Difference between revisions of "ISSS608 2016-17 T1 Assign1 Meenakshi"

| Line 31: | Line 31: | ||

<p>The results of the study are shown in the infographics below. The observations will enable stake holders to see the past and current trends for housing supply and prices. Business decisions can be influenced positively by studying the demand and supply.</p> | <p>The results of the study are shown in the infographics below. The observations will enable stake holders to see the past and current trends for housing supply and prices. Business decisions can be influenced positively by studying the demand and supply.</p> | ||

<br/> | <br/> | ||

| − | =Public Housing supply 2015= | + | =Public Housing supply 2015 Infographics= |

<p>The results are summarized visually in the below infographic</p> | <p>The results are summarized visually in the below infographic</p> | ||

<gallery> | <gallery> | ||

| Line 37: | Line 37: | ||

</gallery> | </gallery> | ||

<br/> | <br/> | ||

| − | <p>The graph below shows the number of resale applications registered in 2015. We can see that in Q2 there is a surge in supply for commonly transacted flat | + | <p>The graph below shows the number of resale applications registered in 2015. We can see that in Q2 there is a surge in supply for commonly transacted flat types. |

<gallery> | <gallery> | ||

File:QSupply2015.jpg | File:QSupply2015.jpg | ||

| + | </gallery> | ||

| + | </p> | ||

| + | <p>The number of units transacted can be compared for the first half of 2015 and 2016. The stacked bars show the shares by room type. The common trend is that 4 room, 3 room and 5 room units contribute mostly to the totals. The trend seems to be repeating in both the years. | ||

| + | <gallery> | ||

| + | File:CompareSupply015016.jpg | ||

</gallery> | </gallery> | ||

</p> | </p> | ||

Revision as of 16:38, 29 August 2016

Contents

Abstract

Public housing in Singapore is governed by the Housing and Development board. HDB flats are home to over 80% Singaporeans and hence it is important for all the stake holders to understand the supply and price trends for public housing. This will greatly influence the planning in future.

Problem and motivation

The study aims at -

- Understanding the share of supply of resale public housing in 2015.

- Studying the distribution of resale prices with respect to important dimensions such as town and flat type.

- Compare the patterns for 2015 and first half of 2016.

- Note key observations and inferences through visual analytics. The goal is to note a minimum of 3 observations in each case.

Tools Used

Tableau version 10.0

Approaches

- Data collection and cleaning:

The housing data for 2015 and 2016 is available at https://data.gov.sg .The data is clean and ready for analysis. It was necessary to format few fields and data types to be ready to use with the tool.

- Understanding the data:

The various dimensions used in the data set needs to be recorded. This can be easily achieved with appropriate visualization tools. Then we make a note on the different parameters we wish to study and the suitable graphical representation for each case. For instance, Histograms and Box plots could be used to study the Distribution of continuous data types such as prices.

- Analysis:

The data set is imported to the tool and Visual infographics designed for each case. With the graphs and various statistical parameters we note our key observations and compare patterns.

Results

The results of the study are shown in the infographics below. The observations will enable stake holders to see the past and current trends for housing supply and prices. Business decisions can be influenced positively by studying the demand and supply.

Public Housing supply 2015 Infographics

The results are summarized visually in the below infographic

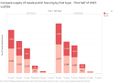

The graph below shows the number of resale applications registered in 2015. We can see that in Q2 there is a surge in supply for commonly transacted flat types.

The number of units transacted can be compared for the first half of 2015 and 2016. The stacked bars show the shares by room type. The common trend is that 4 room, 3 room and 5 room units contribute mostly to the totals. The trend seems to be repeating in both the years.