Difference between revisions of "Analysis"

Renatad.2018 (talk | contribs) |

Renatad.2018 (talk | contribs) |

||

| Line 259: | Line 259: | ||

=== Analysis of the Bus and Train Peak Hour Travel Pattern in Deriving Current Punggol Population’s Workplace === | === Analysis of the Bus and Train Peak Hour Travel Pattern in Deriving Current Punggol Population’s Workplace === | ||

| − | Based on the network analysis we have performed, we | + | Based on the network analysis we have performed, we note that apparently most of Punggol citizens travel out of Punggol during peak hour. Firstly the Train Network map shows a rather spreading travel pattern out of Punggol all the way to Woodlands, Bishan, Ang Mo Kio, and the East Region, Interestingly, when we unview a rather small travel trips to of 1-963 in month September 2019, map revealed that many travel patterns are directed to the Buona Vista, One North, Labrador Park, Pasir Panjang, Paya Lebar, MacPherson, Tai Seng and of course CBD district including Tanjong Pagar, Downtown, Suntec, Promenade, City hall where most of the Big MNCs and well-performing startups and SMEs are currently located. |

| − | Additionally, from the predominant bus travel data during peak hour we can see that interestingly bus trips to the east including Changi Airport and Expo are directed to. It is believed that these 2 locations also provides the aviation industry sector and technology support for big companies such as IBM and DBS tech division and located at Expo. | + | Additionally, from the predominant bus travel data during peak hour, we can see that interestingly bus trips to the east including Changi Airport and Expo are directed to. It is believed that these 2 locations also provides the aviation industry sector and technology support for big companies such as IBM and DBS tech division and located at Expo. |

| − | To conclude this observation, I believe that the goal of creating Punggol Digital District can pose a challenge not just in terms of initiating the vision, but also getting on board companies who are willing to move over to the Punggol region where it is not really well-known as an office area. Looking from the Punggol citizen’s perspective, Singapore ease of transportation allows them to travel down to popular business districts pretty conveniently and thus citizens might not feel it is necessary to work within proximity. Truth is , people don’t mind travelling just to be employed in a company they like. Next, global MNCs which most people prefer to work offers better competitive benefits and salary which in turn becomes the preferable place to work instead of just proximity as priority. | + | To conclude this observation, I believe that the goal of creating Punggol Digital District can pose a challenge not just in terms of initiating the vision, but also getting on board companies who are willing to move over to the Punggol region where it is not really well-known as an office area. Looking from the Punggol citizen’s perspective, Singapore ease of transportation allows them to travel down to popular business districts pretty conveniently and thus citizens might not feel it is necessary to work within proximity. Truth is , people don’t mind travelling just to be employed in a company they like. Next, global MNCs which most people prefer to work offers better competitive benefits and salary which in turn becomes the preferable place to work instead of just proximity as a priority. |

Revision as of 02:19, 24 November 2019

Contents

- 1 Population Growth Trend & Forecast

- 1.1 Data Cleaning Methods

- 1.2 Visualisations

- 1.3 Results

- 1.3.1 Matilda’s Population Trend

- 1.3.2 Northshore’s Population Trend

- 1.3.3 Punggol Town Centre’s Population Trend

- 1.3.4 Punggol Field’s Population Trend

- 1.3.5 Waterway East’s Population Trend

- 1.3.6 *Coney Island and Punggol Canal have 0 population recorded so we are not going to focus on these particular subzones

- 1.4 Analysing The Younger Population’s Needs

- 1.4.1 Going deeper into analysing each younger age group education needs

- 1.4.2 Matilda’s Younger Group Population Trend

- 1.4.3 Northshore’s Younger Group Population Trend

- 1.4.4 Punggol Field’s Younger Group Population Trend

- 1.4.5 Punggol Town Centre’s Younger Group Population Trend

- 1.4.6 Waterway East’s Younger Group Population Trend

- 2 Land Suitability Analysis (Green Zone) For School Redevelopment

- 3 Why Creating a Live-Work-Play-Learn Community can be challenging especially for the economic active?

- 3.1 Data Wrangling

- 3.2 Data Source

- 3.3 Results: Bus Peak Hour Travel Pattern in Deriving Current Punggol Population’s Workplace

- 3.4 Results: Bus and Train Peak Hour Travel Pattern within Punggol Boundary

- 3.5 Results: Train Peak Hour Travel Pattern in Deriving Current Punggol Population’s Workplace

- 3.6 Analysis of the Bus and Train Peak Hour Travel Pattern in Deriving Current Punggol Population’s Workplace

Population Growth Trend & Forecast

In this population we will be using the Singstat’s `Singapore Residents by Planning AreaSubzone, Age Group, Sex and Type of Dwelling, June 2011-2019` data provided. There are few objectives that we want to understand from the population historical data:

- Understand the population trend for each subzone and age group classification (younger group, economic active group, and aged population) in order to facilitate basic necessities for each age group.

- Forecast the future population trend up to 2024 using the auto ARIMA model to re-evaluate the MP19.

- Interpreting the Arima model

- Similar application of ARIMA model in forecasting population trends:

- Zakria, Muhammad & Muhammad, Faqir. (2009). Forecasting the population of Pakistan using ARIMA models.. Agri. Sci. 46.

