IS428 2016-17 Term1 Assign1 Ong Ming Hao

Contents

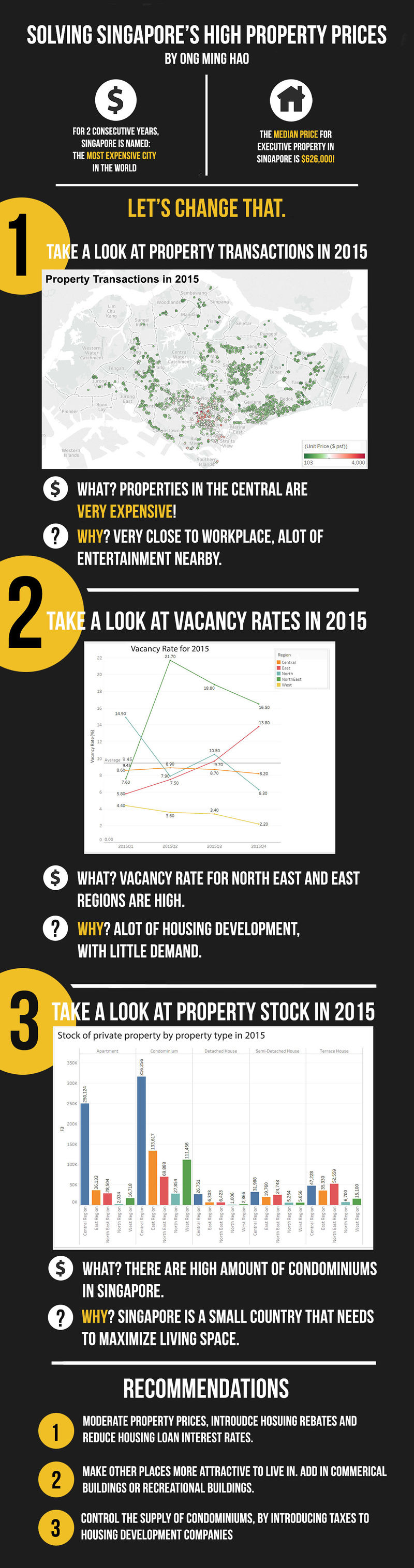

Infograph

Abstract

This article studies the current trends in the private property market in Singapore with the sole purpose of analysing and providing insights to provide useful and effective recommendations that directly solves the issue of the high property prices in Singapore.

Problem & Motivation

A recent study done by the Economist Intelligence Unit (EIU) in 2016 found out that Singapore is the most expensive city in the world. [1] This report is done by comparing the cost of living in New York City with Cities around the world. From housing, food, education, etc.

In addition, according to the Singapore Real Estate Exchange, it found out that the median price for an executive apartment in Singapore is $626,000. [2] At this price, many Singaporeans would find it hard to buy a house and start their own families. Singaporeans should not have to take up exorbitant loans for basic housing.

As such, the focus of this article is to examine and analyse the following:

- 1. Singapore Property Market

- 2. Current Government Plans

- 3. Current Government Policies

By doing so, we are able to determine whether the government is doing is effective job in bringing the price of the Singapore’s Housing Market, and what more can be done to reduce the price of the average Singapore property.

Targeted Data & Policies

Rationale for choosing Data

I have chosen a few data sets from REALIS. The first data set is a list of private property transactions done in 2015. This would help me identify any trends in the private property market, in terms of location, type of housing or pricing per square foot. The next set of data that I want to analyse is vacancy and vacancy rate of private property and the amount of private property projects in progress. This would help me identify places of interest where the government should reduce building in, or change the type of building (commercial, businesses,parks,residential,etc.)

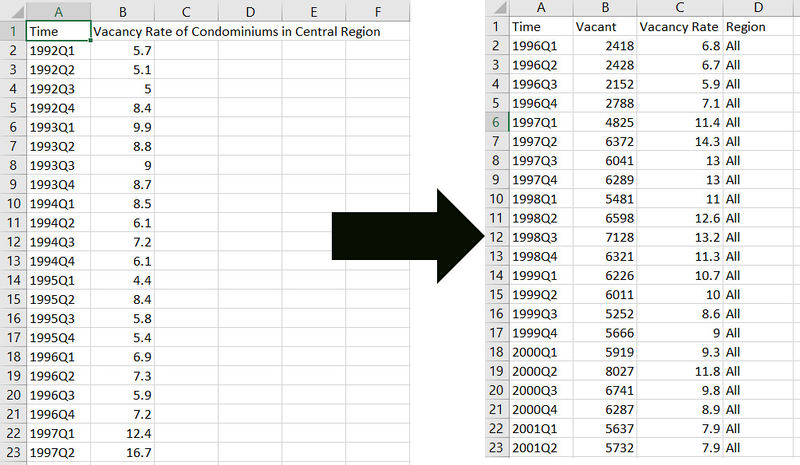

Initial Data Cleaning

Some data that I retrieved from REALIS was needed to be appended together. Such as determining the vacancy rate and vacancy of Condominiums. As such, I had to do some data cleaning to ensure that Tableau was able to read the information.

