the sales. However, we see that new customers form a large portion, amounting to 31% of the total sales. This is a noteworthy result, indicating the success of the online ticketing site in attracting a large number of new customers.

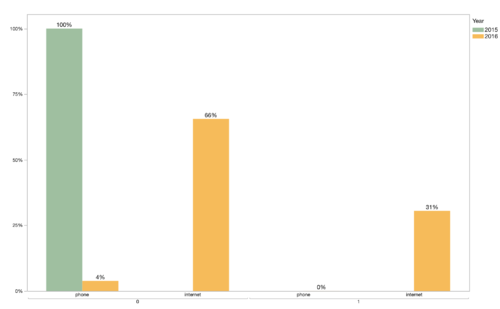

Having seen the composition of old and new customers previously, we delved deeper into looking at the composition of internet and phone users for each customer type. We can tell that majority of the old customers have shifted to using the internet platform, with the proportion of phone users decreasing significantly to only 4%. Similar, the new customers primarily uses the internet platform as well.