- Nyonyi, T and Mutongi, C. (2019). Prediction of total population in Togo using ARIMA models.

- Lin, Bin-Shan, et al. “Using ARIMA Models to Predict Prison Populations.” Journal of Quantitative Criminology, vol. 2, no. 3, 1986, pp. 251–264. JSTOR, www.jstor.org/stable/23365635.

- Make recommendations according to the population trend insights.

Data Cleaning Methods

- Data is cleaned to only show Punggol PA and its subzones.

- Age group were classified into a new group with the following requirement:

- Younger Population: 0-24

- Economic Active: 25-64

- Aged Population: 65 and above

- Summation group by was performed according to each subzone and age group classification.

- Reverse data frame vector was performed to swap rows and columns formatting as it is required to perform graph visualisation in R.

- Methods Deployed in RPubs: Punggol Forecast Population Analysis

- Methods Deployed in RPubs: Punggol Peak Hour Travel Pattern Analysis

Visualisations

- Datatable view of forecast population per age group classification and subzones.

- Plotting time series line graph on each subzone’s population trend.

- Plotting the ARIMA forecasted population on each Subzone.

Results

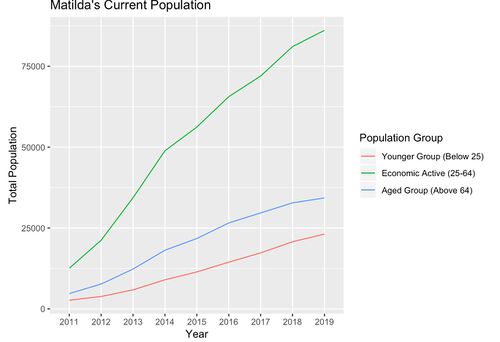

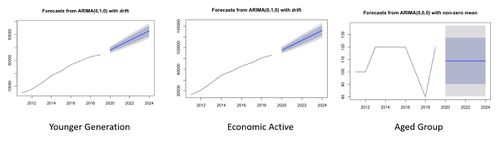

Matilda’s Population Trend

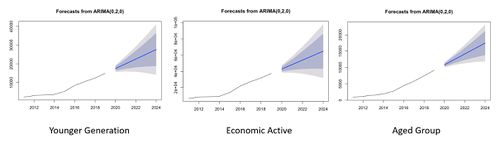

First, the Matilda subzone is one of the most populated subzones in Punggol. The Matilda subzone has been populated ever since the initiation of HDB buildings in Punggol. The subzone is continuously growing ever since 2011 for all age groups. Interestingly the subzone is predominantly filled with the economic active group. Based on the 9 years trend, an ARIMA (0,1,0) with random walk were applied to predict the population for the next 5 years. We predict that there is a major growth in population for this subzone. We anticipate the there is a growing number of younger age group as the economic active age group might plan to start a family.

Northshore’s Population Trend

Next, the Northshore subzone is rather a newer region in Punggol. We haven’t observed a significant rise in terms of population. However, there are on-going government plans of developing smart HDB in these regions for example the Punggol Northshore Residences I and II.

For the upcoming next five years or so, the number of populations might increase exponentially, especially with the attractive government’s plan for the smart HDB which in turn will probably attract most of the economic active group.

Ref: 1. https://www.straitstimes.com/sites/default/files/attachments/2019/04/22/ST_20190422_ITHOMEFINAL_4787163.pdf 2. https://esales.hdb.gov.sg/bp25/launch/19sep/bto/19SEPBTO_page_2671/about0.html#

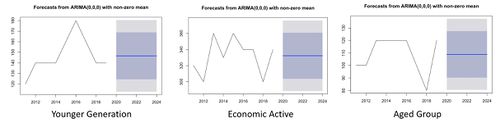

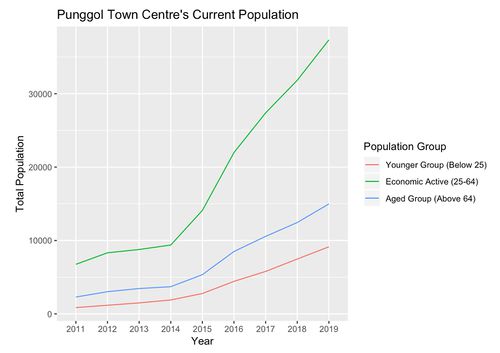

Punggol Town Centre’s Population Trend

The Punggol Town Centre is located at the heart of Punggol planning area. This shows a major exponential growth. This exponential growth could have been caused by the past few year’s major development by the government, especially through the integrated development near Punggol MRT also the the new HDB appearance at the Nibong LRT proximity.

We are projecting that exponential growth will diminish as most of the region haven’t progressed much from previous Masterplan 2008 and Masterplan 2014. Additionally, most of the locations in the area are currently occupied or already planned. However, with the current figure of the economic active population there is a possibility that the younger group might still spike due to family plans and rather mid age group living in the area. We should not deny the potential addition of the aged population even though it might not rise significantly for the next 5 years, but however an early planning is always good to ensure that needs are always met, example: building eldery centres as this subzone currently has approximately 9000. We recommend a child centre built nearby homes as there are only a few in this region.