Targeted Policies

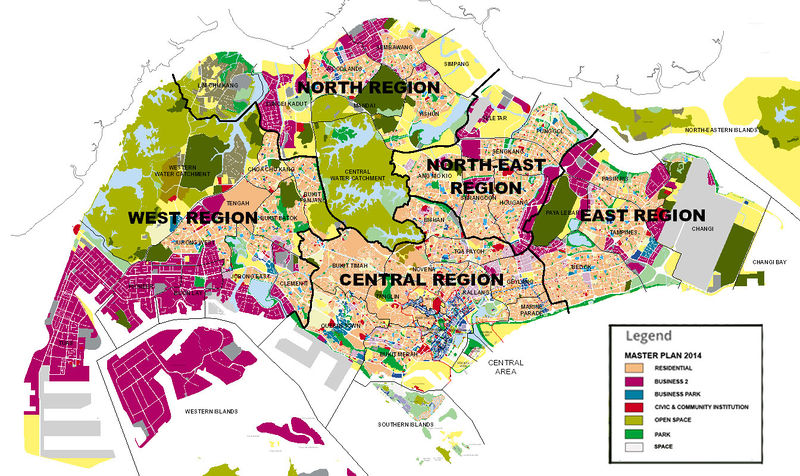

The primary policy that i would be looking into is the Master Plan by the Urban Redevelopment Authority (URA). The master plan is the plan which is renewed by the URA every 5 years, which outlines and dictates where parks, commercial buildings, businesses and residential properties would be located at.

For this article, I would be focusing on planning regions and not planning areas due to the time constraint that I had to work with. If I have more time, I would spend a significant more time analysing the various planning areas.

Approaches

Initial Analysis

For the initial analysis, i looked into URA's Master Plan 2014 and analyzed the various places of interest. Here are my findings:

- West - Has the most businesses among all the regions

- Central - Has the most business parks and shopping centers among all the regions

- North - Has the most parks and open spaces among all the regions

Overall Analysis

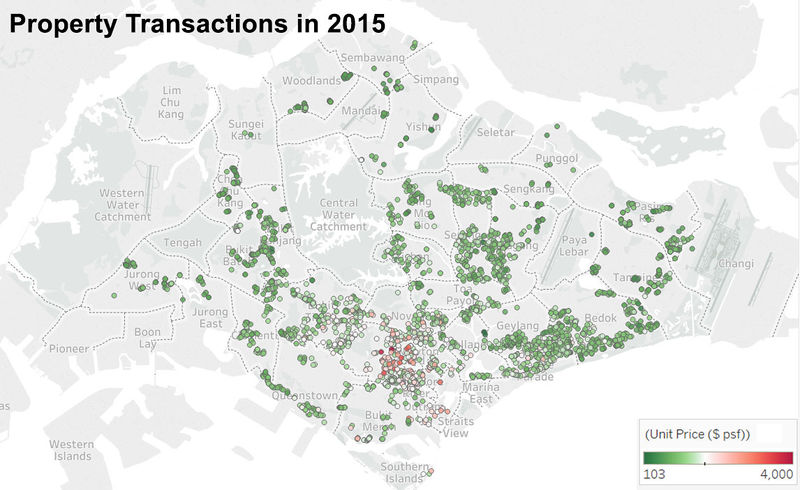

The first analysis i did was an overall map analysis of the transactions that occured in the year 2015. These are my findings:

From the map analysis above i was able to get the following insights:

- Central - Has the most expensive transactions (Unit Cost Per Square Foot)

- North - Has the least number of transactions taking place at that area.

- Although it looked like North East transactions were high, there were little transactions taking place at Punggol.

However, since i knew about the inaccuracy of a map analysis. As such, i decided to analyze all these data again to confirm my findings. I was able to replicate the results.

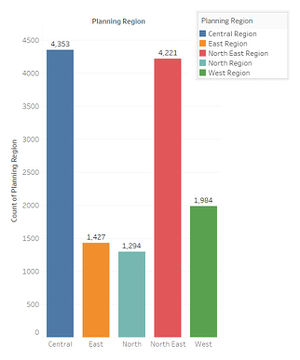

By using a bar graph, i was able to accurately view the amount of transactions that had occurred for the various regions. One interesting note to take note of is that for all transactions taking place in the North East, there were very little transactions taking place at Punggol, which is a place where many development work is taking place, and completed.

