Difference between revisions of "1718t1is428T2"

| Line 198: | Line 198: | ||

* D3.js (https://d3js.org/) | * D3.js (https://d3js.org/) | ||

* Examples By Mike Bostock (https://bost.ocks.org/mike/example/) | * Examples By Mike Bostock (https://bost.ocks.org/mike/example/) | ||

| + | * Housing Development Board (http://www.hdb.gov.sg/cs/infoweb/residential/buying-a-flat/resale/resale-statistics) | ||

<br/><div style="background: #347473; padding: 15px; font-weight: bold; line-height: 0.3em; text-indent: 15px;letter-spacing:-0.08em;font-size:20px"><font color=#fbfcfd face="Century Gothic">OUR BRAINSTORMING SESSIONS</font></div> | <br/><div style="background: #347473; padding: 15px; font-weight: bold; line-height: 0.3em; text-indent: 15px;letter-spacing:-0.08em;font-size:20px"><font color=#fbfcfd face="Century Gothic">OUR BRAINSTORMING SESSIONS</font></div> | ||

Revision as of 21:37, 15 October 2017

In the year 1960, Singapore was facing a huge crisis. Many people were living in unhygienic slums and crowded squatters with only a meager 9% of Singaporeans lived in government flats, while everyone else yearned for a place to call home sweet home.To counter this crisis,, the Housing & Development Board (HDB) was incorporated on 1 February, 1960 and tasked with the critical mission of solving the crisis ar hand. In a mere span of 10 years, HDB had attained its goal and solved the housing crisis.

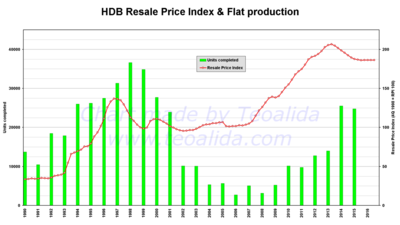

However, in 1993, HDB stopped deciding the prices of new apartments based on construction costs, instead they decided based on market prices. Prices of resale flats and new flats entered in a vicious circle, rising 50% in just 6 months of 1993 and tripled to 1996. This move closed the price gap between small and large flat types and hub pricing have never been he same again.

Thus, as graduates to be who will most likely enter the job market soon and start looking for a place to call home, we felt that it would be interesting to look into the historical flat data so that we can see which flats in Singapore would be the most value for money so that we can actually get a home which is worth its investment. We also felt that it would be fun to explore trends in the resale flat prices and see what factors really affect the prices of HDBs and see how much of a premium people attach to amenities such as proximity to public transport, schools and etc...

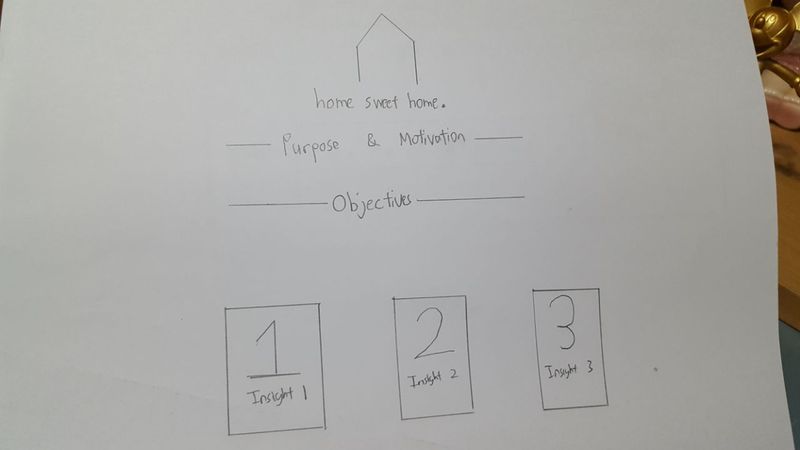

In this project, we are interested to create a visualisation that helps users perform the following:

