ISSS608 2016-17 T1 Assign1 CHIA Yong Jian

Contents

Abstract

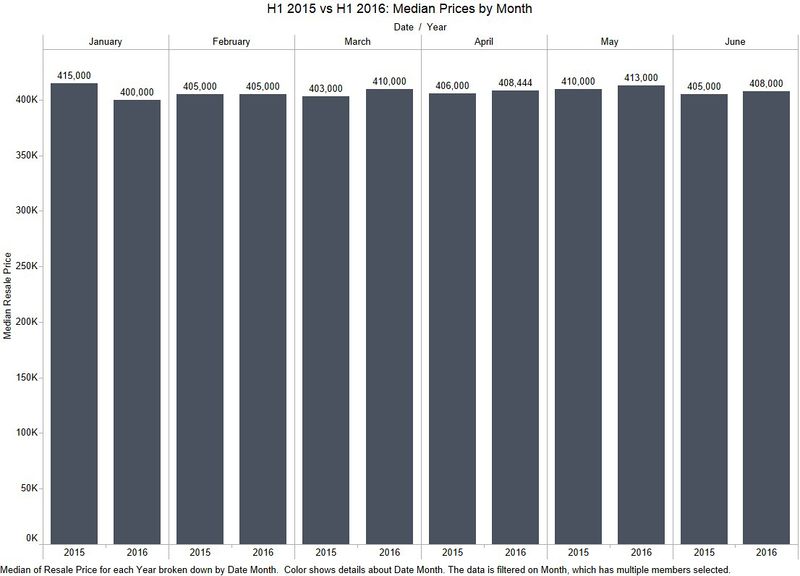

The public housing market remains a closely watched market. In this analysis, we are focused on provided key information for flat buyers to make informed decisions. We extract HDB resale data to answer questions that buyers may have. Majority of transactions that happened are in the major towns in the North, East and West. 4-Room and 3-Room flats are the most popular. For pricing, a median price table across towns was provided for ease of reference, together with top 10 streets with the cheapest or most expensive flats. Comparing the trend of the resale market in 2016, there’s volume growth in transactions, but flatness in prices might indicate continued caution in the economy.

Problem and Motivation

The public housing resale market is a closely watched market. A quick search on news revealed that the public housing resale market movement is watched closely almost on a monthly basis, especially for indicators hinting the stability or trend of the prices. These are crucial information not just for real estate companies, but also buyers and sellers of resale flats.

This analysis is focused on providing relevant information that can aid buyers of resale flats to make informed decisions when deciding to buy or sell a flat. For buyers, they include newly-wed couples that may urgently need a house after marriage or when expecting a newborn. Knowing the prices of resale flats by areas can allow them to decide on a suitable area for house-hunting depending on their budget and preferences for amenities in the area

We assume that the buyers have minimal knowledge of statistics. Hence, charts would be generally designed from an approach that are visually attractive without unnecessary fluff, and requires little time for them to understand without having prior statistical knowledge.

Data

Data Acquisition

The dataset from Data.Gov.Sg: Resale Flat Prices is used to answer the above questions can be found from . There are two datasets available on the webpage. We will be using the resale flat prices data that includes data for the year 2015 to first half 2016, to answer the questions required.

Dataset Variables

In the data.gov.sg dataset, a quick review of the variables reveals no missing data.

