Difference between revisions of "Unicorn Ventures"

Yu.fu.2015 (talk | contribs) |

Yu.fu.2015 (talk | contribs) |

||

| Line 8: | Line 8: | ||

| style="font-family:Century Gothic; font-size:85%; solid #f48024 ; border-bottom:0px solid #FF5A60 ; background:#FF5A60 ; text-align:center;" width="16.6%" | | | style="font-family:Century Gothic; font-size:85%; solid #f48024 ; border-bottom:0px solid #FF5A60 ; background:#FF5A60 ; text-align:center;" width="16.6%" | | ||

| − | [[ | + | [[IS428_2018_19T1_Group03_Team| <font color="#fff">TEAM</font>]] |

| | | | ||

| style="font-family:Century Gothic; font-size:85%; solid #f48024 ; border-bottom:0px solid #FF5A60 ; background:#252320; text-align:center;" width="16.6%" | | | style="font-family:Century Gothic; font-size:85%; solid #f48024 ; border-bottom:0px solid #FF5A60 ; background:#252320; text-align:center;" width="16.6%" | | ||

| − | [[ | + | [[IS428_2018_19T1_Group03_Proposal | <font color="#FFF">PROPOSAL</font>]] |

| | | | ||

| style="font-family:Century Gothic; font-size:85%; solid FF5A60 ; border:0px solid #FF5A60 background:#FF5A60; background:#FF5A60; text-align:center;" width="16.6%" | | | style="font-family:Century Gothic; font-size:85%; solid FF5A60 ; border:0px solid #FF5A60 background:#FF5A60; background:#FF5A60; text-align:center;" width="16.6%" | | ||

| − | [[ | + | [[IS428_2018_19T1_Group03_Poster | <font color="#fff">POSTER</font>]] |

| | | | ||

| style="font-family:Century Gothic; font-size:85%; solid #f48024 ; border:0px solid #FF5A60 background:#FF5A60; background:#FF5A60; text-align:center;" width="16.6%" | | | style="font-family:Century Gothic; font-size:85%; solid #f48024 ; border:0px solid #FF5A60 background:#FF5A60; background:#FF5A60; text-align:center;" width="16.6%" | | ||

| − | [https:// | + | [https://is428-ay2018-2019-unicorn-ventures.shinyapps.io/application/ <font color="#FFFFFF">APPLICATION</font>] |

| | | | ||

| style="font-family:Century Gothic; font-size:85%; solid #f48024 ; border:0px solid #FF5A60 background:#FF5A60; background:#FF5A60; text-align:center;" width="16.6%" | | | style="font-family:Century Gothic; font-size:85%; solid #f48024 ; border:0px solid #FF5A60 background:#FF5A60; background:#FF5A60; text-align:center;" width="16.6%" | | ||

| − | [[IS428 | + | [[IS428 2018_19T1_Group03 Report | <font color="#FFFFFF">RESEARCH PAPER</font>]] |

| | | | ||

|} | |} | ||

| − | [[ | + | [[IS428_2018_19T1_Group03_Proposal-version1 | <font color="#000">Version 1</font>]] | [[IS428_2018_19T1_Group03_Proposal-version2 | <font color="#000">Version 2</font>]] |

<br> | <br> | ||

Revision as of 15:07, 22 November 2018

Blockchain, artificial intelligence, data science, edtech and internet-of-things are all buzzwords today in this new innovation era. More and more founders and investors begin to see the potential of innovation in Asia today. Meanwhile, local governments in the region have introduced new policies and initiatives to explore new technological innovation frontiers in order to boost the competitiveness of various knowledge-based industries. In recent years, both Hong Kong and Singapore government has pumped in resources including start-up clusters, grants and funding to boost its start-up Ecosystem.

The two Asian-Tigers, Singapore and Hong Kong, will be the main contexts for this project. They are two high-growth metropolitan city-states in Asia that share many characteristics in common in terms of GDP per capita and population density. Beyond that, both Hong Kong and Singapore offers a comprehensive financial and technical infrastructure and has attracted a considerable amount of foreign investment. It is commendable that both countries have achieved stellar economic performance despite the lack of natural resources and large land size. Unicorn Ventures strives to study the current start-up ecosystem in these two city-based regions and hope to generate new insights for policy-makers, founders and investors.

Our research is motivated by the lack of comprehensive comparison between these two countries’ startup ecosystem. Currently, there are many sources of fragmented datasets on different aspects of the startup ecosystem such as top-funded companies, industry breakdown and funding analysis. Our project aims to consolidate the data sources and study the two different startup ecosystems through a centralized interactive web application.

This project will focus on start-up companies and funding organizations in the tech ecosystem. The insights generated could help:

- Hong Kong and Singapore policy makers improve its existing infrastructures or policies to cultivate a more robust startup ecosystem

- Potential and current founders to understand the growing industries, competitor landscape and investors

- Potential investors to identify the growing industries and dominant players

Our project aims to explore and compare the following aspects for the startup

ecosystem in Singapore and Hong Kong by considering the startups founded after

2000.