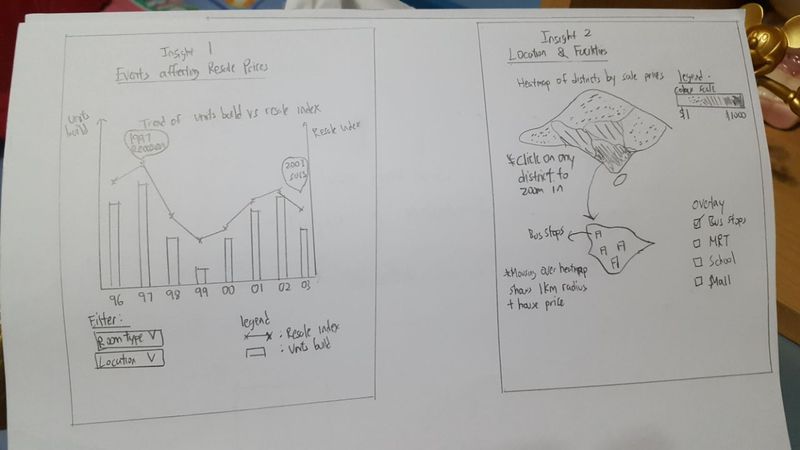

- View the trend in the resale prices over time with respect to major events that happened in the year (Example: 1993 Change in Pricing Model,1997 Recession

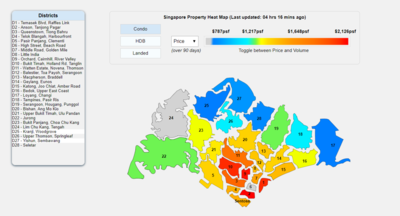

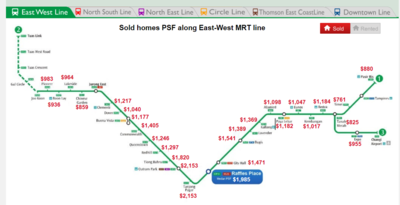

- Identify which areas are more expensive and possible reasons for the high value (Proximity to public transport, Schools, Shopping Malls, Park)

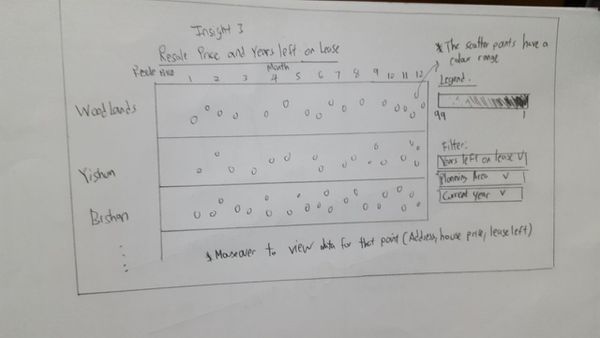

- To find out if getting a specific HDB is a good investment based on the number of year left on the lease and which locations may potentially be more profitable based on the age of the HDB.

By using our visualisation, we will be able to give users a better idea of the pricing situation of the resale HDBs so that people can make better decisions in the HDB which they want to choose to call their home. Such as when is the best time to buy as HDB; where are the most profitable / cheapest locations; whether a HDB is expensive

In our analysis, we will only be using data within the year of 1990 - 2017. The rationale for the range of data selected is as follows:

The dataset for analysis will be retrieved from multiple databases, as elaborated below:

| Dataset/Source | Data Attributes | Rationale Of Usage |

|---|---|---|

(https://data.gov.sg/dataset/resale-flat-prices?resource_id=83b2fc37-ce8c-4df4-968b-370fd818138b ) (https://data.gov.sg/dataset/resale-flat-prices?resource_id=8c00bf08-9124-479e-aeca-7cc411d884c4 ) (https://data.gov.sg/dataset/resale-flat-prices?resource_id=adbbddd3-30e2-445f-a123-29bee150a6fe ) |

|

|

(https://www.mytransport.sg/content/mytransport/home/dataMall.html#) |

|

|

(https://www.mytransport.sg/content/mytransport/home/dataMall.html#) |

|

|

(https://data.gov.sg/dataset/school-directory-and-information) |

|

|

There are many charts and visualisations available which illustrates the various trends of house prices and index. We have selected a few of these to study and learn before we begin developing our own visualizations.

