ISSS608 2016-17 T1 Assign1 CHRIS THNG REN JING

Contents

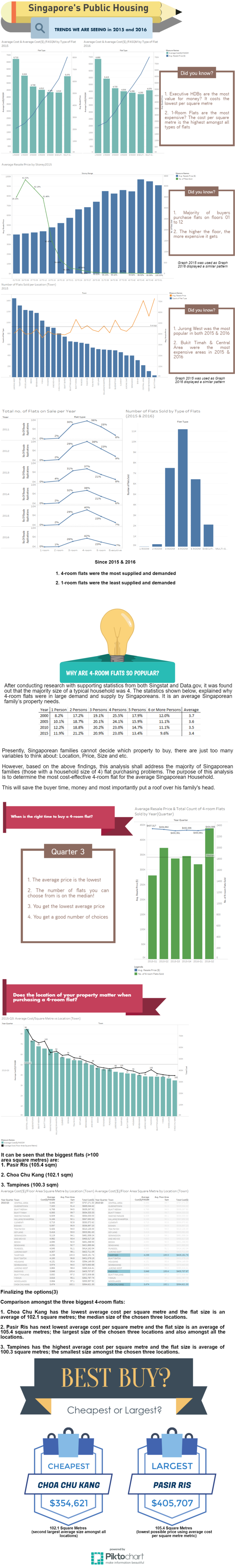

Infographic

Abstract

The Singapore government has developed many public housing estates for Singaporeans for many decades. They have kept the records in their database but have they used it? Since it is an open source data, analysis can be done in order to find out patterns about Singapore's resale public housing supply, demand and prices. Using this analysis, it can provide an overall picture in assisting us in finding an analysis of our interest.

Overall Analysis

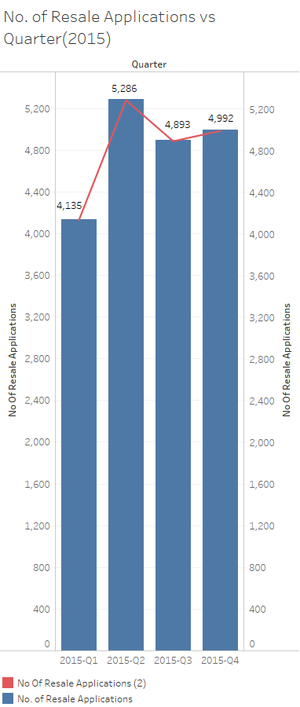

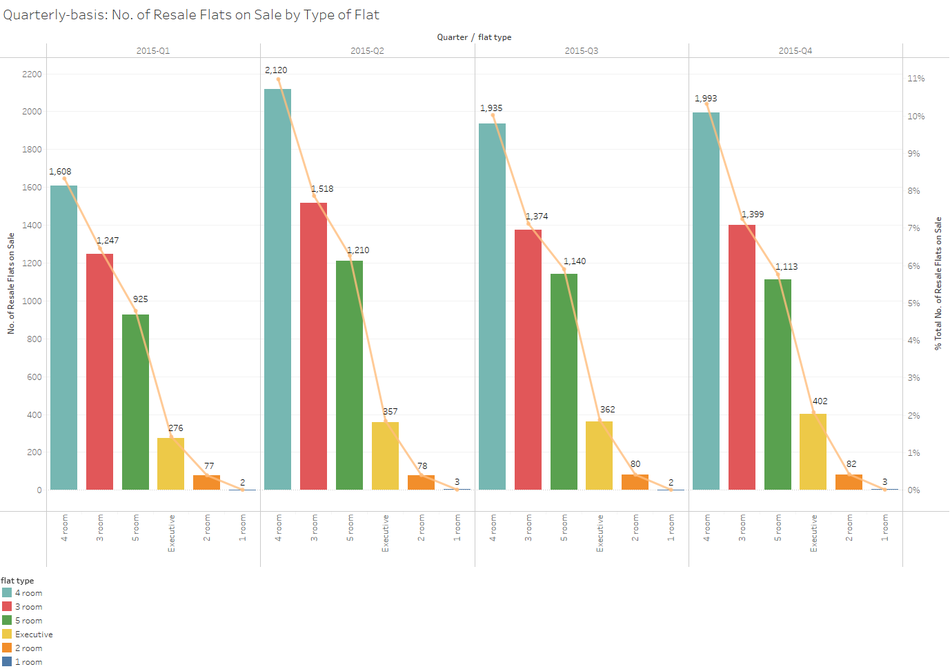

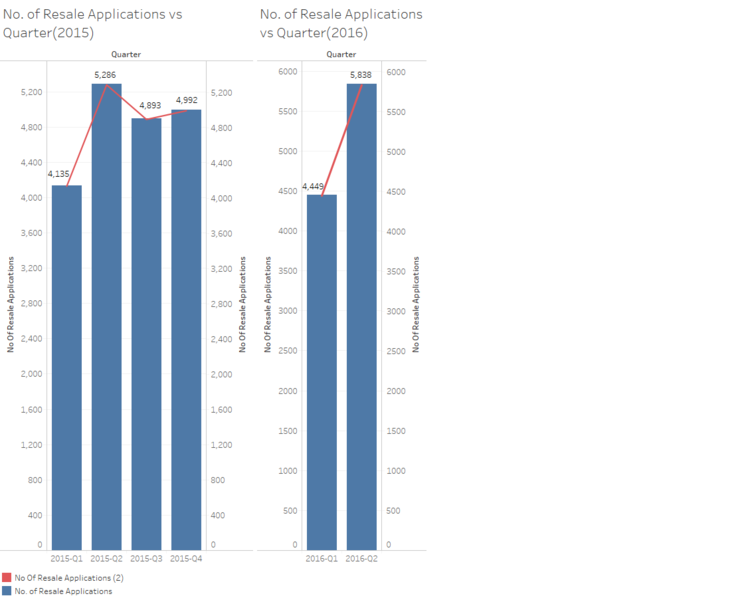

In the first graph, it can be seen that from Q1 to Q2 there was a significant increase in supply of flats. However, an increase in a sale of a certain type of flat e.g. 5 room flats could have been the sole cause. A second graph is included (below) to dispute this; a pattern can be seen. There is an increase in each type of flat quarter on quarter.

