ISSS608 2016-17 T1 Assign1 Nguyen Tien Duong

Contents

Abstract

Singapore housing is always one of the top-most concern of residence in the country. This project aims to study, discover, and evaluate the local public housing market structure, trends and any further information that can provide as a trustful, insight to guide new business, investment and household to buy public property in Singapore.

In this project we are concentrating to data in year 2015 and bench-marked for trend moving in 2016.

Problem and Motivation

Aims of this study is:

- Graphically and interactively discover and present Singapore Public housing information.

- Make a firm justification and evaluation to guide market (on trends and possibility).

- Couple with real context information related to Singapore policy and economy to elaborate the sight extracted from data.

Data source

This project used data source provided by HDB via national data centre at "http://data.gov.sg"

Data manipulation and preparation were conducted on "Date", "HDB Age" and "Price per square meter" to support for further processing.

Tools Utilised

This is a solely Tableau-based product.

Tableau - Data preparation, manipulation and presentation

Results

Overall Housing Data

1. Housing Ages in Singapore have 3 peaks: 15, 31 and 38

This shows that there are existing houses with high ages. The peak may correlated to national-wide building phase initiated by government or macro economy factors that influence sellers decisions

There are upcoming "younger" phase, buyer who wish to buy relatively new house can target for those after the first owners decided to sell.

2. Singapore is small island, but high demand for multiple room-type housing (4, 3 and 5 rooms)

A typical and most common house type here is "3+1" which is showing a dominant month in the chart. This suits the needs of most residents for living as a couple and children or renting out to paying back the house loan. Purchasing small house can be costlier and less chance to make a room for rental.

3. Public Housing remains its shares among type of house and having recovering signal

Singapore Housing marketing has been experiencing a dip and depression mode due to hazing economy. However, we can observe a slight move up which may mark the bottom of depression. But this signal is not obvious enough to bring us to conclusion.

Geometrical Distribution Housing and its price

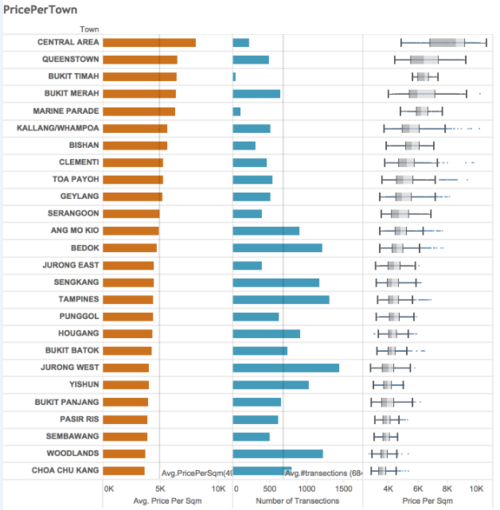

An obvious contrast has been drawn out for 2 regions of Singapore housing: Services (central) and Industrial (industrial lands)

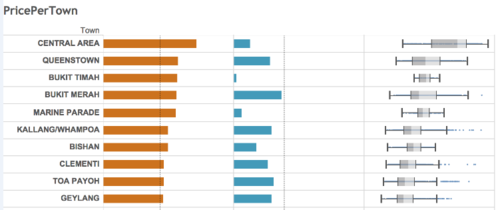

1. Central areas: leading price, high deviation (wide range) in pricing, but less small market

Centre has been top the price and leading the board, in terms of number of transactions, it is below the average line.

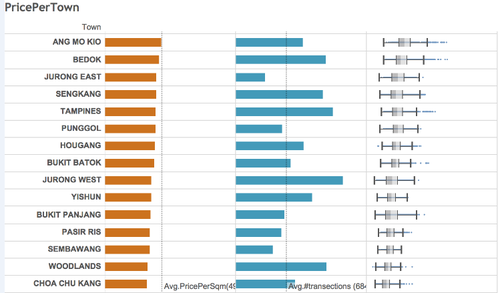

2. Industrial areas:below average price, less variation, and leading market share in terms of units

Contrasted with Central area, this industrial land have been number of transaction beyond average line, however, the price of houses in these lands are falling below the market average.

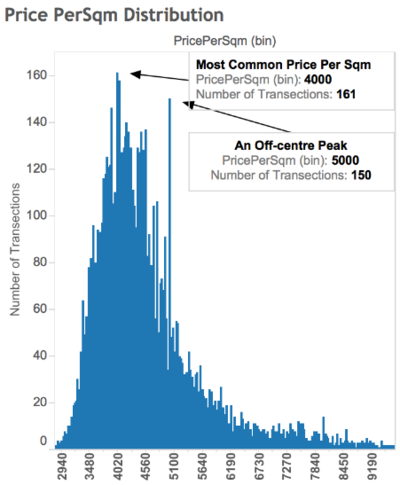

Majority house floor size and price

The chart presented density of transactions happening in Singapore in 2015 with regarding to Floor Area and Price per square meter (psm). Highlighted color area (in orange) is majority group.

1. Majority 85% houses have floor area below 150 sqm

2. Majority 85% houses resale price below SGD5500 sqm

Major price psm is in range SGD 3800-4500, and SGD5000

1. Major prices are in range SGD 3800-4500 psm

2. $5000 psm is "favorite" price with a abrupt sharp peak

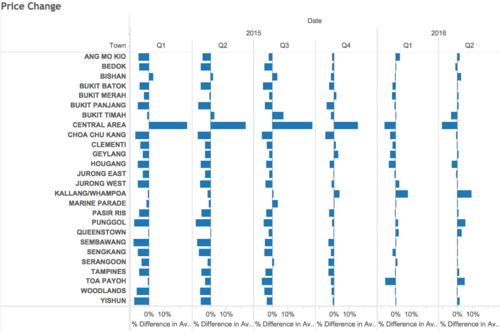

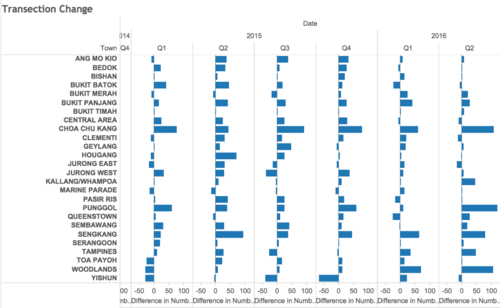

Market Movement

Observing the change in 2015 to 2016 by quarter in terms of price and buy transactions we found the new trends of market is to move out from costly city central and find house in re-development lands.

1. Central Areas lost growth rate

Continuously, central are loosing growth rate in terms of price and also number of transactions. It changes from high positive growth to negative in the last 2 quarters of 2016. No signal of recovering.

2. Re-development lands gain interest

Sengkang, Pungol and Woodlands are attracting by its own below-market price and new plan of movement to redevelop the infrastructure in those land, which bring a kick to price and interest of market, showing a positive-trend moving of price recovering and more buyers are hunting for house here.