ISSS608 2016-17 T1 Assign1 Linda Teo Kwee Ang

Abstract

xxxx

Problem and Motivation

“The public housing resale market has continued on its long stabilisation path”, according to Singapore Real Estate Exchange (SRX) in a Straits Times article dated 5 Aug 2016 [2]].This is what I would love to hear. Being one of the lucky ones to be allotted with a unit in the recent Built-to-Order (BTO) project, it will be necessary to offload my current flat unit within the next five years. However, the cooling measures introduced by the Housing Development Board (HDB) over the past 10 years seem to be taking effect, with consistent dropping of the Resale Price Index (RPI) since the third quarter of 2013. The burning question thus pops up: when will be a suitable time to my current flat, in order to fetch a good price. It is opportune, to start monitoring now, with the use of visual analytics.

Approaches

HDB resale data obtained from data.gov.sg was analysed. The Resale Flat Prices data set selected covers the period of Mar-2012 to Jun-2016, and has quite a good range of information for analysis, like resale flat prices based on date of registration, town, flat type/model and lease commencement date [3]].

Such data provides the scope for the following comparisons over time:

- Towns – to show distribution of resale flats sold across 27 towns in Singapore

- Flat type – to show the relative size of the resale flats. The more rooms the flat has, it will be relatively bigger in floor area

- Storey range – typically the higher the flat is, the higher the price it is able to fetch

- Lease commencement date – the age of the flat can be determined from calculating the number of years since the flat was leased, assuming that the resale transaction was made by the first owner.

- Resale price – the price of the flat in the resale transaction

Tools Utilised

Tableau was mainly used to run the data.

Data preparations: The data set is not ready for use immediately. Slight calculations were required in the following:

- Conversion of Date field: The Date field of the data set was in the format YYYY-QQ, as in “2012-03” for 2012Q3 and was treated as string character field by Tableau. To convert to a date format, the following formula was used on the Month field: DATEADD('month',INT(RIGHT([Month],2))-1,DATEADD('year',INT(LEFT([Month],4))-1900,#1/1/1900#)).

- Standardisation of Lease Commencement Date: The Lease Commencement Date was actually in YYYY format. A similar conversion was done using DATEADD('year',INT([Lease Commence Date])-1900,#1/1/1900#).

- Calculating a proxy for flat age: Given the standardisation of dates above, the age of flat is estimated by getting the difference between transaction date and lease commencement date. The formula used was ([Year-Month]-[Lease commencement year])/365. As this estimated age is likely to be overstated, given that lease commencement date was using default 1st Jan of the respective years, this calculated field is rounded down to a whole number using if [Age of flat]=int([Age of flat]) then [Age of flat] elseif [Age of flat]<0 then int([Age of flat]) else int([Age of flat]+1) end.

- Calculating the price per square metre of resale prices: The prices in the resale transactions were expressed in absolute price of the units. For a more uniform comparison, the prices were converted to price per square meter (psm) using [Resale Price]/[Floor Area Sqm]

During analysis:

The use of tooltips and colour markings will be very useful when making distinctions across the voluminous data. For tooltips, it is recommended that important data like street name, blk and storey range be applied, to better interpret the results when hovering over the points.

Preparation of infographics:

This infographics is designed for the purpose of sharing with the mass public. Hence the technical statistical analysis is minimised, and the charts/diagrams in the infographics was deiberately selected for ease of interpretation by a layman.

Results

General observations

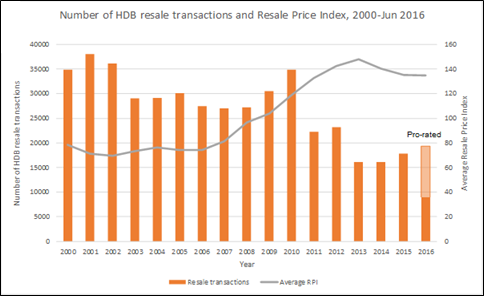

Generally, the number of HDB resale flats transacted over the past 16 years is on a downward trend, with slight upheaval in the last two years. The year 2016 may show an increase from 2015, based on pro-rated figures. The average RPI, on the other hand, shows an opposite trend, with increasing index over the years, only to decrease in the last two years.