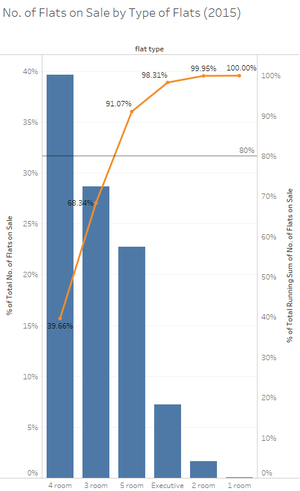

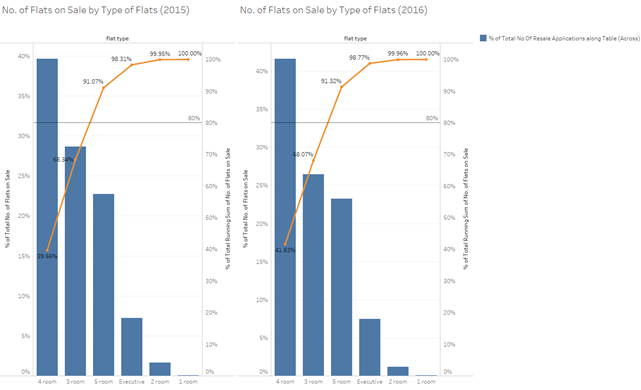

The graph below represents the total % of each type of flat on sale in 2015. The orange marks are the total cumulative % of flats on sale in 2015. It can be seen that 4-room, 3-room and 5-room flats make up the majority of flats on sale in 2015. 4-room flats can be seen as the most supplied type of flat. While, 1-room flats are the least supplied flats.

The graph below represent a year on year basis, it can be seen that the distribution of flats put on sale remains the same. In ascending order 1-room being the least supplied, 2-room, Executive, 5-room, 3-room and lastly the most supplied 4-room flats.

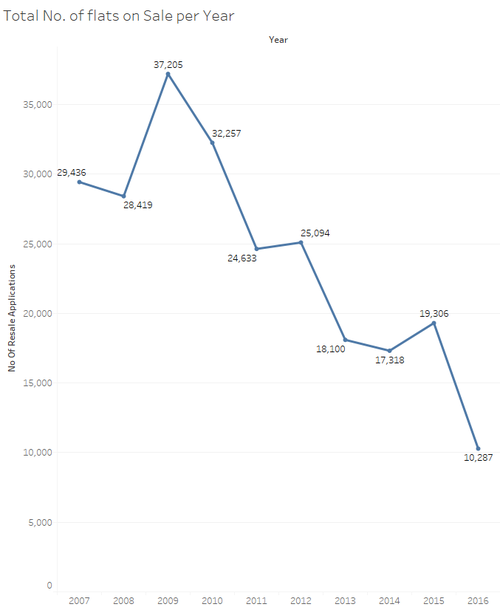

From the graph below, 2009 can be identified as the year where the most flats were put on sale. 2009 onwards, supply began to decline, until 2015 when it had a slight recovery. However, this graph has its limitations due to the nature of the dataset used, the number reflected in 2016 cannot be concluded as another decline as it only takes into account two quarters.

