IS428 2016-17 Term1 Assign1 Wang Jingxuan

Contents

Abstract

Problem & Motivation

We know that private property pricing in Singapore has been rather high due to its land limit, and its government has introduced a series of cooling measures. Some people believe in the value of private property, some people say the value of property is decreasing. Through exploring the private property supply and demand in 2015, we want to answer these questions:

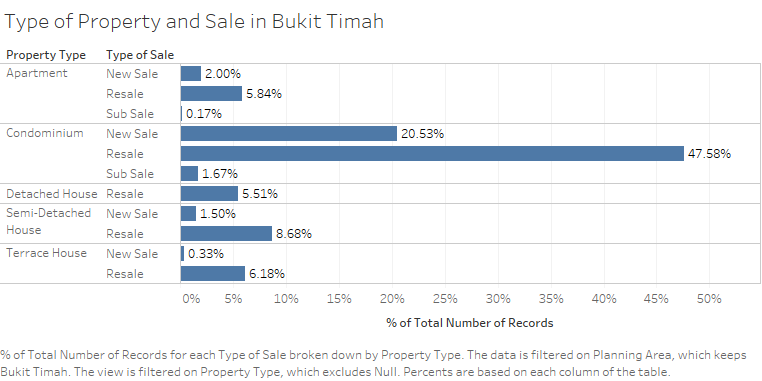

- For buyers, is it a good time to invest in private property, what and where should they invest?

- For policy makers, is it a good time to further constrain the supply of property, and what type of property?

Tools

Approaches

Data Selection and Preparation

Data Source: The data sources selected are:

- Transactions of Private Residential Property in 2015

- Quarterly Supply of Private Residential Properties in 2015

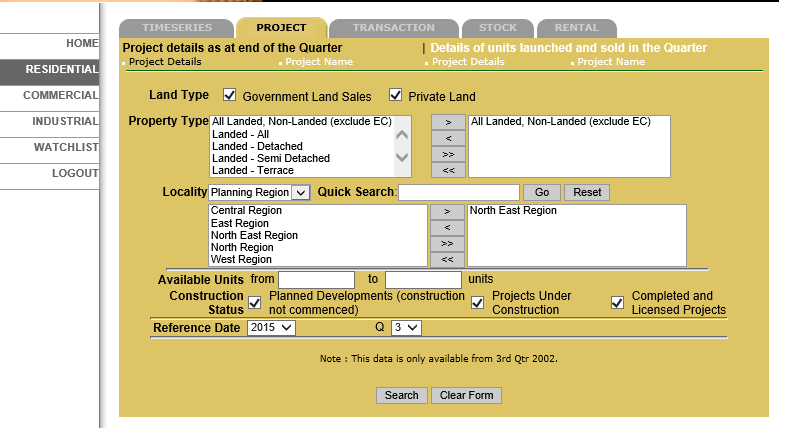

There is no raw data for supply grouped by dates, region and area. In order to collect data from database REALIS, I have to select region then select quarter. It was very troublesome as I can only download one file of data in one region or area during one quarter, then I combined and merged all the downloaded files together as integrated data for exploration.

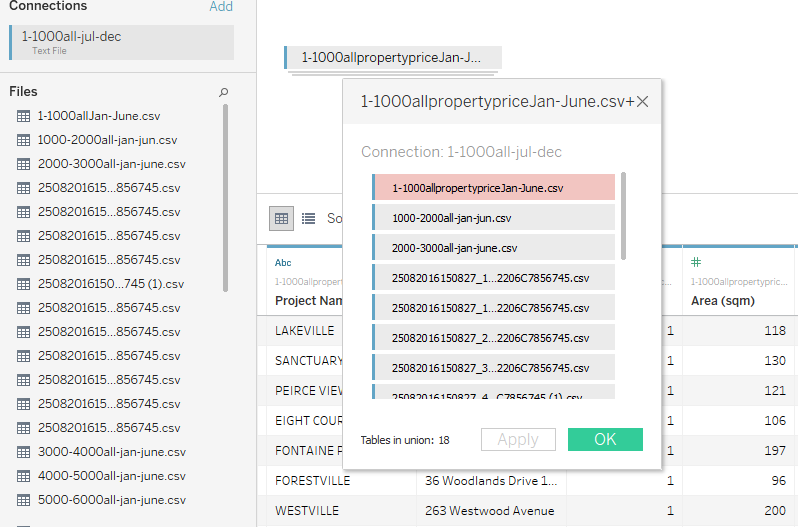

The downloaded transactions are in 18 files so when I explored data, I have to union them.