The dataset includes the following variables:

| Variable Name | Description | Example Levels/Values |

|---|---|---|

| Month | The 4-digit year and 2-digit month of the transaction | From “2012-03” to “2016-06” |

| Town | Includes the 23 towns and 3 estates under HDB planning | ANG MO KIO BEDOK BISHAN |

| Flat Type | The flat type sold. More information can be gotten from HDB: Types of Flats | 1 ROOM 5 ROOM EXECUTIVE |

| Block | The block number of where the flat was sold. | 99C 99B 977 |

| Street Name | The street name in the town or estate where the flat was sold. | ZION RD YUNG SHENG RD WHAMPOA WEST |

| Storey Range | The storey of the flat sold. Ranges from first floor to highest fifty-first floor. Floors are binned to groups of 3 to 5, and may include overlaps | 01 TO 03 25 TO 27 43 TO 45 |

| Floor Area Sqm | The floor area of the flat sold. Ranges from 31 to 280 square metres. | 45 74 92 |

| Flat Model | The model type of the flat sold. There are 19 types. Details of the different flat models can be view on a website providing comprehensive information: HDB History and Floor Plan Evolution | Adjoined Flat Model A New Generation |

| Lease Commencement | The starting year of the flat lease, typically a 99-year period | 1966 2004 2013 |

| Resale Price | The transacted price of the flat sold. | $195,000 $515,000 $1,088,888 |

Data Modelling

The following are changes made before charting was done on Tableau: <TBD>

| Variable | Changes Made and Rationale |

|---|---|

| Month | A new variable "Date" was created to parse the YYYY-MM format of the Month variable. The formula DATEPARSE('yyyy-MM',[Month]) was used in the calculated field. |

| Town | The variable is set to a State/Province geographical role for purpose of applying it to filled maps in the analysis. |

Approaches

General Colour Scheme for Charts

A consistent colour scheme was used in the charts to retain a sense of familiarity with the readers and reduce confusion.

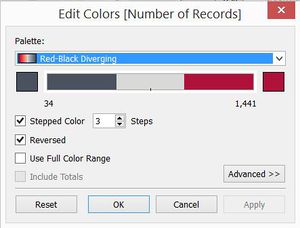

Several colour schemes was experimented for use across the charts. The final colour scheme selected deliberately used contrasting colours containing red colour and shades of grey. Depending on the chart used, either 3 steps or 5 steps colours was used to provide an intuitive implicit meaning to the chart.

Data Analysis

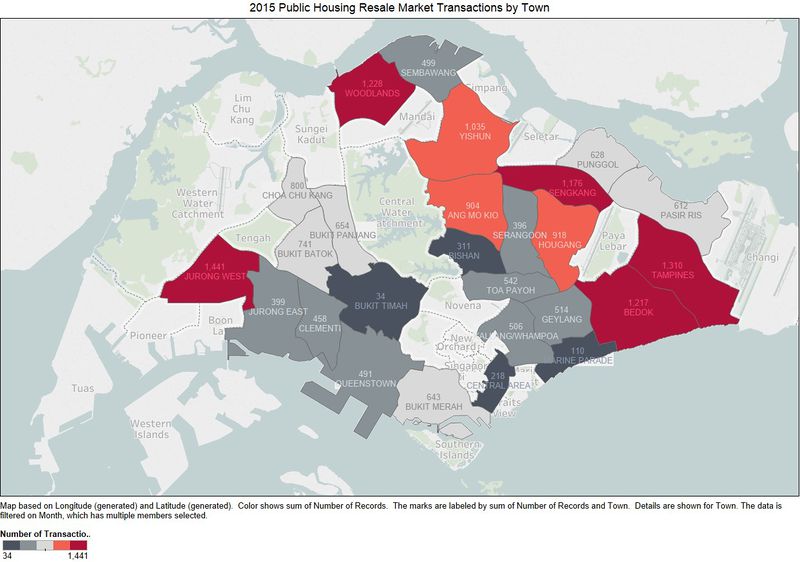

Description: An overlay of the number of resale transactions by each HDB town or estate on the Singapore Map reveals that towns with the most resale flat transactions are from Jurong West, Tampines, Bedok, Sengkang and Woodlands. It can be observed that most of these areas are mature towns and well built-up. They includes amenities such as shopping centres and major supermarkets. These towns also have the some major developments up and coming:

- Jurong: A Jurong Innovation District will be set up to develop products and services for the future. The future Singapore-Kuala Lumpur High Speed Rail will have its terminus in Jurong.