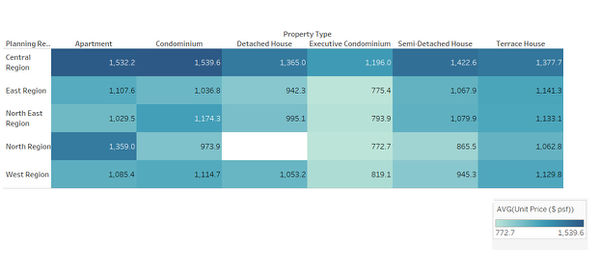

By using a highlight table, I was able to accurately view the average unit cost per square foot for the various regions, confirming that people didn't mind paying a premium for a place to live in the central. According to a study done by TreeHugger, the city (central area) is usually the most expensive as it's closer to their workplace and there are usually a wider range of entertainment there. [3]

Vacancy Rate Analysis

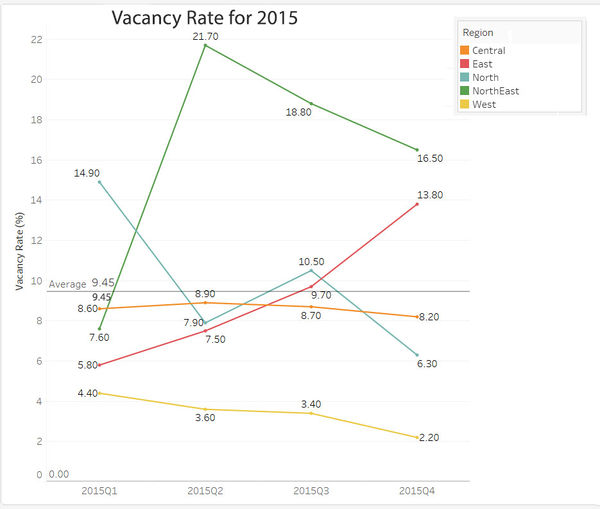

Next, i went to analyse the vacancy rate for the Condominiums. This is what i was able to find out.

From this analysis, I was able to get the following insights. Firstly, in the North East and the East Region, i was able to find out that both of them has a high percentage of vacancy rate, at 16.5% and 13.8%. Alternatively, for the West Region, it has quite a low vacancy rate, at 2.2%.

This is crucial as we would be able to see which regions of Singapore would require more or reduce housing development. In addition, instead of reducing housing development, we would also pinpoint locations in which we are able to alter the layout of the Master Plan, to attract more people to live in areas which have a high vacancy rate, either by building more shopping centers or commercial buildings.

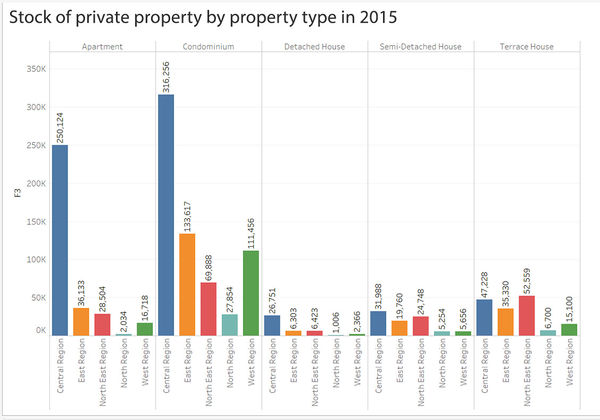

Lastly, I went to analyse the Share patterns of private properties supply in 2015.

From this, we can see that there is a high number of condominiums in Singapore, with apartments coming in next. I believe that due to Singapore's low surface area, it needs to maximize the amount of people living in Singapore. One such way to achieve that, is by building condominiums and apartments, and less of Detached house, Semi-Detached house and Terrace House.

Tools

Tableau - For graph Visualization to perform analysis to find patterns and gain insights.

Microsoft Excel - Used for Data cleaning and transformation so that it can be imported into Tableau.

Adobe Photoshop - Used for creating the infographic and edit some of the graphs quickly.

Suggestions

For the first suggestion, by looking at the map analysis, we can see that central area has very pricey properties. Since the goal of this article is to reduce the cost of property prices in Singapore. We can try to move some of the characteristics of a "city" area into another part of Singapore. For example, if we were to move these characteristics to Punggol. In regards to the URA's Master Plan, plans could be made for Punggol to include more of these commercial buildings, leisure locations, etc. By doing so, it would make Punggol a much attractive place to live in, reducing the attractiveness of the Central Region of Singapore and overall reducing property prices in Singapore.

The next suggestion is for governments to moderate property prices and introduce rebates, lower housing loan interest rates, etc. By doing so, it would reduce the property prices and enable more Singaporeans to afford housing. Subsequently, it would reduce the vacancy rates of private property in Singapore as well.

Lastly, the last suggestion is to control the supply of condominiums. This is especially true in the Central and the North East Region, where the vacancy of in these 2 areas are too big. One thing that the government could do, is to add taxes to development companies, making it much less attractive to develop housing in Singapore.

Sources

[1] - http://pages.eiu.com/rs/783-XMC-194/images/EIU_WCOL2016_FreeReport_FINAL_NEW.pdf?mkt_tok=3RkMMJWWfF9wsRovuK7AZKXonjHpfsX56%2B8vXqW2lMI%2F0ER3fOvrPUfGjI4JTsthI%2BSLDwEYGJlv6SgFTbjGMbht2bgMUhU%3D

[2] - http://www.srx.com.sg/research

[3] - http://www.treehugger.com/sustainable-product-design/why-is-urban-housing-so-expensive-because-people-want-to-live-there.html