IS428 2016-17 Term1 Assign1 Tee Yu Xuan

Contents

Abstract

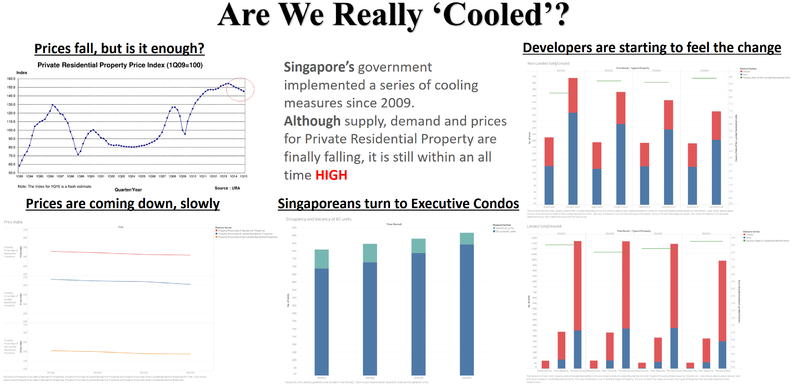

This project aims at identifying the trends of private residential properties (including Executive Condominiums) in Singapore for the Year of 2015. The price index and share of property distribution will be taken into consideration to evaluate if the previous private property policies implemented by the government has made any significant changes.

The findings of this project will provide 3 recommended policies to further improve the private property markets in Singapore.

Problem and Motivation

Since residential prices surged in 2009 by 15.75% after the recovery of the slump in the economy during 2008. The surge in property demands renewed fears of a property bubble and the Singapore government has warned against the speculation and implemented a series of cooling measures along the years. Additional taxes such as stamp duty on additional private property purchases and harder requirements for taking up loans were introduced to make property purchases a much heavier decision to make than before.

Some important cooling measures introduced were:

- Stamp duties on private property purchases (up to 3% depending on property price)

- Additional stamp duties on purchasers who are looking to by their 2nd, 3rd or nth private property (7% for 2nd, 10% for 3rd etc.)

- Additional stamp duties on PR or foreign purchasers (up to 15% of property price)

- Bank Loan restrictions, banks are allowed to give loans up to 80% of total property price

- Stricter income requirements to qualify to different amount of loans, to prevent likelihood of defaulting on mortgage payments

After six years of cooling measures, many developers, property agents and industry associates have been calling for the measures to be lifted or amended.

But has Singapore's private property market really recovered and escaped the risk of a property bubble? Or are these industry related agencies looking to increase their profits by calling for amendments?

Data (I almost wanted to give up here)

To understand if the cooling measures implemented have made any effect on the property market, the prices and supply of the property in Singapore have to be analysed.

Data used in this project are taken from REALIS which is managed by Urban Redevelopment Authority (URA) of Singapore, to ensure accuracy and relevance to the property market the project is targeting. For higher relevance, most data acquired regarding the Year of 2015.

Approaches

On further research on the URA website, they have released certain real estate figures describing the amount of private property launches and their take-ups by buyers.

While examining the data collected from REALIS, a certain trend can be seen aligning with the launch and take-up trends.

The above charts all show a significant trend which aligns with URA's launch and take-up data:

- The amount of properties being built is on a decline (small amounts, but certainly a consistent decline).

- The vacancy rate of units are increasing, even though smaller numbers of units are being built.

- Number of units being sold in each quarter is declining.

If take-ups and sales of properties remain consistent, smaller number of properties being built will result in lower vacancy rates as people are purchasing more than the supply. However with vacancy rate declining along with supply, it shows that not only are the buyers declining as well, but at a faster rate than the number of properties built per quarter.

This finding indicates that the private property market in Singapore is definitely slowing down and the cooling measures have worked to a certain extent. (That or the economy, is really just bad right now...)

However, while looking through the data, this project also managed to identify an outlier from the common trends.

Although all other categories of private properties are on a decline, EC supply are still increasing consistently and vacancy rates are also decreasing. This can be seen as a good news for Singapore's property market as EC purchases are more strictly governed by HDB, mainly supplying to the 'sandwiched' upper-middle-class families whose income are too high for HDBs but insufficient for private properties like Terraces and Condominiums.

This can also be an indicator that private property market's cooling measures worked and have reduced both local and foreigners from investing too heavily in Singapore property market which was threatening a property bubble. The increase in EC purchases also indicates that Singaporeans looking to purchase their homes still have an alternative in the EC market even though private properties have gotten more difficult to finance.

Further examining in the data provided by price indexes of the private property market revealed the following information:

The price index for all areas of private properties can be seen in the above chart, showing a steady decline in 2015.

However just basing on the above information, it would have given property market industry players a reason to call for amendments to the cooling measures. As it can be seen that the market is indeed in a 'cooling' off phase with both supply, prices and demand declining.

Therefore this project also wish to bring reference to a piece of data released by the URA in Jan 2016[2].

As seen in the above charts:

- Although the property price index has fallen in 2015 with the cooling measures in place, it has barely returned to the same level it was in 2011.

- Taking also into account, the cooling measures were put in placed after the surge of 15.75% in 2009 and continued rising till its first visible decline in 2013.

- Although prices are indeed falling, it has yet to returned to a level where concerns of a property bubble are no longer needed. Prices are still at a high as compared to 2009.

Therefore it is still an uncertainty if there should be any removal or easing of the cooling measures as called for by property industry players.

Possible Policy Recommendations

With support of the charts and data identified above, cooling measures that are in effect are working to a certain extent as intended. However it is still too early to decide if the private property market is out of the dangers of the property bubble.

Therefore the following recommended addition/changes to the policies can be made.

- For completed private properties that have been left vacant for a stipulated number of years, the additional stamp duties can be removed/lowered.

The reason for this being, it is definitely not helping the economy for completed properties that have been vacant for a period of time to be under the same cooling measures. There properties should they be vacant for a decided period of time, would be exempted from the additional stamp duties, thus developers will be able to sell vacant units they held for too long, and foreign investors have another option for investing in Singapore properties. Developers will not be able to leverage on this policy much as no one expects to build a property to be left vacant for X number of years just to benefit from the lower stamp duties.

- Additional cooling measure, increased taxes on private residence property rental income. (for total rental income above X amount, in tiers)

Since majority of property investors rent out their private property purchases and wait for a better market price to sell off their property. Increased taxes on rental income from private residences will deter investors, instead buyers that wishes to make the property one of their residences will not be included in this tax policy. This would increase the likelihood of private property purchases being for personal accommodations instead of investment purposes.

- Lower/Removal of stamp duties for private property purchases by Singaporeans buying their first home.

There are definitely Singaporeans out there who are looking to buy their first homes but are not eligible for HDB, ECs or properties within their income are simply not of their preference. This would allow Singaporeans to purchase their first homes, should their income allow it, to be private properties. The EC market would also be less competitive with the wealthier families going for other private properties instead.

Tools Utilized

- Google Search Engine

- Uncountable numbers of Tableau tutorial videos

- Tableau

- Filters and Excel functions that aids data cleaning

- REALIS

Inforgraphics

Results

Data used in the above ways, chart generation etc. is very beneficial to seeing trends in data that were not possible to be seen in mere tables and numbers. Numbers can easily depict an increase or decrease simply by figures, but whether the amount decreased or increased is meaningful, can be depicted by charts as shown above.

Simply following numbers, property investors have called for amendments and removal of cooling measures just because numbers have declined. But we now know, with the visual aid of analytical charts, the decrements are not sufficient to call for that just yet.

Comments

References

<references>