The quarterly supply of private residential properties downloaded are in 4 csv files, and each file contains a quarterly supply data. However quarterly supply data does not contain quarter number so I added in quarter parameter in csv files, then I unioned them with tableau.

General Trend

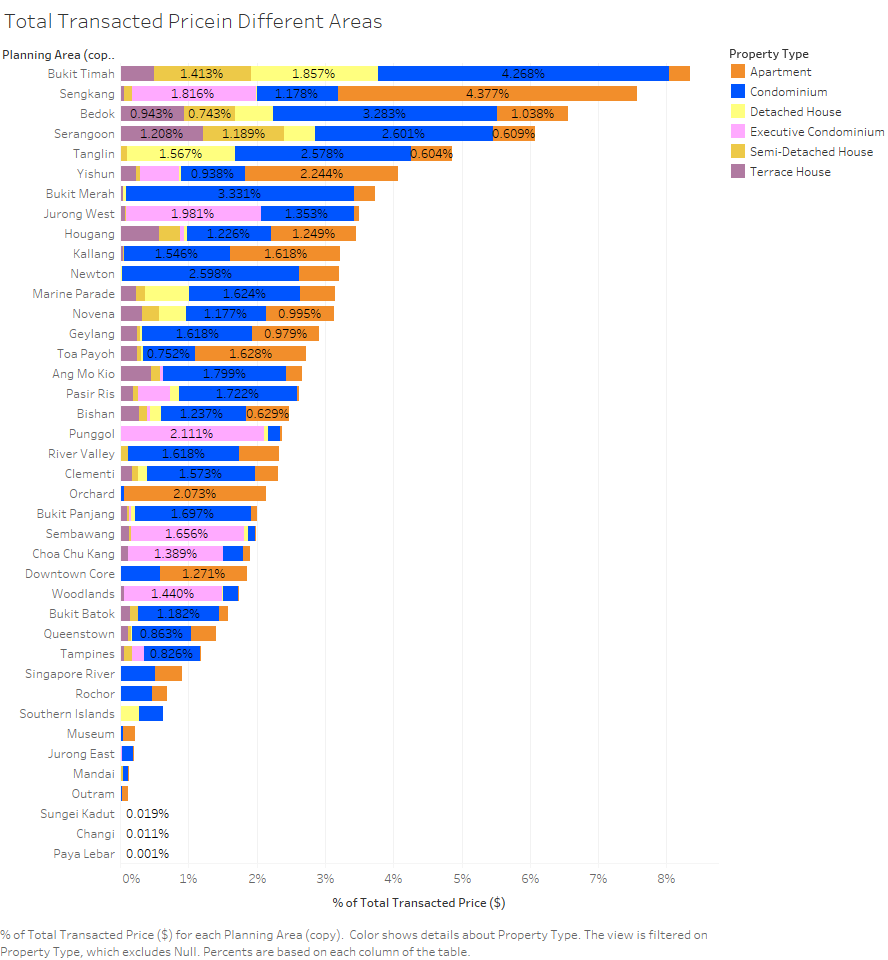

Transactions of property in 2015 directly answered our most concerning question:how was property selling and buying in 2015?

