IS428 2016-17 Term1 Assign1 Margot Marie T Stelleman

Contents

Abstract

This project aims to look into the trends of the private residential property market in Singapore during 2015. To better understand the market, I would be looking into the supply of private residential properties as well as property prices, with hopes to discover market insights that maybe useful for making policy decisions in 2016.

Problem and Motivation

This project will look at the patterns of the share of private residential property supply in 2015 as well as the distribution of private property price in 2015. From these various insights discovered, this project aims to provide 3 policy recommendations for decision makers implementing policy changes for 2016.

Data choices and cleaning

For this project, data from the Urban Redevelopment Authority (URA) is used, for the period of 2015. In terms of supply of private residential property, we would be looking at the stock available by both planning region and planning area. Stock in this case is refers to completed units or space, whether occupied or unoccupied, that is available for physical occupation, according to the URA. In addition, property prices would be examined in this project as well. Point to note is that considering Executive Condominiums (ECs) would be examined in this study despite it being a Public-Private hybrid property. The reason for looking into ECs in this project is because in 2015, Prime Minister Lee announced an increase of income ceiling for ECs from $12,000 to $14,000. This housing policy change has allowed more couples and families who earned too much to purchase a Build to Order flat to purchase ECs as an option, as opposed to paying for Private property. Hence, it would be interesting to look into ECs as well.

Where could I live in Singapore?

How to represent the supply share for private properties as clearly understandable as possible? When I read share, I am directly thinking to a pie I could share with family or friends. So Pie chart could be an option but it is actually not the best solution. We want to be clear as possible but it won’t be the case with it. The lecture of a pie chart graph can be messy like we have seen it during class lessons. A big graph for not so much which can be misleading the information we want to enlighten because of bad choices in colors of the pie, labels misplaced or bad perception of ratio we do. And it does not fit for comparing over time. Bar chart will be more appropriate. We want to concentrate on thy supply by type or still by region. These are made of different categories; this is why it will fit perfectly to bar chart.

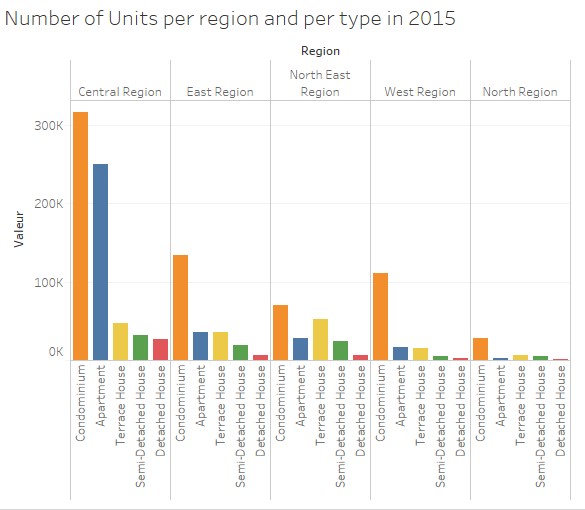

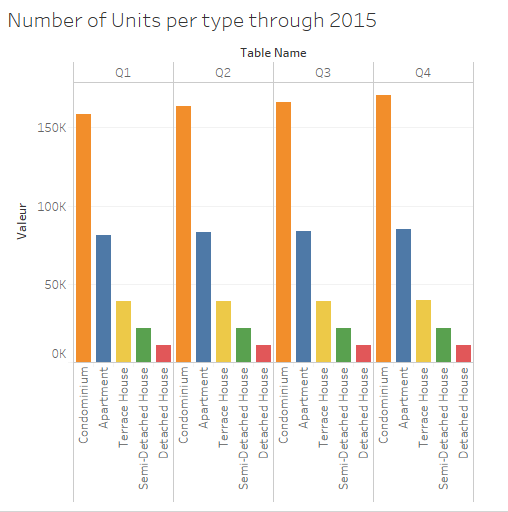

As we can see it in the chart above, in every region, Condominium is the type of housing we will find the most. It will be almost omnipresent in the West and North regions. While in Central region we can find a lot of apartments and in the North East region it will be Terrace House in adding of Condominiums. For this graphics choice of different colors have been made to see the differences between all the types of housing and particularly through the time. And the values have been sorted out to clearly see what types are the most important for each region. In the next graph, it is not on the region we concentrate principally but on the type of housing. Again we are sorting out. And here each type will have a different color to see that we are not talking about the same type for each sub-graphs. We can clearly see that the most important type in term of number is Condominium, next Apartment, Terrace House, Semi-Detached House and finally Detached House. Below, we can see the importance of the Central region, ranking the first in term of number of units for each type except for the Terrace House. They are the most in the North East region, this is explain why apartment were not second in this region in the previous graph.

The next graph shows us how the supply evolves through 2015. Condominium evolves slowly which is strengthening their “leader” position. While the other types are more stable and evolves quite less quick than Condo’s. Again each type is in a different color which allows to remark every type in every quarter and compared the same type easily.