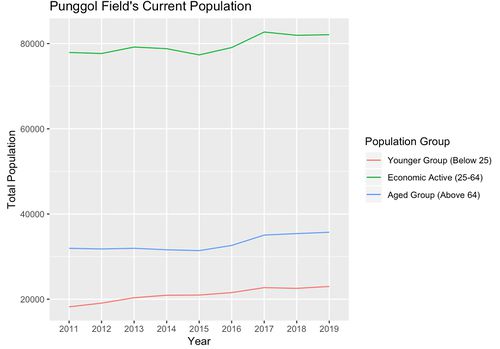

Punggol Field’s Population Trend

The Punggol Field subzone is rather been mostly an occupied zone since 2011 and growing at a rather consistent rate ever since. According to the change model analysis as described in the previous section. This area had mostly minor changes to an additional education institute and residential facilities. We are not projecting that there will be major changes in terms of figure, but there is a possibility that the aged group might rise about 4000 for the next 5 years, thus suggesting the need of more eldery facilities.

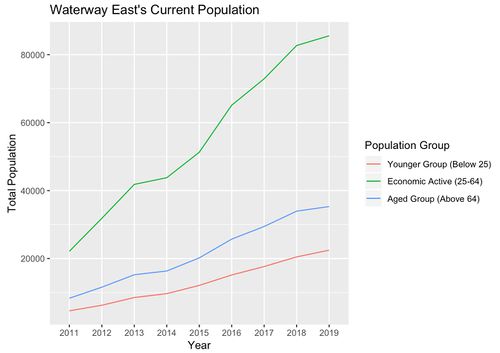

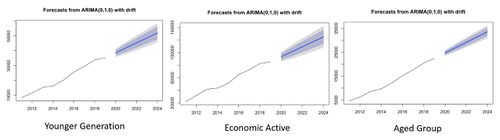

Waterway East’s Population Trend

Similar to Matilda and Punggol Town Centre, the Waterway East has one of the fastest growing subzones in Punggol. We can observe a similar trend of age group division, where the economic active dominates the population. In terms of its current figure, Waterway East have reached Punggol Field’s figure. However, when it comes to potential growth, we project that there will be an increased number of addition across all age group classifications.

*Coney Island and Punggol Canal have 0 population recorded so we are not going to focus on these particular subzones

Analysing The Younger Population’s Needs

Going deeper into analysing each younger age group education needs

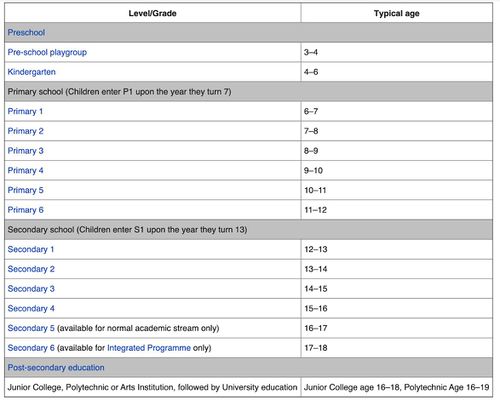

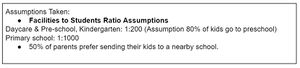

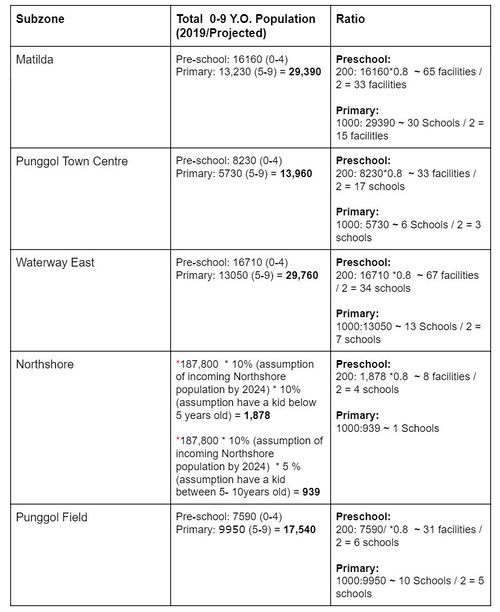

In this section we will perform a micro analysis of the younger age group needs. The diagram above clearly separates different education stages of each young group classification. We will make recommendations whether there is a need to revise the current availability pre-school, kindergarten, primary school, secondary school, and post-secondary education.

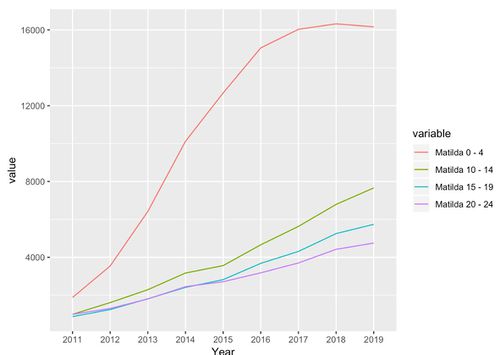

Matilda’s Younger Group Population Trend

The above line chart depicts the historical younger group population trend in Matilda’s subzone. Interestingly the subzone are predominantly filled with age group 0 - 9 which emphasises the need of having preschool and primary school nearby residential buildings. Proximity to residentials are important in this subzone so that parents can drop or pick-up their kids before or after work conveniently. From this figure we can conclude that for the next 5 years, preschools, kindergarten and primary schools are priority.