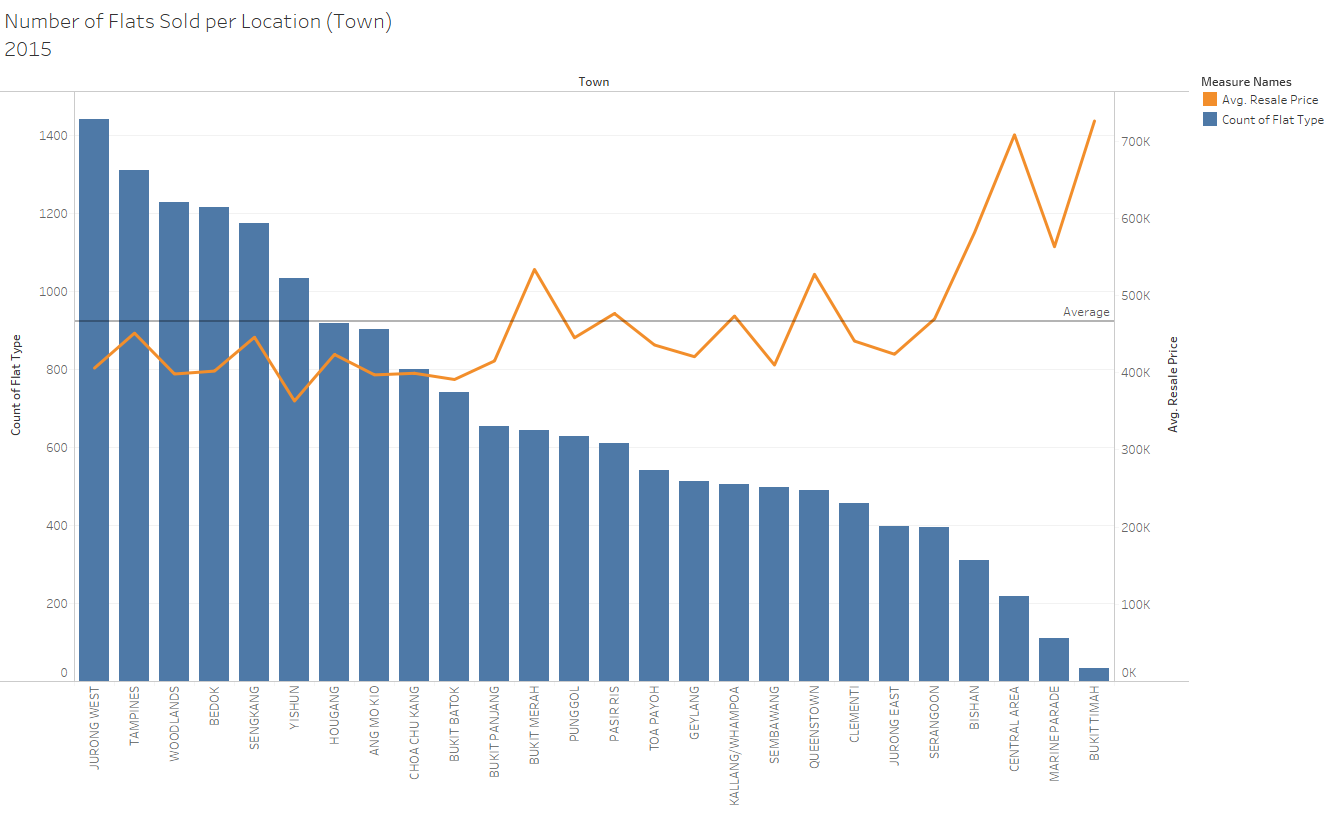

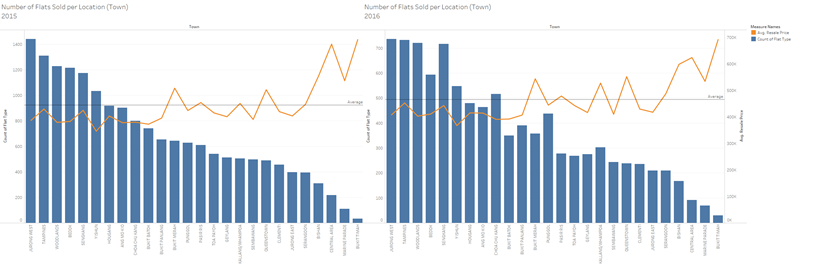

What are the distribution of the resale public housing prices in 2015

The graph above shows the distribution of the number of flats sold per location. It can be seen that Jurong West had the most number of flats sold in 2015 and Bukit Timah had the least number of flats sold in 2015. Has this got to do with the price of the location? The orange line depicting the average resale price shows the relationship between the number of flats sold and the price. It can be seen that Bukit Timah had the highest average resale price, this could be the reason why few flats were sold in this area. Jurong West flats had an average price which was below the average. This analysis shows that there is an inverse relationship between number of flats sold and the cost of the flat.

