IS428 2016-17 Term1 Assign1 Au Loong Zer Kirby

Contents

Abstract

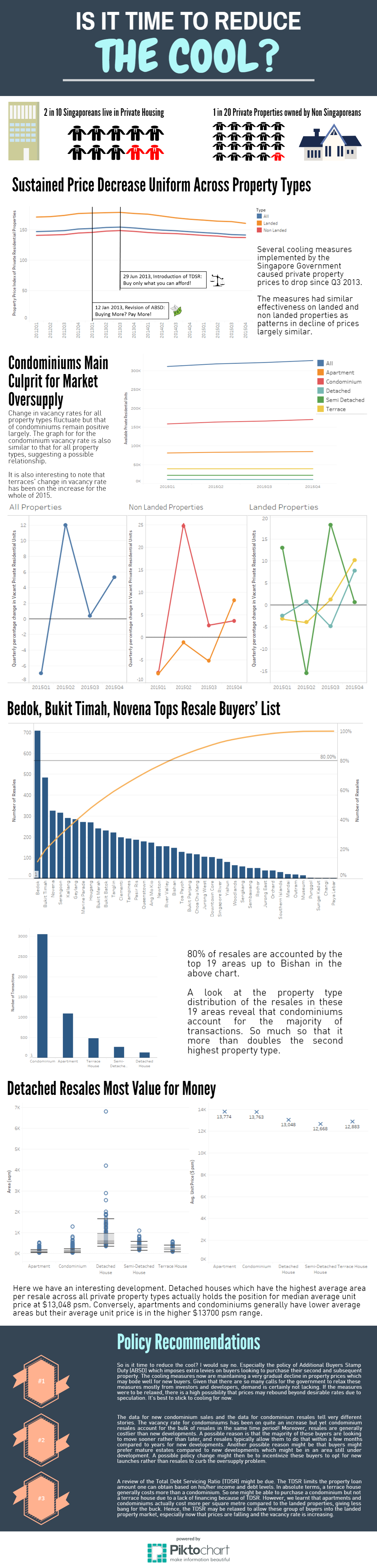

The Singapore Government introduced several property cooling measures between 2012 and 2013 to prevent an uncontrolled property bubble. The measures have worked to good effect, resulting in a sustained fall in property prices since its implementation. Some developers have called for the cooling measures to be relaxed but is it too early to do so? We attempt to find an answer by analyzing the price and supply of private residential properties in 2015.

Problem & Motivation

On one hand, there are the concerns associated with a housing bubble. On the other, there is also the concern that falling prices may contribute to a recession and stagnate the economy. In Singapore, where most people own their residential properties, falling house prices will mean a drop in their main form of wealth. Foreign investment might also fall if the property market continues to look gloomy. So is it a case of simply continuing with or lifting the cooling measures? Or is there a different approach to this problem?

In the following analysis we try to identify:

- Is there a certain segment of the market which requires special attention and a review of policies?

- Patterns in the supply of residential properties.

With these pieces of information, we would then recommend a few strategies that attempt to achieve a balanced outcome for the property market.

Tools

These tools were used in mini assignment 1:

- Micorsoft Excel - For data cleansing and transformations

- Tableau 10.0 - For data exploration and the generation of charts

- Piktochart - For generation of infographics.