- Bedok: Bedok town centre has rebuilt a new hawker centre and town plaza, which came after the town's first major shopping mall, Bedok Mall, was opened in late 2013. A new integrated complex comprising a community club, sports facilities and more is also being planned.

- Tampines: A new Tampines Town Hub is being constructed to bring new life into the Tampines Regional Centre.

Not far behind from the above towns are Yishun, Ang Mo Kio and Hougang. These are also densely populated areas that are mature estates. Last but not least are the areas closer to the city centre. These are highly sought-after resale flats at a higher price premium.

Visualisation rationale: The filled map serves to be the "gateway" to which buyers will be attracted to the read more into the infographics. The use of 3 colours to indicate high, medium and low transactions provide a quick visual sense and perception. to support buyers in easily seeing where the transaction volume are across Singapore.

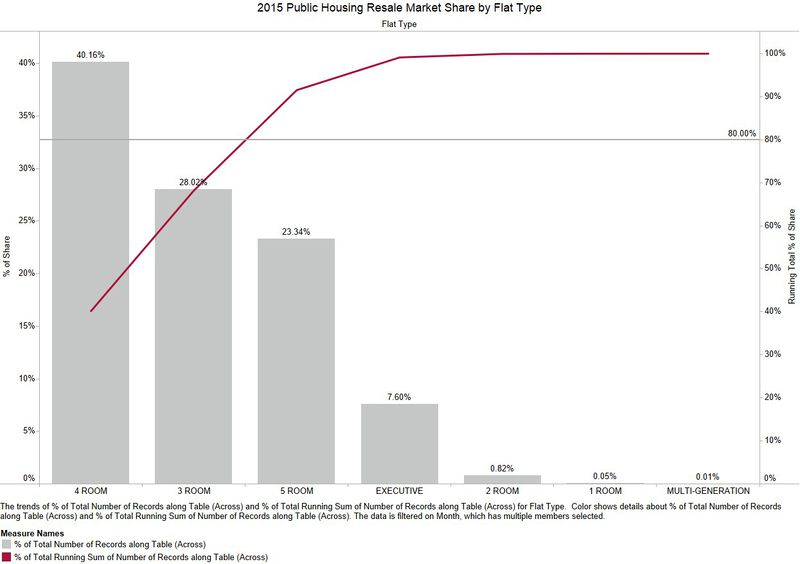

Description: The most popular flat type transacted on the resale market was 4-Room and 3-Room flats. These flats made up about 70% of all transacted flats. These probably serve as the "minimum" flat sizes especially for newly wed couples who wants to have a family, and will need rooms for their children.

Visualisation rationale: A simple bar chart, with a pareto chart overlay was used to quickly allow buyers to see the flat types most sold on the market. Red line was used for the pareto chart to provide contrast against the light grey bar chart.

