IS428 2016-17 Term1 Assign1 Wu Wei

Contents

Abstract

Property Cooling Measures

With limited land resources in Singapore, high demand for private properties was observed in the last 20 years as a general trend. However, in recent years, private residential property segment is indeed heavily oversupplied due to some cooling measures introduced by the government. In this assignment, it analyzes the private residential properties in Singapore by using the share of supply and distribution of prices in 2015. Through this analysis, we would consider whether the property cooling measures should be lifted.

Problem & Motivation

One of my friend's father has worked in real estate industry in Singapore for more than 30 years. He once complained to me that he was experiencing a hard time currently. His salary decreased gradually over the years because he had great difficulties to secure enough tenants for those investors. He blamed the property cooling measures which almost ruined his job.

For me, this is a good opportunity to use this visual analytics project to understand the current situation for private property industry. On the other hand, I also want to get some meaningful findings which could help my friend's father to solve his problem.

Tools

- Excel for data transformation and data processing

- Tableau is used to generate all the graphs

- Piktochart is used to generate infographics

Approaches

Data Preparation

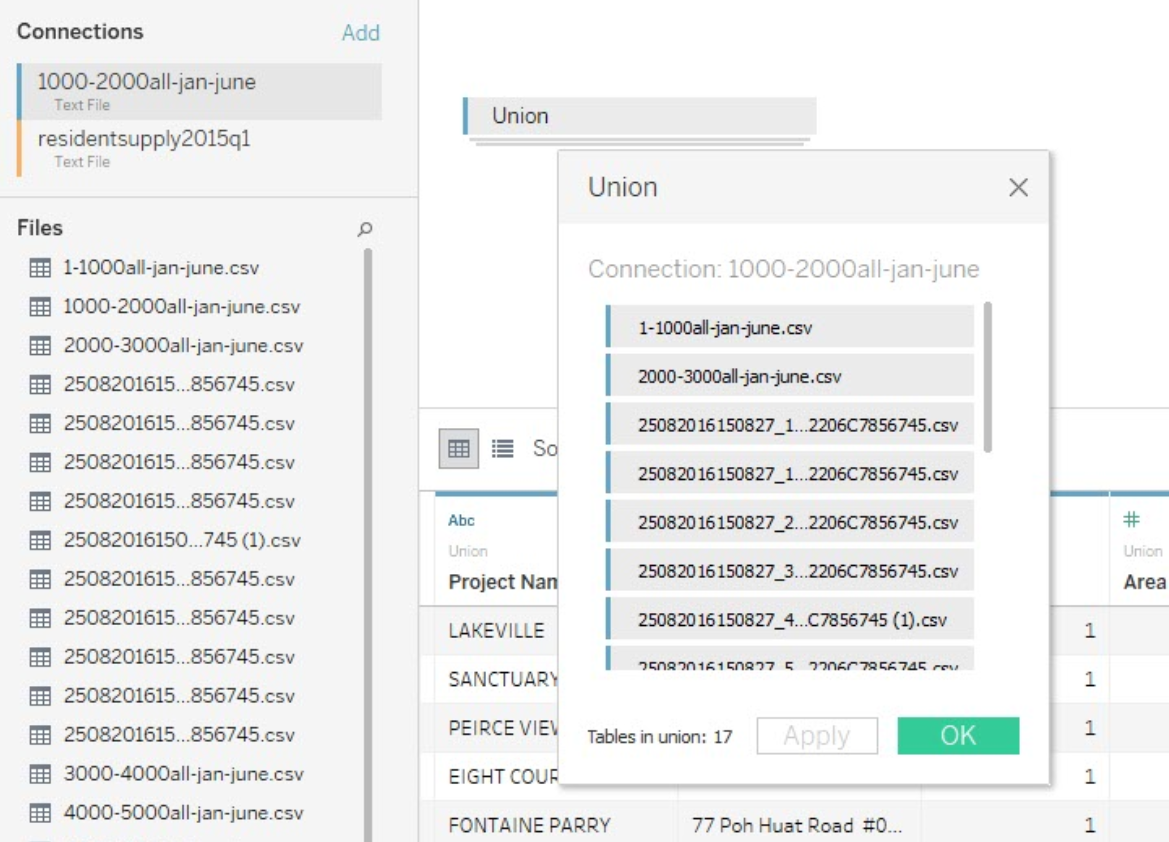

Data sets for the supply and distribution of prices are retrieved from REALIS database. Supply data can be directly retrieved from the table of Residential Supply 2015 q1-q4 through Timeseries.

