Difference between revisions of "Unicorn Ventures"

Yu.fu.2015 (talk | contribs) |

Yu.fu.2015 (talk | contribs) |

||

| Line 41: | Line 41: | ||

<br /> | <br /> | ||

| − | + | As there is a general lack of effective and user-friendly visualization for discovering country-specific differences between the start-up ecosystems, the main motivation behind this project is to create a centralized, dynamic and interactive dashboard for quantitative comparisons on various aspects of start-ups and funding organizations in Singapore and Hong Kong. Based on User-Centric Dashboard Design Guide, this dashboard takes a broad, strategic, customizable, drillable and exploratory approach and is targeted at potential entrepreneurs, policy makers and investors. | |

| + | This project will focus on start-up companies and funding organizations in the tech ecosystem. The insights generated could help: | ||

| + | *Enable potential entrepreneurs to understand the growing and declining industries, investors’ profile as well as pinpoint the top funded start-ups | ||

| + | *Help policy makers to identify the potential profitable and leading industries and dedicate more resources in specific industries | ||

| + | *Assist investors in identifying the difference between Singapore and Hong Kong’s start-up industries and strategizing future investments in these two regions | ||

| − | |||

| − | |||

| − | |||

| − | |||

<br /> | <br /> | ||

<div style="background: #FF7F50 ; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">OBJECTIVES</font></div> | <div style="background: #FF7F50 ; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">OBJECTIVES</font></div> | ||

<br> | <br> | ||

| − | Our project aims to explore and compare the following aspects for the | + | Our project aims to explore and compare the following aspects for the start-up ecosystem in Singapore and Hong Kong by considering the start-ups founded after 2000. We hope to address the following questions |

| − | ecosystem in Singapore and Hong Kong by considering the | + | For Entrepreneurs: |

| − | 2000. | + | *Time-series analysis: When was the start-ups founded, exited and funded? |

| + | *Funding Analysis: Discovering the top funded start-ups | ||

| + | *Spatial Analysis: Where do the investors originate from? | ||

| + | For Policy Makers/Investors: | ||

| + | *Profile Analysis: What are the differences in terms of start-up formation across the years? | ||

| + | *Industry Analysis: Comparing the start-ups in various industries and sectors based on different performance indicators | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

</br> | </br> | ||

<div style="background: #FF7F50 ; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">SELECTED DATASET</font></div> | <div style="background: #FF7F50 ; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">SELECTED DATASET</font></div> | ||

| Line 74: | Line 70: | ||

*Description: This dataset includes various key attributes on startups in Singapore and Hong Kong that was founded after 2000. | *Description: This dataset includes various key attributes on startups in Singapore and Hong Kong that was founded after 2000. | ||

*Source: [https://www.crunchbase.com/search/organization.companies/a7600f0093365b7c1eb51e6325036762f5a19635 Crunchbase] | *Source: [https://www.crunchbase.com/search/organization.companies/a7600f0093365b7c1eb51e6325036762f5a19635 Crunchbase] | ||

| − | *[https://drive.google.com/ | + | *[https://drive.google.com/open?id=1y0lhzu9b1CD4hRvORNhakkraBorUBmiX Dataset] |

*Components: | *Components: | ||

| Line 123: | Line 119: | ||

|String | |String | ||

|Organization exit date | |Organization exit date | ||

| + | |- | ||

| + | |- | ||

| + | | style="text-align: center;" | Last Funding Date | ||

| + | |Date | ||

| + | |Last Funding Date | ||

| + | |- | ||

| + | |- | ||

| + | | style="text-align: center;" | Last Funding Type | ||

| + | |String | ||

| + | |Last Funding Type | ||

| + | |- | ||

| + | |- | ||

| + | | style="text-align: center;" | Last Funding Amount Currency (in USD) | ||

| + | |String | ||

| + | |Last Funding Amount in USD | ||

| + | |- | ||

| + | |- | ||

| + | | style="text-align: center;" | Total Funding Amount Currency in USD | ||

| + | |String | ||

| + | |Total Funding Amount in USD | ||

|- | |- | ||

|} | |} | ||

| Line 130: | Line 146: | ||

*Description: This dataset details the individual disclosed funding transactions that are public and are published in crunchbase. | *Description: This dataset details the individual disclosed funding transactions that are public and are published in crunchbase. | ||

