IS428 2016-17 Term1 Assign1 Heng Yi Teng Mabel

Contents

- 1 Share of Private Properties Supply in 2015

- 2 Distribution of Private Property Prices in 2015

- 3 Policy Recommendations

- 4 References

Industrial Properties

Data Cleaning

Since there was no field for selecting a timeframe in REALIS, I used “Written Permission Date” as a proxy for when the property was supplied. “Written Permission Date” was reformatted in Excel to ensure it was in Tableau-readable date format. Irrelevant records were deleted where the “Written Permission Date” field was empty or year was 2016. Upon data import into Tableau, it appeared there were no records of commercial public property supply before 2014, making records before 2014 meaningless for calculating share of private property supply. Hence all years were filtered out except for 2014 and 2015.

I also noticed there were columns pertaining to factory space and warehouse space in the dataset, indicating there two categories under industrial properties. Hence I used Excel to recode these columns into a new column "Category" where records were classified into factory or warehouse.

Graphical Design

As the data is categorical, I chose to use bar charts. The simplicity allows the reader to quickly draw conclusions. Where a larger number of categories are used in the analysis, I chose to use a deviation analysis rather than a side-by-side bar chart. This simplifies the image and allow the reader to spot trends at a quick glance.

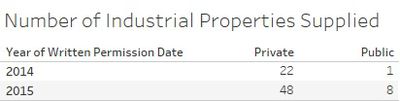

In 2014 and 2015, the supply in number of private industrial properties far exceeded that of public industrial properties. 2015 also saw an increase in number of both private and public industrial properties as compared to 2014.

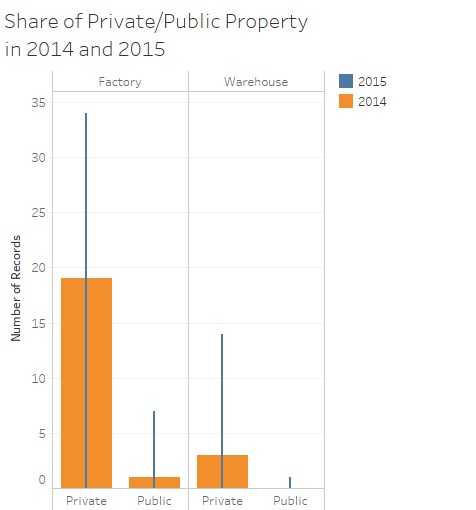

Across public and private factories and warehouses, all categories experienced growth in supply.

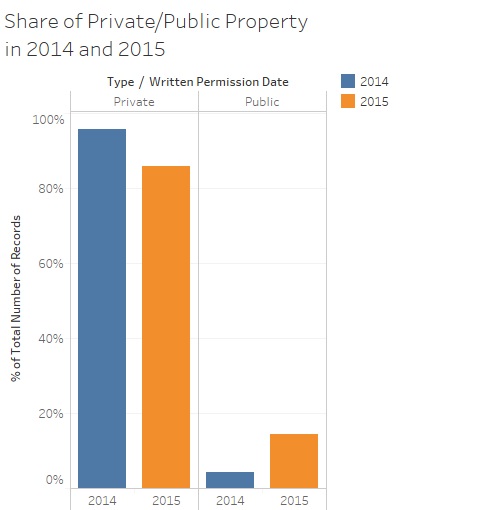

However, further analysis shows that the share of private industrial properties actually decreased in 2015. Compared to 2014, 2015 had a reduced share of private properties and an increased share of public properties.

Commercial Properties

Data Cleaning

Similar to the data cleaning for the Industrial Properties, “Written Permission Date” was used as a proxy for date supplied and reformatted. Irrelevant data were deleted, leaving entries from 2014 to 2015.

When extracting from REALIS, commercial properties data produced columns pertaining to office space, retail space and hotel rooms. Hence I deduced that commercial properties were categorised into office, retail and hotel spaces and created a new column “Usage”. If a project had values in the hotel room-related columns, I would recode it as “Hotel”. If a project had values in more than one column e.g. in the office and retail space columns, I would duplicate the row and record one as “Office” and the other as “Retail”.

Graphical Design

Bar charts were chosen as the data is categorical. I also chose a deviation analysis, rather than a side-by-side bar chart due to the larger number of columns. Overlaying columns allow the reader to spot trends at a glance.