Whereas the prices retrieval is more complecated, we need to merge a few csv files from Transaction category together in order to get a complete version of private property price distribution.

Whereas the prices retrieval is more complecated, we need to merge a few csv files from Transaction category together in order to get a complete version of private property price distribution.

Private Residential Properties Supply

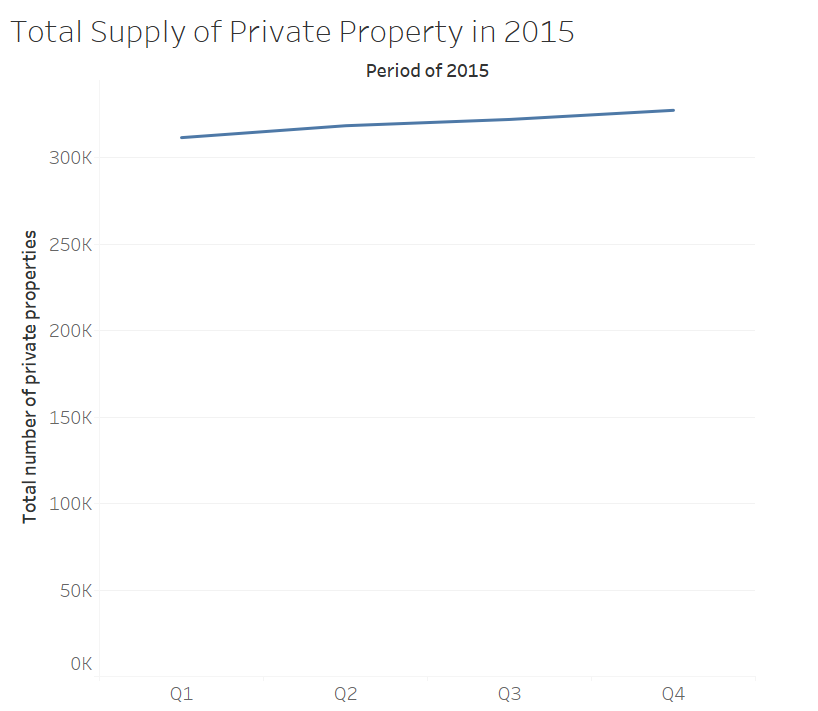

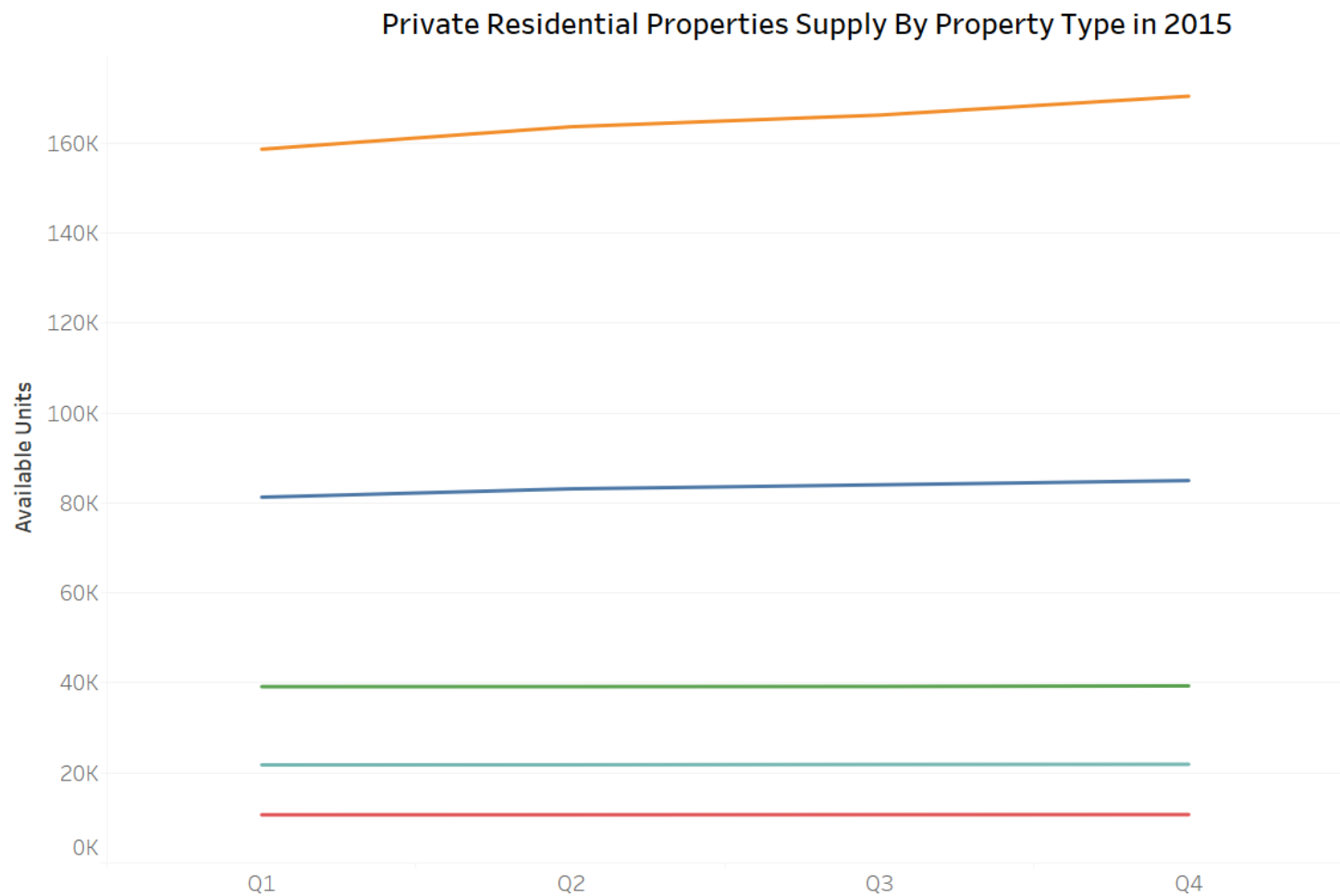

Firstly, we need to take a look at the overall trend of supply for private residential property:

We can see the trend of supply is increasing over time in 2015.

Then, we need to break down it to different categories:

Now we can see that among all five categories of private properties, only condominium shows a significant increase. Thus, condominium is the key factor which affects the whole market of private property.

However, based on the previous findings, we still could not link this to oversupply of the private property.