| Related Works | What We Can Learn |

|---|---|

|

|

|

| |

|

| Proposed Layout | How Analyst Can Conduct Analysis |

|---|---|

| |

| |

|

The following are some of the key technical challenges that we may face throughout the course of the project:

| Key Technical Challenges | How We Propose To Resolve |

|---|---|

| |

| |

| |

|

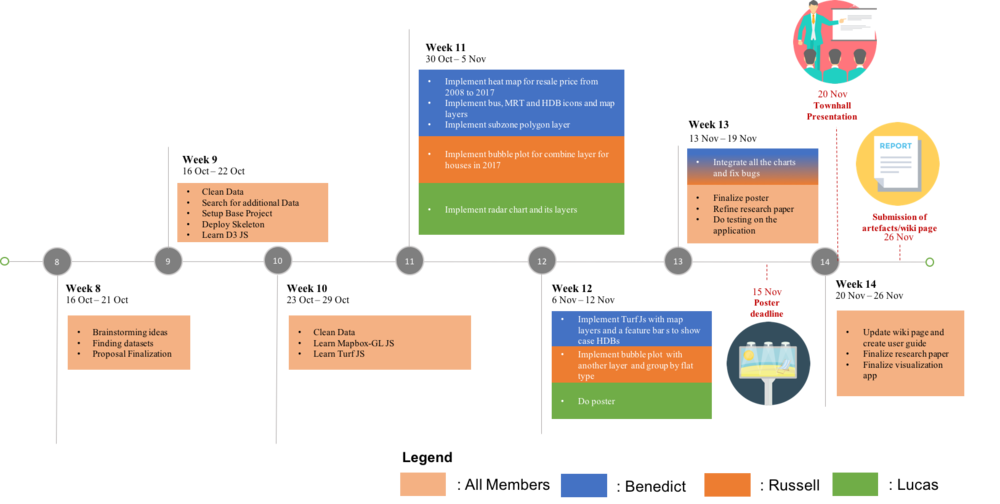

The following shows our project timeline for the completion of this project:

The following are some of the tools/technologies that we will be utilizing during the project:

- D3.js

- Proj4.js

- Google Maps Distance Matrix API

- Google Search API

- Github

- Node.js

- Angular.js

- DrWealth’s infographic (https://www.drwealth.com/singapore-property-prices-along-mrt-lines/)

- Data Gov Database (https://data.gov.sg)

- D3.js (https://d3js.org/)

- Examples By Mike Bostock (https://bost.ocks.org/mike/example/)

- Housing Development Board (http://www.hdb.gov.sg/cs/infoweb/residential/buying-a-flat/resale/resale-statistics)

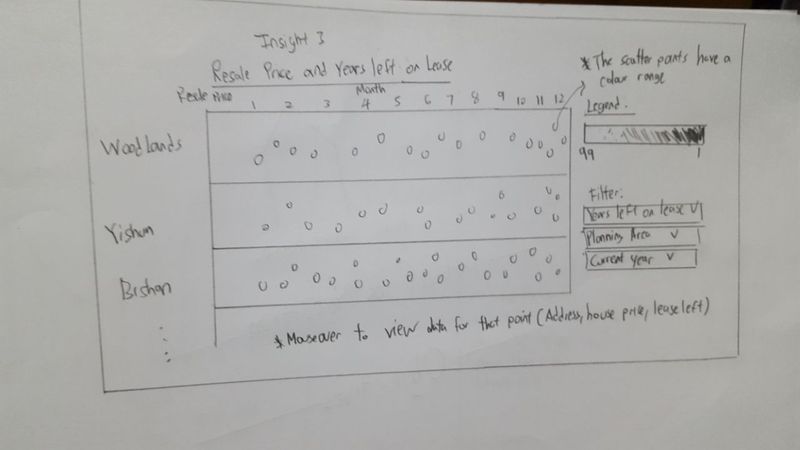

The following are some of the proposed storyboard that we designed during our brainstorming sessions:

Our idea was to provide charts which are able to visualise the trends of HDB over the years in Singapore. We decided to split into multiple charts to be able to showcase the information more clearly.

Feel free to comment to help us improve our project! (: