ISSS608 2016-17 T1 Assign1 Li Dan

ISSS608 2016-17 T1 Assign1 Li Dan

Contents

Abstract

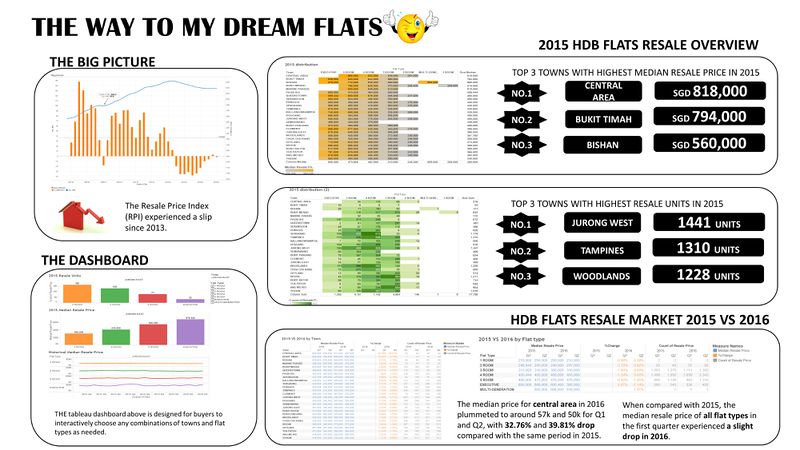

This project presents the historical HDB resale price index showing a big picture of Singapore public housing resale market, and focuses on analyzing the market condition of 2015 and 2016 to give a general guidance to intended HDB flats buyers.

Problem and motivation

Housing and Development Board (HDB) makes homes affordable to everyone in Singapore. However, if a Singaporean or PR wants to buy HDB flats, the key fact and analysis information is not easily accessible as they spread cross websites such Data.gov.sg, SRX and propertyguru. This report aims to analyze and present key facts and statistic analysis of Singapore public housing resale market, which allows intended HDB flats buyers to gain a general idea of HDB flats resale market condition.

Tools Utilised

Tableau version 10.3

Approaches

- The big picture:

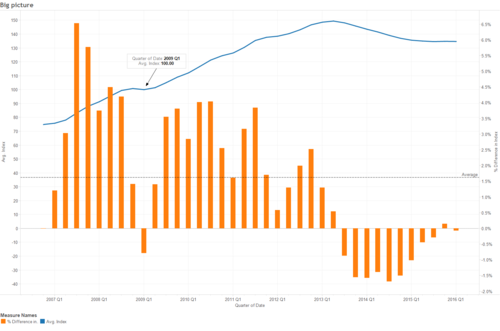

The Resale Price Index (RPI) is an indicator of overall price trend of HDB flats resale market. Previously, RPI is calculated using flat type, flat model as well as location. From 4th quarter of 2014 onwards, the computation method of RPI is modified to further include the attributes of flat structures (storey, height, age) and micro location (closeness to MRT/Plaza).

For the latest 10 years’ period, HDB RPI saw an increase from 74.9 to 149.4 before 2013 Q2, followed by a slip to 134.7 at 2016 Q1. Though with the drop in recent 3 years, there was an average of 1.6% increase each quarter for the whole plotted period. Also note that the RPI experienced less fluctuation in from 2012 to 2016.

- 2015 resale market :

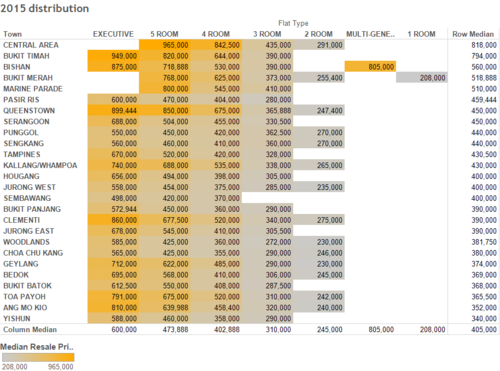

-The Median price distribution

At the first glance, the resale median prices of executive, 5 room and 4 room flats are relatively higher as the majority of dark yellow highlights occur in the first 3 columns. For the 7 flat types, executive flats saw the highest column median of 600 k, which is almost twice to that of 3 room flat. For the resale price of all the towns, central area holds the maximum row median of 818,000 SGD, indicating that half of HDB flat in central area sold at prices above 818,000 SGD; while the row median price for Yi shun is 340,000 SGD, ranking the lowest in all towns.

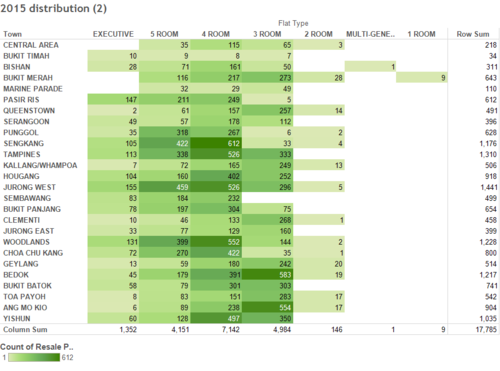

-The transaction volume distribution

Most flats sold are from 3 room ,4 room,5 room type as bigger volume values or darker greens are observed from those 3 columns. 4 room flat type is the best seller with 7142 units sold in 2015, followed by 3 room flats and 5 rooms with transaction volume of 4984 units and 4151 respectively. Besides that, 1441, the highest transaction record among all towns, for second hand HDB flats happened in Jurong West in 2015 while the least number of resales occurred in Bukit Timah.

- Tableau dashboard:

From flats buyers’ perspective, one maybe only interested in buying flats at certain towns or certain type of flats, a tableau dashboard is thus designed for buyers to interactively choose any combinations of towns and flat types as needed. As shown in the picture, if user select the town as Jurong East and check all the flat types, they will get, first, sales volume across flat types in 2015; second, median resale price by flat types in 2015; third, the historical median resale price across flat types from 2012 Q1 to 2016 Q2.

- 2015 VS 2016 HDB Resale Market:

-2015 VS 2016 by Flat type

The RPI of 2016 Q1 is 134.7, dropped 0.66% as compared with the same period in 2016, indicating a gentle downward trend of the HDB resale market. In the first half year of 2016, as it is expected, the resale prices for 4 room, 5 room as well as executive rooms are relatively than those of other type. When compared with 2015, the median resale price of all flat types in the first quarter experienced a slight drop. Especially, 2 room flats’ median resale price fell 3.79% in 2016 Q1. For Q2, there was ups and downs across flat types, no change observe for 3 room and 4 room flats while the median resale price of 5 rooms and executive rooms dropped more than 1%.

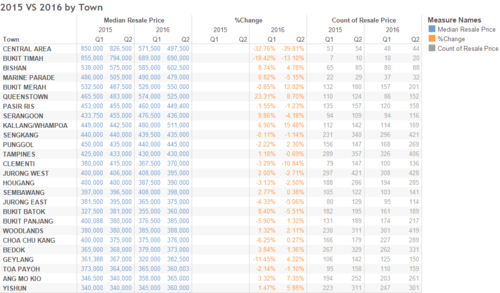

-2015 VS 2016 by Town

In terms of the median resale price by town, central area, as mentioned, holds the highest median transaction price in the first two quarter of 2015. However, the median price in 2016 plummeted to around 57k and 50k for Q1 and Q2, with 32.76% and 39.81% drop compared with the same period in 2015. It can also can be observed that there was a slump in the transaction units in 2016.

The median resale price of Queenstown on the other hand, saw a surge of 23.31% from SGD 465,500 to 574,000 in 2016Q1 as compared with those of 2015Q1, thought the total units sold for this area dropped from 110 to 86.

Results

A public website embedded with tableau dashboard with the above analysis could be developed to help intended HDB second hand flats buys to access the resale market facts and analysis with ease. To enable those buyers to gain a more comprehensive view of the HDB resale market, more attributes such as storey, age and flat model could be further included in the dashboard.