Difference between revisions of "IS428 2016-17 Term1 Assign1 Liang Bing"

m (Edited format for infographic) |

m (Edited format for infographic) |

||

| Line 111: | Line 111: | ||

==Inforgraphics== | ==Inforgraphics== | ||

| − | [[File:Lb 2016-17Term1 Assignment1 Infographic.jpg|1000px|thumbnail]] | + | [[File:Lb 2016-17Term1 Assignment1 Infographic.jpg|1000px|thumbnail|left]] |

==Results== | ==Results== | ||

Revision as of 01:14, 29 August 2016

Contents

- 1 Abstract

- 2 Problem & Motivation

- 3 Tools & Sites

- 4 Approaches

- 4.1 Overall Unit Supply Pattern in 4 Quarters in 2015

- 4.2 Overall Unit Price Pattern in 4 Quarters in 2015

- 4.3 Intermediate Analysis 1

- 4.4 Unit Supply Pattern by Types of Private Property in 4 quarters in 2015

- 4.5 Unit Price Pattern by Types of Private Property in 4 quarters in 2015

- 4.6 Intermediate Analysis 2

- 4.7 Unit Supply Pattern by Regions in 4 quarters in 2015

- 4.8 Unit Price Pattern by Regions in 4 quarters in 2015

- 4.9 Intermediate Analysis 3

- 5 Inforgraphics

- 6 Results

Abstract

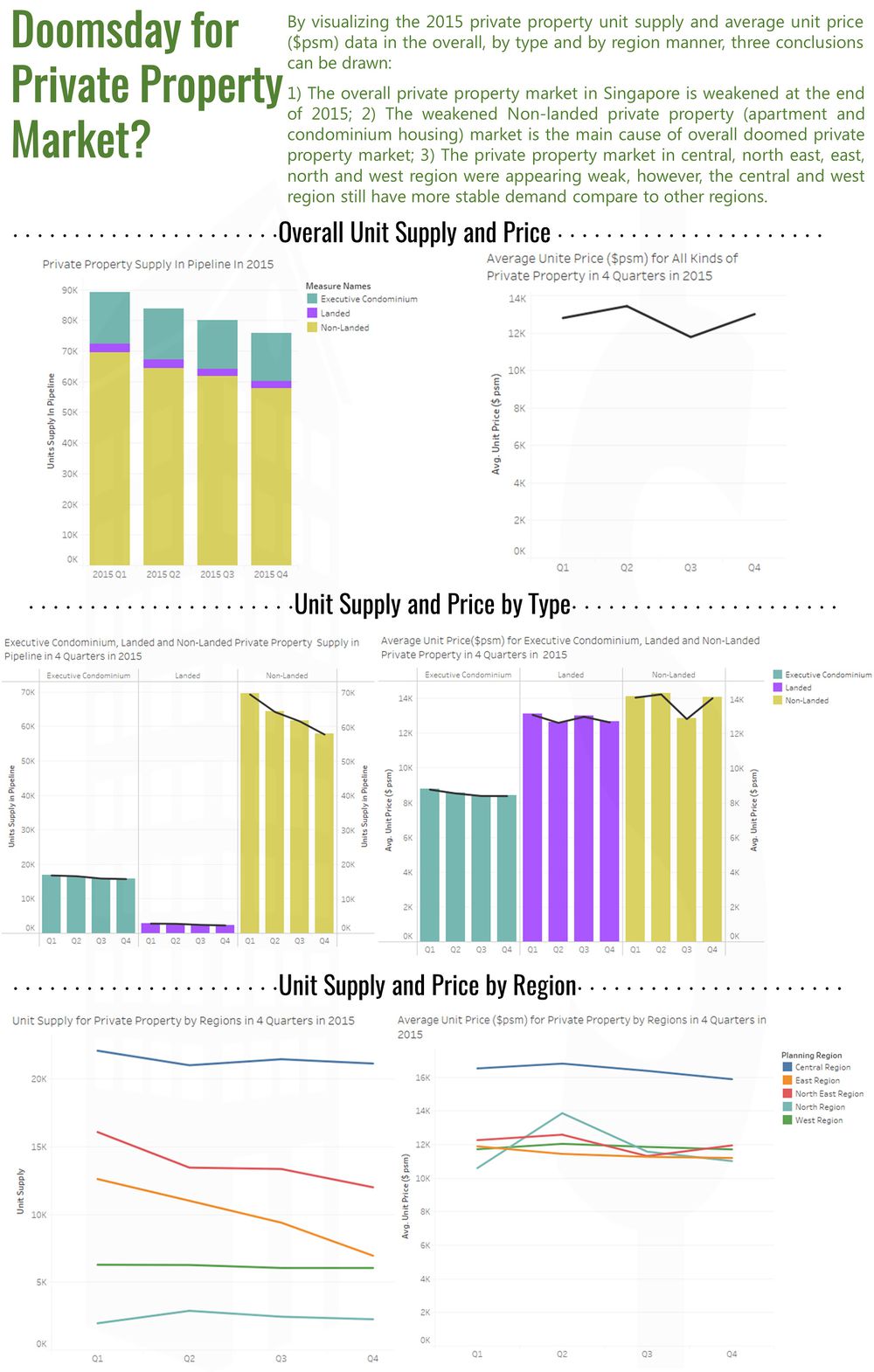

The focus of this report is using data visualization tools and techniques to find the change patterns of private property's supply and price by type of private property and regions in 4 quarters in 2015. By analyzing the patterns and their relationships, the report aims to give insights for suggesting development policies in 2016.

Problem & Motivation

Using the data set I have chosen, I have done a mini analysis to decide the attributes/variables which I am interested to study. And I found that the supply and price pattern for different types of private properties and for private properties in different regions appear to be clear and insightful. It drives me to think the following questions:

- What's the overall pattern for private properties' supply and price?

- What's the supply and price difference for different types of private properties?

- What's the supply and price difference for private properties in different regions?

- What's the relationship between the price and supply for the above two scenarios?