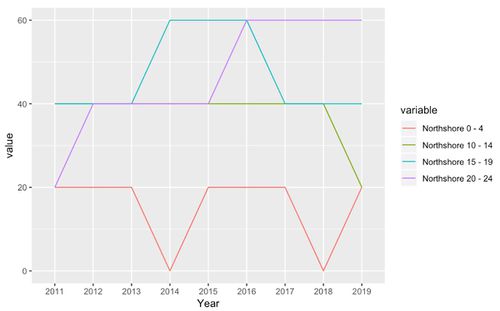

Northshore’s Younger Group Population Trend

As per discussed under the “Northshore’s Population Trend” section, the government are rolling out HDB on-going projects that will be projected to complete in 4 or more years. Thus, even though the younger population figure seems to be less significant as compared to other subzones, the subzone will experience a major spike once units are completed. Thus, there is a need for proper planning to ensure that the younger age group needs are met.

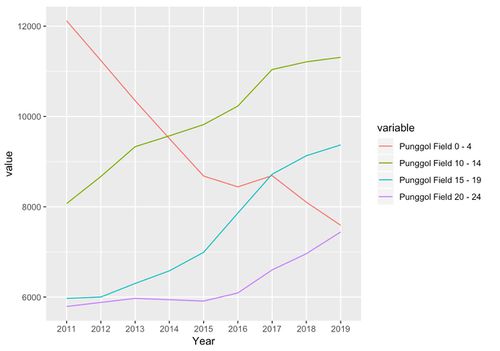

Punggol Field’s Younger Group Population Trend

The Punggol Field’s subzone is rather different as compared to Matilda’s. Younger age group comprises of majority 10-19 years old which touches primary, secondary, and some post-secondary level of education. Despite the pretty big ratio of secondary and post-secondary figures, our team believes these planning facilities for these 2 stage of education should consider a higher level planning zone, for example across Punggol planning area instead of just subzone. As age group tend to be more independent, accessibility is not an issue as long as the number of supply meets the demand. Thus we are only prioritising the facility for primary school here.

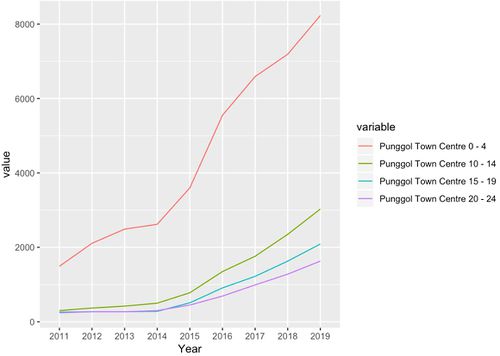

Punggol Town Centre’s Younger Group Population Trend

The Punggol Town Centre have roughly consistent growth rate in terms of number per each group. Our team observes a pretty similar case to the Matilda’s Subzone where total population of 0-9 age group are way more than the other age groups. We will prioritise in building more preschools, kindergarten and primary schools for these age groups.

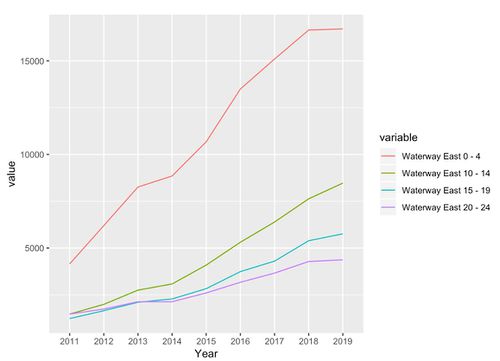

Waterway East’s Younger Group Population Trend

The Waterway East’s have also a roughly consistent dominant total of age group 0 - 9. Our team believes that this trend of dominant age group of 0 - 9 years old is not random, the fact that it has appeared to be distinctly apparent on 3 out of 5 occupied subzone. This trend also implies that most of current Punggol residents are young family and it is continuously adding. If we consider the current social norm in Singapore, newly married couples will tend to look for a new BTO as they venture out to a new phase of life together. Coupling with the recent BTO launches especially in the Northshore subzone, we expect the same pattern to happen again. Where it emphasis the need of more children facilities in the region.

As we focus on providing children facilities especially the education needs, we will roughly measure the approximate ratio of available educational facilities on each subzone, number of pre-school, kindergarten and pre-schools, and lastly the total of 0-9 age group.

Ref:

- “Punggol has an estimated HDB resident population of 187,800 and we manage 49,909 flats in the town (as of September 2019)”

- https://www.hdb.gov.sg/cs/infoweb/about-us/history/hdb-towns-your-home/punggol

- https://mothership.sg/2019/09/punggol-point-bto-september-2019/

Facilities to Cater for the Younger Population’s Needs:

- Mainly narrowed down in ensuring that school for 0-9 years old age group are all provided

- Building of new library looking at the trends of younger group rise:

- However its already planned. Punggol's library is currently being built and will be available in 2021.

Land Suitability Analysis (Green Zone) For School Redevelopment

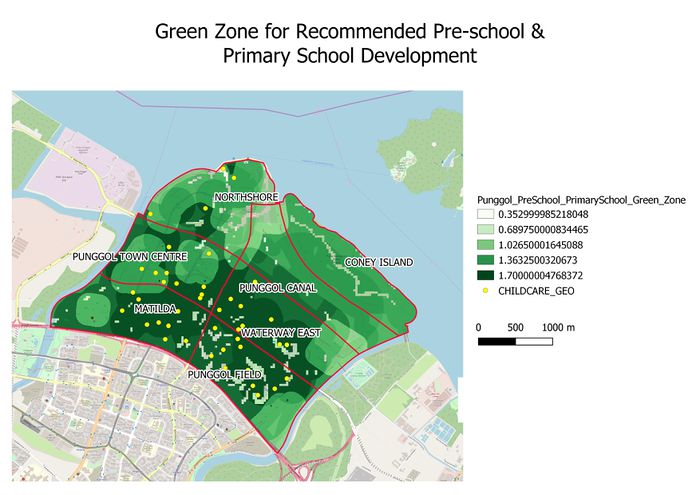

In this section we will explore options in meeting the younger population needs especially in catering for the preschool and primary school needs as mentioned in the previous section. We note that there is a greater demand yet limited supply of schools in order to fulfill the Masterplan 2019’s vision of Punggol as a place to play-work-learn-live. Going back to the numbers, 5 out 7 subzones in Punggol are currently growing in terms of the number of population between 0 - 9 years old. Moreover, a further migration of the economic active especially the newly married couples through the recent purchase of BTOs will pose as an increase potential number of these age group.

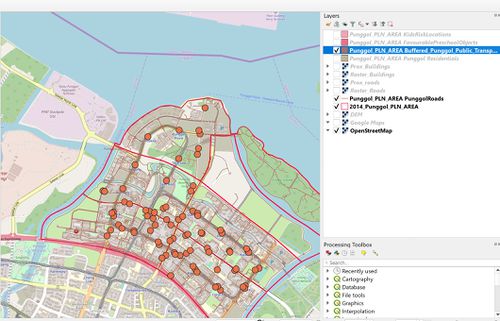

The above map shows the currently available childcare centre and schools in Punggol retrieved from the Data.Gov site, shows a lack of supply for the demand to meet the current vision. Next, we will evaluate alternative recommendations that can be performed. We will apply a land suitability analysis to predict where in Punggol subzones can we add on the number of supply for this need.

For this land suitability, we will develop what we call a green zone to identify preferred locations with multi-weighted criterias with the following suggested factors:

- Economic factor: < =15deg slope for an ease of construction development which results in no additional time and manpower cost. Our team aims to look at the potential of building an integrated schools within pre-existing buildings, the reason is to leverage and optimise the use of empty & reserved land for something else. Thus, the slope standardisation method was not performed.

- Road Accessibility factor: <= 100m from roads for ease of private transportation.

- Children Risks Avoidance factor: >= 150m away from school as a highly important factor as parents would want to send their kids to a less risky locations with lesser construction areas.

- Favourable Objects Proximity factor: <= 500m from favourable objects for better outdoor learning possibilities such as empty fields, grass, playground, etc.

- Public Transport Accessibility factor: <= 200m from public transportation data points for convenience of majority population.

- Residential Proximity factor: <= 300m from residentials because we want to go back to the Masterplan 2019 vision to create Punggol as a place to play-work-learn-live.

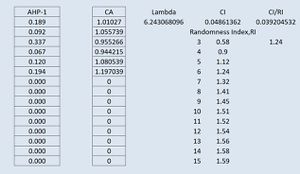

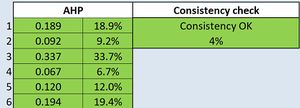

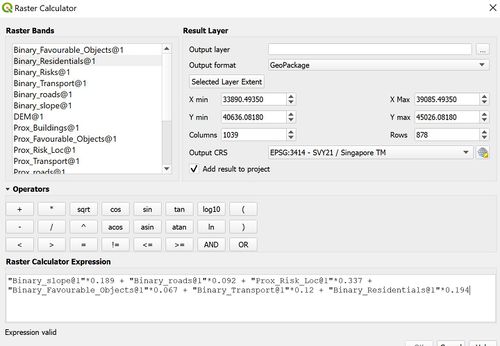

We make use of the SAGA Analytical Hierarchical Process to simulate and ensure the consistency weightage based on what is a priority. The above picture shows the priority matrix we have plotted.

The current random index represents a consistent prioritisation matrix by weighing Economic factor as 18.9%, road accessibility factor as 9.2%, children risks avoidance factor as 33.7%, favourable Objects Proximity factor as 6.7%, public transport accessibility factor as 12%, and residential Proximity factor as 19.4%.

children risks avoidance, residential proximity factor, economic factor, public transport accessibility factor, road accessibility factor and favourable objects proximity factor in that order.