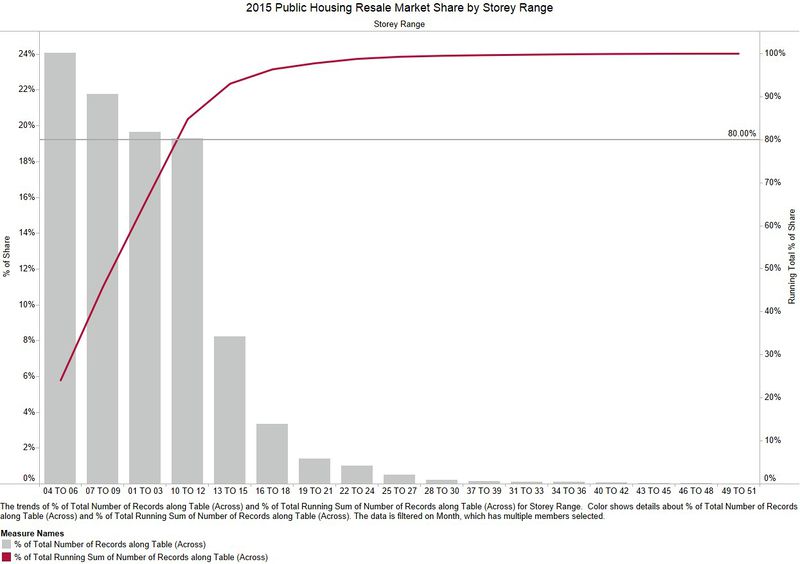

Description: The top 80% of transacted flats have a floor range of 1st to 9th floors. There are two reasons to explain this - high rise HDB flats are still a relatively new phenomenon, hence the supply of high-rise flats may not be plentiful. Secondly, as higher floors enjoy better air circulation and views, there might be a preference for HDB owners to continue to retain their flats that has such advantages. Either way, this provides some constraints and considerations for buyers if they would like to get a higher floor flat.

Visualisation rationale: Once again, a simple bar chart, with a pareto chart overlay was used to quick allow buyers to understand the bulk of the storeys where resale flats are sold. Red line was used for the pareto chart to provide contrast against the light grey bar chart.

Distribution of the resale public housing prices in 2015

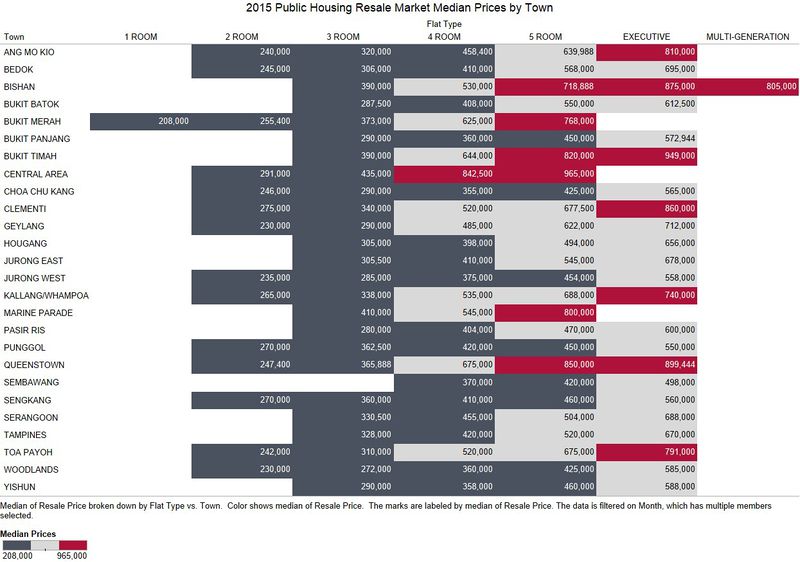

Description: This is a handy chart created to allow buyers to understand the median prices they probably have to pay, by flat type, for a flat in their desired town. There are no big surprises here. Towns closer to the city centre (such as Bishan, Bukit Timah, Queenstown) commands a premium over all other areas. Multi-generation flats are only just began to appear on the resale market, specifically in Bishan.

Visualisation rationale: A highlight table is used to present hard figures for buyers to consider, with the 3-step colour scheme used to easily point out high prices at which towns. Median prices are selected so that they are not affected by outlier resale prices that might be one-off.

Since most flats sold on the resale market are 4-Room flats, we will focus on 4-Room flats for 2 of the following charts. These 2 charts are meant to allow buyers to quickly see top 10 streets and their towns in where the cheapest or most expensive median 4-Room flats are.

Description: For the above chart, we can quickly see that cheaper flats are available almost all at the north (such as Woodlands) and west side (such as Choa Chu Kang) of Singapore. The range of the top 10 cheapest, however, is rather close, at $16,000.

Visualisation rationale: A simple horizontal bar chart is used to allow users scan the street and town names quickly on the left hand side, before focusing on the prices on the right. Median prices are selected so that they are not affected by outlier resale prices that might be one-off.