With these questions in mind, the data visualization and analysis conducted in this article should find out useful patterns, help me answer the above questions and suggest the policy of private properties supply for 2016.

Tools & Sites

Tools

- Microsoft Excel: Always powerful and user-friendly in dealing with huge data set. Used for merging data from different files.

- Tableau: Very powerful tool for data visualization and data analysis. However, it is lacking of a user-friendly UI and tutorials for rookies.

Sites

- The official Urban Redevelopment Authority website : It contains quite clear words explanation which helped a lot when I was confused about the URA data's terminology.

Approaches

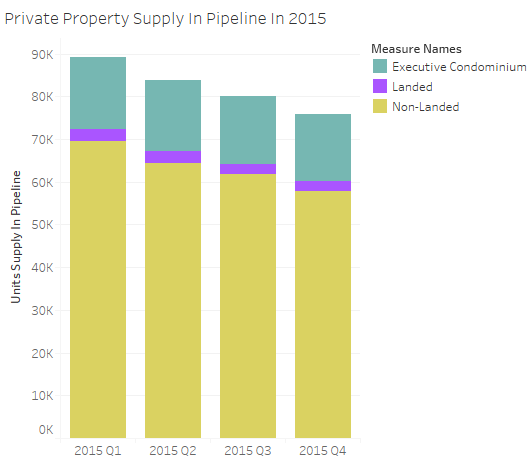

Overall Unit Supply Pattern in 4 Quarters in 2015

- Data Source: The data sets selected for this portion are Supply of Executive Condominium Units in the Pipeline.csv,Supply of Landed Private Residential Units in the Pipeline.csv and Supply of Non-Landed Private Residential Units in the Pipeline.

- Step by Step:

1. Data set combination: To facilitate Tableau data importing, I used excel to combine the data from these three csv files. This excel file basically has one column for quarters and three columns for supply of three types of private properties.

2. Data visualization: In order to know the supply pattern in 4 quarters in 2015, the graph plotted should clearly portray the total units supply for each quarter for comparison. Therefore, bar graph is used. Each bar represents the private property units supply for that quarter, and the height represents the sum of all kinds of private property units supplied in that quarter. Also, to prepare the insights for the following questions, the bar graph is designed to be stacked bar graph in which the portion of each private property type is included in the bar. The height of each colored portion represents the share of that type of private property over the total number of units supply in respective quarter. The higher the colored portion, the larger the share.