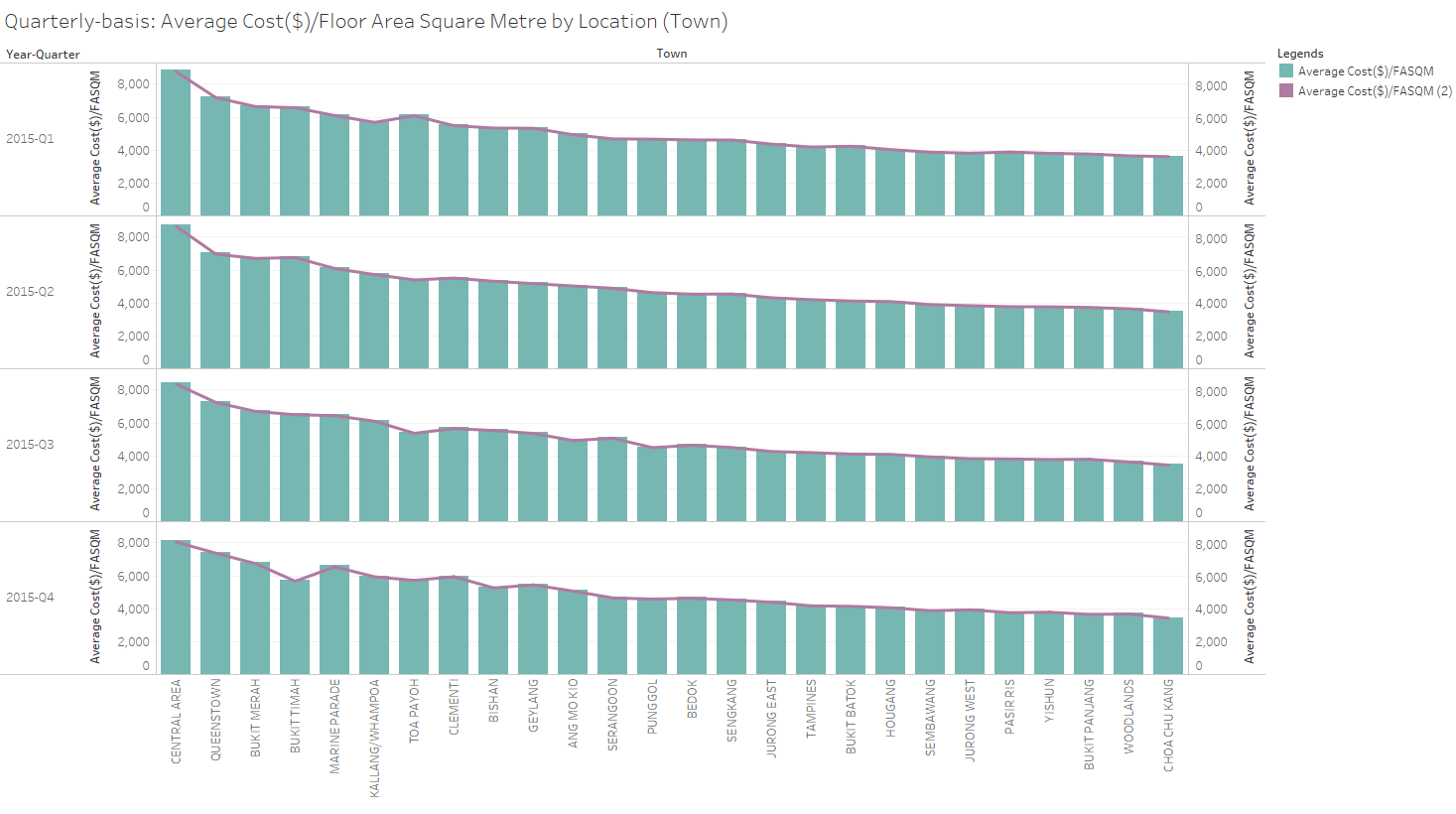

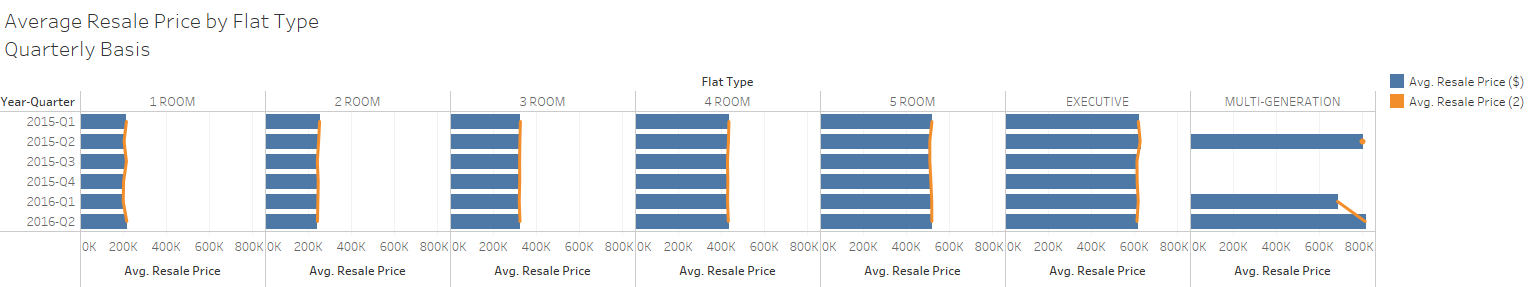

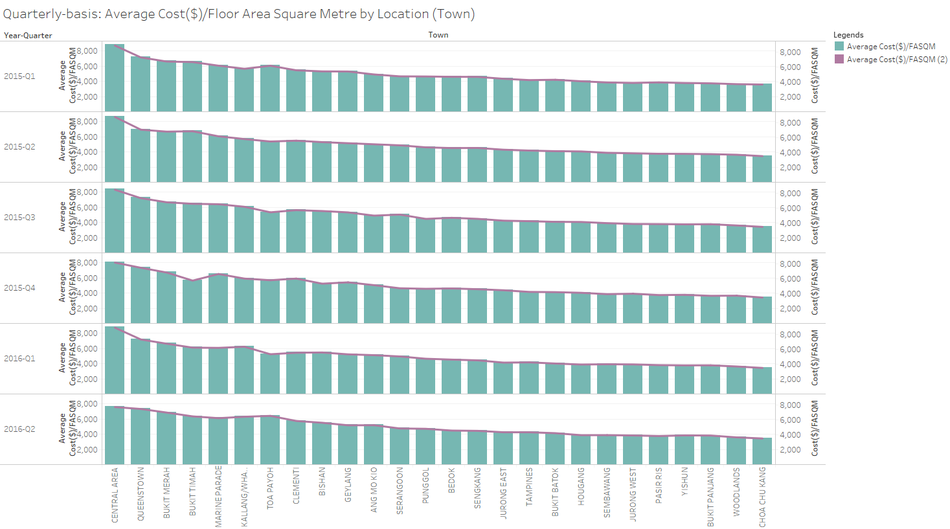

From the graph above, it can be seen that for every quarter, the average cost per square metre does not change much. The same pattern can be seen quarter on quarter, it means there was little price volatility for the year 2015.

