ISSS608 2016-17 T1 Assign1 WEI Jingxian

Contents

Abstract

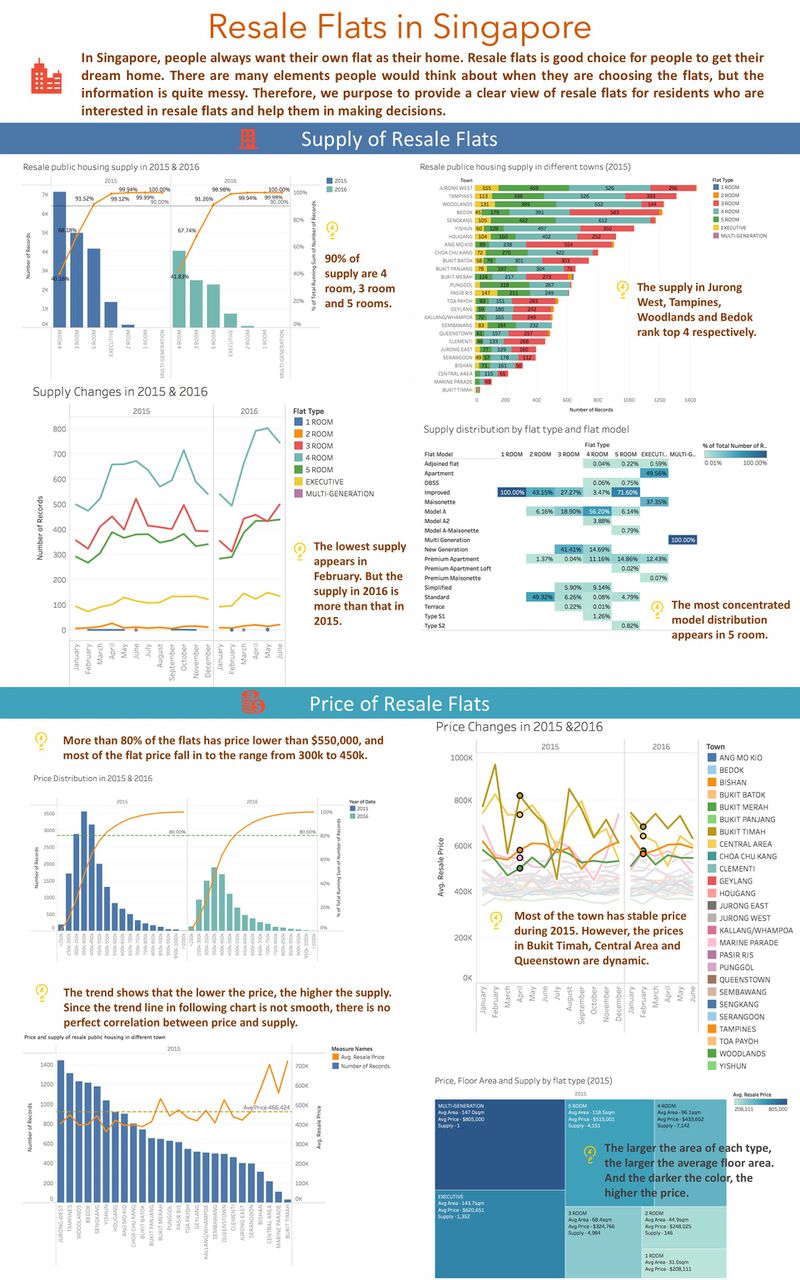

In Singapore, people always want their own flat as their home. Resale flats is good choice for people to get their dream home. There are many elements people would think about when they are choosing the flats, but the information is quite messy. Therefore, we purpose to provide a clear view of resale flats for residents who are interested in resale flats and help them in making decisions.

