ISSS608 2016-17 T1 Assign1 LI Nanxun

Abstract

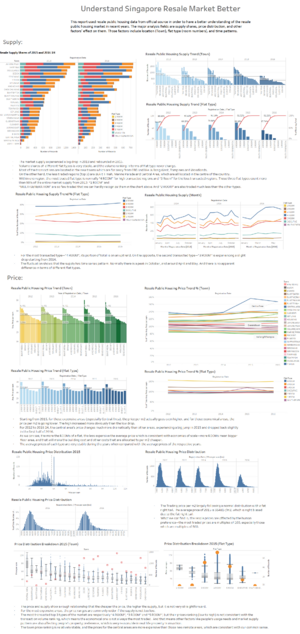

This report used resale public housing data from official source in order to have a better understanding of the resale public housing market in recent years. The major analysis fields are supply shares, price distribution, and other factors’ effect on them. Those factors include location (Town), flat type (room numbers), and time series. The market is relatively stable in recent years with no abnormal phenomenon. Interesting findings are: • The average prices per m2 of expensive regions are increasing, while the prices of cheap regions, which are normally far from the CBD but have more supply, are actually dropping. This phenomenon starts from 2015. • The average price per m2 keeps dropping, while the supply rebounds in 2015 after the 2013’s shrink.

Problem and Motivation

Property spending always counts or will count a big part of people who live in Singapore, especially of the relatively young generation -- us. Although the market is quite vivid and we have many convenient tools (i.e. PropertyGuru) to check the market by clicking mouse, the issue is we can only know part of the whole story if we only do the mouse clicking work. And here is a good chance to look at the whole story by analysing the official data, then, why not? This analyse will mainly focus on the major concerns of the market: price, supply, and following trend.

Problems addressed:

- What are the shares of the resale public housing supply in 2015? (Compulsory)

- What are the distributions of the resale public housing prices in 2015? (Compulsory)

- What are the factors that can affect the housing price obviously?

- Is there any difference between the patterns of resale public housing supply and price in 2015 and 2016 1H? (Compulsory). But I would like to answer this question by observe the trends from 2012 to 2016, only 2-year comparison cannot tell as much as 4 years.

In the following sections, these questions will be listed out in the respective analyses. For both supply and price, I will talk about the factors that may affect the market, such as location (Town), Flat Type (Room), in order to give a deeper understanding of the market history.

For the trend, I would like to use the data to plot the historical trends and mainly discuss the recent (2015~2016) trend features.

Approaches

HDB resale data was obtained from data.gov.sg and analyzed. The Resale Flat Prices data set selected covers the period of Mar-2012 to Jun-2016. It also contained the following information that was utilized:

- Year-Month - Showing year and month of which the flat was resold

- Towns - District where resale flats were sold in Singapore

- Flat Type - Made up of 7 categories, where the more rooms a flat has, the larger the flat

- Storey Range - The floor range of which the flat was sold

- Floor area sqm - The area of the flat

- Lease Commencement Date - Year of which the flat finished construction and was sold

- Resale Price - Price at which the flat was sold

From the above data, extra fields were derived

- Registration Date - created by transforming "Month" from "abc" to a date variable.

- Price per sqm - Derived by taking (Resale Price) ÷ (Floor Area sqm)

- Price per squm(bin) - in order to show the price distribution chart.

Through the use of Tableau, the above data was analyzed and charts were created to show relationships and findings. Summarized results were then compiled into an infographic for easy reading. Detailed results can be found in the "Results" section below. For further detailed information about how to derive the charts and other non-important findings, pls check the assignment report.

Results

General observations

For Supply:

- Most of the transactions are located in the new towns which are far away from CBD and like JuRong West, Tampines and Woodlands

- On the other hand, the less traded regions (top 3) are Bukit Timah, Marine Parade and Central Area, which are all located in the centre of the country.

- Within one region, the most traded flat type is normally “4 ROOM” for high transacted regions and “3 Room” for the less transacted regions.“1 ROOM” and “MULTI-GENERATION” are so few traded that we can hardly recognize them in the chart above.And “2 ROOM” are also traded much less than the other types.

- The Supply Volume experienced a big drop in 2013 and rebounded in 2015.

- Volume Distribution in terms of flat types is very stable, and the volume ranking never change.

- The most traded type is “4 ROOM”, followed by “3 ROOM” and “5 ROOM” when talking about the total supply of each year.

- The transaction pattern of the major types of flat don’t have big change, they are all fluctuating slightly.

- For the most transacted type—“4 ROOM”, its portion of total is on an uptrend. On the opposite, the second transacted type—“3 ROOM” is experiencing a slight drop starting from 2014.

- The fluctuation shows that the supply has time series pattern. Normally there is a peak in October, and around April and May. And there is no apparent difference in terms of different flat types.

For Price:

- The Trading price per m2 largely following a normal distribution with a fat right tail. The average price of 2015 is S$4817/m2, which is right biased due to the fat right tail.

- What we can find is, the resale prices are affected by the human preference—the most traded prices are multiples of 100, especially those which are multiples of 500.

- The Price Distribution Patterns of 2015 and 20161H are very similar.

- As we can see, the more the ROOMs of a flat, the less expensive the average price which is consistent with economies of scale—more ROOMs mean bigger floor area, and that will make the building cost and other costs that are allocated to per m2 cheaper.

- The most transacted top 3 types of the market are respectively “4 ROOM”, “3 ROOM” and “5 ROOM”, but their prices ranking (low to high) is not consistent with the transaction volume ranking, which means the economical one is not always the most traded. And that means other factors like people’s usage needs and market supply pattern are also affecting people’s property preference, which is very reasonable in real-life property transaction.

- The town price ranking is relatively stable, and the prices for the central areas are more expensive than those new remote areas, which are consistent with our common sense.

- As you can see, starting from 2015, for those expensive areas (especially Central Area), the price per m2 actually goes even higher, and for those economical areas, the price per m2 is going lower. To sum up, the high higher, the low lower. The high increased more obviously than the low drop.

- For 2012 to 2016 1H, the central area’s price changes much more dramatically than other areas, experiencing a big jump in 2015 and dropped back slightly in the first half of 2016.

- The transaction prices are dropping during the years.

- The average prices of each type are very stable during the years when compared with the average prices of the respective years.