Methods Taken

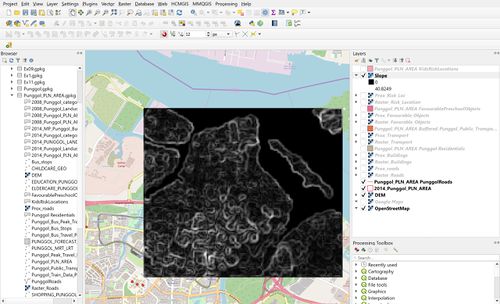

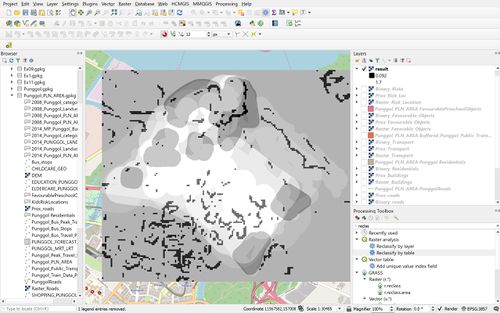

- Binary land suitability modelling by using raster-based GIS operations in QGIS. By transforming export vector layers into raster layer for computation. Each layer attributes were added with a `POI_CODE` = 1 to represent the binary value.

- Catering to MRT/LRT stations and bus stops in Punggol, we apply buffering from the vector geometric tools of 50m dimension to represent its station reachability.

- Next, we perform `Rasterize (Vector to Raster)` to each `POI_CODE` function to convert into raster format.

- For each Rasterized vector, we generate a proximity analysis using the `Raster > Analysis > Proximity (Raster Distance)`.

- Ranking land suitability modelling of the generate raster-based layers, we perform the binary multiplication with the analysed weightage for each factor using the Raster Calculator.

- The binary model is generated, however we need to clip raster to fit the Punggol subzone using the `Clip Raster by Mask Layer` of the MP14 subzone boundary.

- Finally, we run `QGIS2Web` plug-in and deployed analysis app on the Heroku platform. The product can be found here.

Results

The above map shows the overall green zone suitability map for building new primary and preschool. The darker the green zone represents a more suitable location according to the weighted analysis.

Firstly, the Matilda, Punggol Town Centre, Punggol Field, and Waterway East has the most 0-9 age group population. However, the current figure of child centres and primary schools does not meet its tremendous demand. We can observe visually and count manual how many centres are there. This should be a priority that the government should prioritise because we are talking about ensuring about providing a good quality education for the future generations of Singapore. Between this 4 populated subzones most of the recommended locations are located at the heartbeat of Singapore which ensures the nearby proximity to community facilities, public transport, road network, and residentials.

The challenge now is that the recommended green zones are populated with buildings, thus no empty land to build.

Our team believes that this challenge can pose as an opportunity in embedding preschool under the HDB blocks and future new residentials as seen as the picture above. Additionally, as there is a high demand and low supply preschools in the Punggol region we can see the building of preschools as an open job opportunities for new teachers thus tackling Punggol as a place to play-work-learn-live.

Going back to the green zone land suitability analysis, the Northshore region will experience an exponential growth of economic active and the younger group age group with only 3 pre schools at the moment. The map above depicts the on-going Punggol redevelopment from Master Plan 2008. We can see that learners and creative corridors are being built nearby the subzone, that will most likely be the best place to plan the redevelopment of the facilities.

Data Sources

- Master Plan 2014 Subzone Boundary from URA. This data can be downloaded from data.gov.sg.

- Roads, buildings, land use data from OpenStreetMap (OSM) data sets.

- Child care layer from Data.gov.

- Bus stops and mrt data points from DataMall.

- ASTER Global Digital Elevation Model (GDEM) dataset jointly prepared by NASA and METI, Japan. This data can be downloaded from NASA’s EarthData Search site.

Why Creating a Live-Work-Play-Learn Community can be challenging especially for the economic active?

Ever since the Masterplan 2008, Singapore envisions its planning subzones to be a place to live, play, work. Under the Draft Master Plan 2019 itself states that “Punggol Digital District will continue to provide jobs closer to home”. However can we evaluate whether this plan is applicable for the economic active age group?

Firstly, the Punggol Digital District (PDD) aims to bring together the Singapore Institute of Technology (SIT)’s campus and JTC’s Business Park spaces within Punggol North to create Singapore’s first truly smart district. Thus, potentially creating new opportunities for Punggol citizens and their surroundings. We will review the current possibilities and challenges of the current initiative, especially how likely it is to bring work closer to home.

To understand its possibilities it is important to perform analysis to understand where does most of the Punggol economic active group works. The explicit data for this case will be extremely hard to access, however we can imply that most citizens will travel to how using public transportation. The DataMall API provided by LTA summarises the monthly travel patterns by origin destinations to each train’s station and bus stops. Additionally, if we could gather both travel pattern data during AM & PM peak hour, we can probably capture most of the traveling to work trips.

Data Wrangling

Our assumption will be that AM peak hour is between 8 to 10 am interval. While PM peak hour takes time at 6 to 8 pm. Based on the row screenshot of the raw data shown above, we can potentially filter time based on the peak hour timing on weekday and match train stations and bus stops to gather information of total trips which takes place during peak hour and punggol origin.