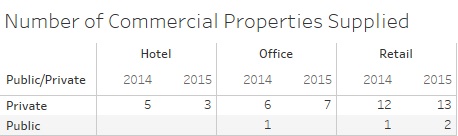

At a glance, we cannot spot any trend in commercial property supply. The difference in numbers from 2014 to 2015 appear small.

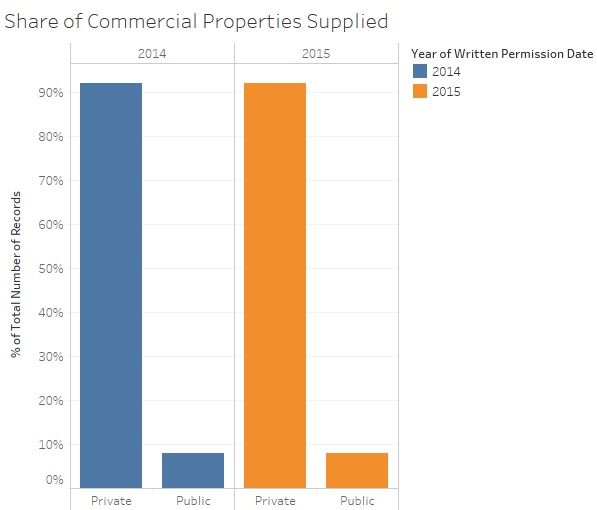

At a macro level, we see that private property dominates the supply of commercial property. Additionally, the share of private property in 2014 and 2015 appear equal.

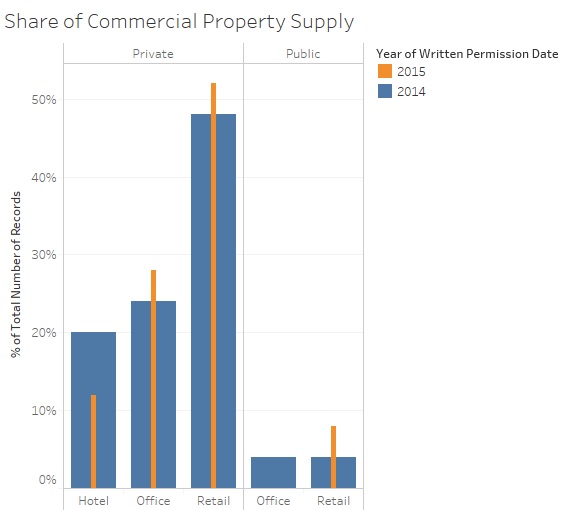

However, a deviation analysis zooming in on sub-categories allows us to quickly observe that the share of office and retail space has increased in 2015. This is possibly fueled by a decrease in share of commercial hotel spaces.

Residential Properties

Data Cleaning

Similar to previous data cleanups, “Written Permission Date” was used as a proxy for date supplied and reformatted. Irrelevant data were deleted, leaving entries from 2014 to 2015.

Upon extraction from REALIS, I realised residential projects were split into six categories: Apartments, Condominiums, Detached, Semi-Detached, Executive Condominium, Semi-Detached and Terrace. I created a new column “Type” and recoded the data so that each project was categorised under at least one of the six categories.

Graphical Design

Bar charts were chosen as the data is categorical. I also chose a deviation analysis, rather than a side-by-side bar chart due to the larger number of columns. Overlaying columns allow the reader to spot trends at a glance.