Problem and Motivation

Public housing is an icon of Singapore, and HDB flats are home to over 80% of Singapore's resident population (ref). However, sometime it is not easy for resident to apply flats due to financial or other problems. The resale flat is a good choice for these resident. The dataset we used is from HDB. resale-flat-price

There are two key variables related to resale flats market, including supply and price. For people who want to buy a flat, the essential factor they concern about is price. Also, apart from price, people would also care about locations of flats. Therefore, we would like to show insights for following three aspects.

- How many resale flats are selling in 2015?

- 1. The supply for different flat types

- 2. The supply for different flat model

- 3. The supply in different location

- 4. The trend of supply in 2015

- What is resale flats price in 2015?

- 1. Price distribution

- 2. Price and floor area for different flat type

- 3. Price in different locations

- 4. Price fluctuation by locations

- Comparison between the first-half of 2016 and 2015.

- 1. Supply of resale flats

- 2. Supply changes by flat types

- 3. Price distribution by flat types

- 4. Price changes by locations

Approaches

Data Preparation

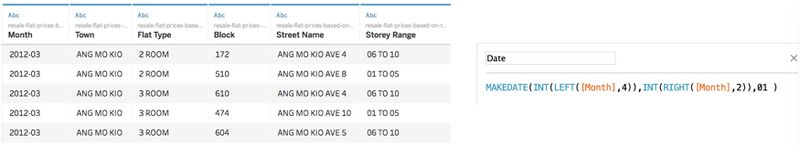

There are ten variables in the dataset, including registration date, flat information, and flat price. The sample data has shown below. Noticed that the date variable Month is treated as string in Tableau, so we need to use the formula below to calculate a new variable Date, which is in date format in Tableau, so that we can use the variable to do further analysis.

The time period of the dataset is from March 2012 to March 2016. But we only focus on the 2015 and 2016. Thus, before our analysis, we need to filter out the data before 2015.

Supply of Resale Flats in 2015

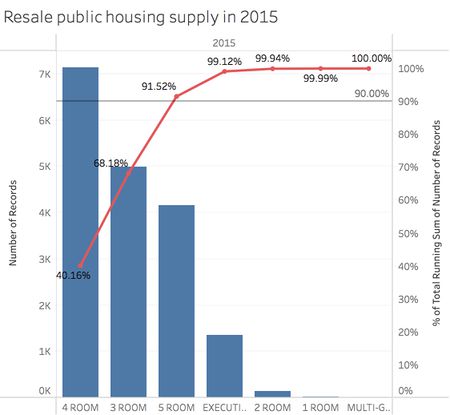

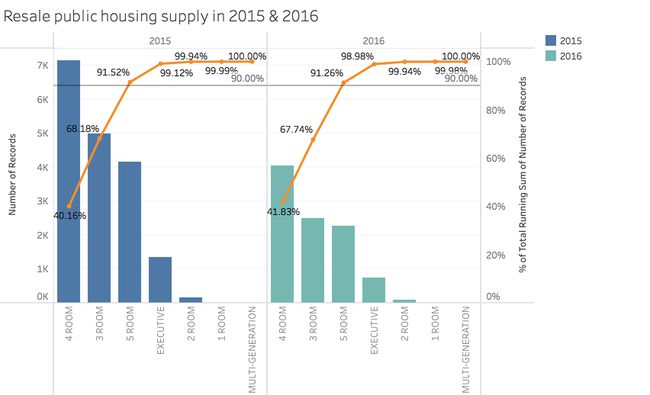

- First of all, we check the overall supply of different flat types in 2015. There are seven types of flats, including 1 to 5 room, executive and multi-generation. The top three types, which have higher supply, are 4 room, 3 room and 5 room. The percentage of supply for 4 room and 3 room already exceeds half of total resale flats supply. In addition, the total amount of these three types account for 91.52%.

