ISSS608 2016-17 T1 Assign1 Goh Kar Hock Raymond

Jump to navigation

Jump to search

Abstract

- A quick and dirty visual analysis of public housing resale market for 2015, using data extracted from data.goc.sg to understand the prevailing trend in today’s resale market. The analysis was focused on the share of resale public housing supply and distribution of resale public housing prices, focusing on 2015. A comparison of trends between first-half of 2016 and 2015 was also included in this study.

Problem and Motivation

- Singapore’s public housing today has housed over 80% of Singapore's resident population, and of which 90% of these households owned their home (Housing & Development Board 2016) (Housing & Development Board 2016). The movement and changes of the public housing’s prices, especially the resale housing, will have a significant impact on a Singapore resident’s ability to own the house. Hence the main motivation of this project is to understand the behaviours of the resale public housing market and its prevailing trend, in order to identify any unusual trends that could influence the prices of the resale public housing.

Approaches

- Number of Resale Applications Registered by Flat Type (https://data.gov.sg/dataset/number-of-resale-applications-registered-by-flat-type) and Resale Flat Prices (https://data.gov.sg/dataset/resale-flat-prices) were the 2 sets of data extracted from data.gov.sg website, for use in this analysis. The dataset Number of Resale Applications Registered by Flat Type was used to understand the share of the resale public housing supply, focusing on 2015 data. The dataset Resale Flat Prices was used to analysis the distribution of resale public housing prices, also focusing on 2015 data. Lastly, a comparison was done to identify notable trends between first-half of 2016 and 2015.

- During data preparation, a total of 4 variables were computed in Tableau, 1 variable in the Resale Applications dataset and 3 variables in the Resale Flat Prices dataset. For the Resale Applications dataset, the variable “Quarter” which recorded the year and quarter of the data per row, in string format, was converted into date and time format, using the “DATEADD” function. The formula was “DATEADD('quarter',((INT(LEFT([Quarter],4))-2007)*4)+ (INT(RIGHT([Quarter],1))-1),#2007-01#)”. For the Resale Flat Prices dataset, the variable “Month” which recorded the year and month of the data per row, in string format, was converted into date and time format, using the “DATEADD” function. The formula was “DATEADD('month',((INT(LEFT([Month],4))-2012)*12)+(INT(RIGHT([Month],2))-3),#2012-03#)”. Next the “Age” variable was computed using the formula “2016-[Lease Commence Date]” to calculate the age of the resale housing. Lastly, the variable “Price Per SQM” was computed using the formula “[Resale Price]/[Floor Area Sqm]”, to calculate the price per square metre of the property.

Tools Utilized

- Tableau was used to prepare the data and analysis the data. These included creating the required visual aids and charts for reporting and presentation. MS Words was used to create the report before uploading into Wiki, and MS PowerPoint was used to create the analytical infographic.

Results

- The resale application of 4-room, 3-room and 5-room received in 2015 made up of 91.08% of the total application received, with 4-room applications as the largest share of 39.66%. The ratio of resale applications received in the first quarter of 2016 has an almost similar proportional of applications as 2015, with a slight increase in the 4-room applications of 40.66%. The proportion of the applications could be relevant to the amount of flat type built and available in the market. The packed bubbles chart was used to represent this finding with different colours to denote the different flat type. The packed bubbles chart was used to visually denote the size of each flat type applications.

- The resale applications received for all housing type received in the first quarter was the lowest, and the applications received in the second quarter was the highest among the four quarters in 2015. This could be attributed to the start of a series of holidays in the first quarter that encouraged lesser number of people to submit for resale. As a downstream effect, the applications received in the second quarter balloon up to account for the lowest number of applications in the first quarter. The resale market for 1-room and 2-room were generally very low as this group of dwellers tend not to change house more than necessary, as compared to those owning 3-room or more public housing. The continuous line chart was used to represent this finding as line chart could clearly defined the changes in patterns for each flat type.

- There was a slight increase in resale application received in first quarter of 2016 against first quarter of 2015. The increase was mainly attributed to the Executive, 4-room and 5-room applications with a 25%, 12.5% and 10.5% increase respectively. There was also a slight drop in application for 1-room, 2-room and 3-room, with a decrease of 50%, 33% and 2.1% respectively. The increase in applications could be due to more owners in the Executive, 4-room and 5-room seeking to upgrade their flat type in the recent quiet housing market, which offered a cheaper housing as compared to 2 years ago. The decrease in applications could be due to owners in 1-room, 2-room and 3-room seeking to hold on to their flat due to the not so promising job market in Singapore. Pie chart was used to represent this finding, for a clear comparison between the two Q1, side by side.

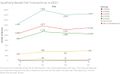

- The number of resale flats transacted in 2015 reflected a similar pattern to the applications received in 2015, with a lower number transacted as compared to applications received. In the monthly view, February recorded the lowest resale flat transactions across all flat type in general. This lower in number could be due to majority of the population who are Chinese, celebrating Chinese New Year. The number of transactions went up in general from April 2015 to July 2015, and dip in August 2015 before picking up in October and dip back in November and December 2015. The dip in August 2015 could be due to the hungry ghost festival, where the majority of the population whom are Chinese believed that buying/selling of houses in that period is generally bad luck. The dip in November and December could be due to school holidays and multiple festival seasons, where more people went overseas. The first half of 2016 also reflected a similar pattern to the first half of 2015, with the lowest transacted sales in February, before picking up in April 2016. Similarly the selection of continuous line chart was to allow the visualisation of the change in trending, and different colour lines to represent the different flat types.

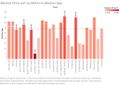

- In the study of median resale flat’s age against median price per square metres (PSM), it was no surprise that the resale flat in Central Area with the lowest median flat’s age and the highest median PSM. Interestingly, the resale flat in Marine Parade and Queenstown with a median flat’s age of 41 years and 40 years commanded a median PSM of more than $6,000. This could be due to a combination of factors such as proximity to city centre, popular district and presence of popular primary schools. These factors could also apply to town like Bukit Merah, Bukit Timah and Bishan, which are between 28 to 33 years in flat’s age and commanded a median PSM of $5,607 to $6,417. The side-by-side bar chart was used to compare the median age between towns. Using different colour shade to represent the range of PSM, with lightest red as the lowest PSM to the darkest red as the highest PSM.

- In further breakdown on the median resale flat’s age against median PSM by flat type, it was observed that the 4-room and 5-room in Central Area, Queenstown and Bukit Merah town were the generally newer HDB flat that set the high PSM in the respective town. Bukit Timah and Marine Parade’s HDB flats were more than 20 years in median age and yet commanded a median PSM of more than $5,900. There was a possibility that people were willing to pay a premium price for the public flats due to close proximity to popular schools.

- The median PSM in Bukit Timah, Central Area, Marine Parade and Toa Payoh in general had the wide fluctuations of price throughout 2015 into the second half of 2016. The median PSM for 3-rooms, 4-room and 5-room in Central Area fluctuated the widest. It was observed that public housing which commanded high prices tended to be more prone to wide price fluctuation, and this could be due to the willingness of buyers to pay above market valuation in good times, potentially resulted in bigger fall in prices during poor economy performance. Similarly the selection of continuous line chart was to allow the visualisation of the change in trending, and different colour lines to represent the different flat types.

References

Housing & Development Board. 2016. Public Housing – A Singapore Icon. http://www.hdb.gov.sg/cs/infoweb/about-us/our-role/public-housing--a-singapore-icon.