The next graphic has a fail. It should have been colored in the same way of thinking than the previous one. We can see the importance of colors and how it helps. We can figure it out the same results but it is taking much more time and more difficulties to do it. In fact, we can barely compare the numbers for a same region because every region is blue, which is confusing. Anyway we are able to see that every region is in rising. This is more visible for the Central region.

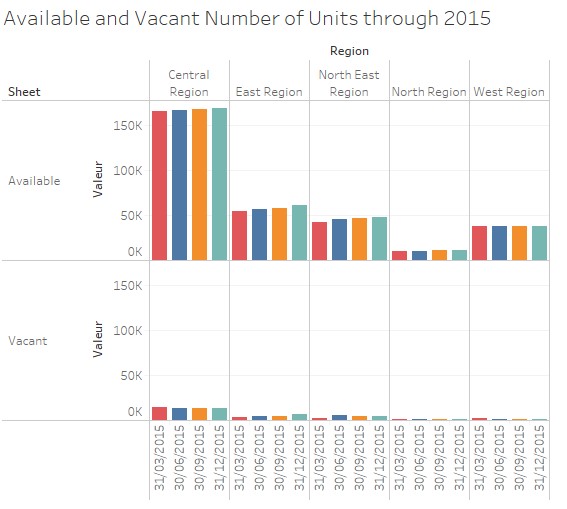

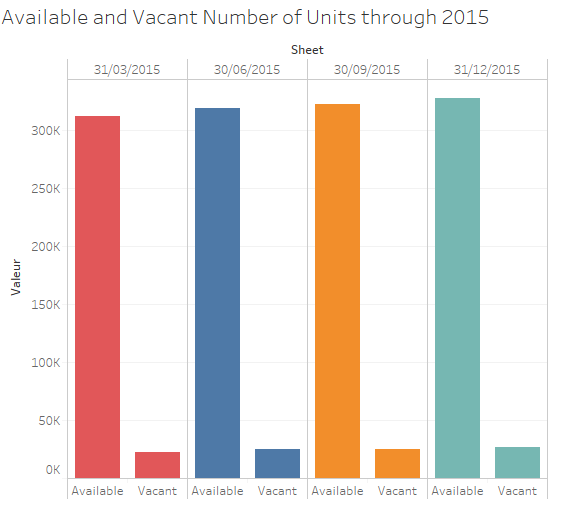

On the next graphic we can see this rising more definitely efficiently and easily, colored, grouped by region. This is a perfect example to prove that designing of a graph is essential. It confirms the growth for the Central region but also for the others, which was not quite obvious on the previous one. Just the West region remains stable. Here again we can see how the Central region is busy. It is because it is the central area of Singapore were people are working. Moreover, this graph goes also about vacancy and we can see she is proportional to the availability. The more the regions offers housing, the more it will have vacant places. But through the different quarter vacancy is falling slowly, except for East region.

The graph below presents the situation in an aggregate way. We can still clearly see that availability is rising. But here it is surprising to see that vacancy is rising. So we could make an assumption as followed: because availability grows, vacancy do so. Here again the colors are important making differences between the quarters. And the labels are easy to read because they are horizontal.

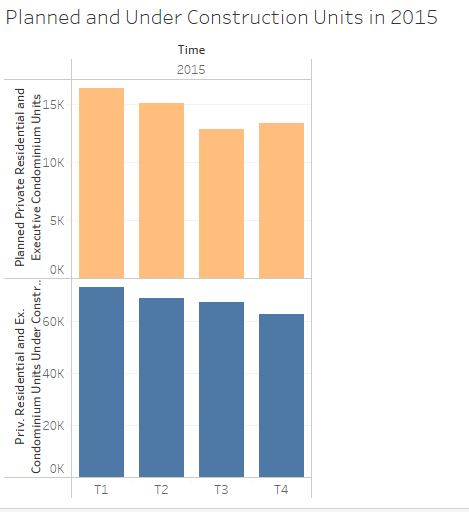

We also need to have attention on the current construction at that time to know how they will influence the supply and the availability in the next years.

Under construction units are falling down. While the planned ones, which are quite inferior to the under construction ones, are also falling down quickly but slightly rising in quarter 4. With the two different colors we can difference that we are not talking about the same variables.

After analyzing the supply in 2015 for private residential we can say several things:

- Central region is where the most of housing are, specially with condominiums and apartment and the vacancy was falling down slowly in 2015.

- Condominium is the most important type of housing.

- The new construction might be fewer than in the past.

Is it out of my budget?!

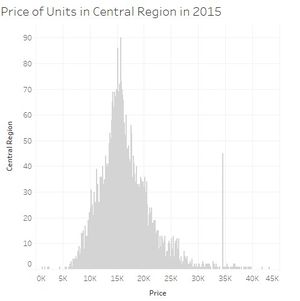

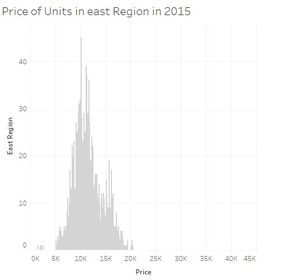

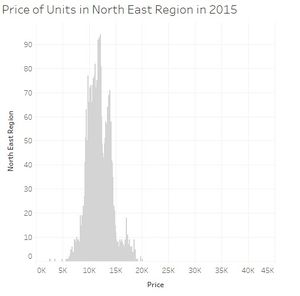

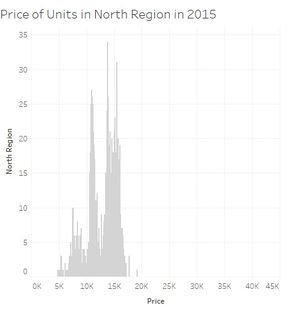

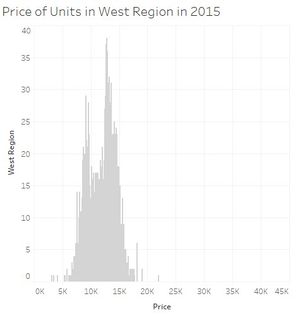

When we look carefully at all the price distribution for each region we can see that most of them the prices are usually between 5000 and 20000 SGD per 100 square meters and with a peak around 10000-15000 SGD. Two regions are not following this. Central region is even more dispersed, 5000 till sometimes almost 45000 SGD per 100 square meters. And the peak is also moving to around 15000 till 20000 SGD. And finally North region is less expensive while units per 100 square meters reaching not the 20000SGD.

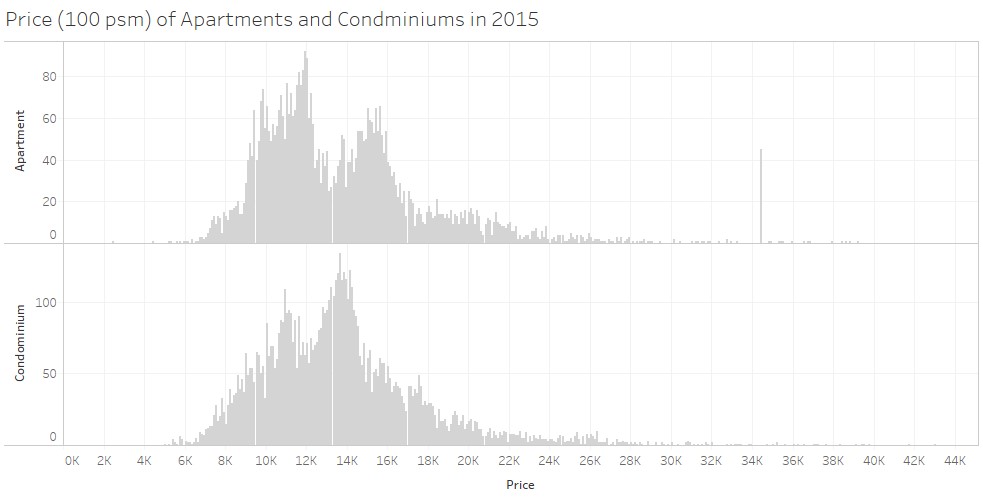

Because non-landed are significantly more important in term of numbers of units, I have chosen to concentrate on the price of this type, which is Apartment and condominiums. These two types are quite similar in the prices. Apartment could tent to be more expensive for some of them. There is a peak in the price for apartments before the peak of the prices of the condominiums, but after there is again a peak for the apartments around 16000 SGD. It is quite difficult to say which one is the best deal.

This disposition allows us to compare easily the curve of prices. For all the graphs in this section, histograms have been used because they are perfect to represent the distribution of a continuous variable, here the price.

We can say after these observations that:

- Non-Landed numbers of units is a lot more important than the Landed and can be more expensive.

- Central region is the most important in term of number of units but also the most expensive.

- North region has the lowest numbers of units but also less expensive.

If I was the president...

1) The Central region is offering much more units than the others. Rising the number of units in the other region will rise the vacancy which is quite low in the others regions, and will reduce the prices for the Central Region. It could improve the quality of living for the people in the Central region by reducing the numbers of people living there but of course the others regions need to be attractive. Several changes need to be thought and made before, such asthe transportation; find a way to take the people as faster as possible to their work place such as if they were living in the central area. Or also developed more green places and facilities to sell them a peaceful life and not the rush and the noise of the city center.

2) The planned and under construction units are falling down. But population will still grow. Government needs to stimulate the construction of units to avoid a break in the vacancy. Vacancy which is as we analyzed it slightly going down in some regions. For example, they can play on the interest rate for a loan to stimulate and encourage people to build houses or still giving some money rewards or help.

3) Condominiums and apartments are good in busy area to fit a maximum of persons. But in the regions more far away of the city center, we could build regular houses which are landed properties. Landed properties are much less than Non-Landed one. The government could promote landed properties to equilibrate the balance between the different types of housing and then it could also be a way develop the other regions not in the center of Singapore to have more units in term of numbers as said in the point 1.

Inforgraphics

Click on the image to enlarge and zoom. Erratum: Condominiums and Apartments are the two types of housing we wil find THE MOST*