*Source: [https://www.crunchbase.com/search/funding_rounds/635cbd9bcafca178f043955a5ddebe9b5603acaa Crunchbase] | *Source: [https://www.crunchbase.com/search/funding_rounds/635cbd9bcafca178f043955a5ddebe9b5603acaa Crunchbase] | ||

| − | *[https://drive.google.com/ | + | *[https://drive.google.com/open?id=1XTr_kgsya8LDM4GjuM1S7k4vGAmfSVeg Dataset] |

*Components: | *Components: | ||

| Line 189: | Line 205: | ||

*Source: [https://www.crunchbase.com/search/principal.investors/6803113d3482513cb2152ca68c002ad6501dd7c7 Crunchbase] | *Source: [https://www.crunchbase.com/search/principal.investors/6803113d3482513cb2152ca68c002ad6501dd7c7 Crunchbase] | ||

| − | *[https://drive.google.com/ | + | *[https://drive.google.com/open?id=1Cy7HH-1gCbh8CIQHYAjhFw1cBcT5IkHM Dataset] |

*Components: | *Components: | ||

| Line 226: | Line 242: | ||

*Description: This dataset includes other attributes on startups in Singapore and Hong Kong that was founded after 2000. | *Description: This dataset includes other attributes on startups in Singapore and Hong Kong that was founded after 2000. | ||

*Source: [https://www.crunchbase.com/search/organization.companies/a7600f0093365b7c1eb51e6325036762f5a19635 Crunchbase] | *Source: [https://www.crunchbase.com/search/organization.companies/a7600f0093365b7c1eb51e6325036762f5a19635 Crunchbase] | ||

| − | *[https://drive.google.com/ | + | *[https://drive.google.com/open?id=1sYx1lezHo9KyTFD5l6M8GPgE1nuPk001 Dataset] |

*Components: | *Components: | ||

| Line 394: | Line 410: | ||

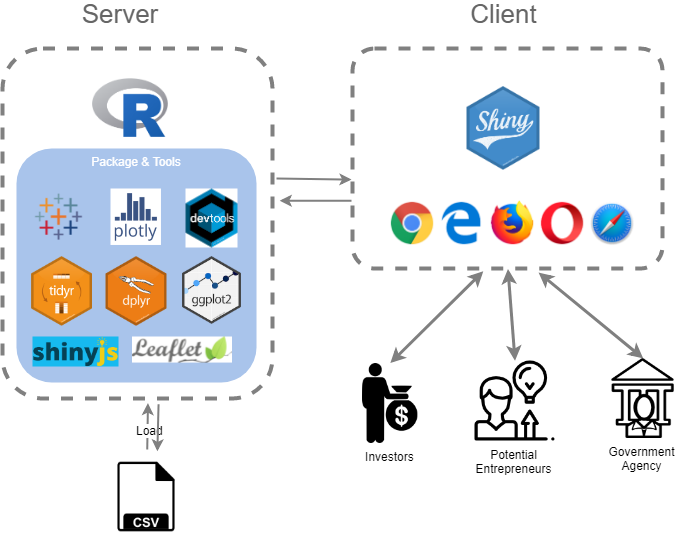

<div style="background: #FF7F50 ; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">ARCHITECTURE DIAGRAM</font></div> | <div style="background: #FF7F50 ; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">ARCHITECTURE DIAGRAM</font></div> | ||

| − | <br>[[File:Technology diagram VA.png|center| | + | <br>[[File:Technology diagram VA.png|center|700px]]</br> |

<div style="background: #FF7F50 ; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">KEY TECHNICAL CHALLENGES</font></div> | <div style="background: #FF7F50 ; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">KEY TECHNICAL CHALLENGES</font></div> | ||

| Line 411: | Line 427: | ||

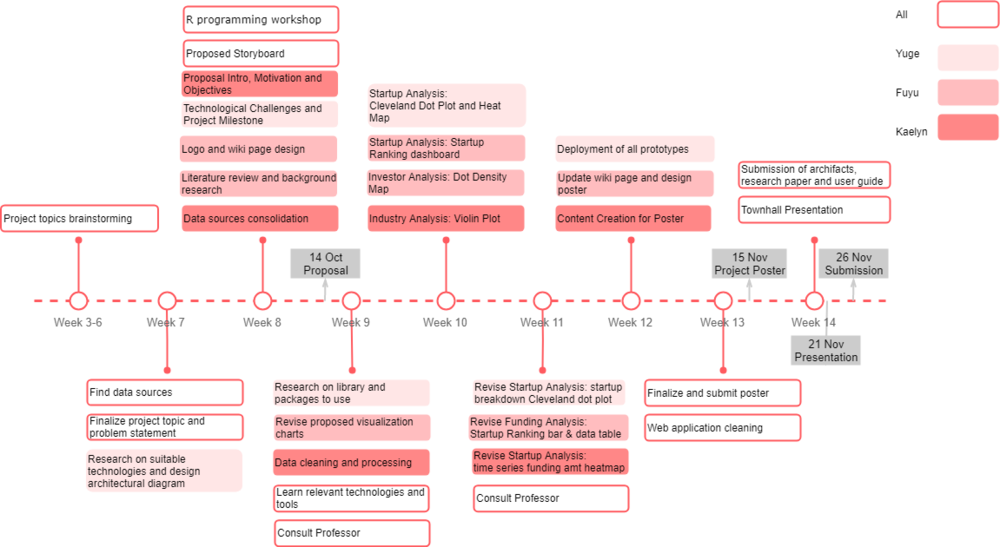

<div style="background: #FF7F50 ; margin-bottom:10px; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">PROJECT TIMELINE</font></div> | <div style="background: #FF7F50 ; margin-bottom:10px; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">PROJECT TIMELINE</font></div> | ||

| − | <br>[[File: | + | <br>[[File:Timeline Diagram.png|1000px|center]]</br> |

<div style="background: #FF7F50 ; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">REFERENCES</font></div> | <div style="background: #FF7F50 ; margin-top: 40px; font-weight: bold; line-height: 0.3em;letter-spacing:-0.08em;font-size:20px"><font color=#FF5A60 face="Century Gothic">REFERENCES</font></div> | ||

Latest revision as of 23:59, 25 November 2018

Blockchain, artificial intelligence, data science, edtech and internet-of-things are all buzzwords today in this new innovation era. More and more founders and investors begin to see the potential of innovation in Asia today. Meanwhile, local governments in the region have introduced new policies and initiatives to explore new technological innovation frontiers in order to boost the competitiveness of various knowledge-based industries. In recent years, both Hong Kong and Singapore government has pumped in resources including start-up clusters, grants and funding to boost its start-up Ecosystem.

The two Asian-Tigers, Singapore and Hong Kong, will be the main contexts for this project. They are two high-growth metropolitan city-states in Asia that share many characteristics in common in terms of GDP per capita and population density. Beyond that, both Hong Kong and Singapore offers a comprehensive financial and technical infrastructure and has attracted a considerable amount of foreign investment. It is commendable that both countries have achieved stellar economic performance despite the lack of natural resources and large land size. Unicorn Ventures strives to study the current start-up ecosystem in these two city-based regions and hope to generate new insights for policy-makers, founders and investors.

As there is a general lack of effective and user-friendly visualization for discovering country-specific differences between the start-up ecosystems, the main motivation behind this project is to create a centralized, dynamic and interactive dashboard for quantitative comparisons on various aspects of start-ups and funding organizations in Singapore and Hong Kong. Based on User-Centric Dashboard Design Guide, this dashboard takes a broad, strategic, customizable, drillable and exploratory approach and is targeted at potential entrepreneurs, policy makers and investors.

This project will focus on start-up companies and funding organizations in the tech ecosystem. The insights generated could help:

- Enable potential entrepreneurs to understand the growing and declining industries, investors’ profile as well as pinpoint the top funded start-ups

- Help policy makers to identify the potential profitable and leading industries and dedicate more resources in specific industries

- Assist investors in identifying the difference between Singapore and Hong Kong’s start-up industries and strategizing future investments in these two regions

Our project aims to explore and compare the following aspects for the start-up ecosystem in Singapore and Hong Kong by considering the start-ups founded after 2000. We hope to address the following questions

For Entrepreneurs:

- Time-series analysis: When was the start-ups founded, exited and funded?