Data Cleaning and filtering were performed in R and published in RPubs Punggol Peak Hour Travel Pattern Analysis. During the data cleaning process, we realised that MRT/LRT transfer stations such as Punggol, City hall, and Dhoby Ghaut had a special combined station code, thus we will only take the first mentioned station by default for data matching during analysis, eg: Punggol MRT was listed as “NE17-PTC”, R code transforms it into “NE17”. Also, the bus stop numbers which has a default 6 digits character was read as a digit thus losing its first “0” digit as it was converted into digit.

The MRT/LRT and bus stop vectors were exported in to geopackage. Since we are focusing on travel patterns from Punggol origin, we filter overall data points which falls under the Punggol Region using the clip method. Next we label the coordinate using X & Y geometry through adding new field using the Field Calculator feature. Syntax used was as simple as calling a built-in function that returns X & Y coordinates which are `$x` and `$y`. Next, we also label the entire MRT/LRT stations and bus stops. It is not possible to have 2 vector data points in a single row of data, thus we leverage on the `X_from` `Y_from` and `X_to` and `Y_to` when performing joining according to the appropriate `ORIGIN_PT_CODE` and `DESTINATION_PT_CODE`.

Next, we perform a one-to-many relational data joining of the “Passenger Volume by Origin Destination Bus Stops” and “Passenger Volume by Origin Destination Train Stations” using the Vector general’s `Join attributes by field value`, where input layer as the clean travel pattern data and second input layer as the vector point with the newly created X Y field. Next step uses the same method but linking bus destination all overall singapore travel data points, thus having 2 points of vector data in a row.

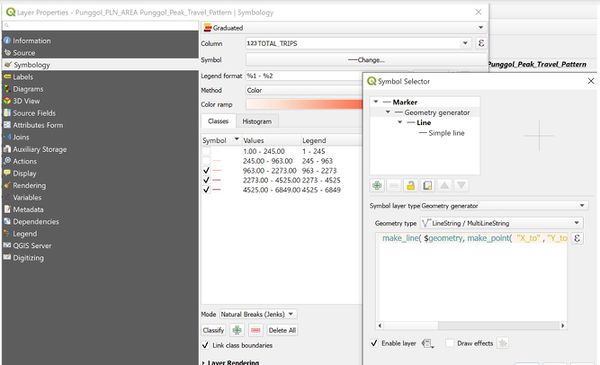

In order to visualise, we export current data into a csv, to vectorise according to the joined X Y data points by importing as delimited layer file. Importing the delimited text layer will point to the `X_from` and `Y_from`. We want to build a graduated network layer between to vector points using the graduated and customised geometry option. To do that we did the following steps:

- Open imported layer’s symbology setting

- Choose `Graduated`

- Click `Symbol` > `symbol layer type` as `Geometry Generator` and `Geometry type` as `Line String/Multiline string`

- We manually plot the `X_to` and `Y_to` data point by indicating geometry expression with the following formula: “ make_line( $geometry, make_point( "X_to" , "Y_to" ))

- Next, we `Apply` changes and select `TOTAL_TRIPS` and the object of graduated value visualisation.

The above screenshot shows the created network layer based on the travel pattern data of public transportation. Next, we will analyse the results of the network map.

Data Source

- [[ http://datamall2.mytransport.sg/ltaodataservice/PV/ODBus%7C“PASSENGER VOLUME BY ORIGIN DESTINATION BUS STOPS”]] , Month Sep 2019.

- “PASSENGER VOLUME BY ORIGIN DESTINATION TRAIN STATIONS”, Month Sep 2019,

- Train data points, DataMall

- , DataMall

- DataMall API.

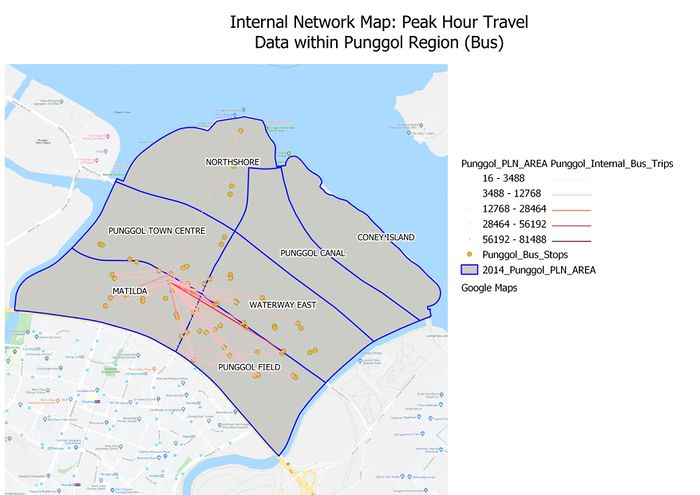

Results: Bus Peak Hour Travel Pattern in Deriving Current Punggol Population’s Workplace