The graph is plotted by 1) placing the quarter dimension at the x-axis and 2) placing the measured value (contains the units supply for executive condominium, landed property and non-landed property) at the y-axis.

The graph showed the following two patterns for private property units supply:

- The units supply in 2015 is showing a decreasing trend

- Non-Landed private properties formed the major part for the private property units supply in all quarters in 2015

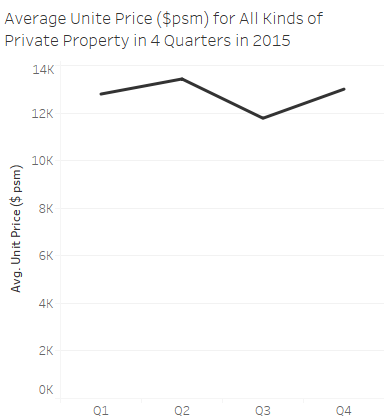

Overall Unit Price Pattern in 4 Quarters in 2015

- Data Source: The data set selected for this portion is Private Property Transactions from Jan to Dec 2015.csv.

- Step by Step:

1. Data set combination: The data downloaded from URA database are in several csv files and each file contains 1000 records of private property transactions. I used excel to combine all the records from Jan to Dec in one excel file for easier tableau data import.

2. Data visualization: Different types of private properties have different unit prices. Also, for the same type of private property, the unit prices provided by different property developers are different. To better illustrate the unit prices level for one quarter, the average unit price for all types of private property is used. A line graph is chosen to provide simpler illustration of the trend of average unit price change over the 4 quarters. Line graph is preferred over bar graph here because the line helped viewer to focus on the changes, not the amount of the individual data point.

The graph is plotted by 1) placing the sales date at the x-axis and changing its value to Quarter, 2) placing the Unit Price ($psm) at the y-axis and changing its measure value from sum to average.

The graph showed the following pattern for private property average units price:

- The average units price fluctuates throughout the year. The growth and decrease appears alternatively across the 4 quarters

Intermediate Analysis 1

Generally, these two plots did not shown clear relationship between the units supply and units price for private properties. This might be caused by the impact of other factors which are not covered in this report, for example, the demand of private property. However, from individual graph, it can be infer that the overall supply for private property in year 2015 keep declining, it might reach a point that the unit supply of private property does not meet the demand, which shoot up the units price which showed in quarter 4 of 2015.

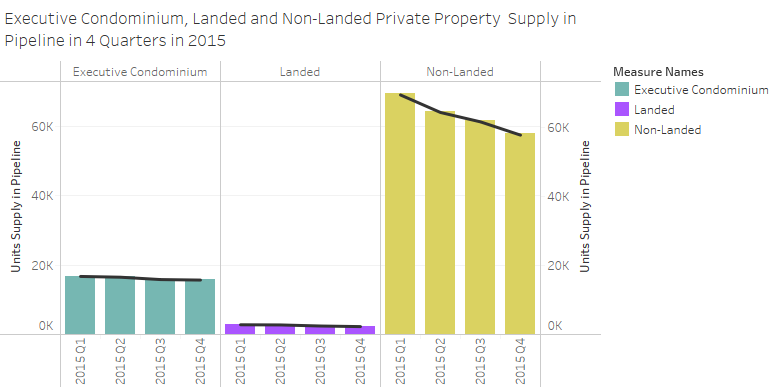

Unit Supply Pattern by Types of Private Property in 4 quarters in 2015

- Data Source: The data sets selected for this portion are The data sets selected for this portion are Supply of Executive Condominium Units in the Pipeline.csv,Supply of Landed Private Residential Units in the Pipeline.csv and Supply of Non-Landed Private Residential Units in the Pipeline. As mentioned above, the data has been combined into one excel file for easier tableau import.

- Step by Step:

1. Data visualization: It can be seen from graph 1 that private property comprises different types. From the URA website: private property can be segmented into 3 main types: Landed private property, Non-landed private property and Executive Condominium. Landed private property includes: detached houses, semi-detached houses and terrace houses. Non-landed private property includes: apartments and condominium housing. In this section, I would like to find out the supply change pattern for these 3 types of private property. A dual combination graph which combines bar and line graph is used for easily comparing the height of bars which is the total units supply for one type per quarter, as well as the trend of supply change across 4 quarters.