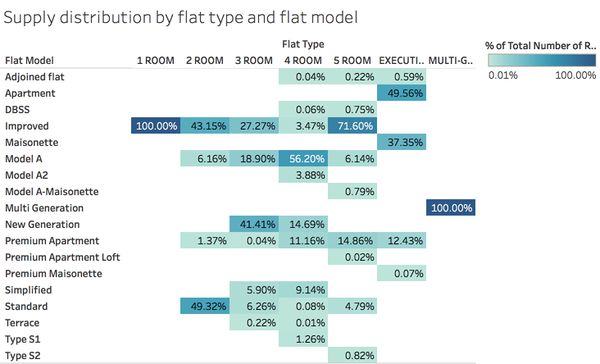

- Based on the types of flat, there is a more specific category called flat model. The following chart shows the percentage of flat models in each flat type.

For 1 room, there is only one model called Improved available. Also for multi-generation, there is only one model. For 2 room, almost half of the model is Standard, while the main model for 3 room is New generation. More than half of the 4 room supply is Model A. The most concentrated model distribution appears in 5 room, and 71.6% of 5 room supply is Improved model.

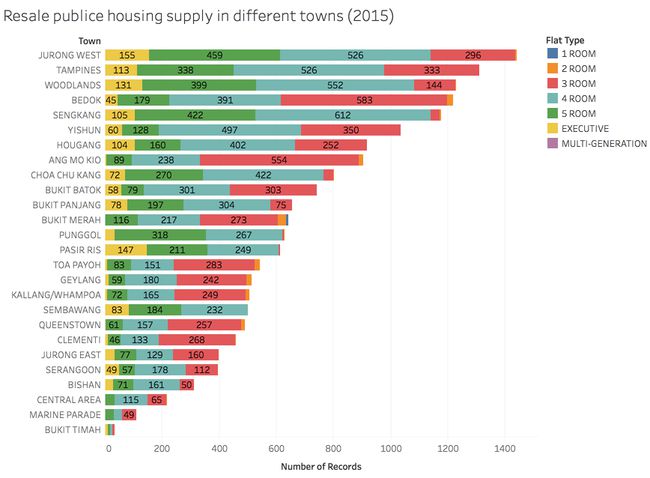

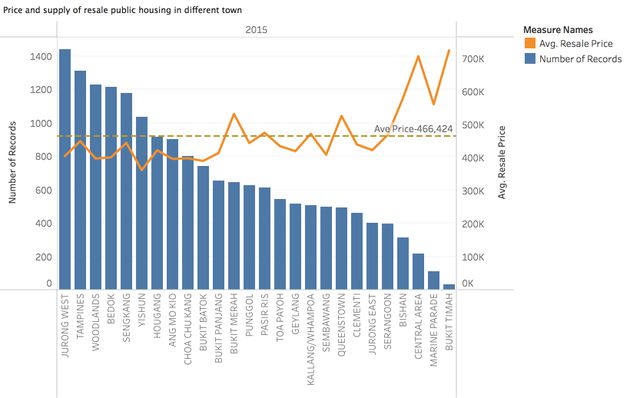

- When choosing a flat, people always concern about location, so here we would like to show the supply in different towns. In the following figure, we can easily find out the supply of different types of flats in each location.

Jurong West has the largest number of resale flats, and there are more than 1400 flats available in resale market. The next is Tampines, which has around 1300 resale flats. Woodlands and Bedok have similar supply, which is about 1200. But most of the resale flats in Bedok is 3 room, also in Ang Mo Kio, while in most of the towns 4 room accounts for largest portion.