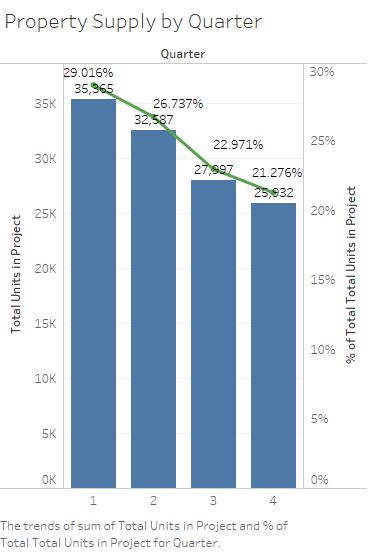

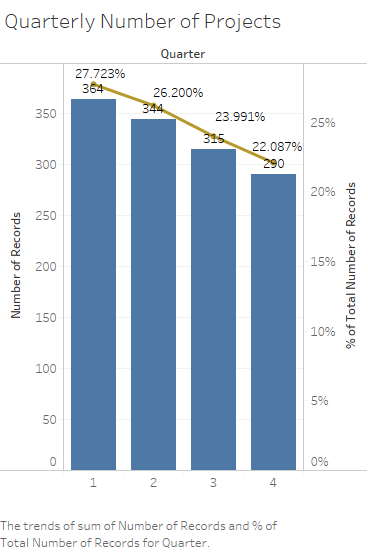

In order to view how supply distributed over 4 quarters in 2015, bar charts are used to clearly demonstrate how supply changes over time. And percentage of decrease or increase are also shown. Total units in projects keeps dropping from 29.0% to 21.3% over 4 quarters. And the total number of projects are also decreasing from 27.7% to 22.0% over 4 quarters. The decreasing trend of both total units and total number of projects indicates a slow down in property supply in 2015.

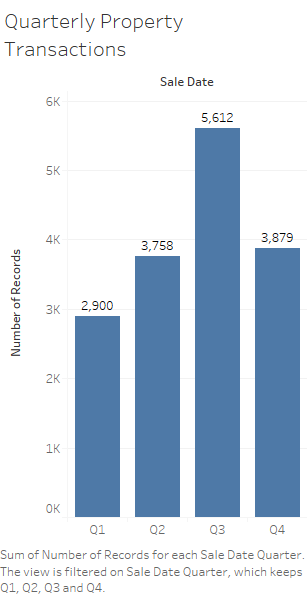

Bar charts are used to show how number of transactions distributed among 4 quarters in 2015. The number of transactions increased from 1st quarter to 3rd quarter then greatly decreased in 4th quarter. But what causes the decrease in 4th quarter?