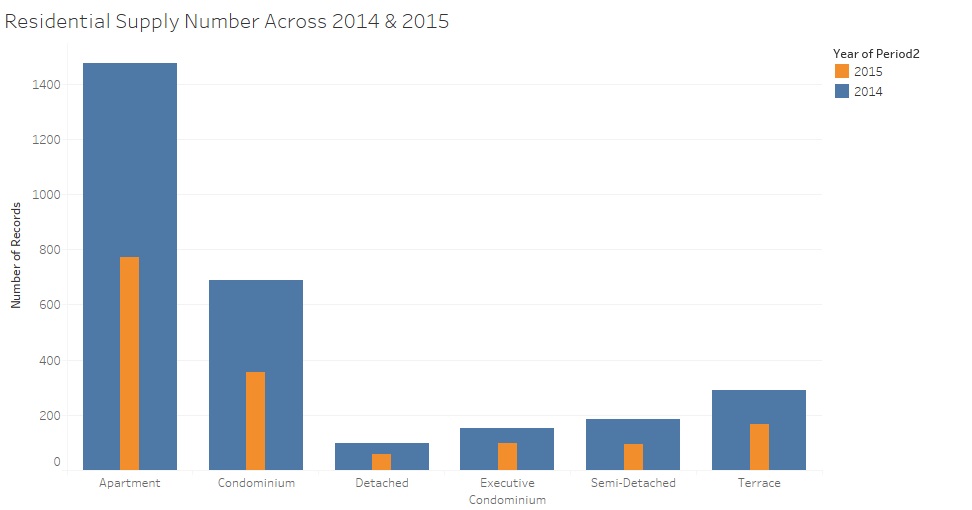

Using only REALIS data, it is uncertain whether the share of private residential properties have changed in 2015. However, a bar chart analysis shows that the supply of properties has decreased across all categories of private residences.

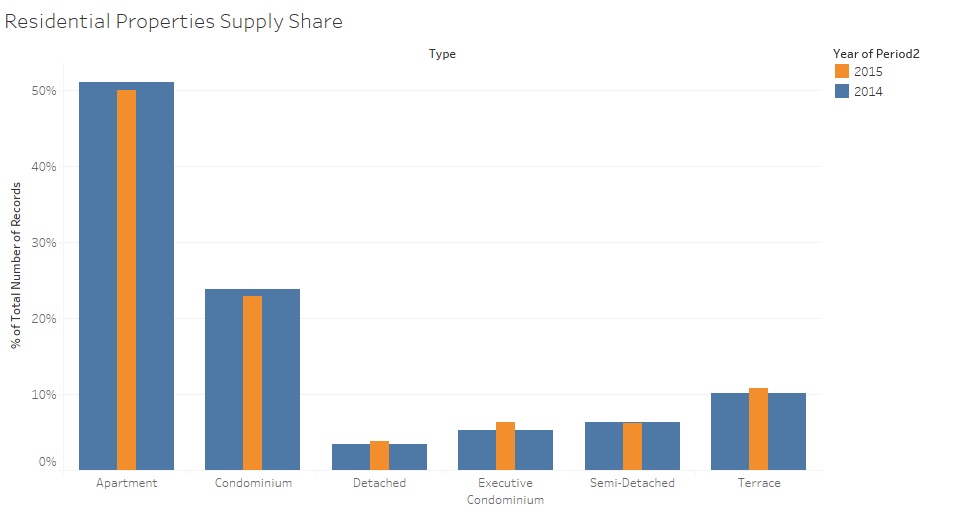

However, the percentage mix of private property categories remain fairly similar from 2014 to 2015.

Distribution of Private Property Prices in 2015

Industrial Properties

Data Cleaning

As REALIS limits the number of entries per download to 1,000, the multiple csv files had to be combined using cmd in Windows.

Graphical Design

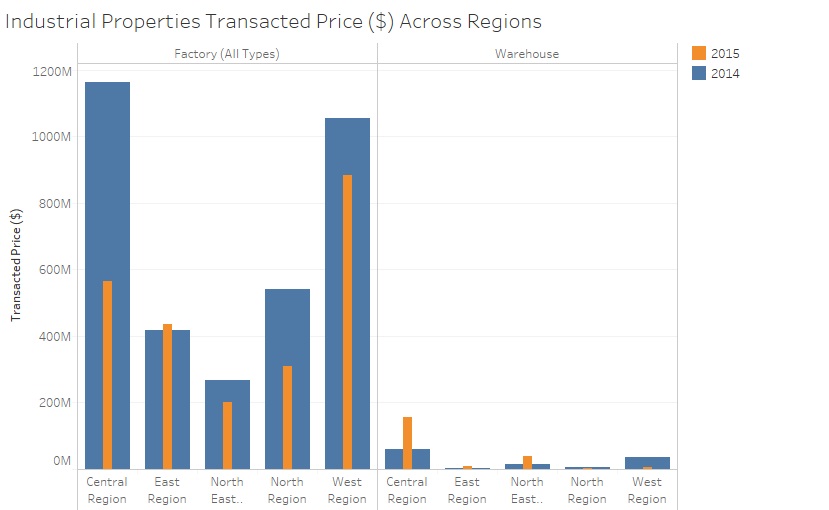

A bar chart with a deviation analysis using overlaying columns allows us a quick view at two trends: which regions contribute most/least to transaction prices and the transactions prices in 2015 compared to 2014. It is also suitable for categorical data.