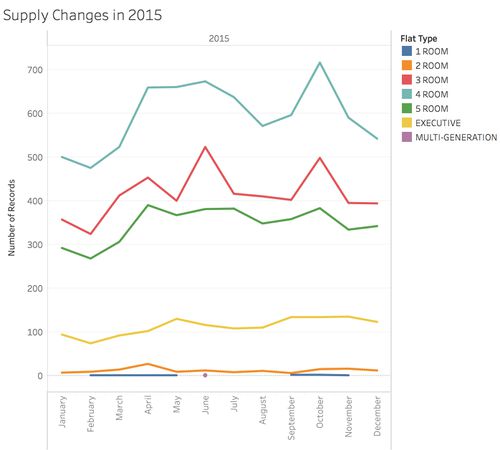

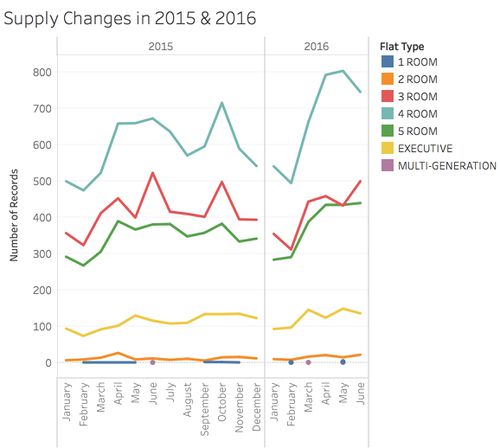

- Next, we would like to find out the trend of supply changes during 1-year period. It is obvious that the lowest supply is in February, while the highest supply appears in October. In addition, the supply for 4 room, 3 room and 5 room varied significantly, but the supply of executive and 2 room is quite stable. There is only a handful of multi-generation flat available in resale market.

Price of Resale Flats in 2015

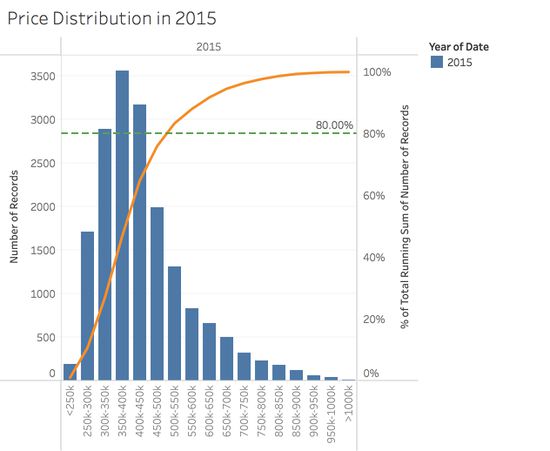

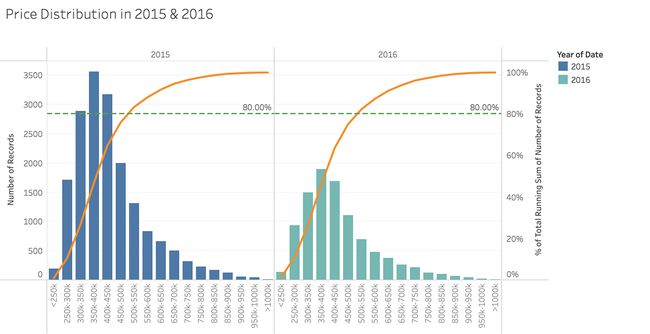

- The first consideration when people are choosing flats is price, so we would like to check the price distribution in 2015 first to gain an overall view. More than 80% of the flats has price lower than $550,000, and most of the flat price fall in to the range from 300k to 450k.

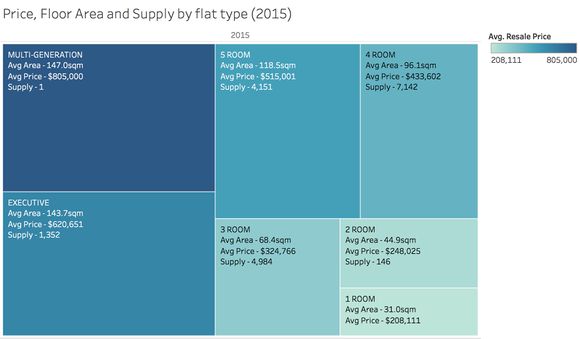

- Although we know the types of flat, we still want to know about the floor area of each type. In the following figure, we can cleanly know the average floor area, average price and the supply for each type of flats. The larger the area of each type, the larger the average floor area. And the darker the colour, the higher the price. Also, it is obvious that as the average price increase in response to the increase in average floor area.

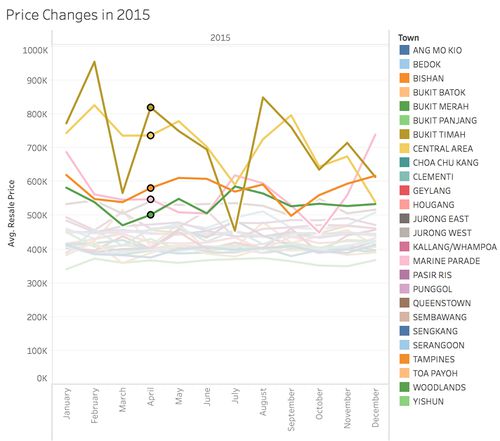

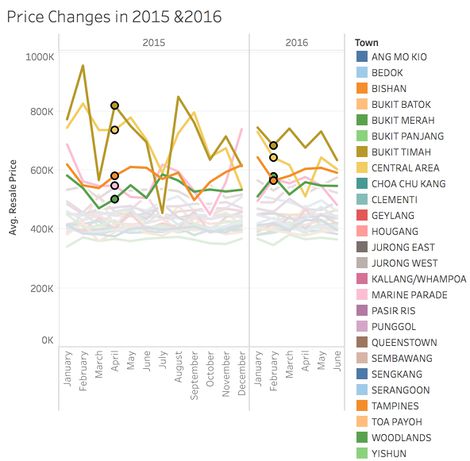

- The trend of price change during 1-year period is also important for people to make decisions. In the below chart, most of the town has stable price during 2015. However, the prices in some towns, such as Bukit Timah, Central Area and Queenstown, are dynamic.

- In our common sense, there must be some relationship between supply and price. The trend shows that the lower the price, the higher the supply. Since the trend line in following chart is not smooth, there are some exceptions. For instance, Sengkang has higher price than Yishun, but Sengkang still has higher supply than Yishun.

Comparison between 2015 and first-half of 2016

- Recalling the supply distribution in 2015, we notice that the supply for different types flat are similar in fist-half of 2016. The top three types, which have higher supply, are still 4 room, 3 room and 5 room.

- The trend of supply changes are also similar in two period. The lowest supply appears in February also. But the supply in 2016 is more than that in 2015. The peak supply of flats is around 800 in May 2016.

- For price distribution, 2015 and 2016 shares almost the same shape. Most of the flats still have the price which is lower than $550k.

- In the first-half of 2016, prices in Bukit Timah and Central Area are still dynamic. There is an interesting fact about the price of Bukit Timah. In the first-half of 2015, the lowest price is in March and the highest price is in February. But in first-half of 2016, price in February is lower than price in March.

Tools Utilised

The tools used in this project is Tableau 10

Conclusions

- 1. The top three types, which have higher supply, are 4 room, 3 room and 5 room. In 2015. The supply in first-half of 2016 shares the similar pattern as in 2015.

- 2. The most concentrated model distribution appears in 5 room, and 71.6% of 5 room supply is Improved model.

- 3. Jurong West has the largest number of resale flats, and there are more than 1400 flats available in resale market. The next is Tampines, which has around 1300 resale flats. Woodlands and Bedok have similar supply, which is about 1200.

- 4. The lowest supply appears in February also. But the supply in 2016 is more than that in 2015.

- 5. More than 80% of the flats has price lower than $550,000, and most of the flat price fall in to the range from 300k to 450k.

- 6. Most of the town has stable price during 2015. However, the prices in some towns, such as Bukit Timah, Central Area and Queenstown, are dynamic.

- 7. There is no perfect relationship between supply and price.