The graph is plotted by 1) placing the 3 types of private property and time by quarters at the x-axis, 2) placing one measure value for plotting the bar graph and one measure value for plotting line graph at the y-axis.

This graph showed that:

- The supply for all three types of private properties are decreasing across the 4 quarters.

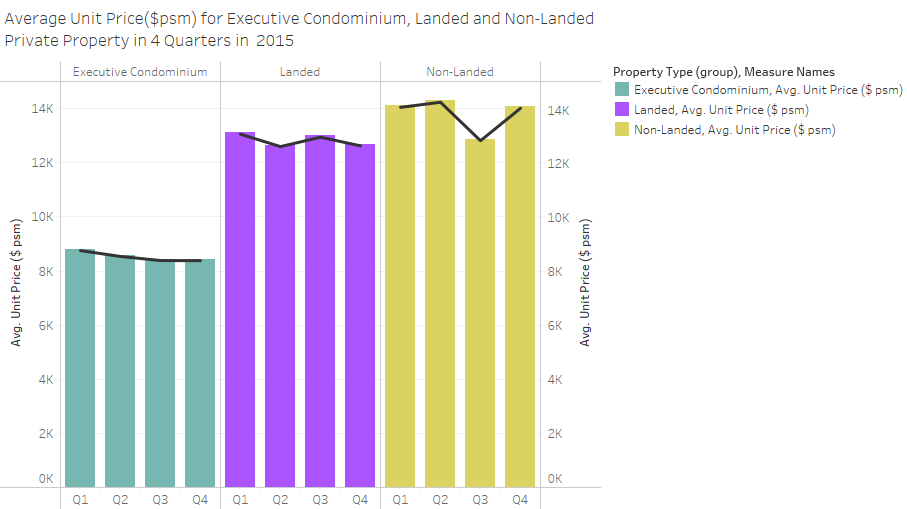

Unit Price Pattern by Types of Private Property in 4 quarters in 2015

- Data Source: The data set selected for this section is Private Property Transactions from Jan to Dec 2015.csv.

- Step by Step:

1. Data visualization: This section aims to find out the average unit price pattern for different types of private property. A dual combination graph is selected due to its ability to illustrate the average unit price level for different types of private property as well as the trend for average unit price across 4 quarters.

This graph is plotted by 1) grouping the private properties by the three types, followed by placing the group and the sale date by quarter at the x-axis, 2)placing 2 measure value (average units price ($psm)) at the y-axis, one for plotting the bar graph and the other for plotting the line graph.

In this graph, we can see that for each type of private property, the average unit price fluctuation pattern is similar to the overall average unit price pattern in section 2. However, more things can be inferred from this graph. The fluctuation extends for different types of private property are different. Executive Condominium's average unit price change in 4 quarters is milder compare to the other two while Non-landed private property's average unit price is more volatile than the rest.

Intermediate Analysis 2

By comparing the unit supply graph per type with the overall unit supply in 4 quarters, and the average unit price graph per type with the overall average unit price in 4 quarters, it becomes clear that Non-landed private property is the major contributor to the overall units supply of private property in 2015. More importantly, Non-landed private property has the most volatile average unit price and unit supply change pattern in 2015 and it affects the overall private property market statistics. This could be a hint that the private property policy should be focused on dealing with Non-landed private property.

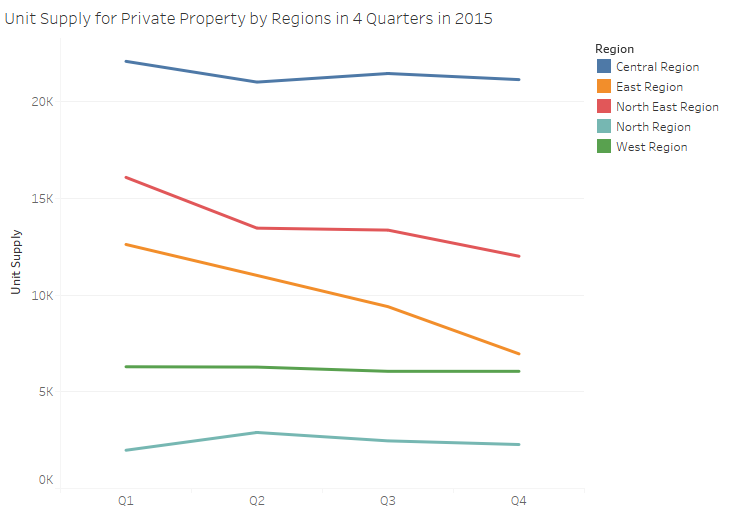

Unit Supply Pattern by Regions in 4 quarters in 2015

- Data Source: The data source is an single excel file which combined the units supply of private property in Central, East, North East, North and West regions.