Description: Flats sold in streets in the towns of Bukit Merah and Queenstown predominantly presents itself in the top 10 streets with most expensive flats. The range of the top 10 are also wider, at about $136,000.

Visualisation rationale: As per the previous chart, a simple horizontal bar chart is used to allow users scan the street and town names quickly on the left hand side, before focusing on the prices on the right. Median prices are selected so that they are not affected by outlier resale prices that might be one-off.

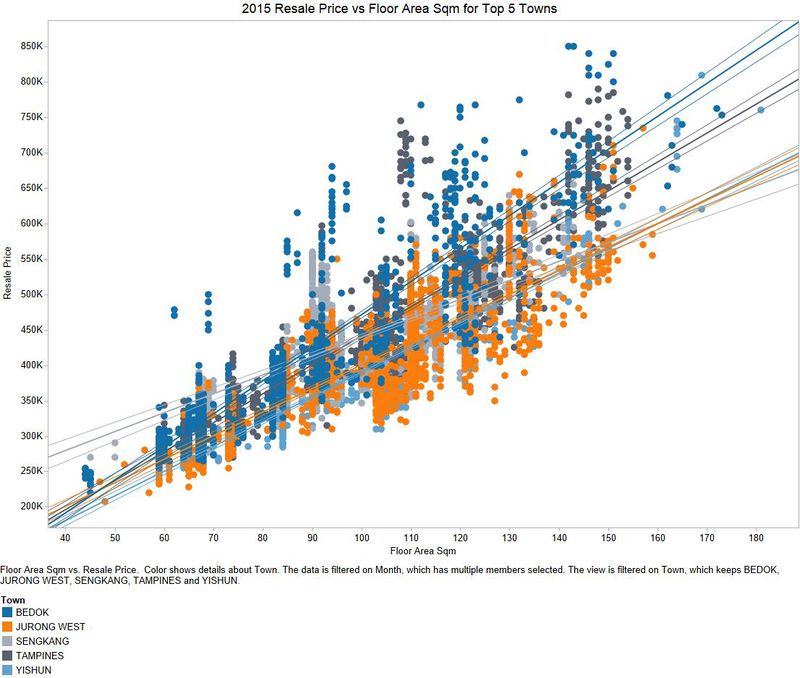

The following 2 charts provide further exploration into the linear trends of the resale prices compared to the floor square areas.

Description: A simple Scatter plot with trend lines was created to view trends of the top 5 towns as identified earlier. Although the diagram is rather "messy", it provided important insights into the resale prices.

We can easily see that a linear trend model created could provide good predictability and formula on how to calculate a resale flat. Surprisingly, the R-Squared value was rather good, with the provided variables explaining more than 70% of variation of the response variable Resale Price. The model also had a statistically significant p-value. For advanced home buyers, they can make use of such simple models to have a good gauge of how much to pay for, for a flat in each town.

Visualisation rationale: Note that this chart was not created for the infographics (evident from the different colour scheme used). This chart demonstrates the possibility of calculating a fair resale price by means of an easily constructed linear trend model.