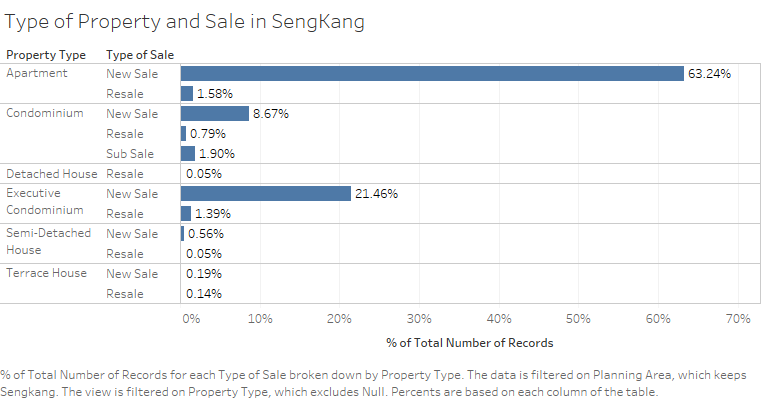

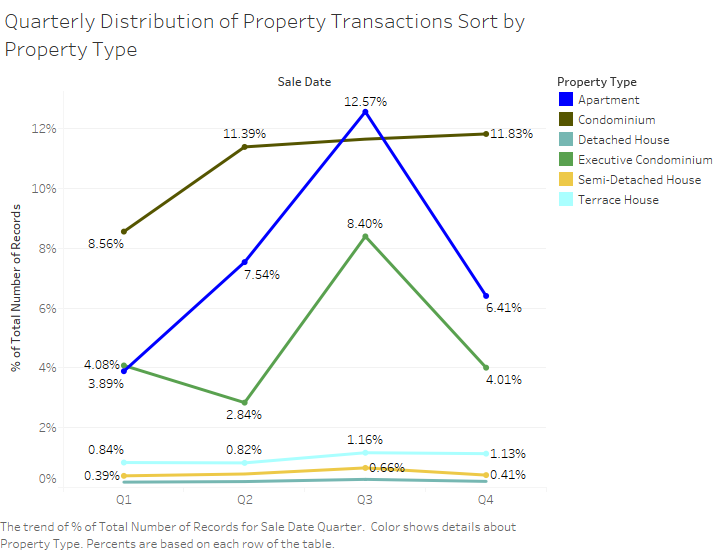

In order to explore what causes the sudden decrease in number of transactions in 4th quarter, I further break down data into categories of property type. Different colors are used to represent different property types. And from the graph we can tell that the number of transactions of Condominium greatly increased from 8.6% to 11.4% in 2rd quarter then slightly increased to 11.8% in 4th quarter. However apartment drops about 6% in 4th quarter and Executive Condominium drops about 4.4% in 4th quarter, while the rest property types remains the same. One assumption could be the increase in pricing of Apartment and Executive Condominium.

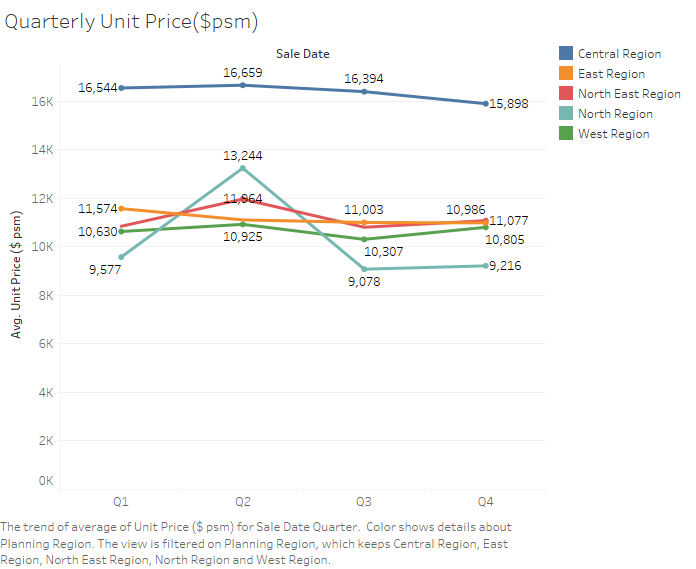

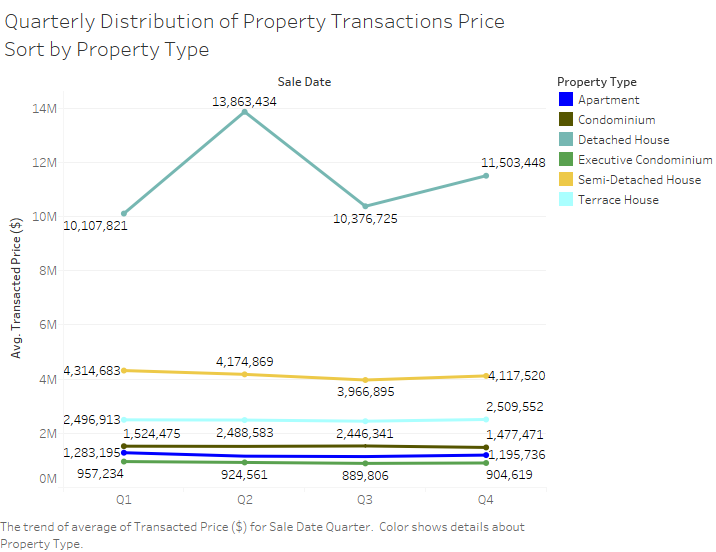

In order to explore pricing changes over time, averaged pricing is used and line graph could easily show the changes over time. The graph shows that the drop of number of transactions of Apartment and Executive Condominium is possibly not caused by increase in their pricing, as shown by the graph their pricing remains quite stable while pricing of Detached House is going up and down.