- Funding Analysis: Discovering the top funded start-ups

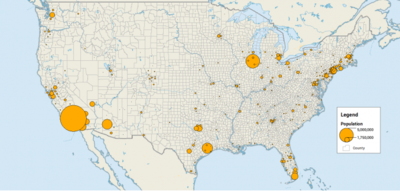

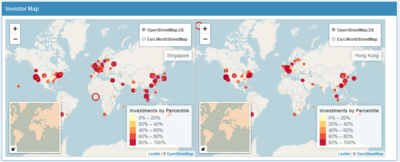

- Spatial Analysis: Where do the investors originate from?

For Policy Makers/Investors:

- Profile Analysis: What are the differences in terms of start-up formation across the years?

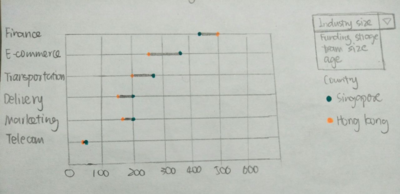

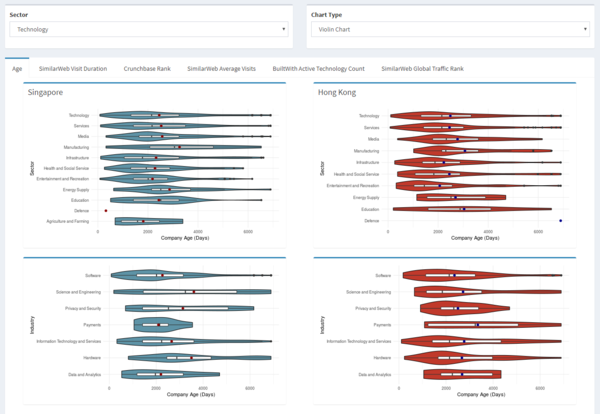

- Industry Analysis: Comparing the start-ups in various industries and sectors based on different performance indicators

| Dataset | |||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||

|

| Related Works | What We Can Learn |

|---|---|

| |

| |

|

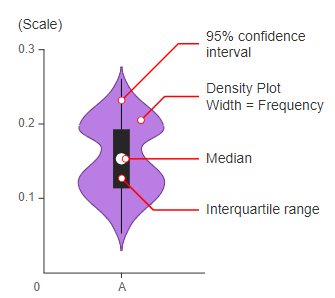

A violin plot show more information in one plot:

This can be used for our industry analysis to achieve a more insightful visualization | |

|

| Sketches | How Analyst Can Conduct Analysis |

|---|---|

|

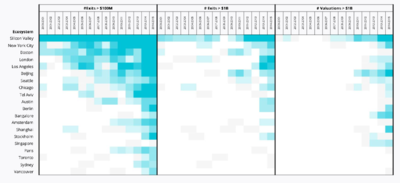

Heat Map:

| |

|

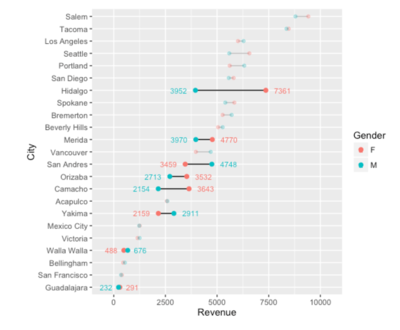

Cleveland Dot Plot with Filters:

| |

|

Violin Plot with filters:

| |

|

|

Dot Density Map:

|

Domain Knowledge Understanding:

- As the datasets involves many technical terms in the startup ecosystem, the group has to study more in-depth on the terminologies used in the ecosystem in order to draw meaningful insights. This includes the definition of different funding stages, types of fundings, types of investors, startup industries categories and etc.

Data Preprocessing:

- Missing data: how to deal with missing values

- Data integration and calculation: understanding the column attributes and perform meaningful summation or calculation

- Multiple values for certain observations: how to deal with such attributes and ensure that the visualizations take into account of start-ups that has attributes with multiple values

Technological Expertise:

- Learning relevant packages under R such as ggplot2, tidyverse, shiny and plotly

- Learning how to integrate D3.js with R to achieve both advanced analytics functions as well as interactive visualization

- Learning integration of different charts and enhance the interactivity and animation techniques of the storyboard

- Global Startup Ecosystem Report 2017

- UC Business Analytics R Programming Guide on Cleaveland Dot Plot

- Data Visualisation Catalogue on Violin Plot

- Data Viz: Give Your Maps Some Hex Appeal

- Crunchbase

Feel free to comments, suggestions and feedbacks to help us improve our project!:D