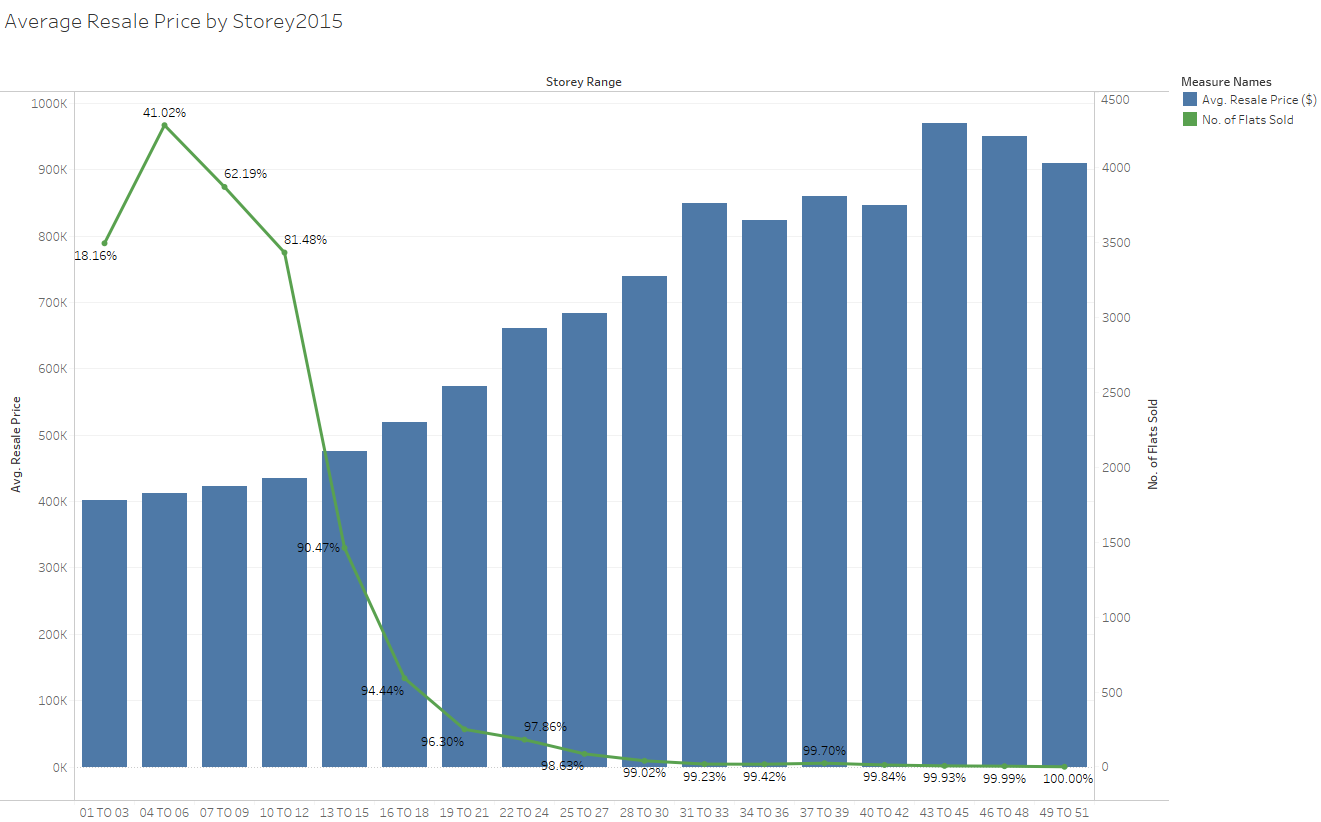

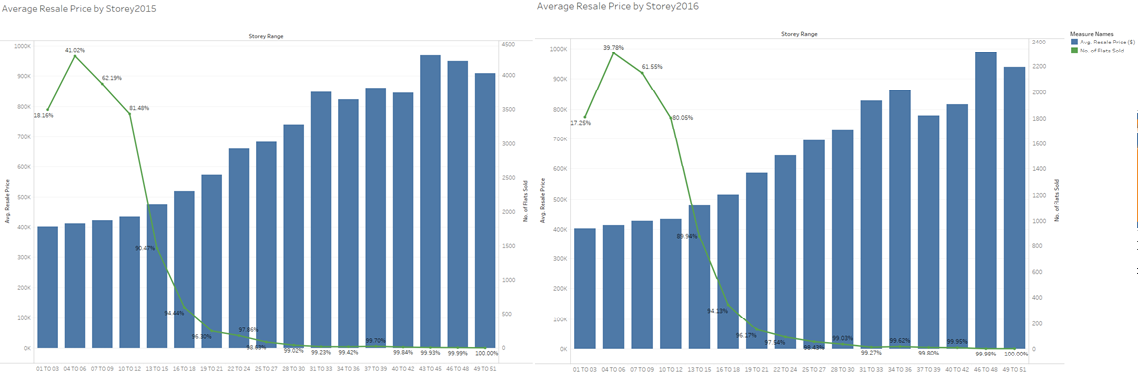

The graph above shows the average resale price per type of floor. It can be seen that the higher the floor is, the more expensive it gets. However, there is an inverse relationship with the number of flats sold. The more expensive the flats got (higher the floor), the less flats people purchased. It can be seen the most popular type of flat is the 04 to 06 flats.

