Difference between revisions of "ISSS608 2017-18 T1 Group5 Report"

| Line 111: | Line 111: | ||

=<font size=4>'''Conclusion & Future work'''</font>= | =<font size=4>'''Conclusion & Future work'''</font>= | ||

| − | <font size=3.5><font color="#8B4513">''' | + | <font size=3.5><font color="#8B4513">'''5.1 Conclusion'''</font></font><br> |

• Overall speaking, aviation industry in China is accelerating its overseas expansion ever since 2013. From Oct 2013 to Oct 2017, there are 267 more air-routes with total number of flights increased by 44.8%. <br> | • Overall speaking, aviation industry in China is accelerating its overseas expansion ever since 2013. From Oct 2013 to Oct 2017, there are 267 more air-routes with total number of flights increased by 44.8%. <br> | ||

• The most outstanding region is Southeast Asia, which takes up about 82.8% of the Total B&R Flights and 72.0% of the B&R Total Air Routes. Southeast Asia countries perform significantly better than countries from other regions, especially Thailand, Vietnam, Malaysia. Although Singapore has almost same number of flights as Vietnam and Malaysia, its flights and routes has almost no growth compared with 4 years ago in 2013.<br> | • The most outstanding region is Southeast Asia, which takes up about 82.8% of the Total B&R Flights and 72.0% of the B&R Total Air Routes. Southeast Asia countries perform significantly better than countries from other regions, especially Thailand, Vietnam, Malaysia. Although Singapore has almost same number of flights as Vietnam and Malaysia, its flights and routes has almost no growth compared with 4 years ago in 2013.<br> | ||

• For major airports in China, Hong Kong is the most important central hub in the Belt and Road Flight Network due to its unique location and international influence. Taiwan, Beijing, Guangzhou and Shanghai are also the key points to explore the opportunities along the Belt and Road initiative. Kunming, Chongqing, Chengdu (3 hubs of Southwest China) plays an important roles in the connection between Southwest China and B&R countries. In addition, serving as the bridge between East Europe, West Asia, North Africa and China, Urumqi also have high potential to explore regional opportunities.<br> | • For major airports in China, Hong Kong is the most important central hub in the Belt and Road Flight Network due to its unique location and international influence. Taiwan, Beijing, Guangzhou and Shanghai are also the key points to explore the opportunities along the Belt and Road initiative. Kunming, Chongqing, Chengdu (3 hubs of Southwest China) plays an important roles in the connection between Southwest China and B&R countries. In addition, serving as the bridge between East Europe, West Asia, North Africa and China, Urumqi also have high potential to explore regional opportunities.<br> | ||

• In terms of airline companies, China Southern Airline contributes the highest number of flights per week (705 out of 5,385). Out of the top 5 airlines with high number of flights, Xiamen Airlines is considered to be regional which served mainly the southeastern region. Whereas for China Southern Airlines, China Eastern Airlines and Air China, their flight network is widely spread. <br> | • In terms of airline companies, China Southern Airline contributes the highest number of flights per week (705 out of 5,385). Out of the top 5 airlines with high number of flights, Xiamen Airlines is considered to be regional which served mainly the southeastern region. Whereas for China Southern Airlines, China Eastern Airlines and Air China, their flight network is widely spread. <br> | ||

| − | <font size=3.5><font color="#8B4513">''' | + | <font size=3.5><font color="#8B4513">'''5.2 Future Work'''</font></font><br> |

As for future work, there is still much space for improvement to gain full insights of the “Belt and Road” initiative. Firstly, the current study is using number of air-routes, number of flights and connectivity as major performance evaluators. If capacity data in units of seats/passengers transported is included, comparison analysis between airlines will be more accurate. Secondly, due to lack in availability of the data, currently analysis is only based on the civil transportation data between China and Belt and Road Countries. If access to cargo transportation data is open in the future, the analysis will be more meaningful to understand the entire trading network in aviation sector. Finally, as trading with many countries might be more frequently transported by maritime and rail, information of both transportation channels should also be considered to understand the overall impact of “Belt and Road” initiative. <br> | As for future work, there is still much space for improvement to gain full insights of the “Belt and Road” initiative. Firstly, the current study is using number of air-routes, number of flights and connectivity as major performance evaluators. If capacity data in units of seats/passengers transported is included, comparison analysis between airlines will be more accurate. Secondly, due to lack in availability of the data, currently analysis is only based on the civil transportation data between China and Belt and Road Countries. If access to cargo transportation data is open in the future, the analysis will be more meaningful to understand the entire trading network in aviation sector. Finally, as trading with many countries might be more frequently transported by maritime and rail, information of both transportation channels should also be considered to understand the overall impact of “Belt and Road” initiative. <br> | ||