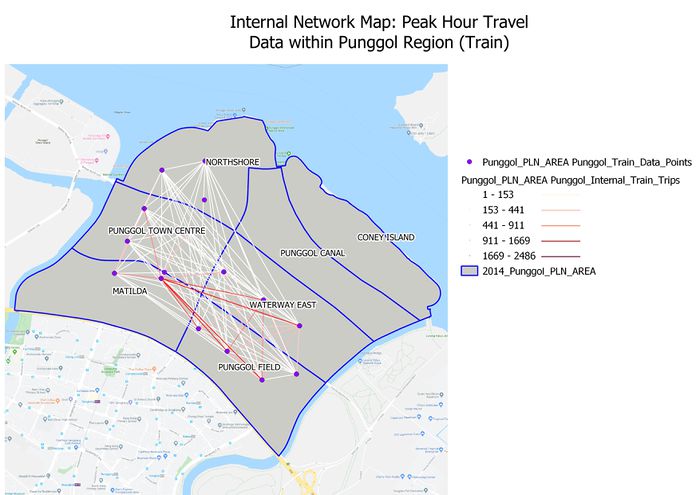

Results: Bus and Train Peak Hour Travel Pattern within Punggol Boundary

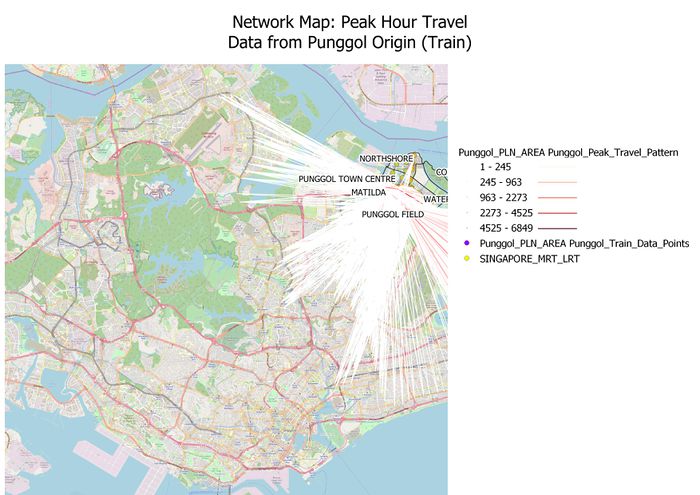

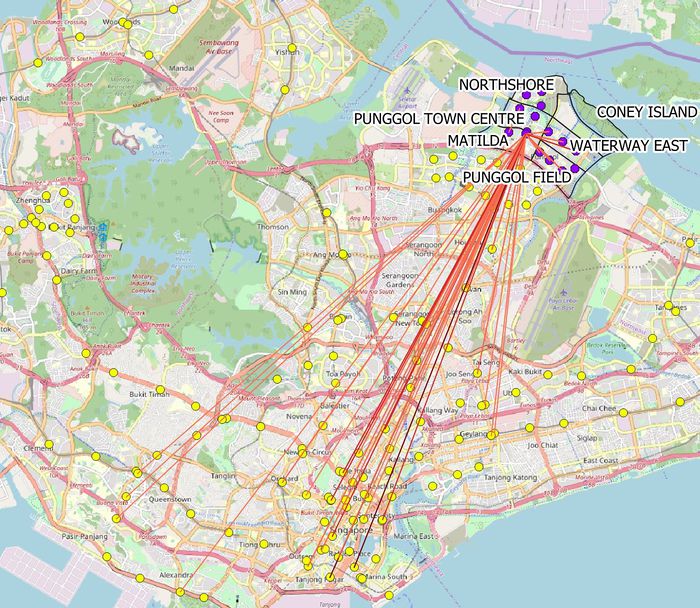

Results: Train Peak Hour Travel Pattern in Deriving Current Punggol Population’s Workplace

Analysis of the Bus and Train Peak Hour Travel Pattern in Deriving Current Punggol Population’s Workplace

Based on the network analysis we have performed, we note that apparently most of Punggol citizens travel out of Punggol during peak hour. Firstly the Train Network map shows a rather spreading travel pattern out of Punggol all the way to Woodlands, Bishan, Ang Mo Kio, and the East Region, Interestingly, when we unview a rather small travel trips to of 1-963 in month September 2019, map revealed that many travel patterns are directed to the Buona Vista, One North, Labrador Park, Pasir Panjang, Paya Lebar, MacPherson, Tai Seng and of course CBD district including Tanjong Pagar, Downtown, Suntec, Promenade, City hall where most of the Big MNCs and well-performing startups and SMEs are currently located.

Additionally, from the predominant bus travel data during peak hour, we can see that interestingly bus trips to the east including Changi Airport and Expo are directed to. It is believed that these 2 locations also provides the aviation industry sector and technology support for big companies such as IBM and DBS tech division and located at Expo.

To conclude this observation, I believe that the goal of creating Punggol Digital District can pose a challenge not just in terms of initiating the vision, but also getting on board companies who are willing to move over to the Punggol region where it is not really well-known as an office area. Looking from the Punggol citizen’s perspective, Singapore ease of transportation allows them to travel down to popular business districts pretty conveniently and thus citizens might not feel it is necessary to work within proximity. Truth is , people don’t mind travelling just to be employed in a company they like. Next, global MNCs which most people prefer to work offers better competitive benefits and salary which in turn becomes the preferable place to work instead of just proximity as a priority.