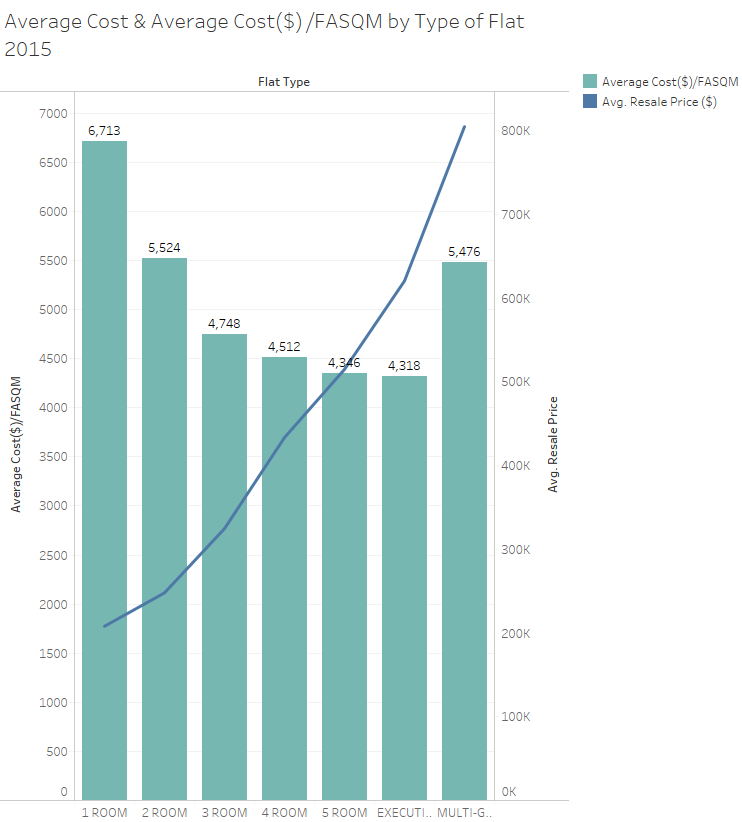

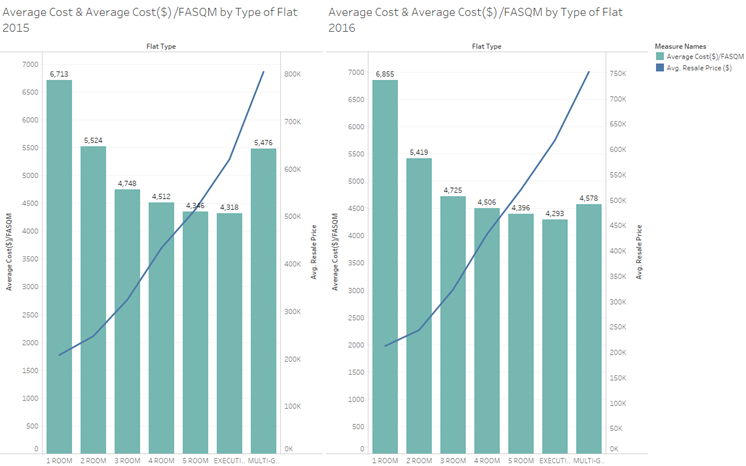

The graph above shows the average cost per square metre by type of flat. Majority of buyers would have the assumption that Executive HDBs are extravagant. However, from this graph it shows that this is false. In fact, Executive HDBs have the most value per dollar. The average cost per square feet is the lowest amongst the different types of flats. Though is the most cost-effective, it comes with a heavy price tag (above 600,000). Another interesting fact to note is the 1-room flats. The irony in this is that they are in-fact the least cost-effective type of flats but are catered towards the lower income families. An interesting point of analysis to further question this, would be to find out the difference between number of rentals and purchased 1-room flats. Answering this would then lead to the next question, is rental or purchase of 1-room flats more cost-effective?

With reference to the above findings, compare the patterns of the first-half of 2016 with the patterns of 2015

From 2015 to 2016, the average price for each flat type has not changed in any noticeable jumps, except for Multi-generational flats as seen in from 2015 Q2's price drop seen in 2016 Q1 and then reverting back in price similar to 2015 Q2.

In this comparison above, the significant jump in terms of number of resale applicants from Q1 to Q2 has continued from 2015 to 2016.

In this comparison above, the % of total number of sales by type of flat has remained the same. 4, 3 and 5-room flats account for 90% of total number of sales in 2015 and 2016.

In this comparison above, it can be seen that there has been a significant increase in number of flats in these locations: Tampines, Woodlands, Sengkang, Hougang, Choa Chu Kang and Punggol. A few reasons for this cause could be due to the increasing number of en-blocs in these areas and also the effect of the Build-to-Order Flats (especially in Punggol where many residents have completed their required owner occupancy criteria and want to resell). Other than these findings, the average cost by location has not changed much.

In this comparison above, it can be seen that in 2016, the price volatility for the average cost per floor area square metre has not moved much since 2015.

In this comparison above, average resale price by storey has not changed. Majority of buyers bought Floors 01 to 15 in 2016 as they did in 2015.

In this comparison above, it can be seen that the average cost per area square metre has remained constant. Executive HDBs remain the most cost-effective while 1-room flats remain the most cost-ineffective.

Problem and Motivation

Based on the conclusions drawn from the previous analysis of the (1) shares of re-sale public housing supply and (2) distribution of re-sale public housing prices. A single conclusion can be drawn; 4-room flats are the most supplied as well as demanded type of public housing in Singapore.

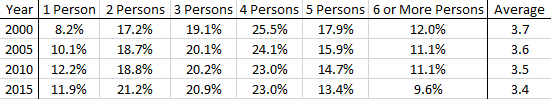

After conducting research with supporting statistics from both Singstat and Data.gov, it was found out that the majority size of a typical household was 4. The statistics shown below, explained why 4-room flats were in large demand and supply by Singaporeans. It is an average Singaporean family’s property needs.

With the analysis done on the resale supply and prices in 2015, single conclusion derived (4-room flats popularity) and supporting statistics from Data.gov and Singstat.gov

affirming the conclusion, this provides us with the necessary information to further analyze the resale trends for a typical household.

Presently, Singaporean families cannot decide which property to buy, there are just too many variables to think about: Location, Price, Size and etc.

However, based on the above findings, this analysis shall address the majority of Singaporean families (those with a household size of 4) flat purchasing problems. The purpose of this analysis is to determine the most cost-effective 4-room flat for the average Singaporean Household. This will save the buyer time, money and most importantly put a roof over his family's head.

Approaches

What is the best 4-room flat an average family can get at the least cost?

Does the time period matter when purchasing a 4-room flat?

To answer the following questions, the analysis conducted will focus on the the trends seen from 2015 to 2016-Q2 and answer the following questions:

Could the timing of your purchase get you the best price?

If so, which quarter should you purchase your property in?

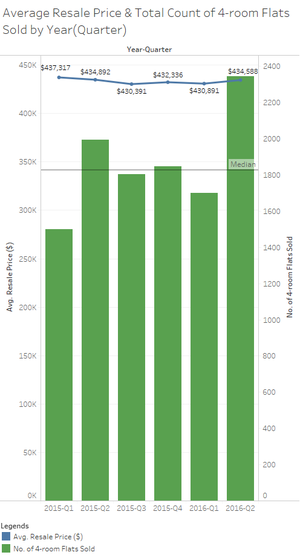

In the analysis below, the graph illustrates the average resale price of a 4-room flat against the different quarters to determine which quarter had the lowest average price. It also includes the number of 4-room flats sold in the different quarters to illustrate the number of choices the buyer would have.

From the graph shown, it can be seen that 2015-Q3 has the lowest average price per 4-room flat sold. In 2015-Q3 it neither has the least nor largest number of 4-room flats sold; it is in the median (as illustrated).

Conclusion we can draw:

- Q3 provides the lowest price

- Q3 provides a good supply (it is at median line) of 4-room flats to choose from

This pattern can be seen from 2015, however 2016 may draw a different conclusion as 2016-Q3 results have not been published. However, if this pattern proves to be true in 2016-Q3 as seen in 2015, it would be recommended for buyers to look for 4-room flats to purchase during Q3.