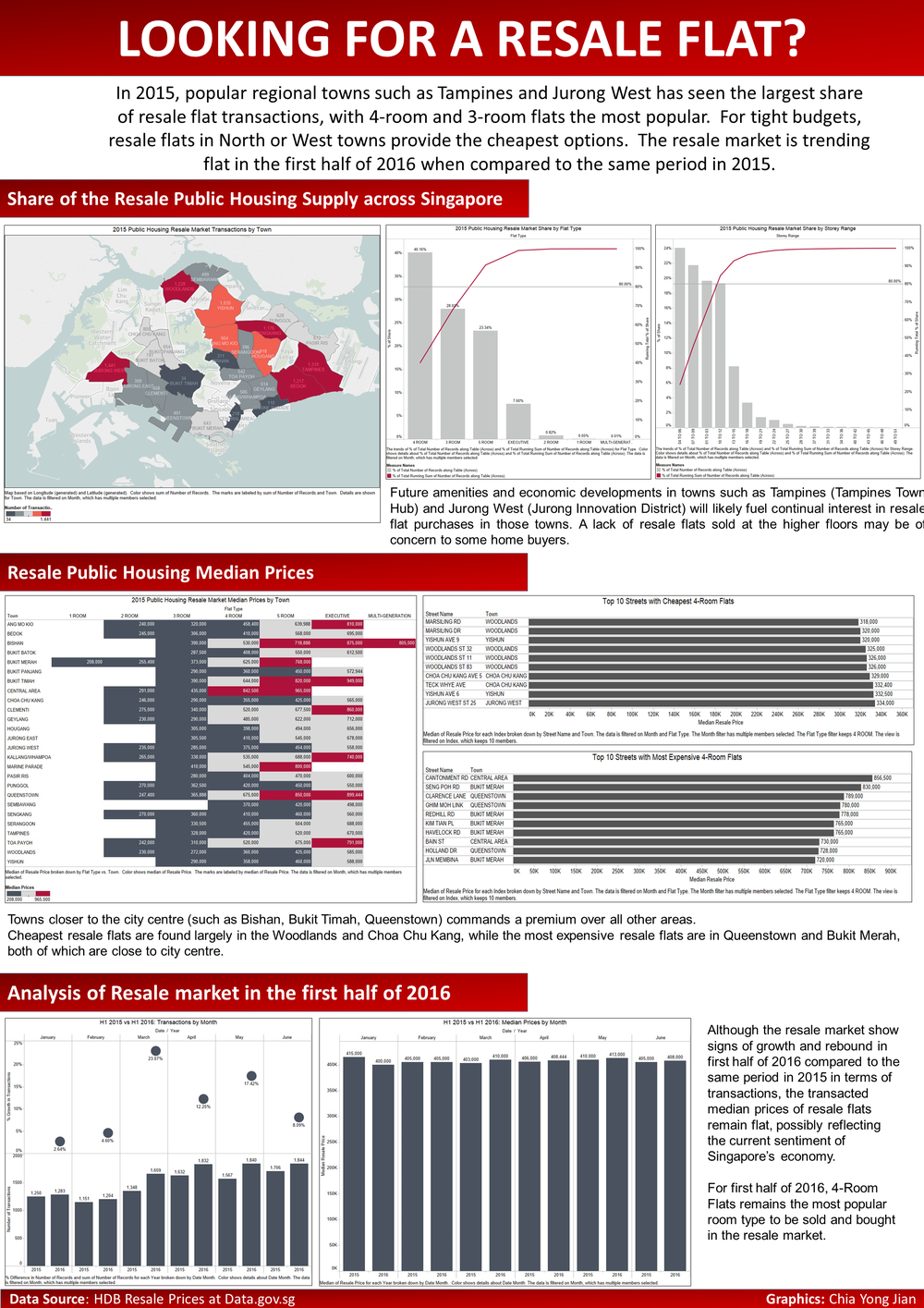

Comparison of patterns of the first-half of 2016 with the patterns of 2015

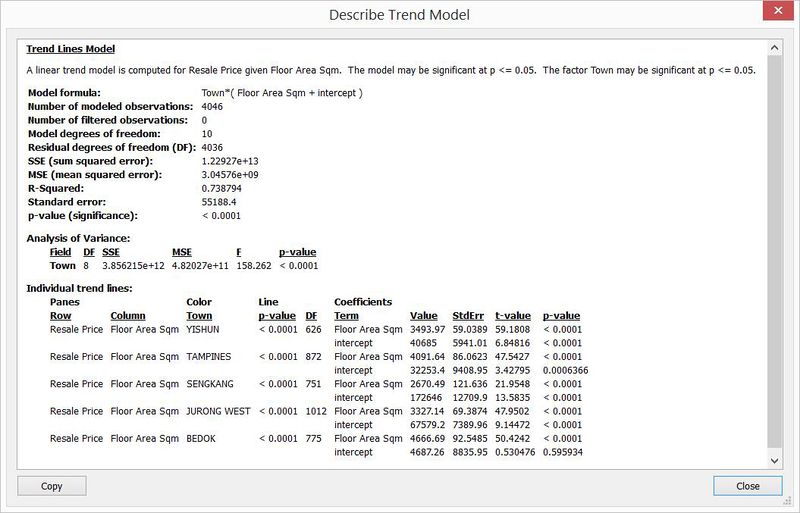

All data used in the following 3 charts comes from first half of 2015 and first half of 2016.

Description: For first half of 2016, compared to the first half 2015, there has been an uptick of transactions in the resale market, with March Year-on-Year growth as the most, at 23.07%.

Visualisation rationale: A simple bar chart is used to group the transactions by months before splitting by the year. The filled circles at the top part of the graph provides a quick visualisation of the growth for each pair of months across 2015 and 2016.

Description: A drill-down into the increase transactions in the resale market is performed, by flat type. We can observe that 4-Room flats are still the highest proportion selling of all flat types, and registered a Year-on-Year increase of about 16%.

Visualisation rationale: A simple bar chart is used that allows a quick judgement of transactions by flat type comparing the first half of 2015 and 2016.

Description: While the volume of transactions has increased, the prices has remained relatively flat, with a difference of not more than $15,000. This could signal caution and worries over the Singapore economy, of which a Gloomy Sentiment still persist.

Visualisation rationale: A simple bar chart is used that allows a quick judgement of flat median prices comparing the first half of 2015 and 2016.

Infographics

Tools Utilised

- SAS JMP Pro 12 – for initial data exploration and analysis

- Tableau 10.0 – for charting

- Microsoft Powerpoint – for Infographics layout

Results

The analysis of the data revealed useful information that buyers of resale flats can use to make informed decisions. These includes knowing the median prices of flat types across towns, and indication of which town has the biggest resale markets by transaction volume. Further analysis including linear trend models can additionally help buyers to calculate a fair price for buying a resale flat. This however, will require some analytical and statistics knowledge. In summary, the key findings of this analysis are presented below:

Share of the resale public housing supply in 2015

- Towns with the most resale flat transactions are from Jurong West, Tampines, Bedok, Sengkang and Woodlands. Most of these towns are mature estates.

- The most popular flat type transacted on the resale market was 4-Room and 3-Room flats. These flats made up about 70% of all transacted flats.

- The top 80% of transacted flats have a floor range of 1st to 9th floors, which can be explained either by the nature of the flats in Singapore or preference for higher-floor owners to continue holding their houses.

Distribution of the resale public housing prices in 2015

- Towns closer to the city centre (such as Bishan, Bukit Timah, Queenstown) commands a premium over all other areas. Multi-generation flats are only just began to appear on the resale market, specifically in Bishan.

- Cheaper flats are available almost all at the north (such as Woodlands) and west side (such as Choa Chu Kang) of Singapore

- Flats sold in streets in the towns of Bukit Merah and Queenstown predominantly presents itself in the top 10 streets with most expensive flats.

Comparison of patterns of the first-half of 2016 with the patterns of 2015

- For first half of 2016, compared to the first half 2015, there has been an uptick of transactions in the resale market, with March Year-on-Year growth as the most, at 23.07%.

- 4-Room flats are still the highest proportion selling of all flat types, and registered a Year-on-Year increase of about 16%.

- While the volume of transactions has increased, the prices has remained relatively flat, with a difference of not more than $15,000. This could signal caution and worries over the Singapore economy, of which a Gloomy Sentiment still persist.