ISSS608 2016-17 T1 Assign1 Ye Jiatao

Contents

Abstract

In Singapore, everyone wants to own their dream house. For the young who just start working, resale house would be a good choice as their first bulk commodity. In this project, we would present some useful information and insight regarding to resale housing market in Singapore using data visualisation, which can help our viewers grab a whole picture about the resale housing market in SG. In this case, we would focus on answering several significant considerations firstly come to mind when we want to purchase a house in SG, such as, location, price, flat type and so on. The dataset we used in this project is Resale Flat records from March 2012 to Jun 2016 took from data.gov.sg.

Problem

Imagine you want to buy your new house in Singapore, what questions do you need to answer yourself before you take action. In this project, we provide some insight about 3 most important considerations we need to go through before we come to the final decision to purchase a new house in Singapore. These 3 issues we include are:

- Price. The price of a resale house definitely would be the first thing come into mind when we want to buy a new house, which can be further separate into 2 question -- "How much can I afford?" and "What is the resale housing supply condition within my budget in market?".

- Attributes of Resale House. What kind of house do we want to buy would be another aspect we need to go through. Actually, this issue can be decoded into several subset in this case -- "What about the location for the house?", "What is the type of the flat?" and "What floor range do you like?" .

- Time Series of Price and Supply Change. The price and supply would change time to time in housing market. Form historical data, we may find some pattern in terms of the price and supply change of resale houses, which make us a advantage in resale housing market.

To come up with the answers for the 3 problems above, the main variables and considerations we take into account in this project include:

- Resale Housing Supply in terms of various flat types.

- Resale Housing Supply in terms of various location (Town).

- Resale Housing Supply in terms of various floor range.

- Resale Housing Supply change monthly in 2015.

- Resale Housing Price Distribution.

- Resale Housing Price in terms of various location.

- Resale Housing Price in terms of various flat type.

- Resale Housing Price change monthly.

Approaches

Approaches Summary

To come up with a reasonable resolution for the problems discussed above, we mainly used bar chart, Pareto chart, histogram, time series analysis and box-and-whisker plot in this project. As a result, we will have several different plots to answer correspond problems. In addition, we can have a whole picture about the Singapore resale housing market from combining all the charts together.

Resale Hosing Supply

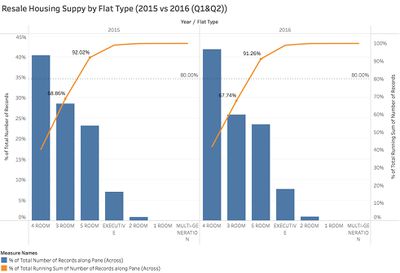

Firstly, let take a look about the shares of the resale public housing supply in 2015 from different aspects, including flat type, location and floor range. Form the 3 chart below, we can have a rough judgement about supply condition for different kinds of resale house in Singapore housing market.

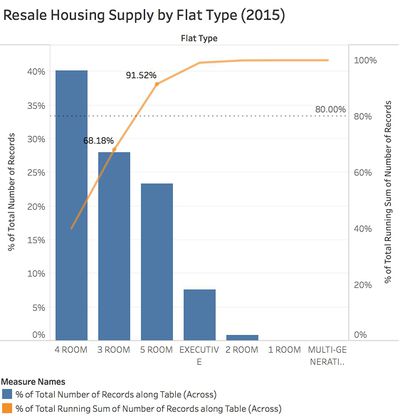

From the Pareto Chart above, we can know that resale public houses with 4 ROOMs (40.16%) are most popular and common in the market, following by houses with 3 ROOMs (28.02%) and 5 ROOMs (23.34%), respectively. In addition, by looking at the cumulative curve, we can draw the conclusion that resale house with 3, 4 and 5 ROOMs take account for large proportion in the supply share, which add up to 91.52%. On the contrary, it is hard to find resale houses with 2 or 1 ROOMs and MULTI-GENERATION house in Singapore comparing to other flat types.

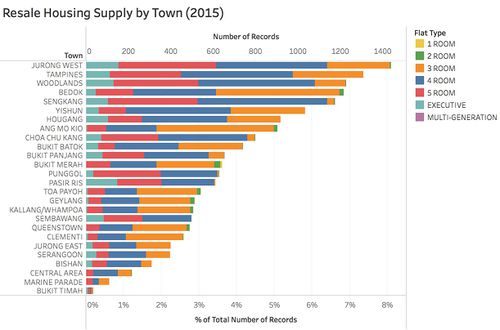

The figure above shows the resale housing supply in terms of different location (Town) in Singapore in 2015. We can know that JURONG WEST have the most sufficient resale housing supply in 2015, which provided over 1400 houses (over 8%) in the whole year, while BULIT TIMAH have the least housing supply (around 2%). In addition, we can clearly understand that there are only a few towns providing resale houses with 1 or 2 ROOMS. For example, we can only purchase resale houses with 1 ROOMs in BUKIT MERAH.

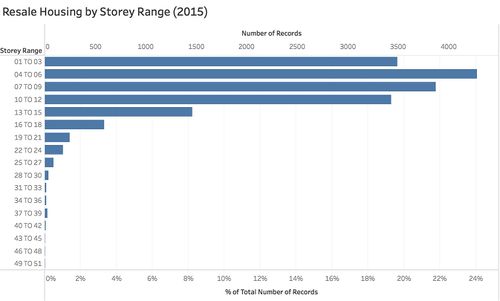

The bar chart above illustrates the resale housing supply change toward different floor range in 2015. Actually, we can can get a rough impression that the housing supply decrease when the floor range increase. There are 2 reasonable explanation for this phenomena. Firstly, most of public houses in Singapore may commonly contain less than 30 floors. In addition, another reason is that people in Singapore more like to live in apartment at high floor, so that most of owners of high-floor houses would not resale their houses.

Resale Housing Price Distribution

Secondly, every potential buyer would interesting about the price of resale housing, which basically another important factor would impact the decision to purchase a house. In this step, we will examine price distribution from different aspects. After that, our viewers would have a better understanding of Singapore resale housing market from a financial point of view.

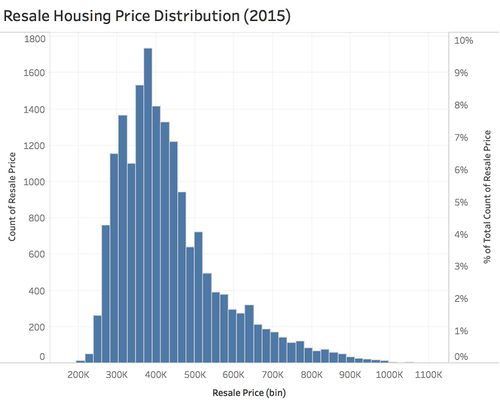

The Histogram above show the distribution of sale housing price in 2015. From the chart, the distribution of resale housing price in 2015 looks similar to normal distribution with slightly right-skew. Most of the resale houses are around 400K, while the highest price can actually reach 1100K.

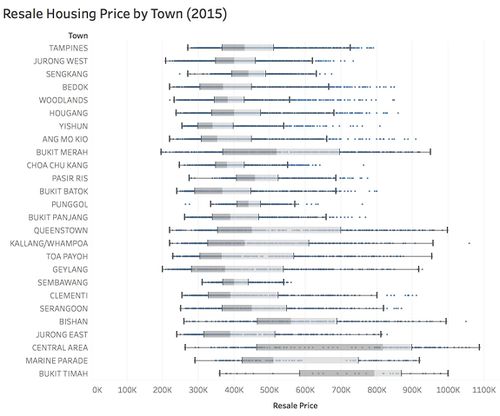

This plot above show the detailed information of price in different location. Form the plot, we can get that the most expensive resale house appear in CENTRAL AREA and most of areas provide a wide range of choice in terms of price to buyers. In addition, although most of resale houses in YISHUN have a relatively low price comparing to that of other town, the up outlier can actually reach 800K.

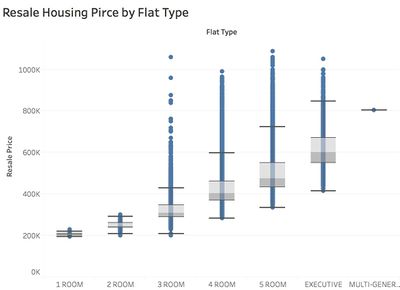

From the plot, we can obviously draw a conclusion that there is a positive correlation between resale housing price and number of rooms. However, there are some resale houses with only 3 rooms have a higher price than that of the most expensive resale house with 4 rooms. In addition, the lowest price of resale houses with 1, 2 and 3 rooms, respectively, are all around 200K.

Time Series Analysis

The price and supply of resale houses change over time in the market. Understanding the patterns of price and supply change monthly would help buyers to determine when would be a good timing to purchase their dream houses. In this step, we perform the time series analysis in terms of these variables, namely, resale housing price and supply.

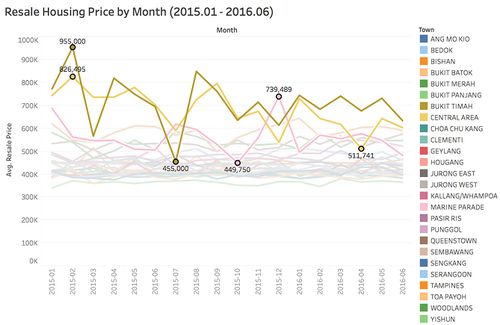

The chart above illustrates how the average resale housing price change monthly from Jan 2015 to Jun 2016. The 3 trend lines highlighted represent 3 towns whose average housing price change dramatically month to month. The average housing price of BUKIT TIMAH ranges from 955,000 to 455,000, while that of CENTRAL AREA and MARINA PARADE range from 826,495 to 511,741 and 739,489 to 449,750, respectively. The dramatical movement of resale housing price demonstrate a high volatility in term of house price in these 3 areas.

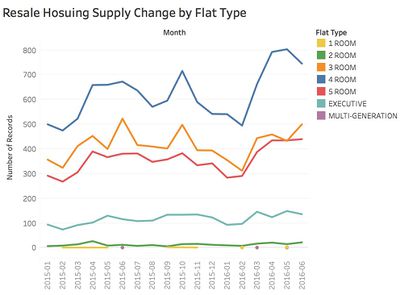

The chart above is the resale housing supply change monthly, It looks would be a down trend of supply of resale houses with 4 rooms in Jul 2016, because the supply just reach the historical highest level in May 2016 in these one and a half years. In addition, 1 room and multi-generation resale houses cannot alway be found in the market.

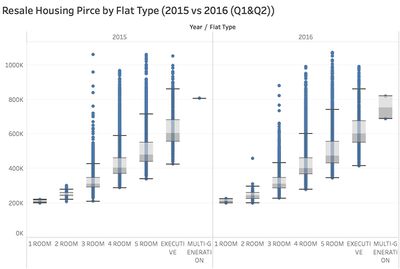

2015 VS 2016

Finally, we compares the pattern of Singapore resale housing price and supply distribution in 2015 and 2016 to check out whether they are similar or not. Basically, the figures below show the pattern of resale housing are very consistent from 2015 to 2016.

Infographics

Tools Utilised

Tool used: Tableau

Chart used:bar chart, Pareto chart, histogram, time series analysis and box-and-whisker plot

technologies used: Univariate analysis, Bivariate analysis, Time Series analysis