Does the location of your property matter when purchasing a 4-room flat?

To remain consistent, the same time period of 2015 to 2016-Q2 will be used to conduct this analysis and answer the following questions:

Which location can you get the best price from?

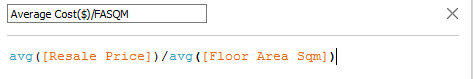

>>Metric used: Average Cost ($)/Floor Area Square Metre

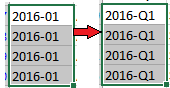

In order to go about answering this question, the data used had to be reorganized as shown below and a new calculated field, Average Cost ($)/Floor Area Square Metre had to be created. This uses a simple formula together with the respective filters for the Year-Quarter (2015 to 2016) and Flat Type (4-Room). This metric is key to begin this analysis.

Based on our previous analysis: Does the time period matter when purchasing a 4-room flat?

I found out that:

- Q3 provides the lowest price

- Q3 provides a good supply (it is at median line) of 4-room flats to choose from

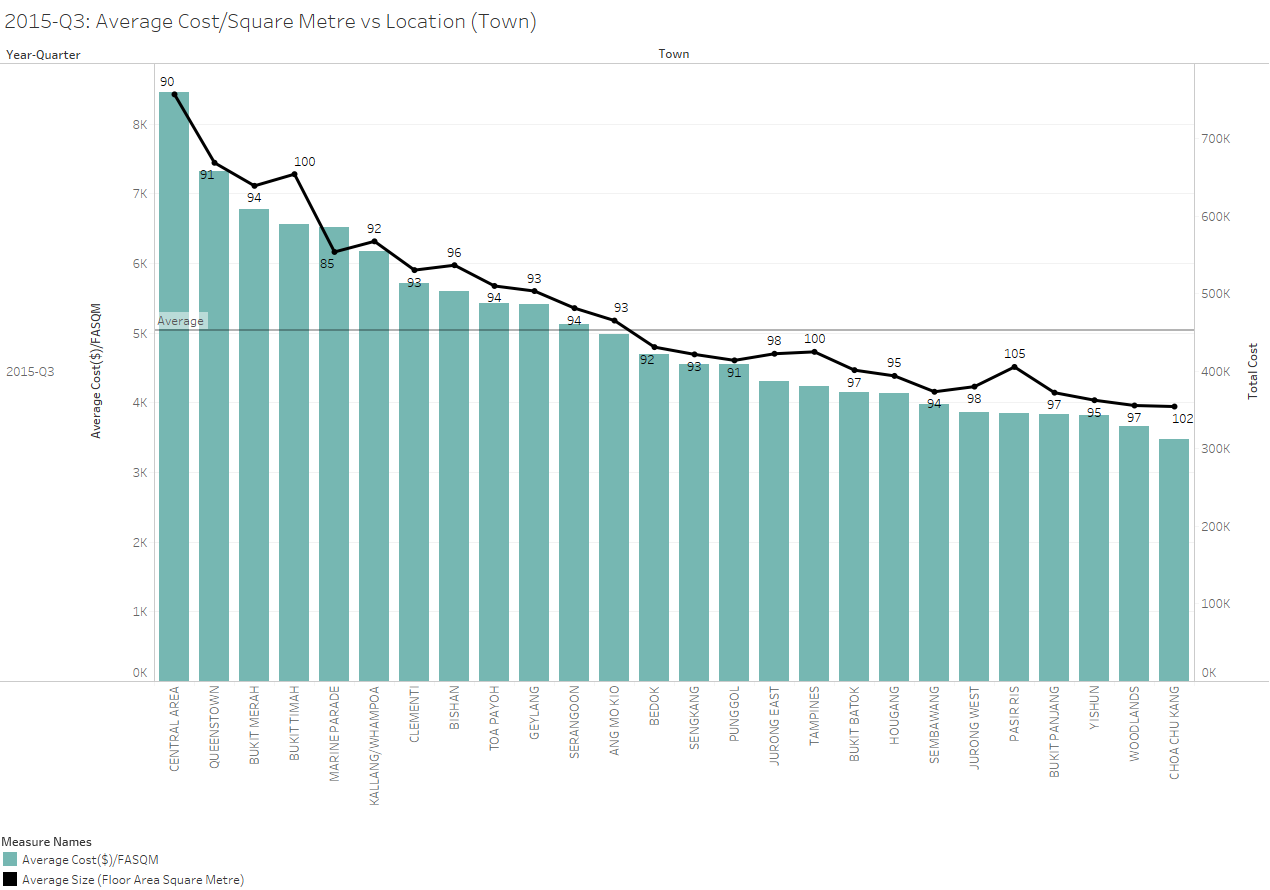

Hence, the focus will be on 2015-Q3. In this graph, its primary focus is to show the average cost ($) per square metre per location. The secondary purpose is to show the average size of a typical 4-room flat per location. The average square metre per location is marked and labelled in black. Using this, we will focus below the reference line (average) of the average cost per square metre in order to narrow the scope towards the most cost-effective flats per location. From this, the most cost-effective and largest sized flats can be identified easily.

It can be seen that the biggest flats (>100 area square metres) are:

- Pasir Ris (105.4 sqm)

- Choa Chu Kang (102.1 sqm)

- Tampines (100.3 sqm)

The data in the table below supports these findings and provides the cost of the respective flats per location for reference.