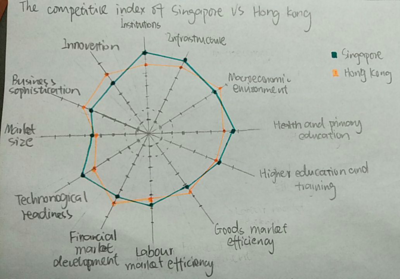

Ecosystem Index Analysis:

- What is the difference of Hong Kong and Singapore in terms of Global Entrepreneurship Index and Global Competitiveness Index?

Startup Analysis:

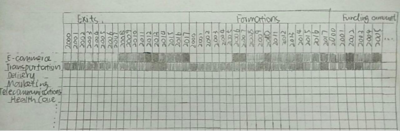

- Time-series analysis for startups that has formed/exited across the years by different industries

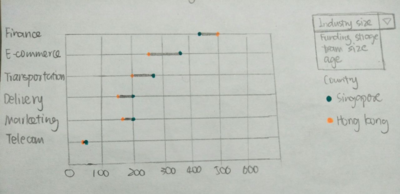

- What is the current breakdown of startups by industries, key industries, team size, funding stage, age and gender of founders?

Funding Analysis:

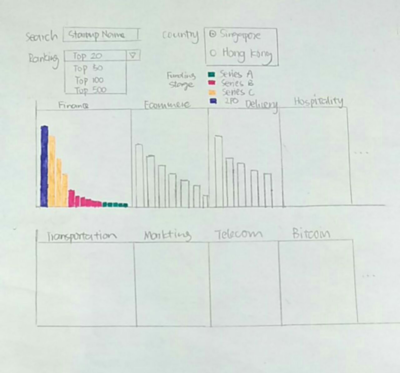

- What are top funded startups and their funding stages and industries?

- Time-series analysis of the disclosed funding over the years by industries

- Where does the investors originate from and what are the investor types?

| Dataset | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

|

| Related Works | What We Can Learn |

|---|---|

| |

| |

| |

| |

|

| Sketches | How Analyst Can Conduct Analysis |

|---|---|

|

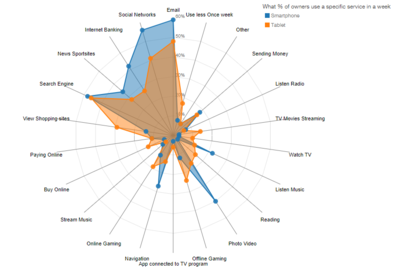

Spider Charts

| |

|

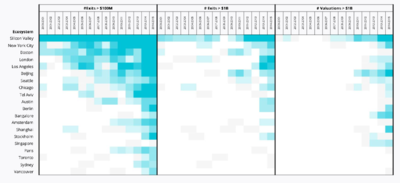

Heat Map:

| |

|

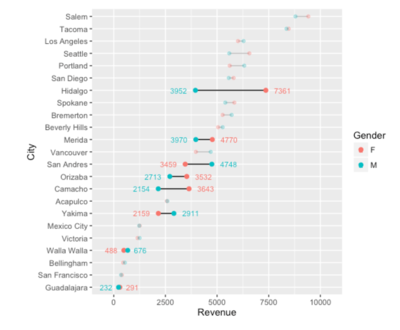

Cleveland Dot Plot with Filters:

| |

|

Grouped Bar Chart with filters:

| |

|

Connection Map:

|

Domain Knowledge Understanding:

- As the datasets involves many technical terms in the startup ecosystem, the group has to study more in-depth on the terminologies used in the ecosystem in order to draw meaningful insights. This includes the definition of different funding stages, types of fundings, types of investors, startup industries categories and etc.

Data Preprocessing:

- Missing data: how to deal with missing values

- Data integration and calculation: understanding the column attributes and perform meaningful summation or calculation

- Multiple values for certain observations: how to deal with such attributes and ensure that the visualizations take into account of start-ups that has attributes with multiple values

Technological Expertise:

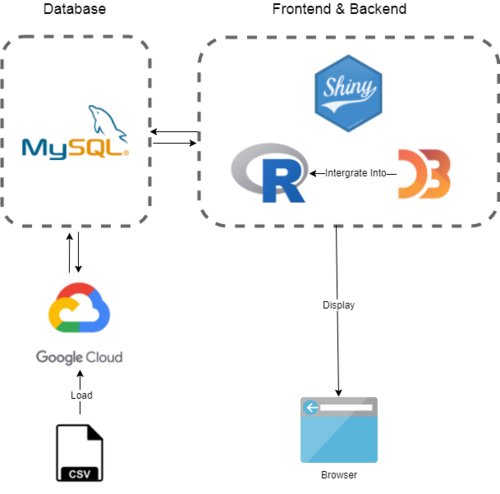

- Learning relevant packages under R such as ggplot2, tidyverse, shiny and plotly

- Learning how to integrate D3.js with R to achieve both advanced analytics functions as well as interactive visualization

- Learning integration of different charts and enhance the interactivity and animation techniques of the storyboard

Feel free to comments, suggestions and feedbacks to help us improve our project!:D