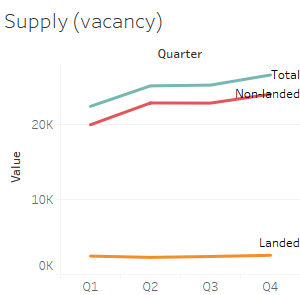

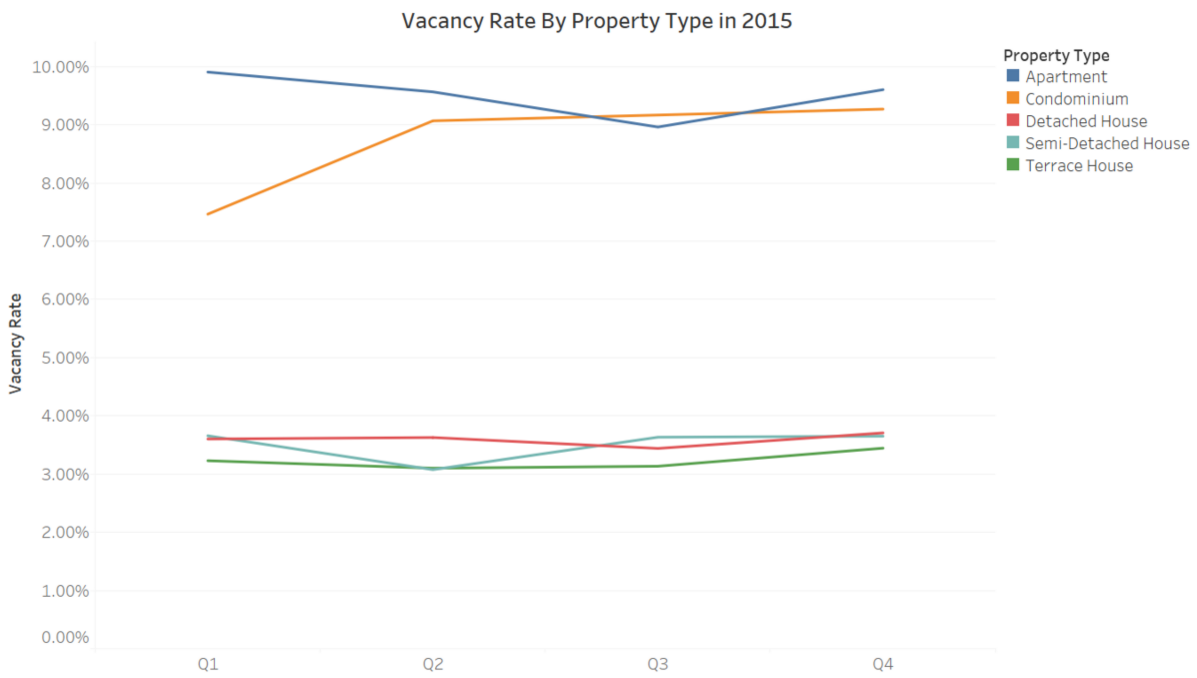

So, we need one more piece of information which is the vacancy rate:

For both apartment and condominium, the vacancy rate is around 10%, which is quite high. In other words, 10% of all condominium and apartment are filled with nobody. Resources are wasted and investors are still trying to build new projects to find new tenants. This comes to a contradicting point which shows the bad allocation of land resources.

Distribution of private property prices

Region

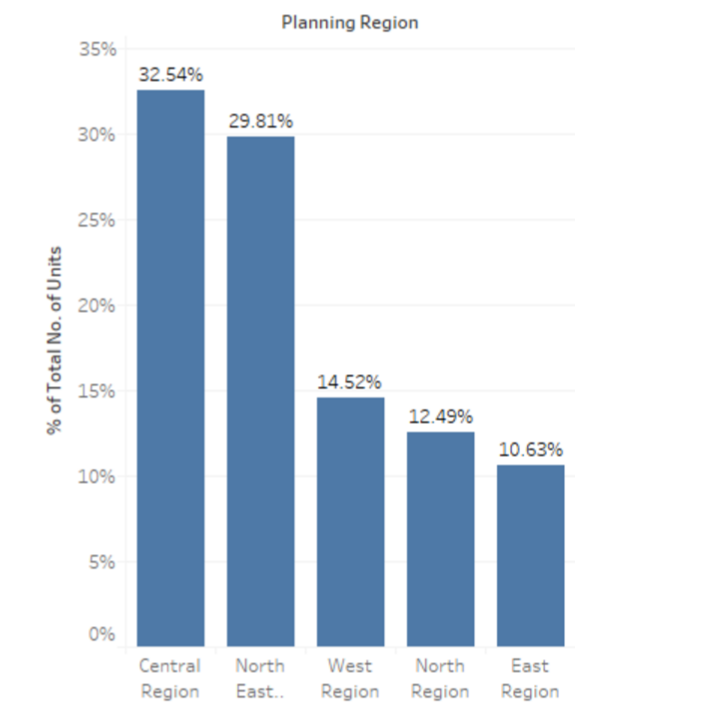

Base on different geographical location, we can draw a distribution graph accordingly:

From this bar chart, we can see largest scale of data lies within the central region. The main focus on sales of private property is still aiming at central region which is not a good sign as the government should come up with a more balanced way to encourage people in other regions to buy their private properties.

Inforgraphics

Suggestions

- Review the conditions of property cooling measures for condominium buyers since the high demand for condominium cause the increasing supply trend.

- Switch the focus of private property sales from central region to other regions which could help real estate industry in Singapore.

- Come up with new policies to encourage people buy vacant condominium, which helps to build a healthy resource allocation system.