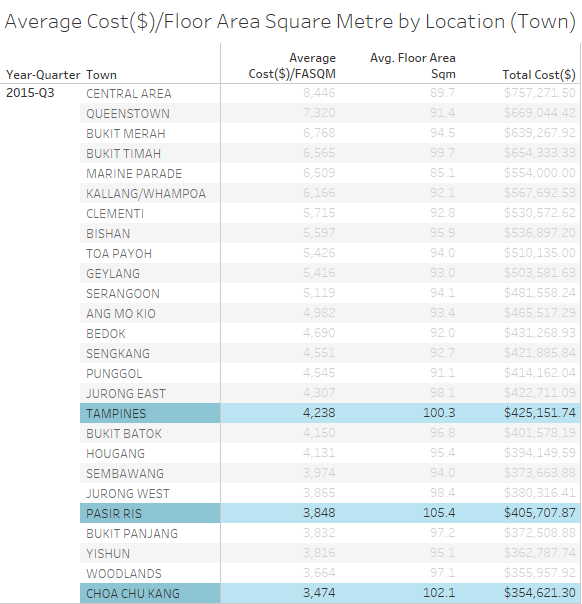

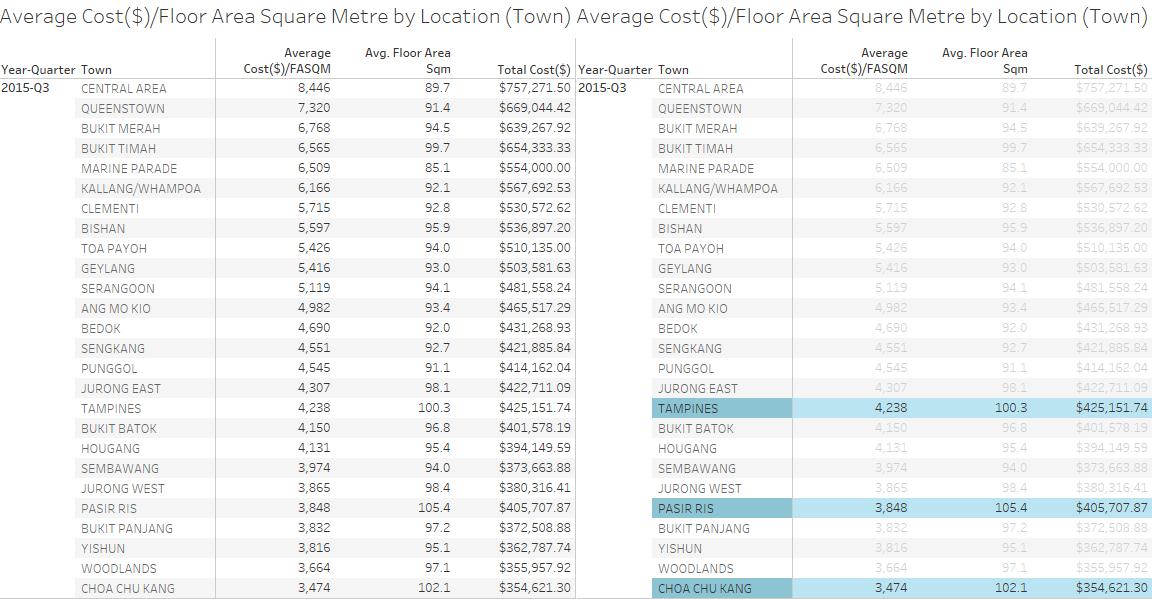

By generating the tables below, buyers can reference against the average cost per square metre, average size and average cost to make their own judgement. The table below is sorted in ascending based on the average cost per square metre, it includes the average floor area square metre and the total cost. This allows potential buyer to identify the most cost-effective flat (by average cost per square metre), the flat size they want (average floor area square metre), and the total amount that would be required to invest in the flat.

Finalizing the options(3)

Comparison amongst the three biggest 4-room flats:

- Choa Chu Kang has the lowest average cost per square metre and the flat size is an average of 102.1 square metres; the median size of the chosen three locations.

- Pasir Ris has next lowest average cost per square metre and the flat size is an average of 105.4 square metres; the largest size of the chosen three locations and also amongst all the locations.

- Tampines has the highest average cost per square metre and the flat size is average of 100.3 square metres; the smallest size amongst the chosen three locations.

Verdict

Cheapest 4-room flat:

Choa Chu Kang

Cost: $354,621

Size: 102.1 Square Metres (second largest average size amongst all locations)

Largest 4-room flat:

Pasir Ris

Cost: $405,707 (lowest possible price using average cost per square metre metric)

Size: 105.4 Square Metres

Tampines, although the third largest flat, does not give you the best average cost per square metre. Hence, will be excluded as it meets neither of the two criteria in picking the most cost-effective flat:

- Largest size

- Lowest cost

In conclusion, should you continue seeing the trend of 4-room flat prices being at its lowest price and having the median number of flats in 2016-Q3, combined with this analysis on the most cost-effective flat, potential buyers can use the analysis as a good reference point in buying the most worth it 4-room flat.

Results

This analysis is focused towards an average sized family looking to buy a flat. However, the methodology into finding out the results can be used in other analysis such as finding the best price for 5-room flats and etc. It does not limit the scope for another analysis but provides sufficient statistics and methods to support other forms of analysis.

Tools Utilized

- Tableau

- Excel Data

- Paint

- Wikipedia

Limitations

Tableau

Although it has gone through many upgrades and has a great user interface, many basic functions such as highlighting, labeling, scale-sizing and etc. are too complex, it requires the user to go through a filter parameter/calculated field/rule-based function in order to conduct such a basic function. I would prefer if it were to be similar to excel, which allows the user to either use conditional formatting or manual formatting, this creates flexibility. Other than that, it is a great software to analyze data!

Data

The data derived from Data.gov.sg is limited often varies in terms of format (year to year basis). This hinders analysis and requires the user to search for other sources to piece together a clear picture of the data set.

The data set used for this assignment is from 2015-2016, it is very limited in terms of identifying trends and the results may not be reliable considering it is only a span of 1 year as compared to data spanning a range of 10 years.