IS428 2017 18T1 Group05

Contents

Problem Statement and Motivation

Have you received a pay check or paid for a product only to find out a significant amount went to paying taxes? In 2017, The Inland Revenue Authority of Singapore (IRAS) collected tax revenue amounting to S$47 billion, a 5% increase from tax revenue in the fiscal year 2016 [1]. Taxes are compulsory contributions made to the government by citizens and firms residing in the nation to fund government operations on certain categories of products and services. In recent years, tax compositions has differed, with similar changes trending globally.[2].

According to a report by the Organization for Economic Co-operation and Development (OECD), Singapore was ranked as one of the lowest-taxed economies in South-east Asia and amongst other economically developed countries[3]. Tax revenue in Singapore serves fund government operations and promote social and economic goals. In doing so, the government aims to ensure competitive tax rates to both corporations individuals to ensure a healthy economy. In this project, we hope to allow users to explore trends and patterns in the composition of Singapore’s tax revenue over the years. Furthermore, we hope that the interactive visualization will aid the public in understanding the key components of Singapore’s tax revenue and the share of their contribution to tax revenue.

Description of Dataset

https://www.iras.gov.sg/IRASHome/About-Us/Taxes-in-Singapore/The-Singapore-Tax-System/

In this project, we will be examining the key components that make up government tax revenue. Data used in this project will be obtained from open data published by the Inland Revenue Authority of Singapore [4]. We will be looking at the following areas of tax revenue in Singapore.

| Type of Tax Revenue | Description | Breakdown |

|---|---|---|

| Individual Income Tax | Revenue from the progressive tax rate imposed on individuals based on their chargeable income status | Based on individual income groups from S$20,000 to S$1,000,000 with a bin of S$5,000 |

| Corporate Tax | Revenue from the direct tax imposed on the income of business entities | Based on corporate income groups from S$10,000 to S$5,000,000 with a bin of S$10,000 |

| Property Tax | Revenue from the progressive tax rate is applied on owner-occupied and non-owner occupied residential properties. All other properties in Singapore are taxed at a fixed rate of the Annual Value | Based on Property type (e.g. Land, HDB) |

| Estate Duties | ???? | ??? |

| Motor Vehicle Tax | Revenue from the taxes (COE and Road Tax) imposed on a person to curb car ownership and road congestion | |

| Customs and Excise Duties | Revenue from duties imposed on motor vehicles, tobacco, liquor and petroleum products | Based on product type |

| Goods and Services Tax | Revenue from the value added tax imposed on most good and services for domestic consumption | Based on economic sector & based on entity type |

| Betting Tax | Revenue from the fixed tax rate imposed on a person or organization receiving bets based on type of betting schemes available in Singapore (e.g. 4D, Toto, Big Sweep, Sports Betting) | ??? |

| Casino Tax | ??? | ??? |

| Stamp Duties | Revenue from tax levied on documents | Based on types of duties (e.g. Sale & Purchase Agreement, Lease Agreement, Mortgage Agreement) |

| Others | Revenue mainly comprising Foreign Worker Levy and Airport Passenger Service charge |

Background of Survey and Research on Related Work

Our group has done prior research on related work on tax composition and pattern visualizations. While there has not been an interactive visualization to depict Singapore's tax revenue composition and patterns over the years, the following work are current visualizations related to Singapore Tax composition and of other countries' tax revenue.

| Related Works | Comments |

|---|---|

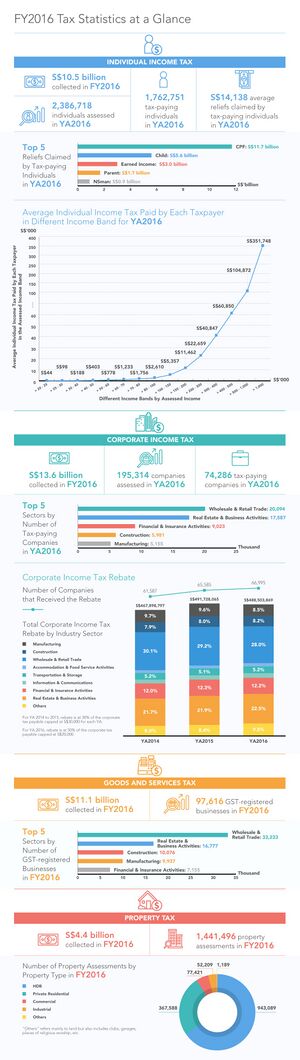

| Data Visualization by Inland Revenue Authority of Singapore for the Public | Simple and intuitive design that reveals key insights on each component of tax revenue. However, the visualization is not interactive and does not allow users to see the overall composition of tax revenue and observe patterns or changes in tax revenue components. |

| Example | Example |

| Example | Example |

| Example | Example |