Analysis: Factory transacted prices form bulk of industrial price distribution

Factory transacted prices far outweigh warehouse transacted prices. For factories, the West region contributed most to 2015 transaction prices. On the whole we see that factory transaction values have fallen noticeably in almost all regions, except for the East showing slight growth.

Commercial Properties

Data Cleaning

As REALIS limits the number of entries per download to 1,000, the multiple csv files had to be combined using cmd in Windows.

Graphical Design

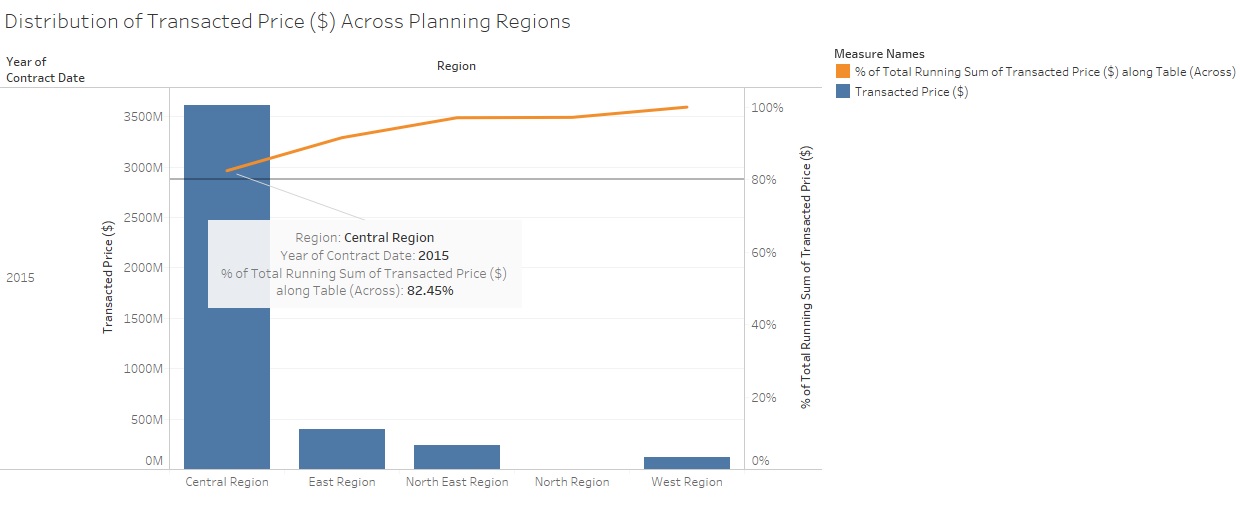

A Pareto chart was selected, firstly, because the data is continuous. Secondly, a bar chart revealed that the Central Region accounted for a large share of the transacted price in the country. A Pareto chart was selected to analyse how much of the commercial transactions in Singapore can be attributed to a number of regions.

Analysis: Central Region accounts for over 80% of commercial transactions

The bar chart below reveals an unequal distribution - the Central Region contributes a large share of the commercial property transactions in Singapore.

The Pareto chart allows us to see that one in five regions, in particular the Central Region, accounts for slightly over 80% of commercial property transactions. Interestingly, Pareto's Principle applies here - roughly 80% of effects are a result of 20% of causes. In this case, 20% of regions contributed over 80% of the value of transactions.

Residential Properties

Policy Recommendations

Reduce Industrial Property Supply

A growth in supply of public and private factories and warehouses, and a fall in transacted prices for industrial properties suggest there may be an over-supply of industrial properties. This has affected rents in factory spaces as industrial space owners struggling with contraction in demand[1]. Sandwiched by lacklustre manufacturing growth and increase in competition as more new space owners enter the market[2], one of the ways policy can ease the pressures are by reducing the supply of industrial property.

References

- ↑ R. Whang, "Singapore industrial rents continued to fall in final quarter of 2015: DTZ" "The Straits Times", Jan 12, 2016

- ↑ "Industrial spaces to bear the brunt of flailing manufacturing industry" "Singapore Business Review", Aug 26, 2016