- Step by Step:

1. Data visualization: Line graph is chosen for analyzing the pattern for this section. It helped the viewer to easily interpret the supply change over 4 quarters for different regions which represented by colored lines. Also, the position of the colored lines help the viewer to compare the unit supply in each region easily.

This graph is plotted by 1) placing the time by quarters at the x-axis and 2) placing the Sum of units supply at the y-axis, 3) followed by dragging the region to the color tab for creating different lines for different regions.

The most obvious pattern from this graph is the decrease in units supply for all regions in Singapore. The graph also shows that overall, the units supply in central region is higher than all other regions. In terms of fluctuation, units supply in the west region shows the most stable pattern throughout year 2015.

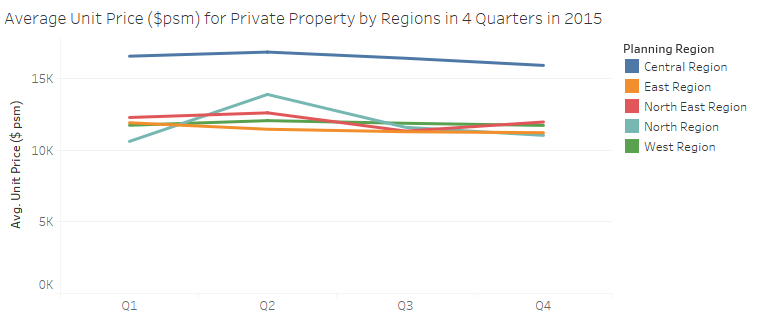

Unit Price Pattern by Regions in 4 quarters in 2015

- Data Source: The data set selected for this section is Private Property Transactions from Jan to Dec 2015.csv.

- Step by Step:

1. Data visualization: Line graph is chosen for analyzing the pattern for this section. It helped the viewer to easily interpret the average unit price change over 4 quarters for different regions which represented by colored lines. Also, the position of the colored lines help the viewer to compare the average unit price in each region easily.

To plot this graph, 1) place the sales date at the x-axis and change its appearing type to quarters, discrete value, 2) place the average unit price ($psm) at the y-axis, 3) drag the region dimension to the color tab for creating colored lines for different regions.

The graph shows that average unit price for central region's private property is the highest compare to other regions. For other regions, their average unit prices are very close to each other. The average unit price for private property at the north region face the most drastic fluctuation while for the west region, the average unit price has a stable pattern across 4 quarters.

Intermediate Analysis 3

From the graphs for unit price and unit supply by regions, it can be seen that the decline in unit supply in the east region contribute to the overall unit supply declining in Singapore. It has the steepest declining trend line compare to that of other regions. While the average unit price for east region is showing a continuous decreasing trend, it might imply that the demand for private property in the east region is also going down. Overall, the two graphs together portrayed a general decrease in private property demand in different regions.

Inforgraphics

Results

Generally, the graphs are showing a coherent declining trend for unit private property and a coherent non-optimistic unstable trend for average unit private property price in Singapore. The conclusions extracted from these graphs and intermediate analysis are:

- The overall private property market in Singapore is weakened at the end of 2015;

- The weakened Non-landed private property(apartment and condominium housing) market is the main cause of overall doomed private property market;

- The private property market in central, north east, east, north and west region were appearing weak, however, the central and west region still have more stable demand compare to other regions.

Hence, with the conclusions, the suggestions to the private property policy in 2016 to stabilize the private property market are:

- Decrease the private property supply in pipeline for east, north and north east regions;

- Introduce new housing loans or relaxing loan curbs for boosting the demand;

- Release more quota for apartment and condominium housing to non-citizens to boost demand.