Revision as of 11:01, 5 December 2017

Linking the globe: An Interactive Dashboard for Exploring Aviation Expansion Along the "Belt and Road"

Linking the globe: An Interactive Dashboard for Exploring Aviation Expansion Along the "Belt and Road"

| PROPOSAL | REPORT | POSTER | APPLICATION| |

Contents

Introduction

1.1 Background

The Silk Road Economic Belt and the 21st-century Maritime Silk Road, better known as the One Belt and One Road Initiative (OBOR), The Belt and Road (B&R) is a development strategy proposed by China's paramount leader Xi Jinping in 2013 that focuses on connectivity and cooperation between Eurasian countries, primarily the People's Republic of China (PRC). The initiative underlines China's push to take a role in global affairs with a China-centered trading network. The routes cover more than 60 countries in 6 regions. The B&R countries accounting for around 31% of global GDP and more than 34% of the world's merchandise trade.

While the infrastructural development B&R initiative largely focused on rail and maritime links in the first two years, aviation is gradually entering the picture. Constructed 15 new airports and expanded 28 existing ones. Chinese airlines witnessed a robust revenue passenger kilometre growth of 70% with the B&R countries from 2013 to 2015.

Aviation Expansion Accelerated in 2017. 95 new air routes are opened between China and other B&R countries. The support of the Chinese government has helped boost the number of passengers flying between China and B&R countries and regions, which has soared, rising 18.5 percent year-on-year to 8.58 million during first four months of 2017.

1.2 Challenges

• Data quality, quantity, and availability

The main challenge of doing analysis on the development of aviation industry in B&R was lack of data. The historical flight information is not open to public, and the present flight information was not well structured. The data set available was usually crawled by individuals and is of very poor quality.

• Not enough statistics available to the public

There are a lot of news about how the expansion of aviation industry helped in the development of B&R initiative. However, there is no consolidated statistic available that provide numerical evidence to quantify the contribution and development of aviation industry.

• No intuitive overview of aviation expansion

Only very few analyses were done focusing on the role of aviation industry in B&R. Those analysis were all report based. There is no interactive dashboard designed for users to study the performance of aviation industry between China and other B&R countries.

1.3 Motivation

Speaking of Belt and Road, people always put their focus on railway and maritime transportation. However, aviation is making depth and extend contributions to the B&R Initiative by the expansion of air routes and the development of air transport. China’s air transportation, aviation infrastructure and aircraft manufacturing are expected to achieve unprecedented demand growth and the industry’s internationalization is expected to accelerate.

Hence, in this project, we would like to focus on the aviation industry of china and other B&R countries to investigate how aviation industry has been expanded to support the vast transport demand between china and other B&R countries.

1.4 Objectives

The main purpose of this project is to investigate the flight network between China and the “Belt and Road” countries to explore the economic connectivity and development potential. A visual exploration tool will be implemented using R shiny which can be used to easily explore and understand the flight network. The designed dashboard should follow the criteria listed below:

• Show the flight network connectivity between China and the B&R countries

• Show the performance of different regions, countries, airports and airline companies

• Web-based visualization tool using R shiny for interactive exploration

Methodology

2.1 Design Framework

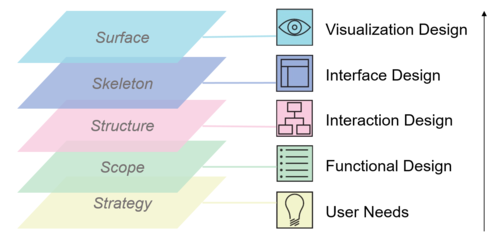

The design flow of our dashboard follows the process below, which is a widely adopted framework of user experience design. There are 5 layers from strategy to final visualization executed from bottom to top.

• Strategy Layer

Identify user needs is the first step to start dashboard design. The major pain point we are solving is to allow users exploring the flight network between China and the B&R countries using visualization tool and aggregated data.

• Scope Layer

In terms of functionality design, the major features of this dashboard are for users to view geographical air transportation network, investigate connectivity of different nodes and study airline company performance.

• Structure Layer

As for interaction design, we have different elements used for different interactive features. An interactive data table is implemented to allow simple searching in dataset used. Sliders will be used for users to filter based on continuous variables like degree, centrality. We will be using treemap and select input box for filtering based on categorical variables like name, IATA, country. By using popup box, users can view information/label dynamically. Foldable panels can be used when space is limited.

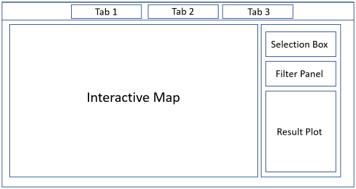

• Skeleton Layer: the interface design is sketched using wireframes as below:

• Surface Layer: lastly, we add in of visualization elements to help making this dashboard more intuitive and pleasing to the eye.

In short, our dashboard design will take into considerations of aesthetic, intuitive, interactive, Informative elements for better user experience.

2.2 Data Description

To support our design framework, we use data from various sources. As Chinese flight data are not public, the flight data used in this project is crawled from VariFlight using Python and other supporting data are collected from Flightradar24, Thematic Mapping and the official website of Civil Aviation Administration of China (CAAC). VariFight and Flightradar24 are both the Chinese Internet service providers on aviation data and real-time flight status. Thematic Mapping is a provider of web mapping and geographic information.

The following figure shows part of the raw data crawled.

After cleaning, data used in this project mainly include the following four parts:

-> Air-routes from China to B&R countries in 2013 & 2017

• Origin

• Destination

• Airline Company

• Departure and Arrival Time

• Flight Number

-> Airport Information

• IATA Code

• ICAO Code

• Airport Name

• Geographical Information: Airport Latitude, Longitude, Altitude, Subordinate Province and City

-> Airline Companies Information

• Airline Name

• Country

• IATA Code

• Country

-> Boundary Information of countries all over the world

• World Border Dataset in shapefile format

Usage of R Packages

Based on the function and purpose, the R packages we use are divided into 5 modules: Data Manipulation, Map Visualization, Network Analysis, Other Analytics Tools and Aesthetics. The following section will introduce each package’s use in our project.

3.1 Data Manipulation

• tidyverse: Prepare, transform and aggregate the data

• data.table: Call the fread function to read the data table in an efficient way

3.2 Map Visualization

• leaflet: Build the interactive map as the application’s background

• rgdal: Read, write and process the spatial data

• raster: Aggregate the country-based shapefile into region-based shapefile to recognize each region’s boundary

3.3 Network Analysis

• igraph: Build the flight network between China and B&R countries

• tidygraph: Derive the centrality measures and call them simply from a table format

3.4 Analytics Tools

• ggplot2: Build the airline composition bar charts

• plotly: Build the charts in Insight Summary Tab and combine its use with ggplot2

• Treemap: Build the airline composition tree map

• D3TreeR: Make the tree map interactive

• DT: View the data table in an interactive way

3.5 Dashboard Visualization

• Shiny

• ShinyTheme: Layout

• ShinyDashboard: Layout

• ShinyBS: Create the foldable collapse box to save space

• ColorBrewer: Change the node color based on the user preference

Analysis and Discussion

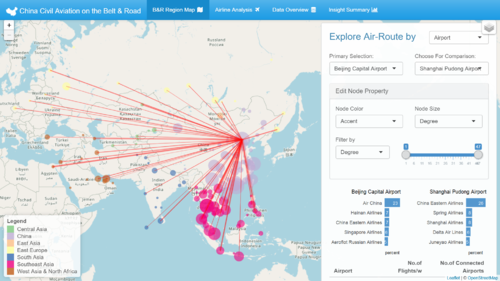

4.1 B&R Analysis

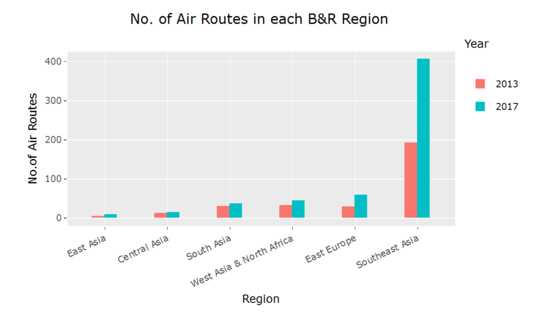

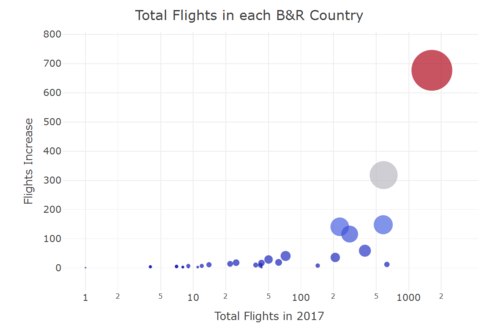

By the end of October 2017, 65 Chinese airports have direct flights to 39 Belt & Road Countries, where 94 oversea airports and 562 air routes are involved and 5386 flights are available per week. In comparison, there are only 295 air routes and 3720 direct flights per week at the beginning of B&R Policy implementation in 2013. No. of routes grow by 90.5% while No. of flights per week increase by 44.8%.

For the region level, Southeast Asia plays the most important role with the most air routes increase and highest flight growth from 2013 to 2017, which takes up 72% of all routes. Generally speaking, every region has achieved the increase of routes and flights. Although East Europe has few flights, its number of air routes increased by 107% since 2013, which is the highest growth rate among the six regions.

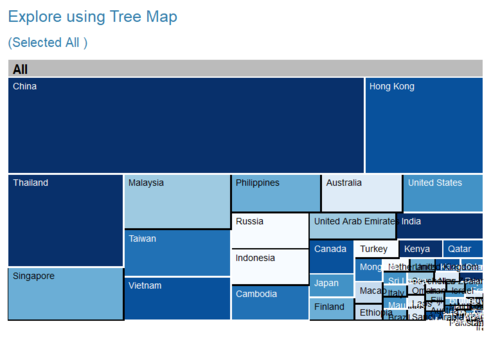

For the country level, Thailand has the absolute advantage and the closest connection with China, with 1640 flights per week. Southeast Asia countries connect relatively well with China. Top 7 countries with the most flights are all Southeast Asia countries, i.e. Thailand, Singapore, Malaysia, Vietnam, Indonesia, Philippines and Cambodia. Note that flights and air routes to Vietnam have an unexpected high growth rate while the number of flight between Singapore and China has almost no increase in the past four year, which means that there has been so many flights and routes since 4 years ago.

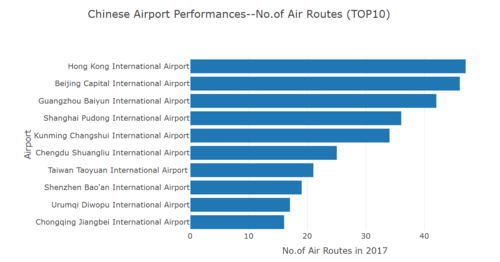

For the airport level, Hong Kong International Airport connects with 47 B&R countries’ airport. With its unique location and prospering economy, Hong Kong is the most important central hub of B&R Flight Network with more than 1000 flights per week while Beijing Capital Airport only has 400+ flights to B&R countries although it connects almost the same number of airports as Hong Kong. From the top 10 airport with most flights, we found that 70% of them are from South China Region. From the top 10 airport with most routes, Kunming and Urumqi International Airports have unexpected performance. Kunming International Airport is one of most important 3 airports in the southwest China and mainly connects with Southeast Asia and South Asia. Urumqi International Airport is located in the west of China so it mainly connects with East Europe, West Asia and North Africa Region.

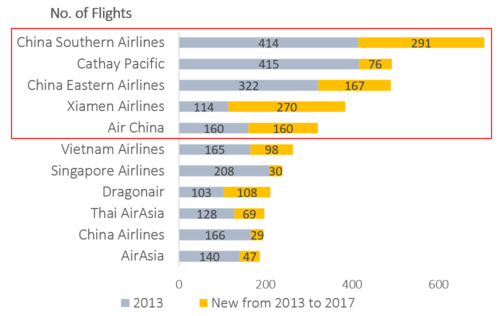

4.2 Airlines Analysis

Nearly 40% of flights between China and B&R region are executed by airline companies in China (including Hong Kong). Major foreign airlines are companies from Thailand, Singapore, Vietnam and Malaysia, which are all Southeastern countries.

Until Oct 2017, China Southern Airlines executes most number of B&R region flights with 705 flights per week. Top 5 places are all taken by Chinese companies, followed by Vietnam Airlines, Singapore Airlines, Thai AirAsia and AirAsia.

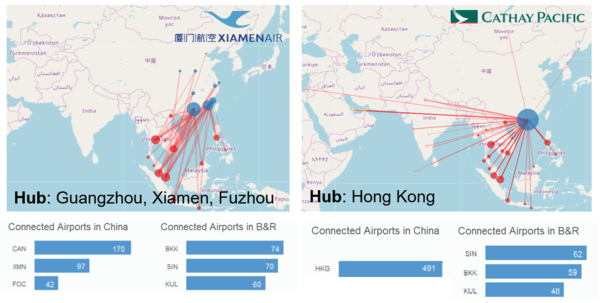

As one of the four major airline companies in China, Xiamen Air has limited geographical coverage compared to others, which mainly flies to South-eastern Regions. Because of this reason, its transportation hubs are mainly located along the southeastern part of China including Guangzhou, Xiamen and Fuzhou. China Southern Airlines has much wider coverage into Europe and Africa by leveraging Urumqi as a connection points for flying to the western regions. It also have large advantages in fleet count and flight count. China Eastern Airlines has weaker geographical coverage as compared to China Southern Airlines with more focus on countries to the south of China. These routes are largely handled by Kunming airport which locates in the southern part of China. As for Cathay Pacific, all the flights departed from Hong Kong International Airport.

Conclusion & Future work

5.1 Conclusion

• Overall speaking, aviation industry in China is accelerating its overseas expansion ever since 2013. From Oct 2013 to Oct 2017, there are 267 more air-routes with total number of flights increased by 44.8%.

• The most outstanding region is Southeast Asia, which takes up about 82.8% of the Total B&R Flights and 72.0% of the B&R Total Air Routes. Southeast Asia countries perform significantly better than countries from other regions, especially Thailand, Vietnam, Malaysia. Although Singapore has almost same number of flights as Vietnam and Malaysia, its flights and routes has almost no growth compared with 4 years ago in 2013.

• For major airports in China, Hong Kong is the most important central hub in the Belt and Road Flight Network due to its unique location and international influence. Taiwan, Beijing, Guangzhou and Shanghai are also the key points to explore the opportunities along the Belt and Road initiative. Kunming, Chongqing, Chengdu (3 hubs of Southwest China) plays an important roles in the connection between Southwest China and B&R countries. In addition, serving as the bridge between East Europe, West Asia, North Africa and China, Urumqi also have high potential to explore regional opportunities.

• In terms of airline companies, China Southern Airline contributes the highest number of flights per week (705 out of 5,385). Out of the top 5 airlines with high number of flights, Xiamen Airlines is considered to be regional which served mainly the southeastern region. Whereas for China Southern Airlines, China Eastern Airlines and Air China, their flight network is widely spread.

5.2 Future Work

As for future work, there is still much space for improvement to gain full insights of the “Belt and Road” initiative. Firstly, the current study is using number of air-routes, number of flights and connectivity as major performance evaluators. If capacity data in units of seats/passengers transported is included, comparison analysis between airlines will be more accurate. Secondly, due to lack in availability of the data, currently analysis is only based on the civil transportation data between China and Belt and Road Countries. If access to cargo transportation data is open in the future, the analysis will be more meaningful to understand the entire trading network in aviation sector. Finally, as trading with many countries might be more frequently transported by maritime and rail, information of both transportation channels should also be considered to understand the overall impact of “Belt and Road” initiative.